Engagement Feature Articles

Sumitomo Mitsui Trust Holdings, Inc. - Trust-related Business Continues to Grow as well as Create New Markets

Left: Hiroyasu Koike, President and CEO of Nomura Asset Management Co., Ltd.

While Sumitomo Mitsui Trust Bank, Limited. (SuMi TRUST Bank) represents the core of the group, Sumitomo Mitsui Trust Holdings, Inc. (SuMi TRUST Holdings) is an institutional investor with a presence encompassing multiple asset management companies. What kind of engagement is necessary for the sound development of the equity market moving forward? Mr. Toru Takakura, Director, President of Sumitomo Mitsui Trust Holding, and Mr. Hiroyasu Koike, President and CEO of Nomura Asset Management (Nomura AM), discussed topics ranging from climate change to balancing stewardship and corporate governance of listed companies.

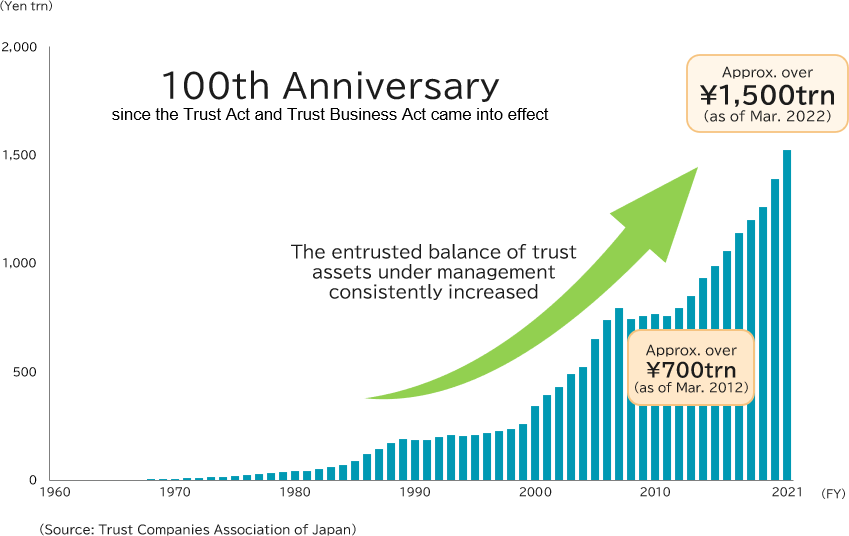

AUM and AUC in Trust-related Business Doubled in the Past Decade

Koike Our companies, Nomura AM and SuMi TRUST Holdings, are both institutional investors. As entities deeply involved in the capital market, we have great interest in engagement as a tool to increase investment momentum in Japanese equities. Today, I would like to hear your opinions as an industry peer.

Takakura Thank you. First, I would like to explain the position of SuMi TRUST Holdings. Roughly speaking, the balance of our trust-related business's assets under management (AUM) is 127 trillion yen and the balance of assets under custody (AUC) is 248 trillion yen. Meanwhile, the total balance of loans in our banking business is about 30 trillion yen (as of the end of March 2022 for all figures). We are also engaged in real estate business and stock transfer agency services, etc. so you can see that we are a financial group whose main business area is the capital markets in a very broad sense.

Compared to 10 years ago, the balance of our credit business, particularly loans, increased only slightly, while the balance of our AUM and AUC doubled. As investment toward carbon neutrality progresses, we expect to see further expansion of the capital market and greater business opportunities for us.

Koike So you have expanded trust-related business area. While your company, of course, also possesses banking capabilities, could you elaborate on the differences and characteristics of your business model from that of so-called commercial banks?

Takakura First, the composition of our loan portfolio is gradually changing. As for loans to corporate clients, we are shifting away from domestic corporate lending to product related lending, such as lending to the overseas subsidiaries of domestic corporates and to asset finance both domestically and internationally. We have made arrangements so our product related lending is not handled solely on our balance sheet, but so that investors can participate as much as possible. By including investor capital, we have been able to offering financing for cases which we could not cover with our own funds alone.

