Engagement Feature Articles

Sony Group - Human Resources and Diversity as Drivers of Corporate Value Creation

Right: Hiroyasu Koike, President and CEO of Nomura Asset Management Co., Ltd.

Following the formation of Sony Group Corporation in April 2021, the group's founding business of electronics inherited the Sony Corporation name and the group architecture shifted to a flat framework encompassing six businesses including game, music, pictures, image sensors, and financial services, under the umbrella of the dedicated group management company Sony Group. Nomura Asset Management CEO Mr. Hiroyasu Koike joined Sony Group's Mr. Hiroki Totoki to discuss how the group will communicate its inherent corporate value to investors including the assessment of intangible assets.

Purpose is the Guide that Shapes Management Strategy

Koike Given this opportunity to speak with the CFO, today I would like to focus on the financial aspects of the company and corporate valuation. To begin, I would like to ask about "Purpose" as an overarching topic. Sony Group has declared its Purpose to be "Fill the world with emotion, through the power of creativity and technology." Could you tell me more about the background that led to the creation of this concept and the management message it represents?

Totoki Sony Group is undoubtedly an extremely diverse organization, comprised of approximately 110,000 employees globally. As such, we must address the question of how best to share our overarching direction and long-term vision among this large group. Our company was founded based on a famous phrase found in its original prospectus: "To establish an ideal factory that stresses a spirit of freedom and open-mindedness." It is this spirit, and its unwritten aspects, that have been passed down to form our corporate culture. Former CEO Kazuo Hirai further added the keyword "emotion," which current CEO Kenichiro Yoshida incorporated into the company's Purpose.

Koike As Nomura Group will be celebrating its 100th anniversary in 2025, we are in the process of examining a new purpose for the company grounded within the spirit of its founding. Do you believe Sony Group's Purpose has strayed greatly from the founding prospectus?

Totoki Personally, I believe there are shared aspects at the core. Purpose, after all, is something that permeates our company's values and spirit. However, how it is best expressed varies over different eras and in different countries. As a global organization, it is difficult to base our thinking solely in Japanese. We must make considerations for a variety of languages.

Kenichiro Yoshida insisted that our corporate direction be expressed with a powerful message. Strategy is one of the most important aspects of management, and it changes with the times. In contrast, our Purpose does not. One reason we have focused on crafting our Purpose and management direction is because they give form to the company's strategy. Additionally, a powerful message will cultivate a company's culture. Cultivation of the company's culture leads to greater effectiveness in execution of our strategies. While this is somewhat of a "chicken and egg" phenomenon, we can say that Purpose encompasses the importance of holding a unified set of values and direction.

Pursuing New Synergies in the Entertainment Businesses

Koike The three entertainment fields of game, music, and pictures are the current drivers of growth. And within those fields, I believe your business model is to maximize value of content IP (intellectual property). In my view, we have reached a time where a company must communicate the value of these unseen assets and their role as profit drivers in order to be properly assessed in the equity market.

Totoki For our company, game, music, and pictures are areas where it is easy to generate synergies. For example, our game "Uncharted" was recently made into a movie which earned over 400 million USD at the box office (as of June 2022). We are currently pursuing other similar projects simultaneously. In the future, as the Metaverse gains traction, the visual medium will become even richer, generating new forms of entertainment, where the content itself creates new value. I believe it is important to communicate quantitatively the specific value that is created by content IP.

Koike Until now, investors have considered balance sheets as main tools to assess the corporate value. However, moving forward, it will be a test for corporations to communicate the corporate value that exists beyond their balance sheet and for investors to evaluate this new information.

Totoki I believe there are some hints as to how we can solve this issue. One, for example, is calculating the lifetime value of content. In accounting for the Pictures business, this is used when calculating amortization of film costs and is used to estimate the profit generated by content. If we expand this concept and reasonably estimate the income an intangible fixed asset will generate over its lifetime, we may be able to produce figures that can stand up to the scrutiny of disclosure. Although estimating hard figures is difficult in the entertainment business, it is an initiative worth pursuing.

