Engagement Feature Articles

Sumitomo Mitsui Financial Group - The courage to make a breakthrough and realize transformation in financial services

Right: Hiroyasu Koike, President and CEO, Nomura Asset Management Co., Ltd. (Nomura Asset)

Sumitomo Mitsui Financial Group (SMFG) seeks to differentiate itself through digital initiatives such as the new financial service "Olive" and the service platform for small and medium-sized enterprises, "Trunk." How is this major financial group confronting significant environmental changes and striving to enhance its competitiveness? Group CEO Toru Nakashima and Hiroyasu Koike of Nomura Asset Management discussed these strategies and prospects.

The mindset that "maintaining the status quo is not acceptable"

Koike In October 2023, I had the opportunity to speak with the former CEO Jun Ohta and heard about his efforts to achieve high added value through digitalization. Since you took over as Group CEO, Mr. Nakashima, it seems that this momentum has continued to accelerate. Looking back on your time as CEO, how do you feel about this?

Nakashima Since becoming Group CEO about a year and a half ago, we have completed a smooth transition, and the new management structure has settled in well. The late Mr. Ohta repeatedly emphasized the phrase "Break the Mold," encouraging employees to get rid of stereotypes, as well as our focus on the logic of precedent and organization. As a result, they have developed a mindset that "maintaining the status quo is not acceptable." However, I also strongly felt the difficulty of translating this change in mindset into concrete actions. Building on this spirit of reform, I adopted the slogan "Make a breakthrough," encouraging everyone to take courageous, specific actions next. Recently, I felt that this message has taken root, and that various areas within the group are beginning to move toward transformation. As Group CEO, I am very pleased to see this progress.

Koike That said, I imagine it's not easy to spread the CEO's message and translate it into action within such a huge financial group with many employees. Were there any particular efforts or initiatives you implemented to make this happen?

Nakashima Communication with employees is crucial, so I make a point of delivering messages directly whenever possible. For example, we have a section on our internal SNS called "President! Can I Follow You?" where several times a month, reports on my activities are posted. These include my thoughts and expectations for our employees, and on average, over 10,000 employees read these posts.

At the same time, I place equal importance on traditional communication methods. While the concept of "Tone from the Top" is important overseas, in Japan, messages tend not to permeate unless they come directly from one's immediate supervisor. In our Management Meeting, I ask the executives to thoroughly convey what I have communicated down through their respective layers. This creates a terraced system of information flow-from management executives to executive officers, then to department heads, group leaders, and frontline employees-ensuring effective communication throughout the organization.

Differentiating Factor: Speed of Response and Agility

Koike You achieved the milestone of ¥1 trillion in net income ahead of schedule in your Medium-Term Management Plan. Looking ahead, what are your prospects for further improving ROE and enhancing the PBR?

Nakashima This year marks the final year of our three-year Medium-Term Management Plan. When we formulated the plan two and a half years ago, the bottom-line profit target for the final year was set at ¥900 billion, but we now aim for ¥1.3 trillion, reflecting a level of profitability that was beyond our initial expectations.

Several factors have contributed to this improvement. The long-standing negative interest rates environment has finally been lifted, allowing deposits to generate earnings. Additionally, progress in corporate governance has led to reductions in equity holdings, and combined with stock price increases, this has resulted in higher gains on sales of stocks than originally anticipated.

Beyond these environmental factors, the regrowth of Japan has significantly boosted domestic business. Corporate actions such as M&A by Japanese companies, new investments, carve-outs arising from corporate restructuring, and delisting has become more active, presenting us with growing business opportunities that drive our profits.

Among retail customers, the shift from savings to asset formation is accelerating, expanding our wealth management business. Moreover, progress in cashless payments has also led to increased revenue from transaction fees.

Koike When looking at the global business environment from a broad perspective, what kinds of risks do you take into consideration?

Nakashima The primary risk remains the US economy. If tariffs lead to an economic slowdown in the US, the impact would inevitably spill over to Japan, raising concerns that GDP growth could stagnate or even turn negative temporarily.

The worst-case scenario would be if a US-originated recession occurs just as the sentiment shifts toward regrowth, spreading fears that Japan might return to its previous deflationary state.

That said, at this point, the momentum for Japan's regrowth remains solid, and while we expect a slowdown in the US economy, we do not foresee a severe recession.

Koike Earlier, you mentioned that corporate actions have been picking up momentum in the domestic market. In capturing these business opportunities, what do you consider to be the group's core strengths and key differentiators from competitors?

Nakashima Our greatest strength is our responsiveness and agility. We quickly meet customer needs and often anticipate their demands ahead of time, which has earned us particular recognition in serving medium-sized companies with swift decision-making processes.