As a result of these financing deals, we began dealing with investors such as regional financial institutions and Asian banks. SuMi TRUST Group's unique feature is that it leverages its banking business to expand into trust-related business areas such as the provision of investment products and asset administration services.

Cooperating on Business Optimization and Engagement while Respecting Independence

Koike Sumitomo Mitsui Trust Group has two asset management companies, Sumitomo Mitsui Trust Asset Management Co., Ltd. (SuMiTAM) and Nikko Asset Management Co., Ltd. (Nikko Asset).

Takakura Our group AUM is the largest in Japan and Asia and among the top 30 in the world. Our AUM consists roughly of half and half of stocks and bonds, respectively. As for equity investment, SuMiTAM, which has the largest AUM size in the group, has an almost 50/50 split between Japanese and global equities.

Koike Are there many similarities between the two companies in terms of engagement?

Takakura We share a common commitment to working firmly on climate change issues within the group. As the Club of Rome, an international think tank, pointed out in a paper entitled "The Limits to Growth" in 1972, the theme of climate change has existed for a long time. However, as global extreme weather conditions persist and concerns for the global environment spread, finally, a society-wide consensus is emerging toward carbon neutrality. While more people are enjoying a peaceful and affluent lifestyle than in the past, climate change is an extremely important risk factor related to the loss of this wellbeing.

Koike Is there a different in the engagement approaches of the two asset management companies?

Takakura For example, SuMiTAM actively participates in financial initiatives, and based on the discussions that occur there, it strives to take leadership and engage to make progress on those issues. While it actively engages with companies both in Japan and overseas, it consciously engage with Japanese companies based on the characteristics of each region. Our style's strength is its focus on constructive discussions without consideration of divestment (withdrawal of investment funds). This is closely related to the fact that SuMiTAM manages a large amount of medium- to long-term funds from pension funds and other investors, and has a high percentage of passive investments. I believe you can understand how important engagement is to SuMiTAM considering how it can make a positive impact on investee companies and the overall market as a "responsible investor" based on the assumption that they will maintain its holdings.

Nikko Asset adopts a similar approach and philosophy, but has a different structure of organization. Nikko Asset is expanding operations and distribution bases/networks globally while leveraging its strengths. Human capital strategy is not led by the Tokyo Headquarters, but by the overseas offices in London and Singapore, which appoint and place the right people in the right positions. In the ESG area, it has placed an ESG head for the entire company in Singapore, where there are people who can provide leadership.

Koike I think there is an idea to integrate the two companies from the perspective of synergy effects and economies of scale. What are your views on this aspect?

Takakura I understand that there is such a way of thinking. With regard to investment products, it is reasonable for index players to standardize to some extent, but active players work on their own judgment from a variety of strategies, so there is not necessarily a significant benefit to combining efforts. If we aim to improve efficiency while respecting uniqueness, we must first focus on head office administrative work and operations. Both companies are already working to standardize these areas. In the area of engagement, they are not only working independently, but also proactively collaborating with other asset management companies through participation in various initiatives.

Materiality Conscious Human Capital Strategy

Koike Our company is actively engaging with companies overseas, primarily through our London office. However, since our own efforts alone are insufficient, we are seeking partners to expand our activities. Does SuMi TRUST Group have similar concerns?

Takakura We have a good understanding of the domestic market, but when it comes to the global market, circumstances and backgrounds differ from area to area, and it is not easy to accurately understand the situation each company is in. However, through participation in various initiatives, we can gain a sense of common global issues and standards and utilize them in our engagement. In addition, SuMiTAM has accumulated a significant investment volume. We have seen an increase in the number of cases where we are named as a top shareholder in overseas companies, and issuers have responded to our engagement with a certain attitude toward shareholders of a certain size.

Koike I understand the significance of participating in initiatives in order to address climate change and carbon neutrality as a financial institution, but I believe that, in the end, developing and retaining human capital is the key to driving engagement. What is your policy and outlook on human capital?

