Engagement Feature Articles

MS&AD - Transforming Business Style through Sale of Strategic Equity Holdings

Left: Hiroyasu Koike, President and CEO of Nomura Asset Management Co., Ltd. (Nomura Asset Management)

The non-life insurance industry is facing increasingly diverse and complex risks, including intensifying and frequent natural catastrophes, international wars and conflicts, and cyberattacks. The MS&AD Insurance Group (MS&AD Group) is evolving its governance to break away from conventional business practices. Mr. Shinichiro Funabiki, who took over as Group CEO in June 2024, and Hiroyasu Koike of Nomura Asset Management discussed the transformation and growth story of the MS&AD Group.

The Value of Insurance Companies in a Society Where Risk Increases and Changes

Koike I read the MS&AD Group's Integrated Report 2024. The CEO's message strongly conveyed your determination to change the company. While I have high hopes for a culture change following the scandals, I believe the environment surrounding the non-life insurance industry has changed drastically such as with the introduction of EVs, autonomous driving, and frequent natural catastrophes. Could you tell us about your grand design for leading your company in the future?

Funabiki Recently, natural catastrophes have become more severe and frequent, and there is a view that the number of automobile accidents will decrease in the future, which may affect our mainstay automobile insurance. In addition, risks such as international wars, conflicts, and cyberattacks are becoming more diverse and complex. I understand your question as asking what kind of growth story we are creating in this challenging business environment.

As you pointed out, the increasing and changing nature of social risks present a challenging environment for insurance companies, and at the same time, the raison d'etre for insurance companies is greater than ever. In light of this, we aim to achieve growth by meeting customer expectations and becoming the most preferred insurance company by customers.

In response to recent inflation and natural catastrophes, we have been setting appropriate rates and strengthening underwriting (the evaluation process to issue insurance contracts). We are seeing steady effects, as seen in the fact that fire insurance, which had been in the red for a long time, will become profitable in fiscal 2025.

In order to provide insurance products on a sustainable basis against the emergence of new risks, such as intensifying and frequent natural catastrophes and cyber risks, we need to have strong capital strength. To this end, in addition to receiving appropriate insurance premiums, it is essential to accumulate profits by lowering operating expense ratios through improved efficiency.

Expansion of International Business and Thorough Cycle Management

Koike I believe that solutions to social issues such as climate change and loss prevention and mitigation are being provided in various fields. There are also growing opportunities for insurance companies to play an active role in fields such as the metaverse, smart cities, and space businesses that will be necessary for society in the future. However, there are many new areas in these specialty fields, and I feel that it may be difficult to calculate reasonable insurance premiums and manage risks effectively.

Funabiki In areas where historical data and risk assessment models are not sufficient, it is necessary to devise insurance underwriting, but on the other hand, we can differentiate ourselves. We actively dispatch experts from Japan to MS Amlin Underwriting Limited (operates in the UK Lloyds Insurance Market) which has high reputation for advanced underwriting. Through this initiative, we emphasize learning underwriting from the basics and developing hypothesis-building skills regarding risks, thereby contributing to enhancing the group's underwriting capabilities.

Koike When I spoke with Mr. Hara (the Group CEO at that time) in 2022, he said that MS Amlin, which is at the core of its international business, had finally bottomed out. The company has rebounded and is contributing more to its earnings, but in comparison with the global leading insurance group, further catch-up may be required.

Funabiki In the field of non-life insurance, there exists a cycle characterized by repeated rate increases (hardening) and rate decreases (softening). Properly understanding these fluctuations and rigorously managing the discipline of rate setting and underwriting decisions is referred to as cycle management. This is the key to our business success and the point where MS Amlin's bottom line has improved.

The MS&AD Group has the largest market share as a Japanese non-life insurance company in the UK, and has secured a second-tier position in corporate insurance market in continental Europe due to the consolidation of its businesses within the group. In Asia, we are a non-life insurance group with underwriting facilities in all 10 ASEAN countries, and our total insurance premium income is number one in the region.

At the same time, we have room to expand our business base in the United States. In addition to MS Transverse, which we acquired in 2023, we have increased the number of underwriters at MSIG USA and started underwriting for local companies. In addition, we are considering business investments targeting insurance companies specializing in specialty areas.

