Engagement Feature Articles

Mizuho Financial Group - "Proactively innovate together with our clients for a prosperous and sustainable future." Advancing Japanese Corporate Competitiveness with Purpose

Left: Hiroyasu Koike, President and CEO of Nomura Asset Management Co., Ltd.

Under Mr. Masahiro Kihara, who assumed the position of Group CEO in February 2022, Mizuho Financial Group has been promoting transformation of its corporate culture. The preceding 5-Year Business Plan, which started in FY2019, was dissolved one year ahead of schedule, and a new medium-term business plan (FY2023 to 2025) was launched. Mr. Kihara joined Mr. Hiroyasu Koike of Nomura Asset Management to discuss the future of the bank and its business focus areas.

Transforming corporate culture

Koike At the beginning of FY2022, we began activities to promote the appeal of Japanese companies to investors around the world and to attract global investors to the Japanese capital market. We have done so through presentations and conferences during visits to Europe, the Middle East, Asia and the Americas. We believe that Japanese companies have sufficient competitiveness in terms of their technological capabilities and growth potential, which are comparable to those of their competitors in other countries. However, we have strongly felt that the competitiveness and intrinsic value of Japanese companies have not been fully appreciated, as seen by the continued stagnation in valuations of Japanese stocks overall. This year, as last year, we have been conducting investor conferences and individual visits, and we are finally seeing a shift in the way investors view Japanese equities.

Kihara We've been greatly inspired by your activities and we fully resonate with them. We have also revised our Corporate Identity and formulated a new three-year medium-term business plan, within which, we emphasize that we should contribute to enhancing the competitiveness of both Japanese companies and Japan as a nation.

Koike As a leading financial institution in Japan, we are also very interested in the changes that you've made, particularly those that occurred since you became Group CEO, and those planned for the future. This is probably where investors are most interested.

Kihara First, let's look back at the Group's recent history. President Yasuhiro Sato, the CEO who preceded my predecessor, launched "One MIZUHO." We promoted the integration of banking, trust banking and securities operations, and became the first megabank to have a Nominating Committee in 2014 to enhance our corporate governance. After that, President Tatsufumi Sakai took office and created our 5-Year Business Plan, promoting a structural reform focused on three interconnected areas (business structure, finance structure, and corporate foundations). "One MIZUHO" had fully reached fruition. In addition to banking, trust banking, and securities, we operate as a unified group, including Mizuho Research & Technologies and Mizuho-DL Financial Technology. Customer-related revenues have doubled since introducing the in-house company system.

In looking forward to what we should do for the next era, indeed there were significant IT system failures, and when reflecting on the situation, I believe there were weaknesses in our corporate culture, preventing us from taking on new challenges or welcoming constructive opinions. We need to change that culture, so that we may be agile in taking on new challenges and the sharing of opinions among employees is welcomed. Another challenge is to engage more openly in discussions with external stakeholders, including investors. For example, though information sharing and discussions with outside directors is currently very frequent, to do so more transparently is also a personal goal of my own.

Koike I can see that you want to change the corporate culture with your leadership. In this context, you launched a new medium-term business plan and defined Mizuho's Purpose (the raison d'etre of Mizuho Financial Group). What was the process behind these developments? In addition, please share the foundational idea behind the new medium-term business plan.

Kihara Against the backdrop of major changes in global trends and other paradigm shifts, we questioned our raison d'etre, and how we would contribute to our customers. From that, we felt strongly that we should revisit our corporate root - our DNA - and revised our Corporate Identity. Thus far, our Corporate Philosophy and Vision have described how we want to be, but lacked guidance on what our contributions should be, or on what role we play. We established our Purpose as "Proactively innovate together with our clients for a prosperous and sustainable future." This means working together to support our clients facing challenges and contributing to personal well-being in life as symbolized by the "Mizuho" name.

