Engagement Feature Articles

Yokohama Rubber - Top Class Manufacturer of Off-Highway Tires - Promoting Improved Corporate Value through Pro-active M&A and Capital Market Dialogues

Right: Hiroyasu Koike, President and CEO of Nomura Asset Management Co., Ltd.

The tire industry is not limited to passenger cars, but spans a wide range of applications, including trucks, buses, construction vehicles, agricultural machinery, and industrial vehicles, and is closely tied to our daily lives. In recent years, Yokohama Rubber has pro-actively pursued acquisitions of large tire manufacturers overseas and is working to create new corporate value. On January 18, 2024, Mr. Masataka Yamaishi, Chairman & CEO, Chairman of the Board of The Yokohama Rubber Co., Ltd. and Hiroyasu Koike of Nomura Asset Management Co., Ltd. discussed strategies for success in the tire industry and approaches to improving corporate value.

Discovering Growth Opportunities in the Off-Highway Tire Market

Koike Even though the tire industry is inseparable from our daily lives, there are very few who have a detailed perspective on the market. Could you begin by explaining the tire market structure and your company's strategy?

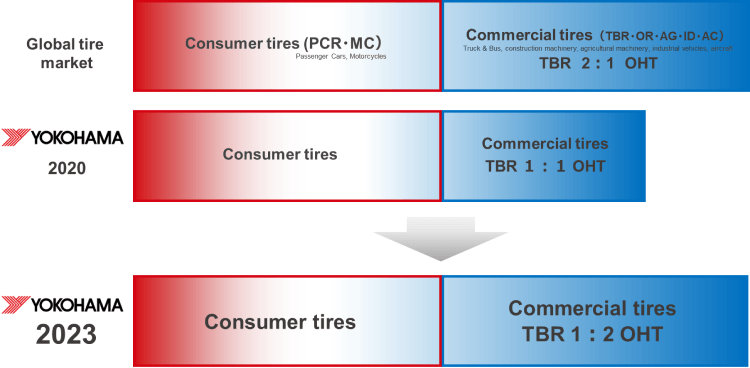

Yamaishi The global tire market can be roughly divided into two halves: "consumer tires", which include passenger cars and motorcycles, and "commercial tires", which include trucks, buses, agricultural machinery, industrial vehicles, construction vehicles, and aircraft. While the figure may change some according to exchange rates, the total value of the market is approximately 20 trillion yen. Our company's business has a unique ratio of production goods. Whereas the ratio of "trucks and buses (TBR) versus "off-highway tires (OHT)" (for agricultural machinery, industrial vehicles, construction vehicles, forestry machinery, etc.) in the overall global market is generally 2:1, our company's business is split 1:2, with a high ratio of "off-highway" tires.

Before I became president in 2017, off-highway tires accounted for only a few percent of our total business. For example, while the market for tires for major agricultural machinery was not very large, demand for tires of many varieties tended to reduce efficiency. At that time, the off-highway tire market was undergoing reorganization due to a series of withdrawals of major manufacturers. However, since off-highway tires are installed in working vehicles, the replacement cycle is also short, and the off-highway tire market is expected to grow at an annual rate of about 5%, compared to 2% in the passenger car, truck and bus tire market. We decided to increase our ratio of off-highway tires based on the analysis that it could become a pillar of our new business if we successfully gain share in the restructured market.

