Engagement Feature Articles

Sumitomo Rubber Industries - New technologies created by refining rubber

Creating value-added with high-performance tires

Right: Hiroyasu Koike, President and CEO, Nomura Asset Management Co., Ltd.

Sumitomo Rubber Industries has its roots in the Kobe Plant of Dunlop headquartered in the UK, which commercialized the world's first practical pneumatic tire. Its technology has led to the development of not only tires but also sports equipment such as golf and tennis, and industrial products such as Vibration Control Dampers and Rubber Parts for Medical Applications. Amid changing circumstances surrounding mobility, what is the company's growth strategy? Mr. Satoru Yamamoto, President and CEO of Sumitomo Rubber Industries, and Koike Hiroyasu of Nomura Asset Management discussed the progress of structural reforms and the company's vision for the future.

The conversation was held on December 17, 2024. The company then acquired the DUNLOP trademark and announced the group's long-term management strategy.

Please refer to the following link for details.

Acquisition of DUNLOP Trademark and Other Rights from Goodyear for four-wheel tires in Europe, North America, and Oceania

Establishment of the Sumitomo Rubber Group's Long-Term Corporate Strategy "R.I.S.E. 2035"

Structural reforms implemented in approximately 10 businesses and products

Koike We continue to hold CEO talks under the name "Project Bridge" to bridge the gap between international investors' perceptions of Japanese companies. We feel that investors' views of Japanese companies have changed as a result of a series of policies aimed at becoming an asset management nation. I think it is our role to communicate what issues companies face and what measures they are taking.