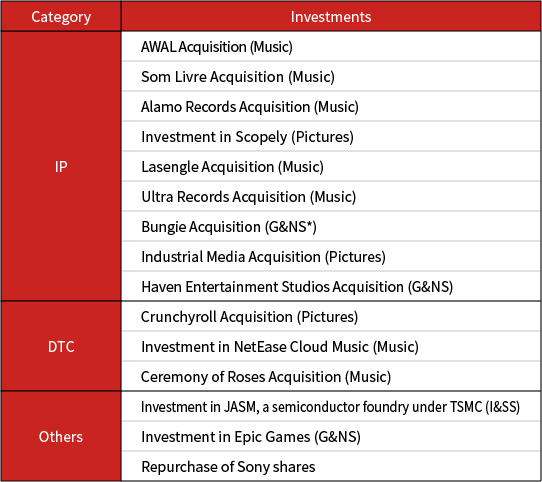

(As of April 30, 2022)

(Source) Compiled by Nomura Asset Management from Sony Group materials

Linking the Value of Intangible Assets to Corporate Value through Pro-Active Information Dissemination

Koike From your point of view, is there a benchmark to use in sectors or companies for which intangible assets play an important role?

Totoki While not related to intangible assets specifically, insurance companies use Embedded Value (EV), which is a similar concept. EV is used to determine an insurance contract's value based on actual profits and estimated future profits. The value can vary greatly depending on the parameters, but I think it is similar to examining how much value is embedded in entertainment IPs.

Koike It does sound very similar. In the case of insurance companies, conditions such as discount rates are generally determined and do not change arbitrarily. It is the same underlying concept. Sony Group possesses a variety of different businesses, and intangible assets are expected to be a driver of future business. However, on the other hand, when viewing Sony's share price, we can see the conglomerate discount(*1) in effect, acting as an obstacle to investment. In order to solve this issue, in addition to efforts from management, Sony will need to conduct pro-active disclosures so the synergies of its intangible assets are incorporated into its share price.

(*1 In cases where a corporation operates multiple businesses, its market valuation and share price are lower than if those businesses were operated independently.)

Totoki I will take that into consideration in our future discussions. Of course, we listen closely to feedback from investors who say that there is a conglomerate discount, and we will not ignore their thoughts and concerns. Although it is a challenge, we want to address this through disclosure and dialogue that deepens our mutual understanding.

Koike At Nomura Asset Management, we have visited with our clients around the world to discuss the issue of why Japanese stocks are discounted. A common comment is that Japanese companies operate too many business lines, which complicates assessment and acts as a barrier to investment. While focusing on a single core business would be easier to understand, Japanese companies are engaged with many incidental businesses which could be harming their corporate value.

Totoki From a certain perspective, I think that could be correct. It is difficult to form business alliances in Japan, regardless of the industry. Japan has many small corporations which would probably benefit from alliances from the standpoint of efficiency, allowing them to pursue greater challenges. However, such developments have rarely occurred.

Koike The global pandemic has been an obstacle to traffic between Japan and other countries, interrupting the flow of information, and possibly creating a distinct impression of Japanese companies for overseas investors. I believe there is value in promoting awareness of the discount that is applied to many Japanese corporations.

"People" are the Key to Creativity that Inspires Emotion

Koike In the field of entertainment, I believe there is a very high value and importance placed on people including creators.

Totoki Even as the importance of people rises, the advancement of artificial intelligence is expanding areas where human tasks can be simulated by technology. In fact, we are already at a point where AI tools have produced music, designs, paintings, and novels. That being said, I believe it is human creativity that inspires emotion in people, and, as the Sony Group which advocates technology, I think it is important to recognize the importance of people. If we lose the ability to inspire emotions in people, we cannot make progress in the future.

Koike As Sony has evolved from an electronics maker known for unique products like the Walkman or VAIO, there may still be old-fashioned types who are resistant to change. What initiatives has Sony taken to spread understanding and adoption of its Purpose and new corporate culture?