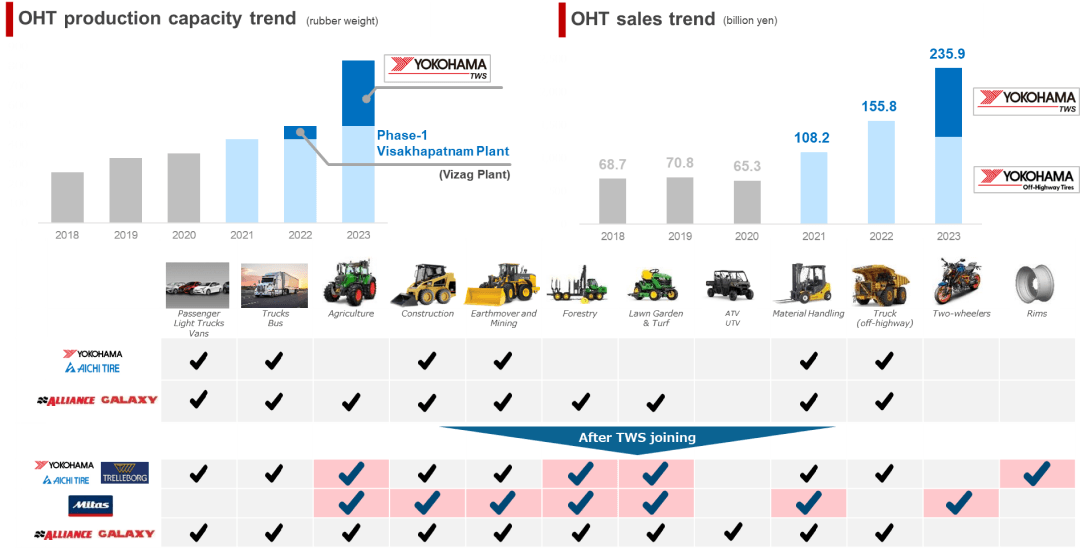

In 2016, we acquired Alliance Tire Group (now YOHT) of India, a manufacturer of tires for agricultural machinery and construction vehicles, for more than 130 billion yen, and we expanded our sales from about 50 billion yen at the time to about 100 billion yen over 5 years. In FY2022, we achieved a high level of profit margin of about 14%, and we feel that our growth in the off-highway tire market is satisfactory. In 2022, we made a major acquisition of the specialty tire division (currently Y-TWS) of Swedish engineering company Trelleborg AB, which has sales of approximately 129 billion yen, for approximately 350 billion yen.

Acquiring Strategies and Brands

Koike It seems you were able to effectively utilize the timing of the restructuring thanks to detailed market analysis. What were the aims behind the M&As of Alliance Tire Group (YOHT) and Trellborg (Y-TWS)?

Yamaishi The concept behind the acquisition of each company was different. The Alliance (YOHT) acquisition was aimed at buying "strategy". The company's Indian production facilities were not highly evaluated, but by taking advantage of the Indian Special Economic Zone (SEZ), which has various tax incentives, we were able to significantly improve our cost competitiveness. In addition, while investment was restrained and growth slowed when a major U.S. private equity firm took control of the Alliance Tire Group, our company was able to expand its low-cost, competitive production capacity and capture a significant market share through aggressive investment after the M & A.

Trelleborg (Y-TWS), on the other hand, was an acquisition aimed at purchasing brand strength. We believed that the company has the brand strength to match Michelin, the world's leading company in sales, and that it is able to sell high value-added products. In fact, Alliance (YOHT) and Trellborg (Y-TWS) rank first in the industry in combined sales for agricultural machinery and second in sales for industrial vehicles (forklift tires, etc.).

Alliance (YOHT) operates three brands: Alliance, Galaxy, and Primex. However, the concept is very different from that of our company's brand. If we replace these three brands with our company brand, we risk reducing the value of the Yokohama Tire brand, which is at the top of Tier 1 or at least Tier 2 in the global market. As a solution, we are considering not immediately integrating the brand, but merging the Trellborg (Y-TWS) brand, which has the same brand strength as Michelin, with our company brand over the next 10 years or so.

In addition, both the Alliance (YOHT) and Trellborg (Y-TWS) have excellent cost competitiveness. To further reduce the cost of the branded Trellborg (Y-TWS) tires, it is possible for the Alliance (YOHT) factory to produce some products. We will continue to explore various ideas to create synergies.

Koike Calculating corporate value is an important aspect of M&A. When you acquired Alliance (YOHT), I believe some viewed its valuation at a premium. What is your assessment?

