Engagement Feature Articles

Panasonic - Further Implement Autonomous Responsible Management, Achieve Growth with Strategy and Operational Capabilities

Left: Hiroyasu Koike, President and CEO of Nomura Asset Management Co., Ltd.

Adopting a new structure in April 2022, the Panasonic Group is now organized as seven operating companies under the umbrella of Panasonic Holdings. Nomura Asset Management CEO Mr. Hiroyasu Koike joined Panasonic Holdings' Mr. Yuki Kusumi to discuss the company's intentions behind its organizational structure called "operating company system", instead of "holdings company system", and its path toward corporate growth over the next 160 years*.

*In 1932, founder Konosuke Matsushita laid out a 250-year plan, of which 160 years remain as of 2022.

Aiming to Enhance Competitiveness through Autonomous Responsible Management

Koike I view the April 2022 transition of Panasonic Holdings to a holding company as a significant change. I understand that the purpose of establishing a holding company is to shift away from a uniform, company-wide HR system and decision-making process and aim to maximize corporate value by encouraging greater competitiveness at each operating company. In fact, each operating company is thoroughly implementing autonomous responsible management with increased empowerment, leading to greater individual activities. I've also heard some say that IR has become a great deal more agile. I would like to hear more about the intent behind your transition to a holding company.

Kusumi Our aim was revisiting the autonomous responsible management set forth in Konosuke Matsushita's management philosophy. In the last 30 years or so, the company has appeared to grow at times, partly through acquisitions, but there has been no major growth in real terms. When examining why, we found that too much emphasis was placed on single-year performance, that is, short-term sales and operating profit. The pursuit of performance targets had become the goal. We had become unable to offer useful and satisfying services to society and customers and receive profits in return.

When the head office sets the direction and that becomes the objective, sales targets and existing practices become fixed, and the evolution of work processes and digitization ceases to advance. We had to thoroughly revise such a situation.

Koike I believe that the governance of individual operating companies is a very important part of holding company system. As a holding company (hereinafter HD), what kind of governance policy do you have for each operating company? Also, I believe that the mission of the HD is to increase corporate value as a group, but how do you view the future position of the HD? For example, do you assume that HD will be positioned as an investment company?

Kusumi The main objective of transitioning to an HD was to enhance the competitiveness of each operating company and encourage an unrivaled competitive mindset, rather than focusing on portfolio management. We wanted to return to the basics to implement the group's Basic Business Philosophy and realign any situation of becoming off track. The HD's role can be divided into 5 categories.

First is the thorough implementation our Basic Business Philosophy. We made an updated interpretation of the contents to make it easier to comprehend the essence of the language written 60 years ago, and we increased the amount of communication from executives about them. Second is strengthening our operational processes and literacy to help enhance competitiveness. In addition to the establishment of the Operational Strategy Department (using digital technology to innovate production sites), we are learning from the Toyota Production System. From the necessity of a new leader to change our process with speed, we brought in Mr. Tamaoki, a specialist in business processes as CIO, and he is leading our DX.

Third is revising our top-down management culture. The HD also has the role of promoting an environment in which we can maximize the potential of each employee. Fourth is reviewing our business portfolio. Whether we invest or divest, we must provide support from a broad perspective. Fifth is risk response. In addition to security and compliance, we must prepare for geopolitical risks. In our roles at the HD, the Group CFO, Mr. Umeda, and I take part in the supervisory function of each operating company.

Koike How has the response from stakeholders been?

Kusumi As the Group CEO, I engage in dialogue with employees using SNS (Yammer, an in-house system), and it is working quite well.

Regarding our business partners, although there are some difficulties involved in changing traditional business practices, we have received generally good feedback on initiatives such as the new sales scheme for consumer electronics in Japan (a new pricing scheme, conducted by the Lifestyle segment, that enables pricing by manufacturers under certain conditions).

When communicating with analysts, I fully understand their expectations of increased profits in the short-term. However, my current priority is to improve our management structure, which may take some more time before the effects would become apparent.

Bolstering Growth Strategies through Large-scale Investment in Automotive Batteries

Koike Next, I'd like to ask you about your growth strategy.