Takakura In our materiality (factors that promote and inhibit the circulation of capital) established through discussion by the Board of Directors of SuMi TRUST Holdings, there are 4 major factors defined as "Impact Materiality" (the positive or negative impacts our corporate activities have on the economy, society, and the environment), in addition to "Management Foundation Materiality" and "Financial Materiality". The first is "Climate change", the second is "Population decline and super-aged society issues", the third is "Technological (digital) innovation", and the fourth is "Financial inclusion". Each of our group companies is approaching their own business strategy formation with an awareness of materiality.

Human capital development is also a major theme, and each company is considering how to secure human capital to cope with climate change. For example, SuMi TRUST Bank has established the Technology Based Finance team to understand the scientific and technical aspects of addressing climate change and support companies within the field. We employ experienced PhDs and Masters who have worked in the laboratories of manufacturers. In addition to improving the quality of our proposals to our clients, we believe that our knowledge will help us evaluate social impact and improve our investment management company's solution capabilities.

Koike You've been able to build the team with impressive speed in response to recent ESG trends.

Takakura I have a sense of speed because I have been working on it for a long time. Around 2000, SRI (socially responsible investment) was emerging in the management of corporate pension funds, and since that time we have been developing our management business with an eye toward future trends. Recently, a consensus on carbon neutrality has finally been reached, and both corporate investment and asset owner interest are moving in that direction. The trend has come to require real social implementation, not false action through greenwashing. However, our group is already moving to hire and promote the necessary professionals in the necessary fields. A virtuous circulation of self-motivated action has also been created, in which professionals bring in professionals to gather in strategic areas such as ESG.

Reduction of Strategic Shareholdings and the Future of Engagement

Koike I have the impression that SuMi TRUST Bank is actively involved in positive impact finance.

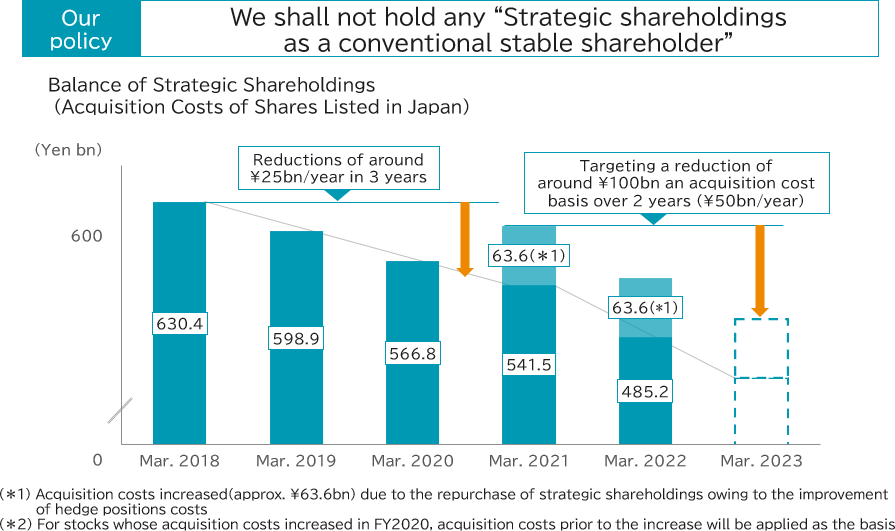

Takakura In May of last year, right after I assumed the position of president, we announced our policy to reduce our strategic shareholdings to zero. Strategic shareholdings form a bond with business partners, but they are also one of the causes of stagnation in capital market's overall circulation. It is an important issue from the viewpoint of the sound functioning of corporate governance, and I wanted to eliminate it as soon as possible in order to promote an economic environment that supports improving returns in Japan.