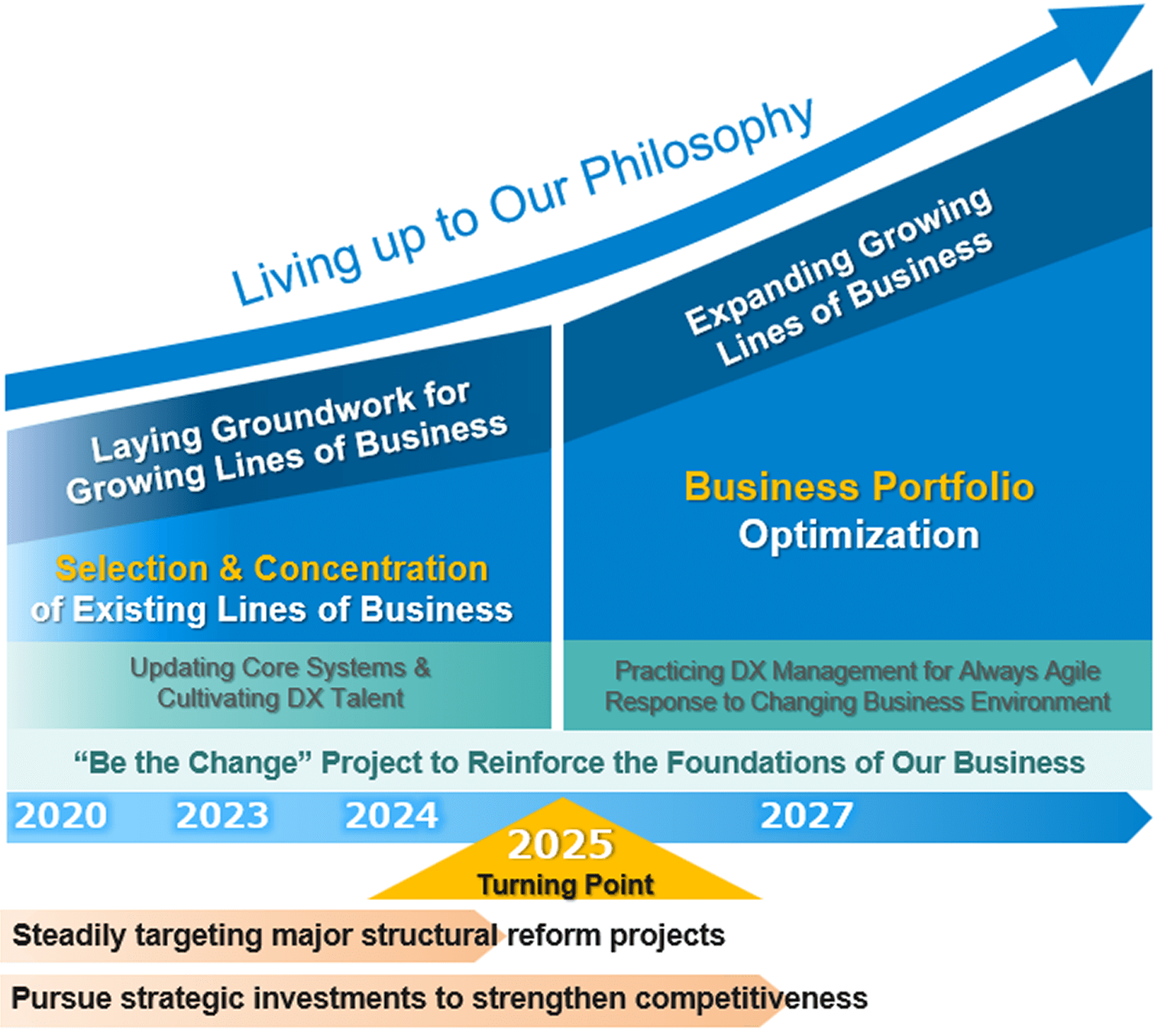

First of all, please tell us about the Medium-Term Plan (2023 to 2027) that was launched in 2023. The plan is divided into 2 stages starting from 2025. What is the aim of the plan?

Yamamoto The background to formulating the medium-term plan was the increasingly severe external business environment. Earnings declined significantly in 2022 due to the rise in raw material costs and ocean freight rates after the COVID-19 pandemic.

A thorough analysis of our activities over the past 10 years revealed the adverse effects of our rapid global expansion. The speedy location of our manufacturing and sales bases is a strength of our company, but there were some inefficiencies, including the factories we acquired.

Therefore, we began by conducting a series of analyses based on data, and established a policy to pursue structural reforms by 2025, consolidating a strong foundation, and then placing emphasis on growth strategies.

From a business portfolio analyzed based on the two axes of ROIC and growth potential, we are implementing structural reforms in about 10 businesses and products over a period of 2 years. At the same time, we revamped our core systems for DX, which had been pointed out to be lagging behind, and DX, which had been promoted by each department, was upgraded to a company-wide strategy.

Through "Be the Change" (BTC) initiatives that started in 2020 aiming to strengthen our management base and reform our organizational culture, we strengthened cross-functional cooperation across departments. We discussed about 7,000 ideas for measures to generate future profits and cash.

We are determined to accelerate growth by selecting and concentrating existing businesses and laying the foundation for growth businesses by 2025.

In promoting structural reforms, progress must be shared with all employees. In an employee survey, some commented, "The management's actions are unclear, and I don't understand how they relate to my work." We therefore took action to hold semi-annual town meetings at 13 offices nationwide. In addition, videos of meetings on the company's performance are shared among employees who are in managerial positions and above, and managers are asked to share information on the company's status in each department.

For the past few years, we have not experienced business closure, but in fiscal 2023, we decided to withdraw from the domestic Gas Hoses Business and sell Lonstroff AG, which produced and sold Rubber Parts for Medical Applications for Europe in Switzerland. In fiscal 2024, in addition to selling the domestic fitness business, we also decided to terminate production and dissolve Sumitomo Rubber USA, a tire manufacturing subsidiary in North America, and we expect to record a loss of more than 74.6 billion yen. However, we expect the effect of the structural reform to be about 45 billion yen, and we hope to use this decision for our next growth.

Koike When we conduct M&A globally, inefficiencies are inevitable. For example, how do you feel about the North American business, including the review?

Yamamoto Sumitomo Rubber USA was acquired in 2015 when the alliance with Goodyear USA was dissolved. 100 years had passed since the company began operations, and the deterioration was noticeable. If we had built our own operations from the start, we would have been able to reflect our company's thinking, but this was difficult with acquired plants. We decided that the time frame for improving profitability was not met, and we were forced to make a difficult decision.

