Engagement Feature Articles

Tokyo Century - Becoming a company that addresses social issues beyond the framework of the leasing industry

Left: Hiroyasu Koike, President and CEO, Nomura Asset Management Co., Ltd. (Nomura Asset)

Tokyo Century was formed in 2009 through the merger of two major Japanese leasing companies, Tokyo Leasing and Century Leasing System. The company is moving away from the traditional leasing business by promoting co-creation with a variety of companies. Koji Fujiwara, who previously served as President of Mizuho Bank and was appointed President and CEO in April 2025, and Hiroyasu Koike of Nomura Asset Management discussed the future vision of Tokyo Century.

What should Tokyo Century aim for 10 years from now?

Koike About six months have passed since you assumed the position of President and CEO of Tokyo Century. You previously served as an outside director overseeing management. Now that you have experience in both oversight and execution, could you tell us your thoughts on "What kind of company is Tokyo Century and what direction does it aim for?"

Fujiwara These past six months have been extremely meaningful as I have actually been at the helm of management and have come to understand the actual state of the company. What kind of company does Tokyo Century aim to become? My first task is to clarify that outline. Tokyo Century now operates across a wide range of sectors, from aircraft leasing to car rentals, and I feel it no longer fits the traditional mold of a leasing company — indeed, it should not be confined to one. We are just beginning to define our future direction through an internal transformation project.

Japan, as a developed country, is facing many social issues, and Tokyo Century wants to be a focal point for resolving global social issues. Also, since we are a young company formed in 2009, we want to cherish a startup mindset and an entrepreneurial spirit.

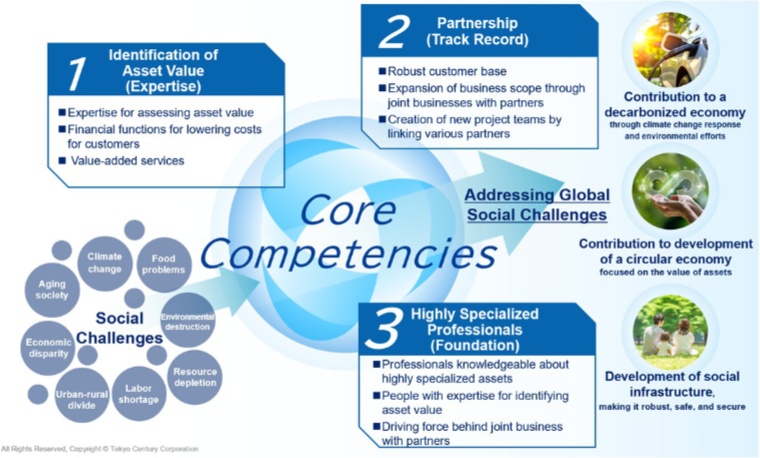

Tokyo Century Group's Vision and Core Competencies

Koike In the Medium-Term Management Plan 2027 announced in 2023, you have set financial targets of net income of 100 billion yen and return on equity (ROE) of 10%. Given your strong performance, I believe you can achieve these targets a little ahead of schedule.

Fujiwara We want to achieve these financial targets as soon as possible. However, achieving these targets is merely a milestone, and our current focus is on how we can present what Tokyo Century will look like in ten years and the KPIs that will measure that. Now that we have a new management team, we want to present them in some way, including revising the Medium-Term Management Plan 2027. In any case, a level of ROE of just under 10% does not sufficiently exceed the cost of capital, so it is the responsibility of management to see how much we can improve corporate value.

Structural change to services that generate added value

Koike That is very encouraging. I look forward to seeing a fairly aggressive target in the near future. Changing subject, the business environment in the leasing business is changing rapidly, with the Bank of Japan changing its monetary policy and the effects of tariffs intensifying overseas. How do you expect profitability to change as financing costs rise due to a rise in interest rates?

Fujiwara Looking only at the rise in interest rates, it is true that we are a business that requires a large amount of funding, and this itself will have a negative impact in the short term. However, there are two major positive factors that offset this.

The first is an improvement in business sentiment. If a virtuous cycle of rising wages takes hold, the macroeconomic outlook will improve and increased corporate capital spending will be a tailwind for our business. In particular, we can demonstrate our strength in the digital domain, such as IT-related businesses, where equipment leasing is prevalent. The second is profits from the sale of leased assets. We earn profits not only from receiving lease payments but also from selling leased assets. Gains on sales increase as prices of goods rise due to inflation.