Totoki I think it is vital to continually promote the company's values. Within Sony, there are individuals with differing personalities and cultures depending on their business. Even so, it is critical that all are linked to Sony Group's Purpose. We are having more personnel transfers across segments, which should lead to greater opportunities for new findings.

Koike Personally, I am very interested to hear more about how Sony Group promotes skill development and encourages growth among its personnel. Is there some form of training program or perhaps efforts to promote development through daily business?

Totoki I believe the latter is more common, though we do have training programs. We have a "Sony University"(*2) program where workshops are held for employees regardless of job type/title, gender, or nationality. I believe offering opportunities to interact with a diverse group has an inspiring effect to some degree.

(*2 Sony University is an internal educational program within Sony Group established in 2000. It involves various programs aimed at cultivating global leaders.)

Diversity is Driven by Success

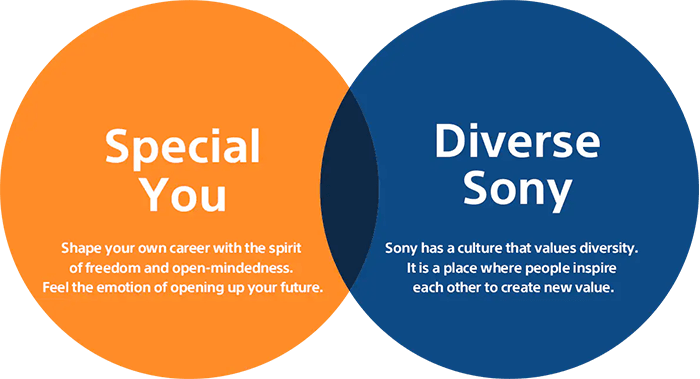

Koike In terms of diversity, I think your HR principle of "Special You, Diverse Sony" is a key concept. Could you share some details regarding management's thoughts and the expectations of personnel?

Totoki It is our message that Sony as a corporation focuses on individuals in order to cultivate their maximum potential, and supports them along the way. However, this does not mean that individuals should not go beyond the framework of our corporate culture. Founder Akio Morita used to say to new employees "We respect your individuality. If we match, we can do great work together. If not, there is no harm in parting ways." I believe this way of thinking is deeply embedded in the company.

Koike There are an increasing number of Japanese companies seeking greater diversity. While there may be differences in eagerness depending on the business segment, where do you think this move for diversity has come from, particularly from a company standpoint?

Totoki While I think others may have differing opinions, personally, I think a large factor is the establishment of a corporate architecture like a holding company, where each business is positioned on equal footing. By revising our corporate framework in which it seemed as if one business, such as electronics, formed the entire group, each division started to evolve its own type of diversity. This may be one positive aspect of a conglomerate.

Koike Growing business based on a diversity of values. To put extremely, linking diversity to corporate performance is one goal of management. Though there is still work to be done.

Totoki I believe that necessity and successful experiences drive adoption. The music segment is an example of this. In my view, it is our most liberal segment and benefits the most from diversity. 70% of our listenership for rap music is comprised of listeners who are Black or female. Music categories themselves are becoming more diverse, with new categories forming as the business grows. The K-pop group BTS becoming a global hit and the success of an Italian rock band are symbolic examples of this. Diversity beyond nationality or gender is driving growth and creating positive spirals. Of course, there are industries where diversity has not taken hold, which further goes to show the importance of successful experiences. Half of Japan's population is women, so I believe it is natural that companies that empower women will succeed.

Koike So, the driver of Sony Group's corporate value is a combination of personnel supported by creativity and technology multiplied by the strength of your diversity. In closing, could you share some of your thoughts on past management and issues to address for the future?

Totoki For the past decade, we faced a difficult turnaround period. What we needed to do was clear, including withdrawing from unprofitable businesses, and it was a time when decisiveness and action were paramount. Circumstances have changed, and we must now pursue growth. To do so, we will need fresh ideas, concepts, and creativity. Diversity will, of course, be a driver in this area. However, the global pandemic, geopolitical risks, and environmental issues pose a variety of risks which will be difficult to assess. That will also be a key challenge.

Koike Thank you for taking the time to join me for this fruitful discussion.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: November 8, 2022)