Essentially, we reflected on our lack of research and analysis prior to M&A. We also realized the importance of having a good corporate culture match.

Businesses that can contribute to the future mobility society

Koike The next focus is growth strategies. The automobile industry is said to be in a period of great change, such as the progress of electrification and the spread of autonomous driving. The rise of Tesla and other emerging Chinese manufacturers has made this a very competitive industry. How do you expect the tire business to change as the business of the automobile industry is changing? Can you also tell us about your company's initiatives?

Yamamoto As the terms CASE* and MaaS* symbolize, the automotive industry is undergoing a major transformation that takes place once every 100 years. The power structure of electric vehicles (EVs) is also changing.

In particular, in China, the spread of EVs has increased through the COVID-19 pandemic, and emerging automakers are making strides. The impact of this change on tires is mainly on general-purpose tires, but our company has decided not to compete with general-purpose tires, but to launch high-performance tires tailored to each market.

High-performance tires have been well received in the North American market, and sales of a high-value-added product called "Wild Peak" for SUVs under the "Falken" brand have been growing significantly. We believe this is because we have responded to the strict demands of US consumers, including design preferences.

On the other hand, for general-purpose tires, we have decided to reduce the number of items by 30%, mainly for sizes that contribute little to sales, and we have already implemented 20% of this reduction.