Koike In addition to inflation and rising interest rates, what other risks are lurking in the future?

Fujiwara As the leasing business uses a balance sheet, the impact of interest rates is unavoidable, but it is essential to transform our business model by shifting to services that create added value. Nippon Rent-A-Car Service is a familiar example of a company that has achieved high profitability. Recently, we made an equity investment in Advantage Partners, a former strategic partner, and it is now accounted for under the equity method. Advantage Partners is a pioneering Japanese private equity (PE) fund that has been able to solve both problems facing Japanese companies and to achieve high profitability.

That said, we do not pursue opportunities solely because they are profitable. As a matter of discipline, we want to build a solid core business.

Having a variety of partners is a source of strength

Koike I understand that you are aiming for a business that is not bound by the concepts surrounding a leasing business, as shown by the fact that the word "Leasing" was removed from the company's initial name; Century Tokyo Leasing. What then is Tokyo Century's core?

Fujiwara In a nutshell, I believe that our company is a company that addresses social issues. Our approach to that work includes both financial solutions and business- and service-oriented initiatives. This reflects societal demand, and I expect the share of our activities coming from business and services to continue rising.

Koike Fujiwara-san, you came from Mizuho Bank and worked in lending. Now you’re on the side that borrows to run a business. From a financial standpoint, do you see the two as similar businesses?

Fujiwara I believe they are alike, yet different. Both are engaged in the financial business, but banks are social infrastructure, and our company is positioned to drive social innovation. In addition, banks are regulated industries with strict regulatory authorities. On the other hand, leasing companies like our company are unregulated industries. Without fear of misunderstanding, I felt a sense of freedom and liberation when I became president. Of course, with freedom comes responsibility, and with liberation comes autonomy. There is a new sense of tension as results are demanded.

Koike In addition to Tokyo Century, other leasing companies with close ties to Mizuho Financial Group include Mizuho Leasing and Fuyo General Lease. Is there any division or differentiation within the financial group? Tokyo Century also has partnerships with companies in completely different business sectors, such as the ITOCHU Group, which is part of its origins. Could you tell us about your positioning in the industry?

Fujiwara Tokyo Century's primary bank is Mizuho Bank, and Mizuho Financial Group is an important partner. Still, we don’t see ourselves as belonging to any single financial group. In fact, we’ve invested in MUFG Finance & Leasing, a subsidiary of MUFG, as well. As a listed company, Tokyo Century conducts business in collaboration with various partners. One of these is Mizuho, and in the same context, we have various partners such as the ITOCHU Group, NTT, and Fujitsu. That diversity of partners is the source of our strength.

In terms of human resources, our workforce used to come mainly from banks and trading companies but we are now hiring more mid-career and experienced employees. I think we are fostering a unique culture.

Aiming for higher positions in aircraft leasing

Koike I understand your underlaying aim is to solve social issues. Given the dramatic changes in society itself, which areas are you focusing on over the medium term?

Fujiwara There are three main areas. One is to pursue mobility. We operate a top-level car rental and car leasing business in Japan. In addition to trends such as electrification and automated driving, we can expect business opportunities such as the resolution of traffic congestion and the promotion of a circular economy through data derived from such trends. The second is to leverage Advantage Partners to solve issues facing Japanese companies. We will contribute to solving social issues such as business succession, corporate revitalization, and regional revitalization. The third is to strengthen new businesses such as renewable energy, data centers, and storage batteries. Recently, the NTT DATA Group, a major partner, announced an investment of 1.5 trillion yen for data centers. We believe we have more opportunities to contribute to the data center business.

