Our Approach/Our Structure

Our Approach

i) Proper Efforts on Environmental and Social Issues

We believe that making proper efforts on global environmental and social issues from the perspectives of risk management and the pursuit of business opportunities will lead to increase in corporate value and sustainable growth. We also see such efforts as a prerequisite for a company to be accepted as a member of the society.

ii) Value Creation through Capital Efficiency

We believe that in order for investee companies to enhance corporate value and achieve sustainable growth, it is necessary for investees to create value that exceeds the cost of capital over the medium to long term by utilizing capital efficiently under proper risk management and constructing a business portfolio that has a high growth potential and is efficient.

iii) Adequate Performance of Corporate Governance Function

We believe that it is necessary for a company to have sufficiently functioning corporate governance as a prerequisite for value creation through the efficient utilization of capital and proper efforts on environmental and social issues.

iv) Adequate information disclosure and a dialogue with investors

NAM believes that it is important for companies to fulfill their accountability for the matters stated in 1. through 3.

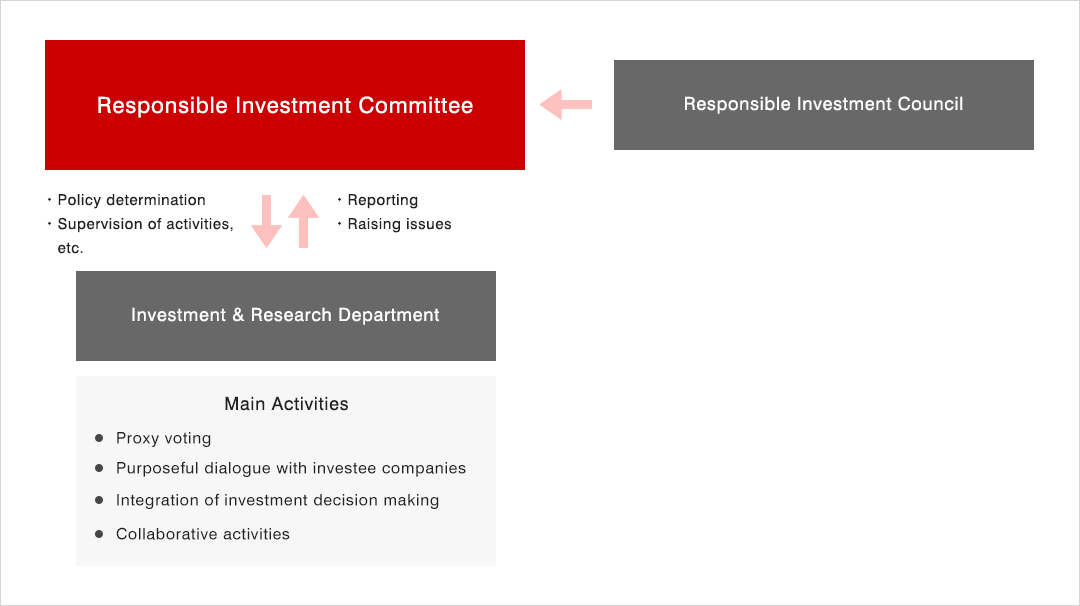

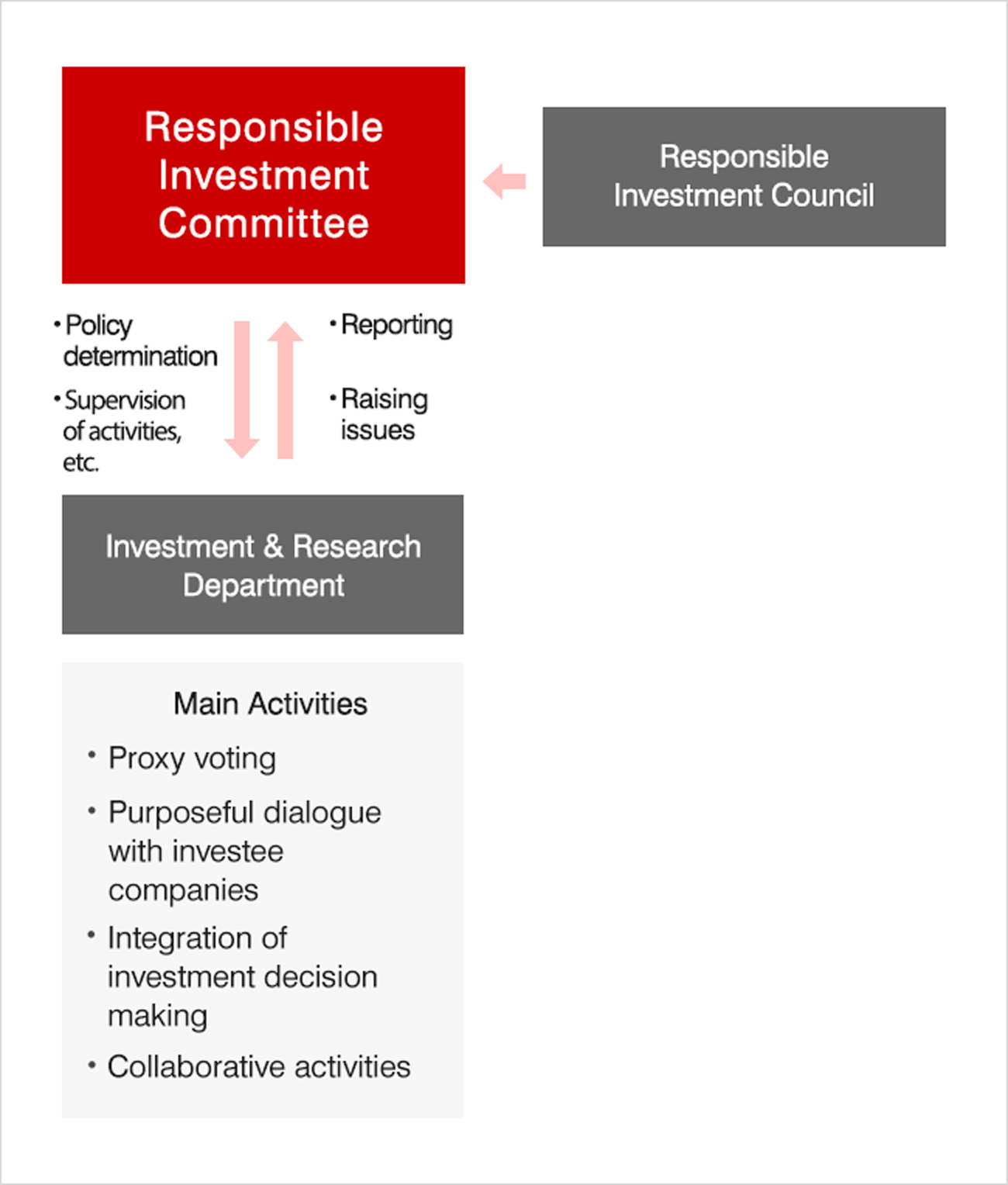

Our Structure

Our objective is to achieve the best investment performance for our clients.

- Responsible Investment Committee: determines NAM's company policy regarding stewardship activities. In principle, the Committee's members are limited to officers and professionals who can make decisions regarding investment management and research, while anyone who is in a position that could involve a conflict of interest (or his or her representatives) is excluded.

- Responsible Investment Council: established under the Audit and Supervisory Committee; the RI Council consists of the Chief Conflict Officer and persons in independent positions in our company including independent outside directors only. It monitors all decisions made by the Responsible Investment Committee.