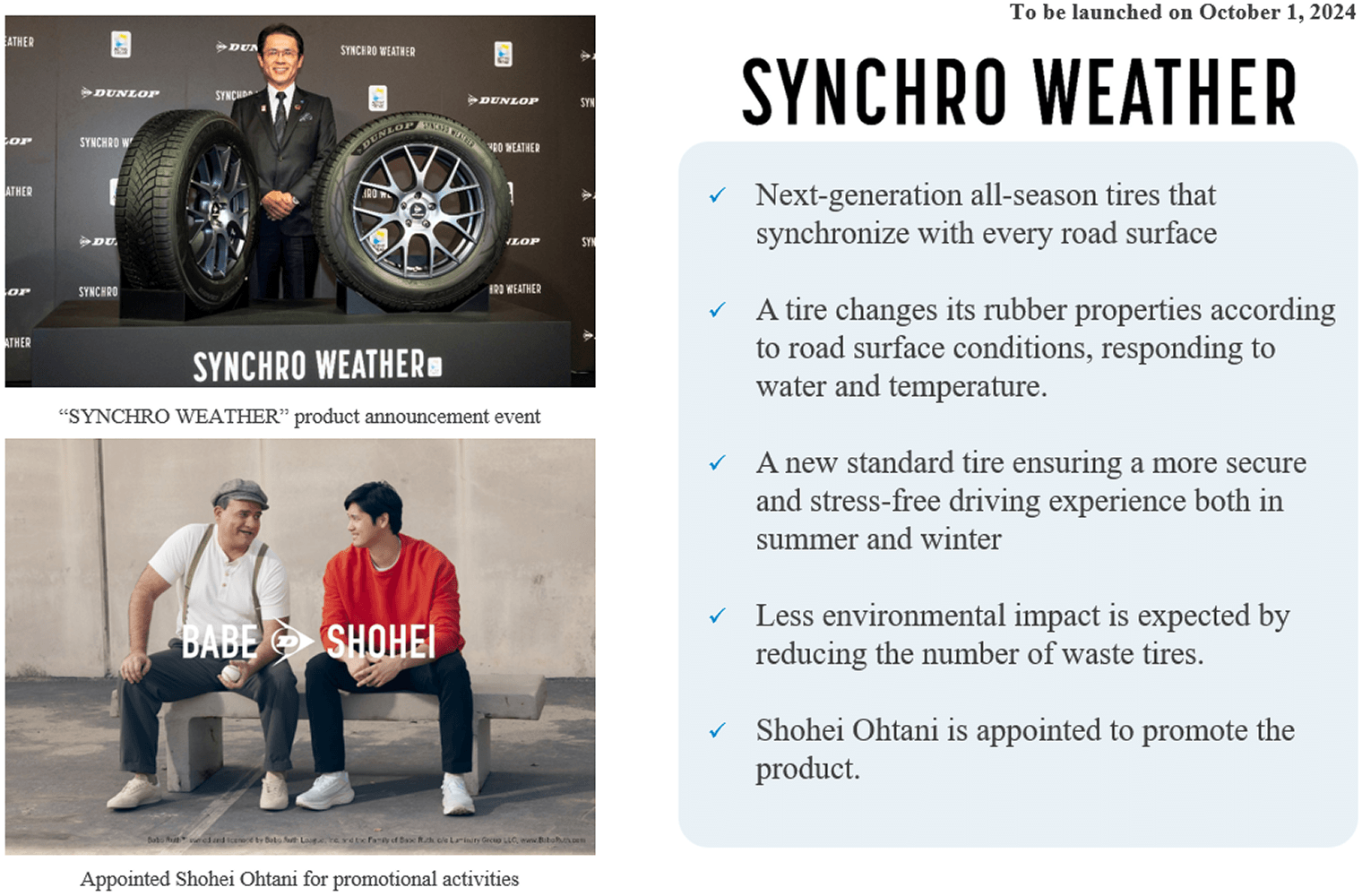

Our company also has a unique tire technology called "ACTIVE TREAD". This type of tire allows the rubber itself to change in response to road conditions caused by rain, snow, and temperature. Last year, we launched this new product in Japan. The price is about 1.5 times higher than general-purpose summer tires at certified stores, but I feel that many customers agree with our high added value and features.

Koike Do you expect the demand for tire performance to increase even further in EV models?

Yamamoto Performance requirements for EV tires are very strict, but we think that we can make the most of our technology. We already sell EV tires in China. We also plan to launch high-performance tires suitable for EVs in Japan in the spring of 2025.

The important consideration for EV tires are the heavy vehicle body from carrying batteries. In addition, because of the torque, the load on the tires is high and they must withstand wear. On the other hand, to increase driving range, it is necessary to reduce rolling resistance, and wet performance is required to reduce rolling resistance while maintaining slip resistance on wet surfaces. Additionally, there is also the issue of sound. Luxury car brands have requested that road noise be silenced because they are not equipped with an internal combustion engine to mask the noise.

Our company's "Active Tread technology" and "Silent Core technology", which incorporate special sound-absorbing sponges into tires, meet these demanding demands from users. We plan to develop tires that utilize these technologies in the future.

*CASE: A coined term formed by the initials of four areas representing the transformation of mobility: "Connected," "Automated/Autonomous," "Shared & Service," and "Electrification."

*MaaS: An abbreviation for Mobility as a Service. It is a service that optimally combines multiple public transportation options and other mobility services to address the travel needs of each individual local resident or tourist on a trip unit basis, allowing for integrated search, booking, and payment, among other functions.

Koike In addition to the hardware of tires, how about developing a business that utilizes data?