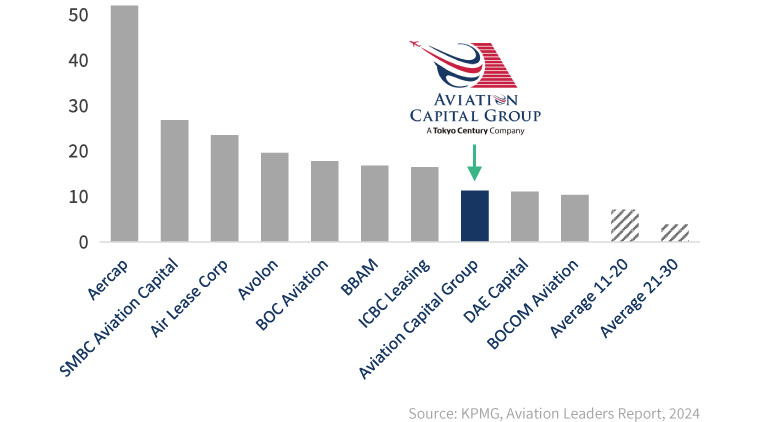

Koike I am looking forward to your future plans. On the other hand, I would like to ask you about current issues. In 2019, Aviation Capital Group (ACG), a U.S. aircraft leasing company, became a wholly owned subsidiary. The business environment is doing well but return on assets (ROA) by segment remains low. What measures are you taking to improve it?

Fujiwara Aircraft leasing is an asset-heavy business. As a result, ROA tends to lower and weight on our overall ROE. ACG is a very good company, but it ranks eighth or ninth in the industry. Scale matters in this business, so we need to grow. In order to maximize ACG’s potential, we’re looking at various options and I want to explain our growth strategy to make ACG a top‑tier player.

Koike I feel that clarifying this message will have a positive impact.

Source: Tokyo Century Co., Ltd.

Creating an Attractive Workplace Brand for Expanding Human Resources

Koike In addition to aircraft leasing, Environmental Infrastructure is another segment with a low ROA. What is your management stance on this business?

Fujiwara I don’t view this business, including renewable energy, in isolation. I believe that what is important is the overall optimization of the business portfolio. Of course, when we review the portfolio, we evaluate both quantitative and qualitative aspects, but we also emphasize complementarity of the businesses. I believe that the environmental infrastructure business can contribute to the business growth of the entire company from a long-term perspective. I also expect that the development of the power grid infrastructure will create highly efficient businesses related to the purchase and sale of electricity.

Koike As you grow across multiple businesses, finding the right talent is a challenge.

Fujiwara We have two pillars for expanding human resources. One is to expand our own employment. To do this, we want to create attractive workplaces. First, we want to create a brand that is recognized outside the company as a rewarding workplace, both financially and non-financially. Second is to tap into talent from other firms as we are focused on partnership strategies. When I say "leading" efforts to address social issues, I used the term to indicate that we will carry them out together with others.

Koike The use of generative AI is rapidly expanding in business practices. While digitalization is important in terms of increasing productivity, it is fraught with ethical and other risks. Cyberattacks and other incidents that negatively affect corporate value are also increasing.

Fujiwara This is a very important and difficult issue. Essentially, I think it relates to the education of people who will use digital technology. Our generation has been taught the ability to solve problems quickly and correctly, but that's not enough to foresee the new world of AI. In other words, we need the ability to set problems, not the ability to solve problems. I think it's important to have a design thinking that discovers problems from a bird's-eye view of the world through experiences outside the company.

It is important to be honest and sincere when communicating with shareholders

Koike From an investor's perspective, I am also concerned about the shareholder returns policy. With many large shareholders, Tokyo Century can’t readily do big share buybacks—how do you plan to address the expectations of minority shareholders?

Fujiwara As a manager, capital policy is one of the most important issues. The key to capital policy is to optimize the balance between shareholder returns, financial soundness, and investment for growth. I hold a high standard for shareholder returns, but I also believe that it is important to be honest and sincere when communicating with shareholders. In other words, if you aggressively promote what you can't do and mismanage expectations, you will lose trust. I want to make having close partners as major shareholders a plus for corporate value, but I also want to deepen how we communicate so minority shareholders will remain long‑term holders.

Koike Lastly, Fujiwara-san, could you tell us your view on the company’s stock price?

Fujiwara Even with the share price having only just approached a PBR near 1, I feel that we still haven't reached the starting line. One factor that shapes the share price is market expectations for the company's future (option value), and brand value is crucial to raising those expectations. I strongly believe we should be a company respected by society and help build an industry that the next generation aspire to join. These are intangible but essential qualities. I want to present a compelling narrative to stakeholders to help enhance our brand value.

Koike Thank you for the wide-ranging discussion; it has reaffirmed my belief that this company has an increasingly promising future. Thank you for your time today.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment, nor does it imply that any prices will rise or fall.

(Date of publication: November 27, 2025)