Employees Should Reconsider the Meaning of "Customer-First" and Improve Their Skills

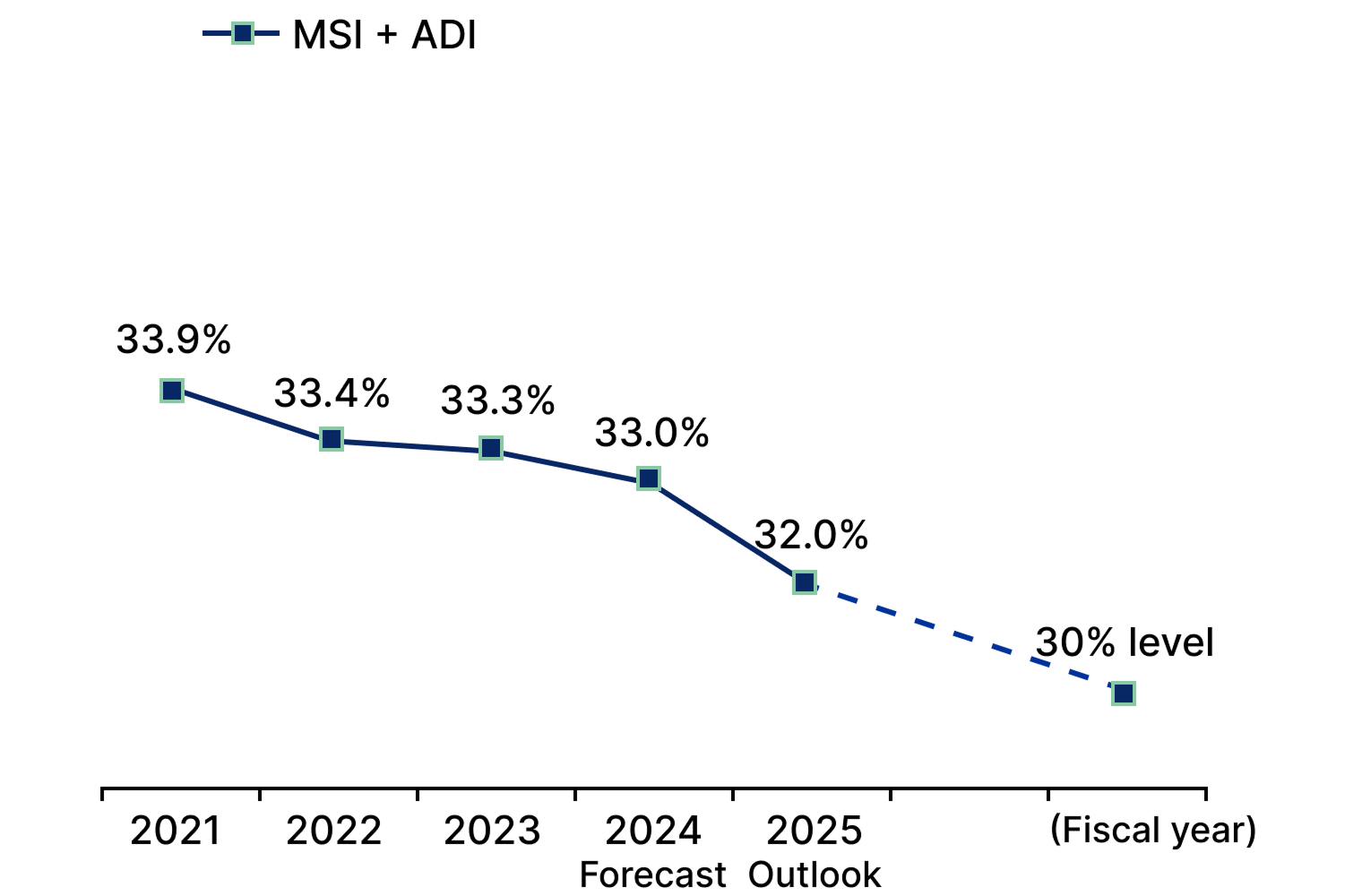

Koike I would like to ask about your strategic equity holdings. You have decided to reduce them to 0 by March 2030. First of all, could you tell us about the reaction from issuing companies of the equities and the negative impact on your core insurance business?

Funabiki Frankly speaking, we have received various responses. On the other hand, I feel that the understanding of the stock market regarding the unwinding of cross-shareholdings has also increased due to the careful dialogue we have had with the issuing companies and the requests made under the Corporate Governance Code.

We believe that negative impacts can be controlled by becoming the insurance company of choice for clients by building on the trust we have built with clients and by upgrading and enriching the value we provide inherent in insurance and our solution capabilities, while working to break away from conventional business practices.

Koike What message would you like to convey to the employees of Corporate Sales as the Group CEO?

Funabiki There is a need to shift away from traditional business practices that rely on cross-shareholdings and core business support to become an insurance company of choice for customers. In order to continue to offer products that meet customers' expectations and to be chosen by customers, we need to improve the expected functions as an insurance company, namely, recognizing the risks of the client company and underwriting appropriately. We would like to see our employees raise their skills by two or three levels, and the company will provide strong support to achieve this.