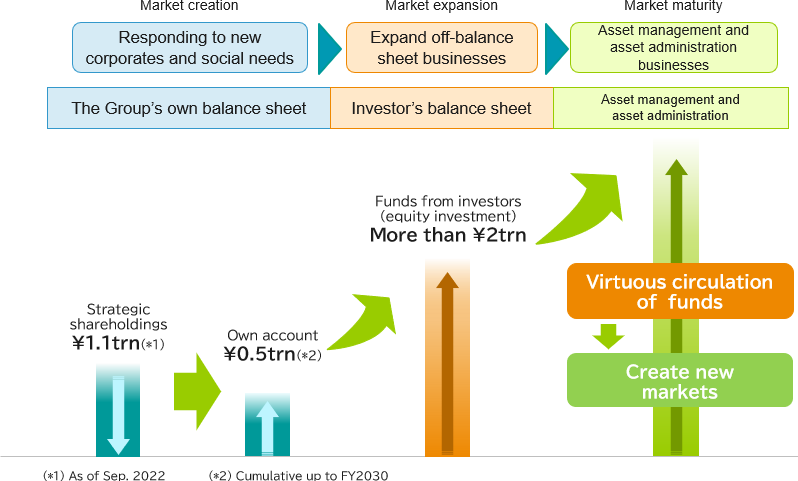

The corporate governance policies of our business partners vary widely, and progress has been relatively slow. However, we can use the investment surplus generated by the reduction of strategic shareholdings to invest in areas that have an impact on social issues related to climate change. In order to achieve decarbonization and other goals, it is necessary to create new technologies and businesses. We want to create a virtuous cycle in which we first identify risk and return before making investments, and then attract funds from investors who share our assessment of those investments.

Koike Strategic shareholdings are an obstacle to capital efficiency and profit growth, and we have no objection to increasing capital efficiency of the company by selling strategic shareholdings and diverting the capital to other investments. On the other hand, with such impressive engagement skills, you could potentially contribute to the further development of the Japanese capital market by seeking to increase the corporate value of your holdings, which had a book value of 500 billion yen at the end of March 2022. While I understand your unique position of balancing governance as a corporate and stewardship activities as an institutional investor, what are your views on this topic?

Takakura I recognize the approach that you mentioned. Efforts to reduce strategic shareholdings will not only improve our capital efficiency, but will also promote a virtuous cycle in capital market.

As a shareholder and financial institution, we engage with unlisted companies in the pursuit of the balanced creation of both social value and economic value. If we assume that we will maintain strategic shareholdings of listed companies, we must pursue engagement activities to gain the understanding and approval of other shareholders. For this reason, SuMi TRUST Bank and asset management companies individually set voting guidelines for strategic shareholdings and exercise their voting rights accordingly. Engagement activities should be conducted with an awareness of common shareholder interests, but we must further study how these activities should evolve.

Expanding the Virtuous Cycle of Funds, Assets, and Capital in Japan through the Creation of a Private Asset Market

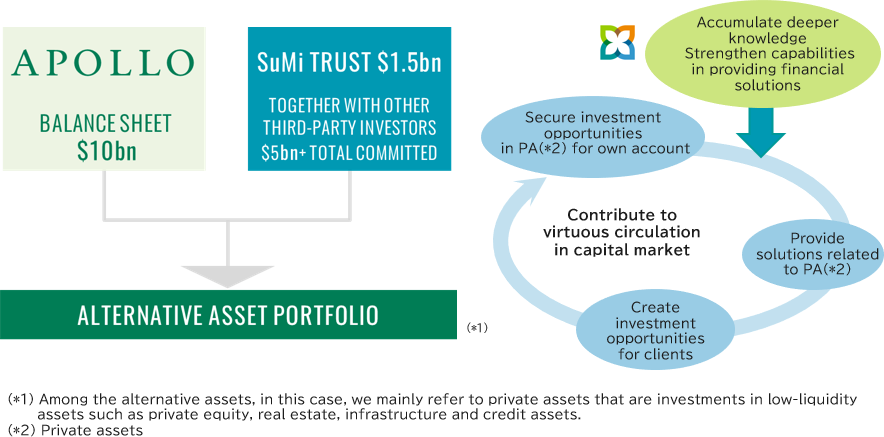

Koike In July 2022, you announced a strategic partnership with the major US investment fund Apollo Global Management in the asset management business, etc.