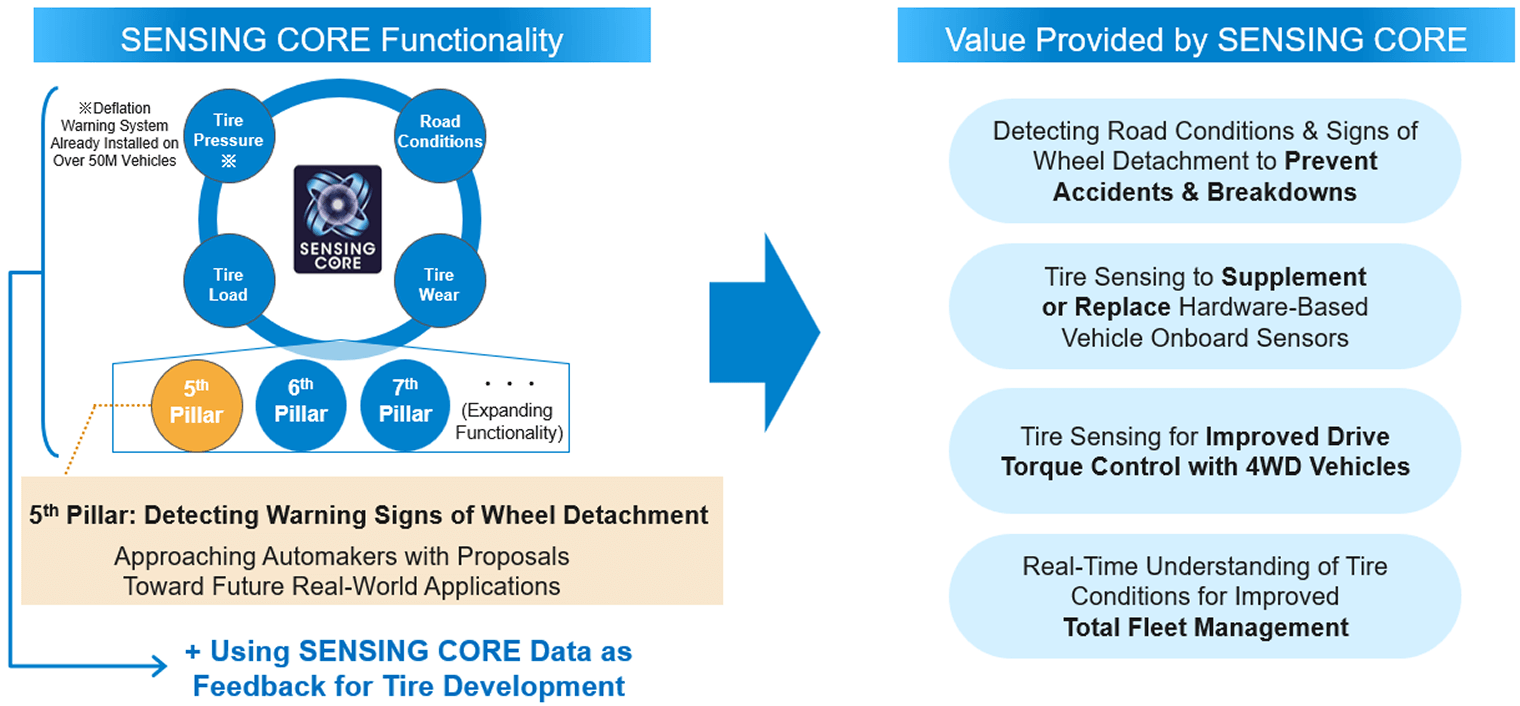

Yamamoto In the future, it will be important to utilize data through software as well as hardware. Our company's "Sensing Core" technology is a perfect match for Active Tread. The Sensing Core technology is highly compatible with not only EVs but also autonomous vehicles, and is a powerful technology to be used in the CASE era.

"Sensing Core" is a proprietary technology that detects the condition around tires. Instead of attaching sensors to tire wheels, the key is to analyze wheel rotation signals. Based on indirect pneumatic pressure warning (DWS) technology, which has a track record of nearly 30 years since 1997, the system detects tire pressure, load, friction, road conditions, and signs of wheel disengagement in real time. To date, the system has been installed in 53 million new vehicles around the world and is highly rated. We aim to generate a business profit of 10 billion yen by 2030.

Sensing Core is also expected to expand globally as a solution business. In 2024, we formed a strategic partnership with Viaduct, a company that provides AI-powered vehicle failure prediction solutions in the US. The data obtained from tires was also a black box for them, so our needs matched. In 2025, we will start full-scale operations in the United States.

In Japan, approximately 140 accidents occur annually, including fatal accidents. The Sensing Core detects the slightest looseness of tires, which cannot be seen or touched. This data is transmitted to truck operators and drivers in real time. This type of solution has strong social needs and has great potential as a business that can contribute to the future mobility society.

Koike What is the growth potential of other businesses?

Yamamoto It is a characteristic of our company that it has a sports business despite being a tire manufacturer. As for our main golf business, sales of "Srixon" clubs and balls are strong overseas, thanks in part to the success of our contract player Hideki Matsuyama. As a global brand, we are aiming for a top 3 position, and in tennis, we maintain a top 3 position in global ball share. It is also widely used in international competitions.