Creating a System to Quickly Recognize a Possible "Uncommon Sense"

Koike In the integrated report, the expression "transforming the business style" is used. The use of the term "business style" rather than "business model" showed a strong commitment to change the culture. For example, do you see it as returning excessive interaction and relationships with agencies back to normal?

Funabiki Precisely. It doesn't mean that the role of insurance will change, but rather that the relationship between the parties involved in insurance will change. It's a matter of course to accumulate knowledge and experience in insurance and provide it to customers. Of course, the fact that agents are important partners will not change. We will work together to ensure that agents themselves provide value.

We use the expression "culture reforms" in our improvement plans, but it is not something that can be realized immediately solely by changing management's mindset. We believe it is necessary to change the culture itself in order to transform the business style.

Koike Has the style change affected governance? Our company requires outside directors to form the majority to ensure effective governance. In the TSE prime market, especially in companies that operate globally, it is starting to become more common to have the majority represented by outside directors. What is your company's view?

Funabiki We believe that the structure and organizational design of the Board of Directors are extremely important to encourage prompt management decisions and bold risk-taking through in-depth discussions. In light of the series of scandals, we would like to strengthen monitoring centered on outside directors.

Koike Could you please share the perspectives of the outside directors regarding the series of scandals and the administrative penalties, as well as the discussions at the Board of Directors?

Funabiki The outside directors expressed their views on the business improvement plan drafted by the operating companies from various perspectives. For example, views on whether the analysis of the cause of the incident was sufficient, whether the plan could be implemented continuously with practicability, and whether it should be flexibly revised in the process of implementation. The Board of Directors spent time discussing these views.

Unfortunately, scandals can happen when what's viewed as a common sense in an industry or company become otherwise within the society. What is important is to quickly recognize these misperceptions and create a system to correct it. At our company, as part of its efforts to improve business operations, we have established a committee responsible for detecting signs of risk. By incorporating external perspectives and enhancing our understanding of the Antimonopoly Law, the Unfair Competition Prevention Law, and the Financial Instruments and Exchange Law, we are building a system to promptly correct potentially inappropriate business practices.

Koike Have you also changed your communication with employees?

Funabiki I believe it is extremely important to have direct conversations with employees. As the president of Mitsui Sumitomo Insurance, I make it a point to visit many workplaces, including those overseas, and engage in direct conversations with people in charge, ensuring cross-level and cross-functional communication. Looking at the Group as a whole, I sometimes feel that there is still a lack of mutual communication, so I would like to introduce social networking tools to increase opportunities for two-way communication and expand this to the entire Group.