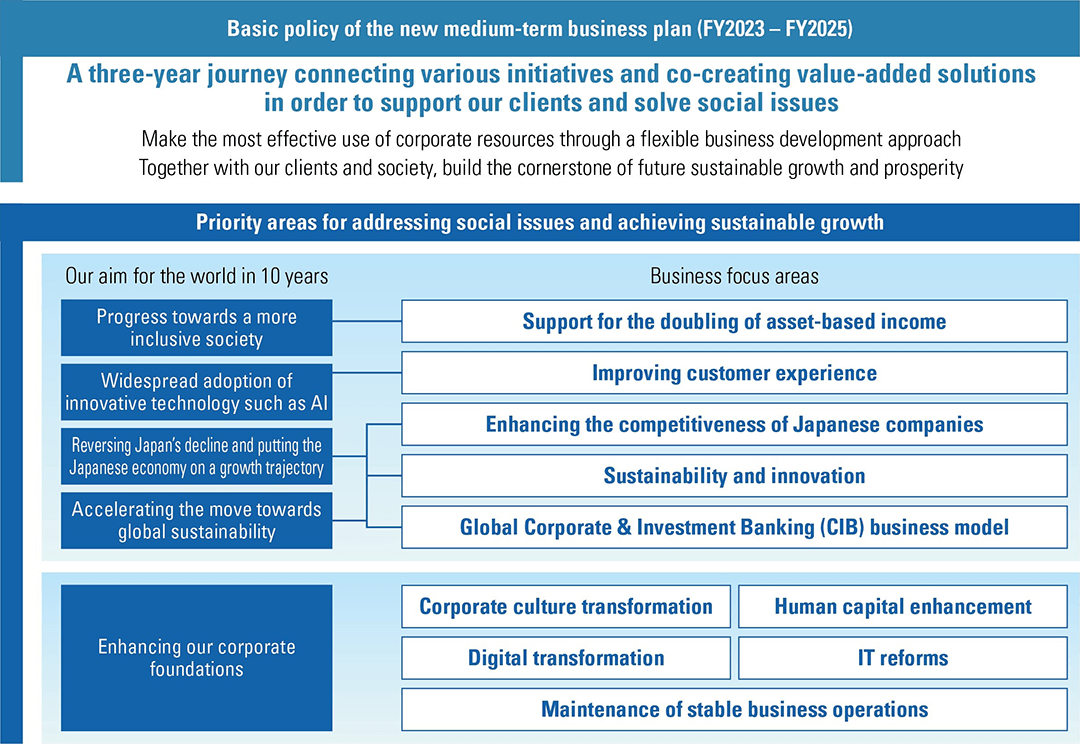

We cannot predict the future 20 years from now, but we can envision the world we want to see in 10 years, and by back-casting from our desired future, we thought about what needs to be focused on, and it is from there we identified key business focus areas for the next three years. Clear aims such as Japan being more competitive as a nation, and putting the Japanese economy on a growth trajectory, or progress in the implementation of new technologies for sustainability. That is the essence of the new medium-term business plan.

Thorough Corporate Value Improvement/Business Growth Support for listed middle-market firms and SMEs

Koike The new medium-term business plan has five business focus areas, one of which is enhancing the competitiveness of Japanese companies. Although Japanese companies have distinguished strengths, they are not seen in the same way globally. Could you share any ideas or plans you have in mind in terms of enhancing their competitiveness?

Kihara Two years ago, we reorganized our branch channels. We consolidated our corporate sales channels for listed middle-market firms, which had been scattered across many departments and offices, to six departments in the Tokyo metropolitan area, and focused thoroughly on engaging with our clients' growth strategies. We've redefined our focus client base, and significantly advanced our solution capabilities that leverage our group functions, such as assigning relationship management staff with wholesale experience or investment bankers from our Securities unit. As you've said, there are companies in Japan that possess a competitive edge in technologies and product offerings, and I feel that we can contribute to further enhancing their corporate value.

The Retail & Business Banking Company (RBC), which covers listed middle-market firms and SMEs, has seen a steady increase in profitability through such initiatives.

Koike "Support for the doubling of asset-based income" is another of your business focus areas. Despite the government's initiatives, the shift from savings to investment has been slow. However, there are signs of change, such as the government stepping up its efforts to reform the framework. What are your thoughts on the structural challenges and business challenges that have kept people from investing?