On the other hand, when SMBC was first established, our large corporate business lagged significantly behind competitors; however, over the past 20 years, we have narrowed that gap considerably. Moving forward, to further strengthen our position, we plan to enhance our capabilities while actively learning from our competitors' strengths.

Specifically, we aim to catch up with competitors by strengthening our industry research functions, deepening our business with Japanese companies overseas, and upgrading our cash management services.

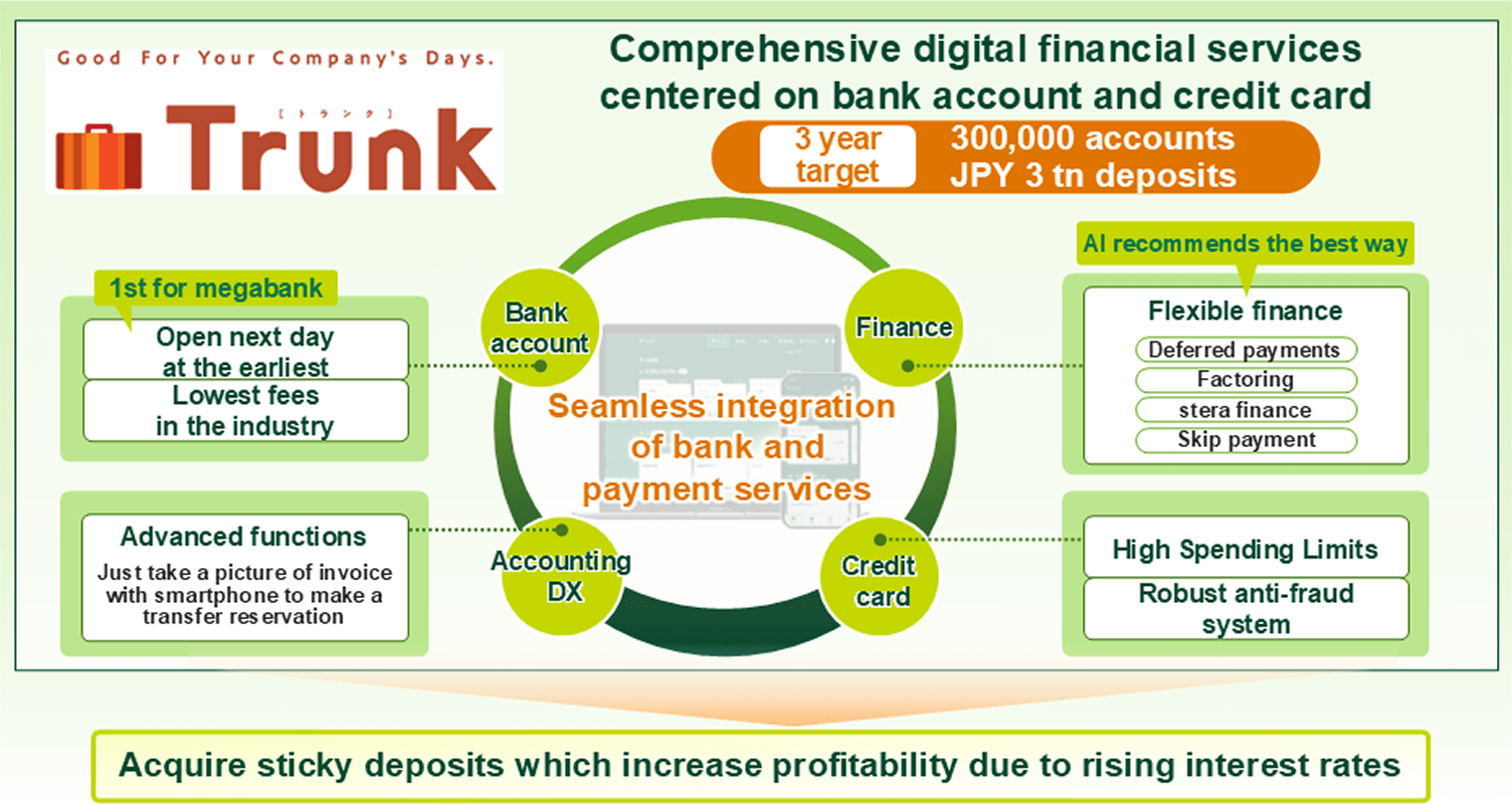

New Service Targeting Small and Medium-Sized Enterprises: "Trunk"

Koike You are also working on small and medium-sized enterprise (SME) business utilizing "Trunk."