Yamaishi Looking at the tire industry as a whole, the EBITDA ratio of acquisition value is about 7-8x. When Trelleborg AB acquired Mitas before our acquisition, it was about 12x, and when Michelin acquired Camso, it was 13-14x, so I think the acquisition price of the off-highway tire specialty companies is about 10-13x. I don't think we paid a premium for the acquisition. Also, the goodwill price tends to be heavy in the M&A of off-highway tires, but I think it is profitable enough because we can expect higher growth potential.

Improving Corporate Value Requires Investor Dialogue and Thoughtful Explanation

Koike I think overseas strategy is an important management issue for your company. What do you view as challenges in growing your business globally?

Yamaishi People are one hurdle. When you buy a foreign company, you basically leave the business to them locally, but I think it is important to place a person who is skilled in manufacturing, sales and technology as a bridge between the foreign company and Japan. We're working on strengthening management skills for these types of employees, and we encourage them to obtain an MBA in their 30's or 40's and to accumulate a wealth of experiences at a young age.

Koike I would also like to ask about your share price. The government's plans for Japan to become a leading asset management center send the message that it seeks to bolster Japan's capital market. The Tokyo Stock Exchange is also among those promoting reform measures. However, the reality is that many listed companies have PBRs of less than 1x. How do you perceive your company's share price?

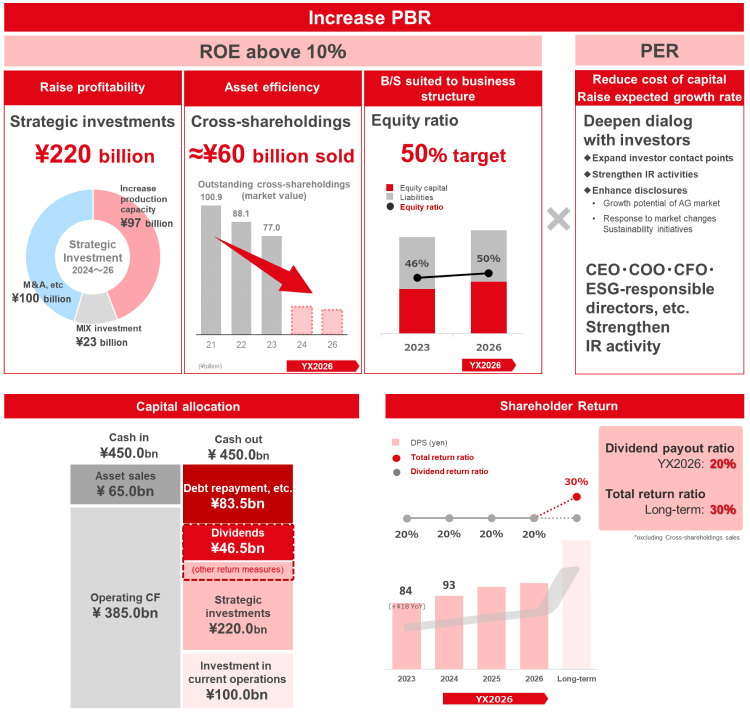

Yamaishi I believe that sub-1x PBRs are a significant issue. We are working to address this by improving our ROE through strategic investments and enhancing our value by utilizing sustainability opportunities. Our company's ROE is expected to recover to around 10%. Our PBR, while improving, has still not passed 1x. Although we are making profits from growth investments, shareholders may feel that our capital policy is lacking. Until now, our company has increased its internal reserves in order to support our M&As. Sales have increased from 600 billion yen to about 1 trillion yen since I became president, and the domestic sales ratio is about to drop below 25%. In order to change the governance of the company, I feel it is necessary to pay attention to the capital strategy as well. In particular, I recognize that the shareholder return rate, such as the payout ratio, is lower than that of other companies in the same industry.