Kihara Japan has been in deflation for a long time, and interest rates are basically stationary. This is probably due to the failure to stimulate investments in the home market amid Japan's declining international competitiveness. However, the way Japan is viewed from overseas has been gradually changing. Global investors for example, who imagine that the Bank of Japan may finally make a move, must feel more dynamism towards a market that has a certain level of volatility. As symbolized by semiconductor manufacturers bringing their factories to Japan, I believe that a reevaluation of Japan is underway and has also led to recent share price gains. We need investors to feel this market momentum, and thereby encourage a virtuous cycle that will further this trend.

Open partnerships and alliances

Koike "Improving customer experience" is a business focus area that calls to mind efforts using digital technology. How are you looking to proceed here, also as the LINE Bank project unwinds?

Kihara This essentially refers to increasing the convenience of our service channels and enhancing the quality of our service provision. For example, we will expand self-service systems, and improve our consultation for customers that opt for in-person service. We will enhance the consulting capabilities of our employees, including our call centers, while enhancing the UI (User interface) and UX (User experience) of areas that can be digitized, enhancing readability and overall usability. We will also continue improving Mizuho Bank's online service, Mizuho Direct, so that we do not fall behind global expectations.

In the future, should enough customers make the shift to online services, we will probably reduce the number of our branches. However, at present, we see a large portion of our customers using our physical locations, so improving convenience is our priority for the present moment. Meanwhile, as the movement to streamline branches service is likely to progress, we are considering moving branches to the upper floors of buildings or relocating them to train stations.

The LINE Bank project had been operating as a joint venture, but further investment was required to provide safe, secure and high value-added services. So, as a result of much deliberation, we decided not to proceed further. However, our basic policy is to maintain open partnerships and alliances with other companies, and our alliances with PayPay Securities and Rakuten Securities are a testament to this.

"Co-creation" as the nexus of Transition

Koike You have also positioned "Sustainability & Innovation" as a business focus area. What do you see as Mizuho Financial Group's role and added value in facilitating corporate transitions, such as climate action?

Kihara From the outset, our Industry Research Department, within Mizuho Bank, has a long history of accumulating knowledge and expertise on various industries. At present, we have appointed a Chief Sustainability Officer (CSuO) and established a Sustainable Business Promotion Department etc. to centralize information. A sustainable society is not something achieved easily by a single company, and "co-creation" is a keyword here. Mizuho will act as a hub to develop a framework that creates transitions in society by matching and connecting the individual challenges and efforts of our clients and society towards achieving carbon neutrality, drawing on our information on clients' technologies and needs.

Further enhancement of the CIB capability in US and extending to other regions

Koike What makes Mizuho unique? Where are your strengths?

Kihara We've worked hard on business with large corporations for a while, and we are able to offer solutions to our clients with our unified capabilities not only across banking, securities, and trust banking, but also our research functions, as I mentioned before. Overseas, we are promoting global Corporate & Investment Banking (CIB: integrated operations for banking and securities, coverage and products, and primary and secondary operations), and we are already demonstrating strength in the US market. We want to expand these strengths to other regions. We are also securing talented personnel at overseas offices, including the US, and we hope to repatriate expertise from overseas back to Japan.

Koike Your recent acquisition of Greenhill in the US is positioned to supplement your global CIB business, correct?

Kihara That's right. M&A has been the missing piece of our efforts in the US. Greenhill provides the M&A capabilities to expand our business value chain.

Enhancing human capital management through new HR Framework CANADE

Koike You mentioned that you are securing overseas talent, but I also have the impression that you're promoting stronger management of human capital, with the aim of enhancing corporate value, as one of your many other strategies.

Kihara We announced a new HR framework called CANADE in November 2022. We'll complete the transition to this system in FY2024. "Kanade" in Japanese expresses the harmony between an ensembles of musicians, and represents a similar idea for our company and employees. Previously, under "One MIZUHO", each of our entities maintained different HR systems. However, by unifying the HR framework of our five core entities, we will significantly expand the career design range available to our employees. We are considering corporate culture, job satisfaction, and HR ideals in an integrated manner while pursuing better HR capabilities and better human capital management.