A major pillar of our hybrid business is vibration control dampers that utilize the advanced rubber technology of tire manufacturers. After the Noto Peninsula Earthquake on New Year's Day 2024, we examined the damage in the area where the seismic intensity was higher than 6, and buildings with our vibration control dampers had zero total or partial collapses. Many of our customers expressed their gratitude, saying, "We were able to save lives and household goods," and we were acutely aware of the high social significance of this technology.

Increase added value through innovation and raise stock valuation

Koike Your company has a lot of solution businesses with technological advantages, and I feel that we have high expectations for future growth. However, when I look at the stock prices, I feel that they are not being evaluated. In the tire sector, valuations have been generally low. Do you see any trends or challenges in the industry as a whole?

Yamamoto I think this is because of concerns that Japanese automakers are struggling in the Chinese market. However, as long as automobiles continue to run, tire demand will grow by several percent each year globally, proving the robust demand. That's why it's important to differentiate and add value through innovation.

We have been focusing on rubber for 100 years. For example, research on sulfur used in tires has led to next-generation sulfur-based battery materials, and polymer technology has led to cancer cell adsorption kits, which are still at the research stage, and we are considering commercialization. We also want to make efforts to connect innovations derived from rubber technology to new businesses.

Koike It may be necessary both to eliminate investors' uncertainty about business profit contribution and to raise awareness of the business. Through cost-of-capital conscious management, your company have set targets for operating profit margins of 7%, ROE of 10%, and ROIC of 6% in 2027. This number seem to be a little more conservative than the competitors.

Yamamoto The background is that we have failed to achieve our medium-term plan targets over the past several times. The numbers we present to our stakeholders are a commitment and we have set them as a commitment to follow through.

Regarding shareholder returns, we aim to provide stable dividends over the long term, with a basic dividend payout ratio of at least 40%. First of all, we want to increase the speed of growth by investing our cash. Once our growth strategy is on track, investors' perspectives will change, so we will focus on IR activities and disseminate a lot of information.

Governance Changes Mode

Koike Please tell us about the promotion of ESG management. First of all, what are the challenges facing Scope 3 in terms of carbon neutrality?

Yamamoto The difficulty of achieving carbon neutrality lies in the fact that approximately 90% of our group's GHG emissions come from Scope 3, or emissions outside the Company's own supply chain. To reduce these emissions, we need not only our company but also the cooperation of related companies. Among Scope 3, we are working to reduce emissions in categories 1, 4, 11, and 12, which have a large amount of emissions. Last year, we received SBT certification from the Science Based Targets Initiative (SBTi) for our GHG emission reduction targets for 2030. Specifically, we are working to reduce Category 1 (material procurement) by utilizing sustainable raw materials and strengthening supplier engagement.

Koike As tires are made from natural rubber, their traceability from emerging countries is in question.

Yamamoto In September 2018, we joined GPSNR *, a global platform for sustainable natural rubber, due to concerns about illegal logging of forests and human rights issues in the working environment. We have formulated our sustainable natural rubber policy in accordance with the GPSNR framework. In addition, our group company in Singapore, which handles procurement, has introduced an environmental and social risk assessment tool specifically for natural rubber. This tool analyzes a large amount of questionnaire data and plots risks on a map. We will steadily promote activities to realize the sustainability of natural rubber in cooperation with our stakeholders.

Koike Regarding corporate governance, our company has adopted a policy against reappointment of directors with long terms of office.

Yamamoto We understand the purpose of this proposal and are considering it internally. Regarding governance, it is important for outside directors to have sufficient information in order to strengthen their monitoring function. In addition to sharing information among the Board of Directors, we also focused on off-site meetings, which we held 8 times in 2024. In addition to highly urgent topics such as the sale of our North American business, we also had a heated debate and deliberation on company-wide growth strategies. We see 2025 as a turning point in governance.

Koike To shift gears further, we would like you to consider appropriate governance necessary. That said, the wide range of topics discussed today gave us a glimpse of what to be looking forward to in the future of your company. Thank you.

*GPSNR: Global Platform for Sustainable Natural Rubber. An international platform established in October 2018, with the participation of tire manufacturers, automobile manufacturers, trading companies and other companies handling natural rubber.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: March 25, 2025)