Nakashima Personally, I am very excited about Trunk. While we aim for around ¥10 billion in revenue within a few years, we are not seeking large profits immediately. Traditionally, the mega banks have primarily served medium-sized and larger companies in major metropolitan areas, but 99% of companies in Japan are small and medium-sized enterprises, many of which are located in regional areas. We have not sufficiently provided services to those companies until now. I have long questioned whether it is appropriate for banks labeled as mega banks to continue on this path.

However, since it is difficult to dedicate significant human resources, we decided to offer a digital service that can be completed seamlessly online, and we are now taking the first step. Given the era of negative interest rates, this business would have struggled to become profitable, but now that the interest rate environment has changed, we can proceed with launching the service. I believe it will become an exciting business with long-term potential.

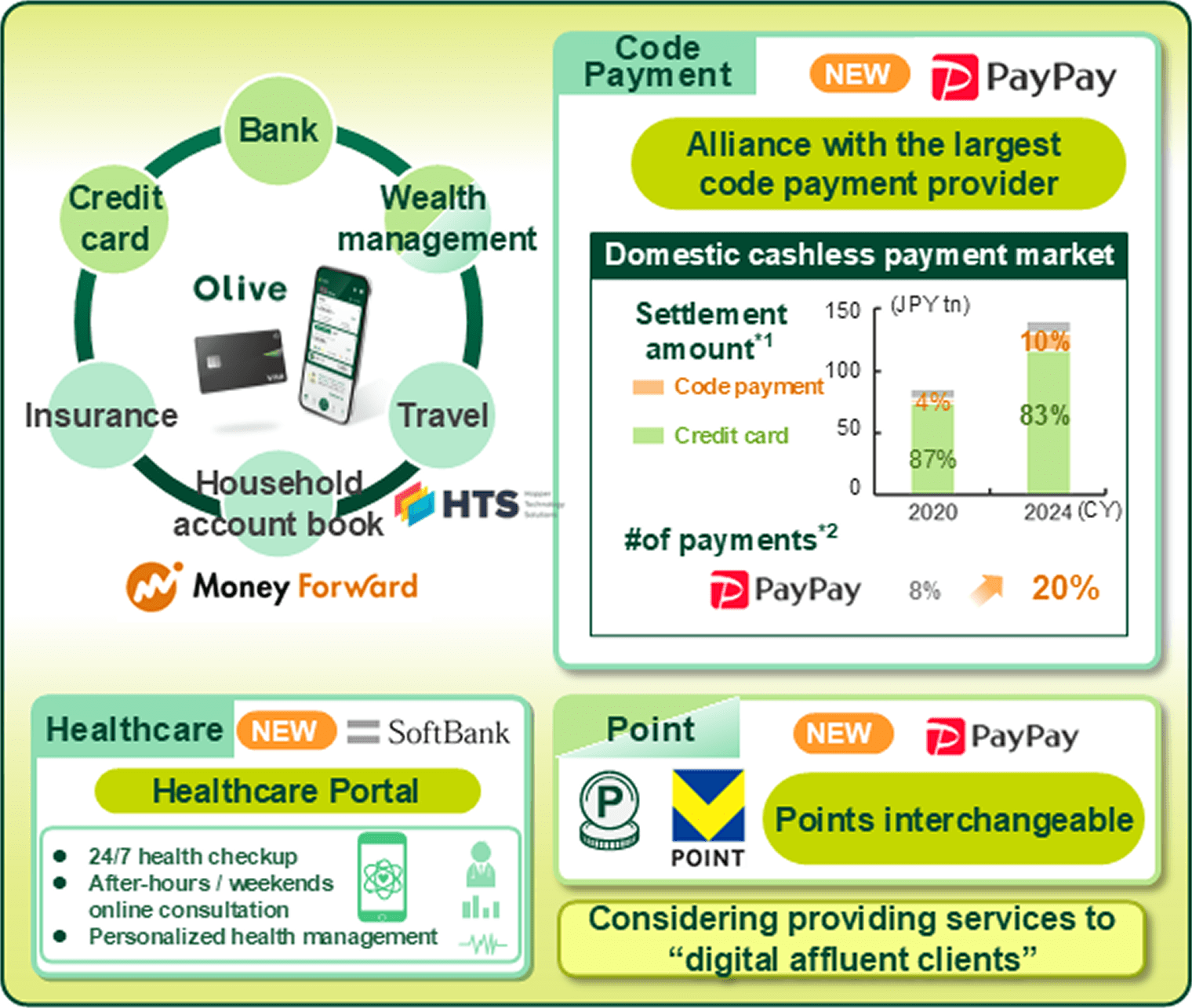

Transforming Retail Business with "Olive"

Koike There have been various reports about initiatives using "Olive" in the retail sector. For SMFG, is Olive primarily a function for differentiation and added value, or is it a fundamental reform aimed at transforming retail banking itself? What goals are you aiming to achieve with Olive?