Engaging the capital market by focusing on capital profitability

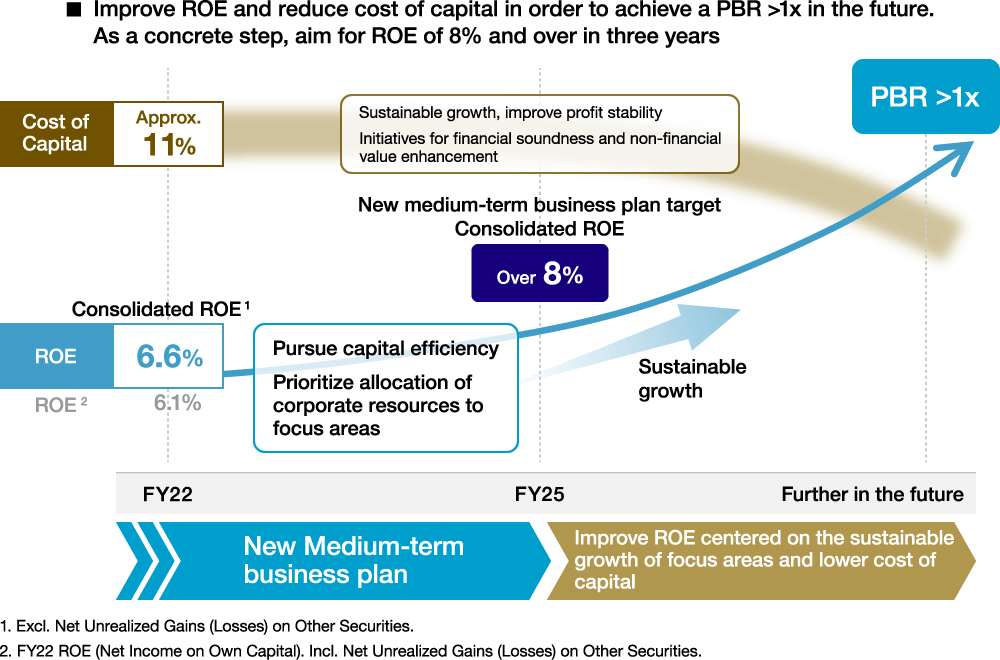

Koike The Tokyo Stock Exchange is requesting that listed companies improve their capital profitability and better understand the cost of capital. While discussions at financial institutions may be difficult due in some part to capital adequacy regulations, I'd like to hear your basic approach to cost of capital and the background behind your decision to make disclosures.

Kihara Under capital adequacy regulations, which are rules that financial institutions must follow, banks are required to maintain a certain amount of capital. However, we believe that it is important to show a path for improving our price-to-book ratio (PBR) in order to engage with the capital market. There are various discussions on the cost of capital, but I feel that it is necessary to demonstrate our determination to actively work on improving the competitiveness of Japan and Japanese corporations in order to address macroeconomic factors.

I believe this is aligned with your Project BRIDGE initiatives, in terms of the movement to strengthen Japanese companies, stimulating the capital market, and marketing overseas.

Koike Thank you. I look forward to future discussions regarding our shared goals. Finally, could you share your predictions regarding the financial industry in the coming 10 years?

Kihara We see many business operators trying to expand their ‘economic zone’ to consumers, coming into financial sectors while putting payment service as their core. With the digital world being our part of our everyday lives, I think we can play a role in providing financial functions behind the scenes, so to speak. For example, J-Coin Pay, Mizuho Bank's online payment service, is built into Yamato Transport's Kuroneko Yamato app. When sending parcels, if you use J-Coin Pay code payment, you can complete the payment directly from your Mizuho Bank account.

Ten years from now, I expect the financial and capital markets in Japan to be more active, such as expansion in IPO finance by startup companies, more middle-market issuers in the debt capital market, a shift from indirect to direct finance, and reinvigoration of asset management. At that time, the shift from savings to investments will be commonplace. But first, we will work on providing customers with growth strategies, thus expanding the capital and financial markets.

Koike Thank you for today's valuable discussion.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: August 23, 2023)