Takakura In addition to entering into the business partnership, our group company SuMi TRUST Bank made the decision to invest $1.5 billion in a private asset portfolio. This initiative is not just for investment, but is also aimed to develop a private asset market in Japan. Domestic corporates are expected to require a significant amount of funds in order to realize a decarbonized society. On the other hand, there are also the long-term investment needs of insurance companies and other institutional investors, as well as those of individual investors. We aim to create a new flow of funds by leveraging our strengths as a trust bank group.

Once we have done so, we can enhance our knowledge and experience by investing on our own balance sheet, and apply that knowledge in the development of more convenient investment products and services for investors. We have much to learn from Apollo and other experienced overseas players, and this is a great opportunity to accelerate our efforts in domestic private asset market development.

Growth Factors Strengthened by Expansion of Trust-related Businesses Areas

Koike Real estate is one pillar of the trust banking group's business. Is ESG drawing attention in this field, as well?

Takakura Real estate is also a type of asset management in a broad sense, and we view it as a field in the asset management and asset administration business. The balance of real estate management trust exceeds \20 trillion. From the perspective of climate change, it is our responsibility to promote green initiatives at properties, and we are focusing our efforts on consulting and supporting the acquisition of environmental certifications. In public and private REITs, there is high interest among asset owners, and we believe that we have a great responsibility to meet the expectations of society.

Koike The image of trust banks has greatly changed, and we can clearly see how you are trying to grow while continuing to flexibly evolve as a unique financial institution.

Takakura 2022 marked the 100th anniversary since the Trust Act and the Trust-related business Act were enacted. Our company's roots, looking back 100 years, were not in banking, but rather as a trust company. I believe that trust functions and services will play a large role in the formation of the green society required today. For example, we have gotten involved in forestry trusts in Okayama Prefecture. Although the status of trust banks has greatly changed since the Showa era, when the focus was on loan trusts, it can be said that we have returned to the starting point in terms of finding solutions to social issues through the power of highly flexible trusts.

Koike That's very interesting. That may change the way we view SuMi TRUST Holdings' stock price. Should we invest from a growth perspective? Or should we invest from a value and yield perspective? What is your assessment of the current stock price level and future prospects?

Takakura I think the fact that the board of directors exists and operates under a fiduciary duty to shareholders is common to all companies. However, even more so, our group is expected to act as a fiduciary for society and our clients. By taking into account capital efficiency while we add value for society, clients, and a wide variety of other stakeholders, we can increase profits and fulfill our responsibilities to our shareholders. As such, I believe that if the scale or volume of the area where we serve our stakeholders is large, growth factors will be more significant, otherwise, value factors would be favored.

Speaking of our group's growth potential with objective figures, the balance of trust assets in Japan has doubled to \1,500 trillion in the past 10 years. If we focus our efforts and improve the flow of investment capital toward carbon neutrality, we expect the trust market to more than double over the next 10 years. As the only financial group in Japan with a trust-related business as its core, our group will develop and grow alongside the capital and trust markets, meaning investors may want to focus on growth factors moving forward.

As for capital efficiency, which is a concern for investors, we have adopted a strategy to improve profitability by replacing capital-heavy banking credit with more profitable assets. Investments on our bank's own balance sheet, such as impact equity and private assets, will also lead to the expansion of asset management and asset administration business that is less demanding of capital. Overall, ROE (Return on Equity) is on the rise, and PBR (Price to Book Ratio) is trending upward.

Koike I am very happy to hear of a growth company in the financial industry. We have high expectations. I also hope that we can work together as institutional investors seeking to encourage the development of the Japanese capital market.

Takakura I believe that fulfilling our fiduciary duty to our diverse stakeholders will lead to expansion of the capital market and business opportunities around the world. In Japan, the base of investors, including asset formation generation, is expanding, and I believe there are many things we can work on together.

Koike I look forward to it. Thank you for today's fruitful discussion.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: December 16, 2022)