Nakashima We are transforming our entire retail business centered on Olive. For example, online banks have digitalized only parts of the journey, but traditional retail services such as deposits, loans, payments, and wealth management have not yet been fully digitized. We launched Olive to redesign the whole business model.

As Olive scales customer acquisition, large branches will no longer be essential. This led us to develop smaller, streamlined branches called "STOREs," based on the concept that it would be useful to have small locations where customers can get advice on using Olive.

In the wealth management business, we plan to capture digitally savvy affluent customers through a new service collaborated with SBI Securities. As the Olive ecosystem expands, we believe our retail business will undergo a significant transformation.

Koike While digital services often achieve a strong initial uptake, many companies struggle with growth afterward and face low profitability. Considering the costs involved in service development, how do you view the profitability of Olive?

Nakashima Currently, Sumitomo Mitsui Banking Corporation has about 29 million individual accounts, and the number of Olive account openings has surpassed 5.7 million. We believe that customers who use us as their main bank have already switched over to Olive.

Olive's earnings have been steadily increasing, and we achieved a single-year profit in FY3/25. Additionally, our shift to the streamlined "STORE" is reducing branch-related costs, already generated savings amounting to several tens of billions of yen.

However, growth trajectories often slow after a strong start. To address this, we are implementing measures such as integrating the T-point and V-point and collaborating with PayPay.

We also receive many proposals from companies that wish to offer their own services through Olive. By selectively incorporating these partners, we aim to make Olive an even more convenient and valuable app. Our target is to reach 12 million users within five years.

*2 Estimate by PayPay Corporation

(Source: Sumitomo Mitsui Financial Group company materials).

Koike As a strategy to transform the traditional banking model, you're aiming to progressively embed yourselves into customers' lifestyles as a platform. How are you approaching the development and acquisition of talent to drive this initiative forward?

Nakashima In our retail business, in addition to nurturing talent internally, we are also hiring designers from outside the company. Moreover, with Sumitomo Mitsui Card Company playing a central role in development, Olive has progressed rapidly within a culture that encourages pushing forward new initiatives.

On the other hand, our wholesale business has long relied on a labor-intensive model, so our shift to digital has been slower and remains a work in progress. We have now established a dedicated department to transform the business model through digital within our traditional culture, and this approach is gradually gaining traction.

Aiming to Become a Financial Group That Can Compete Globally

Koike What are your thoughts and plans regarding overseas business expansion moving forward?

Nakashima Our vision is to become a "Global Solution Provider," and the proportion of earnings from our overseas business has been steadily increasing each year. Although Japan's economy is expected to regrow, given the anticipated population decline, long-term growth rates of around 2% annually may be achievable, but reaching a higher growth rate of 5% will be challenging. To compete with global financial institutions, we must target growth above 2%, which requires meaningful business exposure in regions like the US and Asia.

Moreover, in the financial sector-especially in wholesale banking-focusing solely on strengthening domestic business is unrealistic. Our global network is what enables us to serve Japanese clients better, so expanding overseas operations remains essential.

That said, our immediate challenge is that our ROE is not yet at a sufficient level.

In Asia, we have not yet realized adequate returns on past investments, so our priority is to improve profitability at existing portfolio. Countries targeted under our Multi-Franchise Strategy-India, Indonesia, Vietnam, and the Philippines-are regions where Japanese financial institutions can differentiate themselves through their inherent advantages compared to European and American competitors.

In the U.S., our securities capabilities lag behind competitors', and we have not fully leveraged our lending relationships. However, we see potential here and intend to capture it by strengthening our collaboration with Jefferies.

By concentrating on areas with growth potential and strengths, we are confident that our ROE will improve.

Aiming to Sustainably Exceed a PBR of 1.0

Koike Finally, I would like to ask about the stock price and capital policies. As the CEO, how do you currently perceive your company's stock valuation and price level?

Nakashima The stock price has significantly improved amid the normalization of interest rates. However, our Price-to-Book Ratio (PBR) remains below one, so we are not satisfied with this aspect.

Financial institutions' stock prices tend to be highly sensitive to external environments, but even during unfavorable conditions, we believe we must maintain a PBR above one. In terms of ROE, a minimum of 10%, and ideally around 12%, is necessary.

Additionally, as gains on sales of equity holdings gradually decline, it is essential to implement measures to ensure sustainable growth. This ties directly into the domestic and overseas strategies I mentioned earlier.

Koike Thank you very much. I understand that the collaboration with PayPay and SBI Holdings is a natural outcome within your broader strategic vision. I look forward to seeing how these initiatives develop in the future.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: August 1, 2025)