For the automotive battery business, the business environment has changed drastically over the past year. In the United States, a large amount of tax credit is expected to be made available, but on the other hand, we expect to face intensifying competition from Chinese and South Korean companies. Although the hurdle for investment has decreased, it still requires a significant management decision. In the past, your company has made large investments in plasma display panels and other products. In comparison to those investments, how do you assess the business opportunities and risks involved in investing toward automotive batteries?

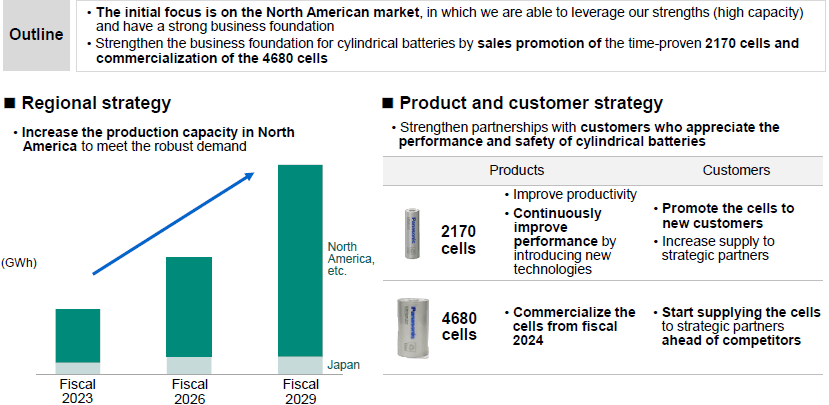

Kusumi In the automotive battery business, competition for materials and other resources and U.S.-China decoupling are showing significant risks. The nature of the business is completely different from that of display panels. Plasma TV business faced unexpected technological competition from LCD technologies. In contrast, it is clear that lithium-ion batteries are the mainstream automotive battery technology for the time being. Plasma display panels ran into yield problems as the display increased in size. However, in the battery business, battery capacity makes the difference, and advances in their internal chemical composition is key. In B-to-C markets, like plasma TVs, cost competition was a core factor, but for automotive batteries, the focus is on performance and safety. That's where communication with customers comes in. We have a strategic partnership with Tesla in the U.S. market, and we have established a joint venture with Toyota Motor Corporation for automotive prismatic batteries. The battery business is one where we invest in line with our customers' requests, while responding to their expectations for high quality batteries. As a result, we do not expect to fall into an excessive capital investment competition as was the case with display panels. Improving productivity and operational efficiency was a challenge for our business, but through our collaboration with strategic partners, we are seeing signs that we are at the top position of the industry in terms of production efficiency.

Note: Fiscal 2023 refers to the year ending March 31, 2023

Koike We recognize that Blue Yonder, one of the world's leading supply chain software companies, creates synergies within the group and that its market value can be actualized by listing. On the other hand, we also believe that there are governance issues in listing while Panasonic maintains a majority holding. Could you discuss the significance of your Blue Yonder investment and the decision-making process that led to consideration of listing?

Kusumi At first, I was skeptical about making Blue Yonder a 100% subsidiary, but after I saw the actual implementation of the company's solutions to our Mobile Solutions business and the distribution center in Osaka, I realized its true potential. The original goal was to provide a more efficient supply chain management solution, shortening lead times and reducing losses by reducing shortages and excess inventory. In addition, we believe that we can create a virtuous cycle in the supply chain by combining Blue Yonder with the technologies we have cultivated in the "Gemba" Solutions business. The other management executives of the Group Strategy Meeting also deepened their understanding about the advantages and agreed to make Blue Yonder a 100% subsidiary. At present, the new CEO is working on transformation, and we intend to further raise its corporate value.

Leading the Manufacturing Industry with "Panasonic GREEN IMPACT"