Koike Your company's slogan is "Excellence by nature". You've been successful in your shift to an overseas strategy and your M&A strategy, and you've produced firm results, thereby embodying your slogan. However, with such an impressive equity story, I think it is necessary to thoughtfully explain it to the market and pro-actively promote yourself, rather than leaving it to nature. As far as your stock's valuation is concerned, your M&A strategy and firm results have not been appreciated.

Yamaishi Our company's ratio of foreign shareholders is significantly lower than the overall average for Japanese stocks. We haven't held events for institutional investors and I think we need to reflect on the lack of sufficient investor relations and shareholder relations activities.

In December 2023, we held an off-highway tire business briefing to highlight the business's growth potential and strategy. We are also working to strengthen our IR framework by recruiting external personnel. By deepening dialogue with shareholders, we intend to reduce capital costs and improve our expected growth rate.

Koike What are your thoughts on cross-shareholdings from the perspective of capital strategy? It appears that you hold a greater ratio than your peers.

Yamaishi We've been aware that we have significant cross-shareholdings for some time. We've been reducing them in recent years, but we may have lacked aggressiveness. In our new medium-term management plan, we intend to clearly show how we will improve shareholder returns and increase growth investments by reducing our cross-shareholdings.

Building Steady Efforts for Environmental and Social Issues

Koike What are your views on reducing greenhouse gases, the circular economy *1, and other environmental issues? In terms of greenhouse gas emissions, your company has reduced Scope 1+2 *2 emissions by 38% and you've set a goal of achieving carbon neutrality by 2050. Indeed, your model plant at Shinshiro Minami has demonstrated progress with the introduction of solar power generation. On the other hand, I don't believe your company has set goals for Scope 3, which accounts for the largest amount of emissions, and has taken few initiatives to address this. Please share your thoughts on environmental issues and the circular economy.

*1: A socio-economic system that aims to maximize added value while ensuring efficient and cyclical use of resources.

*2: Scope 1 is the direct emission of greenhouse gases by businesses themselves. Scope 2 is the indirect emission of electricity, heat and steam supplied by other companies.

Yamaishi As you have pointed out, our company's current greenhouse gas reduction targets are still a little low. However, we are working toward improvement in various areas, such as renewable energy, and our corporate profits could suffer if we are overly focused on only achieving these targets. The idea is to keep an eye on our targets while at the same time boosting our revenues and switching to new measures to reduce greenhouse gases when they come up. With regard to the circular economy, we can now expect to achieve our targets without increasing costs.

Koike I have heard that the natural rubber used in tires is often sourced from emerging countries. We must confront potential risks, including human rights violations and exploitation, in the production of materials. How are you addressing these issues?

Yamaishi Our company has established policies in our "Procurement Policy for the Sustainable Natural Rubber", including fair and equitable treatment, prohibition of forced labor, and adequate working conditions, and we're implementing initiatives to respect human rights. We intend to continue to make steady efforts by conducting due diligence on individual producers.

Koike In recent years, women's empowerment has attracted attention. It is undeniable that the ratio of female managers in your company is only 1.7%. However, I do not think that asking managers to improve in the short-term will necessarily produce good results for the company, and I think a medium- to long-term perspective is essential. How can you increase the motivation of female employees in the workplace?

Yamaishi There is an overwhelmingly large proportion of men working at production facilities in the tire industry. White collar workers were also predominantly male, but since around 2004, our company has been increasing the proportion of female hires, and now it has risen to about 30%. It takes time to become a manager, such as a section manager or department head, but I think it is possible to further increase the proportion of women in white collar jobs because we can see the proportions of each age group. In order to achieve this, we need to continue to create an environment where women can work more easily, for example, when we established a satellite office in Shinagawa after the sale of the Shimbashi headquarters building, flexibly accommodating transfer locations, and taking support measures to ensure 100% parental leave.

Koike Thank you for sharing your valuable views with us today. Your story has communicated your company's position as a global player with a solid growth strategy and rich track record. I'd like to continue helping connect you with investors.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: April 12, 2024)