Achieving Results with Capital and Business Efficiency

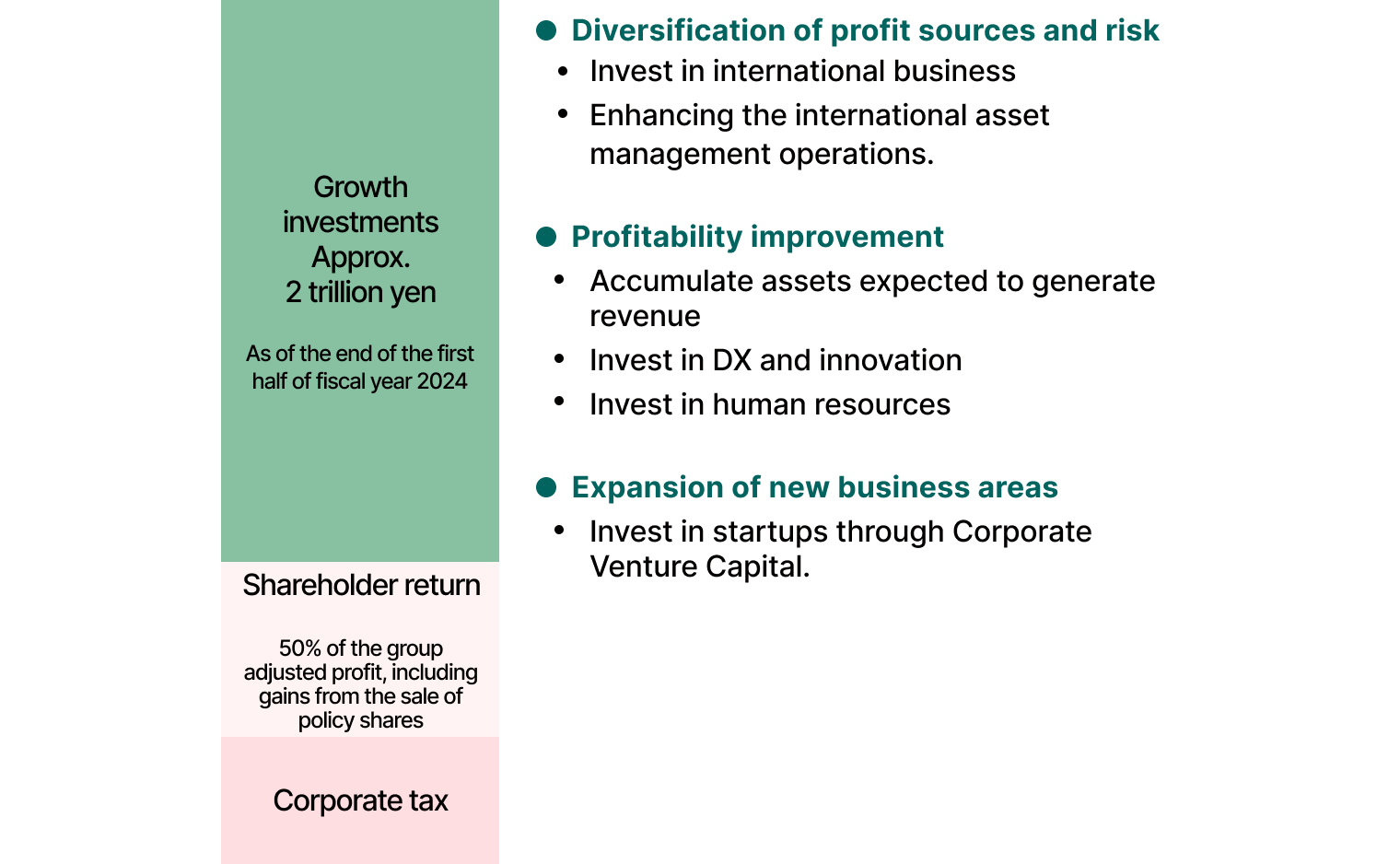

Koike From the investor side, how to reallocate the funds obtained from the sale of strategic equity holdings is a major concern. As dividends received will decrease by selling strategic equity holdings, will it be possible to aim for business expansion with speed while improving capital efficiency?

Funabiki We see the sale of strategic equity holdings as an opportunity to expand profits and improve capital efficiency. From the perspective of risk management, we will increase ROR (return on risk) by optimizing our business and risk portfolios, such as reducing domestic equity risk, which has long been the peak risk in the group, and expanding international operations by investing in growth areas.

With regard to the international business, as I mentioned earlier, we intend to invest in specialty insurance companies in the United States, thereby enhancing risk diversification in terms of regions and insurance lines. Furthermore, we intend to increase capital efficiency by allocating additional capital to operating companies that are expected to have high returns, and by generating synergies on a global basis.

With regard to asset management, we will further strengthen it, taking into account the reinvestment of funds obtained through the sale of strategic equity holdings and the increase in assets under management from growth of international business. With MSR Capital Partners, which was established jointly with a Swiss asset management company LGT as a hub for group collaboration in 2022, we are working to expand the quantity and quality of alternative assets. Going forward, we will also strengthen our management structure for traditional assets such as domestic and foreign bonds.

Koike I look forward to future developments. Lastly, I would like to hear your perception of the current stock price level. Given the challenges that remain for companies in the non-life insurance industry, the stock price of the MS&AD Group, as analyzed through financial indicators, is discounted compared to its global peers. I believe there may still be aspects that have yet to attract sufficient investor recognition.

Funabiki I think it is about achieving results on two issues. One is capital efficiency. Even if we declare that we will reduce our strategic equity holdings to zero, there are some concerns about whether we can really do it and how to use the funds obtained from the sale. Therefore, we will firmly make business investments that will lead to future growth.

The other is business efficiency. The MS&AD Group has high operating expenses in the domestic non-life insurance business, and it is important to show a picture of how to resolve them.

Under the current Medium-Term Management Plan (2022-2025), we have worked to improve profitability in the domestic non-life insurance business, expand profits in international business, and improve investment returns, and have achieved steady results. Going forward, we will transform our business style in Japan to become the most preferred insurance company for customers, and internationally, we will work on expanding our business base for future growth. By doing so, we believe we can achieve a market capitalization of 10 trillion yen and an ROE of mid 10% range at an early stage.

Koike Thank you for showing us your ambitious goals. We would like to help you as an institutional investor. Thank you very much.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: March 11, 2025)