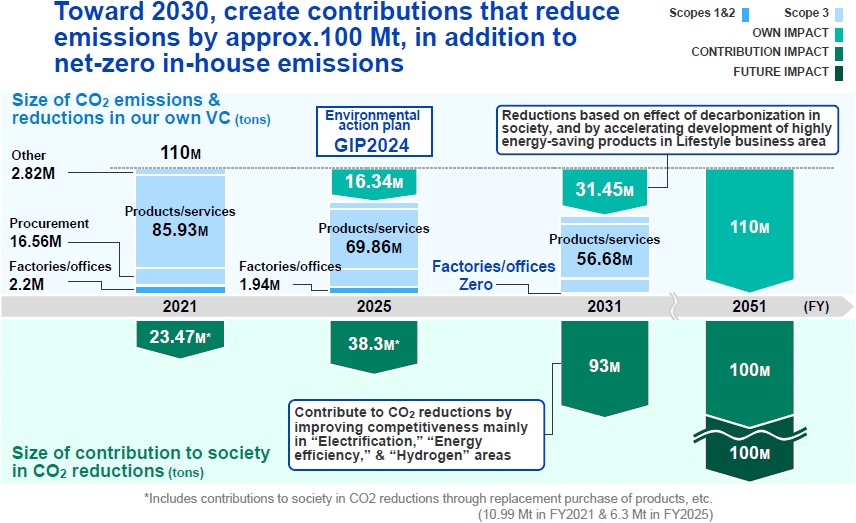

Koike In January 2022, your company announced a new environmental vision, "Panasonic GREEN IMPACT", with the aim of achieving a reduction impact of approximately 1% (≒ 300 million tons) of the current global CO2 emissions by 2050, not only by reducing your own CO2 emissions, but also by making use of avoided emissions. Since your appointment as Group CEO, the company's efforts to address environmental issues have accelerated, and I believe you are garnering greater market attention.

Kusumi We are working to achieve net-zero emissions for Scopes 1 and 2 by 2030 and also achieve net-zero emissions for Scope 3 by 2050. At the same time, we would like to firmly establish the standard of "avoided emissions" throughout the industry to address climate change.

Toward 2050, we recognize that GX (Green Transformation) is a social issue of the highest priority that must be addressed. In 1932, at the company's first foundation day ceremony, Konosuke Matsushita announced the "true mission" along with what came to be known as the "Tap Water Philosophy*". He said that "only after there is spiritual peace of mind and a limitless supply of material goods will humanity achieve true happiness", and this should be achieved "over 250 years". Addressing climate change is also part of our company's management philosophy.

*The "Tap Water Philosophy" describes Konosuke Matsushita's hope of electric home appliances becoming widely affordable, by analogy to inexpensive drinkable water being available in Japan from turning a tap.

Note: FY2021 refers to the year ended March 31, 2021

Koike Nomura Asset Management is also engaged in efforts to properly evaluate corporate efforts to reduce GHG emissions, not only by reducing GHG emissions, but also by incorporating into our ESG assessments the amount of contribution a company's products and services have made to GHG reductions. However, there is no unified standard for measuring and disclosing the amount of contribution to reduction, and we feel that it is a challenge to appropriately evaluate the efforts of various companies.

Against this backdrop, Panasonic Holdings and Nomura Holdings are acting as leaders within the Ministry of Economy, Trade and Industry's GX Business Promotion Working Group, where we are working to establish a framework for properly evaluating emissions reductions through products and services provided to the market. As a member of the Nomura Group, we are also contributing to the activities of this working group. I would like to hear your opinions and advice on these institutional investor efforts.

Kusumi We appreciate that institutional investors are advancing the same initiatives as we are. I hope these activities will further accelerate the efforts of companies to address climate change.

Data standards are an important initiative of the World Business Council for Sustainable Development (WBCSD), and there is a movement to set standards in the electrical and electronics industry by the International Electrotechnical Commission (IEC). I hope that this trend will be recognized more widely in all industries.

Koike When I talk with overseas institutional investors, I feel that there is a misunderstanding about Japanese companies and the Japanese financial and capital market. The management philosophy of Mr. Matsushita has been passed down from generation to generation, guiding bold decision-making, and raising expectations. What do you feel are the key points to reflect Panasonic's strengths as we've discussed in its corporate value?

Kusumi Growth potential is important. Growth potential is brought about by competitiveness. Competitiveness means quantifying how we will change our strategy and realign our systems of operations. When we reach an unrivaled level, from the perspectives of customers and society, profits will increase, enabling employee/shareholder returns, and being able to make the next investment for growth.

As I said at the beginning, the priority is to achieve unrivaled competitiveness, by every employee demonstrating their individual capability to its fullest extent, even if it takes some time, rather than taking a short-term approach.

Koike Thank you for today's very fruitful discussion.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: January 27, 2023)