Engagement Feature Articles

Mitsubishi Electric - Aiming for Operating Profit Ratio of 10% via ROIC Management and Business Area Ownership

Right: Hiroyasu Koike, President & CEO of Nomura Asset Management Co., Ltd.

Mitsubishi Electric, a leading industrial electronics manufacturer, is strong in fields such as Factory Automation (FA) systems and electric power infrastructure. Since improper quality control practices came to light, the company has been promoting fundamental management reforms. Mr. Kei Uruma, who assumed the position of President of Mitsubishi Electric Corporation in July 2021, joined Mr. Hiroyasu Koike of Nomura Asset Management to speak about the progress of the reforms that have spanned more than 2 years and the direction the company's business should take in future transformation.

Progressing Reforms in Quality Assurance, Organizational Culture, and Governance

Koike Interest in Japanese stocks from overseas investors is finally increasing. As part of our engagement activities, we believe it is important to communicate the specific initiatives Japanese companies are implementing, which we are doing through Project BRIDGE.

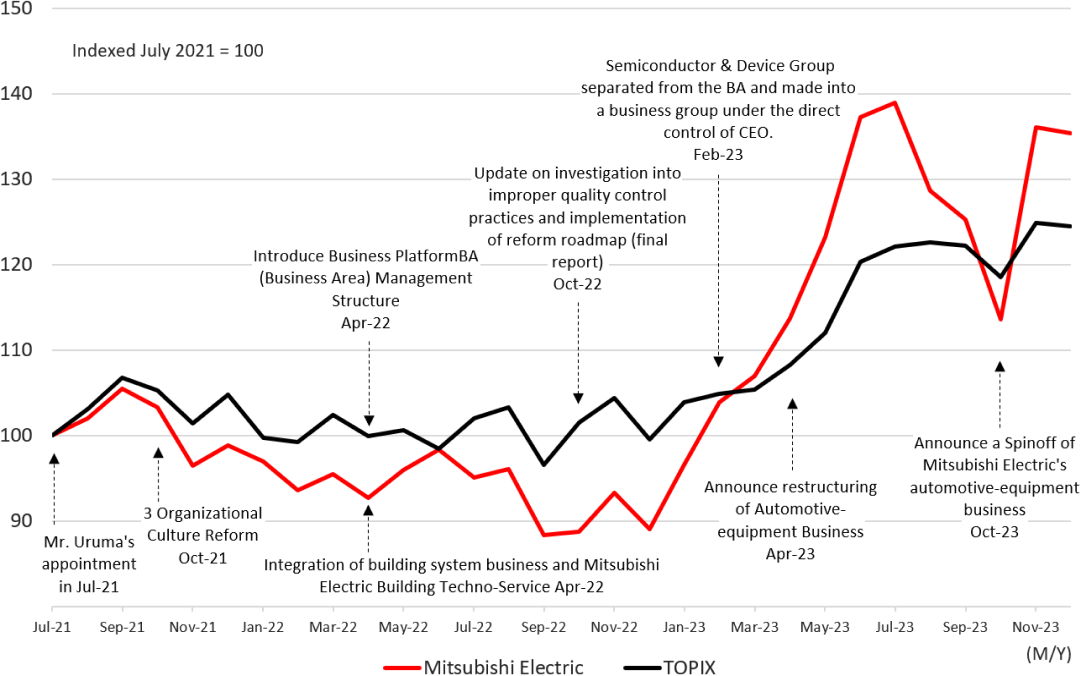

Since Mr. Uruma became president, Mitsubishi Electric's stock price has been firm. I think the capital market appreciates the governance reform and other changes in your company. Could you share what you have accomplished thus far?

Uruma In response to improper quality control practices in July 2021, the company opted for a change in management and I was appointed as president. At that time, restoring trust was paramount, and we embarked on three urgent reforms in our quality assurance, our organizational culture, and our governance.

For quality assurance, we established the Corporate Quality Assurance Reengineering department under the direct control of the President and transferred authority over product deployment. All processes have been digitized and test results have been automatically recorded, instead of the traditional manual quality control we had practiced before. In addition, external personnel were appointed at the top to review the system. Reforming our corporate culture centered on the creation of "Team Sousei (Creation)" consisting of 45 mid-level members selected through an open call. The team members communicated that they would quit immediately if they felt managements were not cooperating, and we communicated our commitment as managers and that we would not run away. Through these discussions, we were able to develop a robust policy. Each member has their own challenges to examine, and we have been implementing measures over the past year and a half, including in departments related to HR benefits or DX efforts and tackling organizational culture issues from our business headquarters.

In terms of governance, the majority of the members of the board of directors are outside directors and the board's chairperson is assigned from an outside director.

Company-wide Initiatives for Organizational Culture Reform

Koike I can see the steady progress you have made. However, I think that the organizational culture cultivated over the long history remains firmly rooted. Even if changing the direction of your legacy is the correct decision, I'm concerned that internal discrepancy in opinion may prevent things from going as expected. What progress have you made in this regard?

Uruma It is important to work on maintaining ongoing dialogue with employees. We have held three rounds of town hall meetings across our 42 locations within Japan. In particular, we believe that it is important for managers to change their mind-set, and we are currently holding meetings focused on department and section managers to discuss issues such as working with employees and solving problems. I have management-level colleagues, like factory managers and division managers, discuss what they should change in the training program called the "President's School".

As they say, "2, 6, 2," changes in the top 20% of your workforce will spread to the middle 60%, then followed by the remaining 20%. I believe we've finally achieved changes in the first 20%. However, it's hard to achieve that change in the first 20%, so I believe our efforts will spread quickly to the next 60%. "Team Sousei (Creation)" is a temporary measure and is scheduled to be retired in another year and a half, but after that, each organization aims to be able to drive itself. I hope that the changes will naturally spread as the team's members return to work in their own departments.

Koike Is the engagement of your employees increasing?

Uruma On average, employee engagement scores haven't increased much. I believe this is largely due to the spinning-off of subsidiaries. In October 2021, we decided to integrate our building systems business into our consolidated subsidiary, Mitsubishi Electric Building Techno-Service. Around that time, the issues of improper quality control practices surfaced, and at the end of October 2023, we announced that our automotive components business would be spun off. The employees who are subject to the spin-off may have complex feelings about this, but we will continue our efforts to make them understand that the reorganization is aimed at maximizing the added value of each business.

Implementing ROIC and Business Area Management

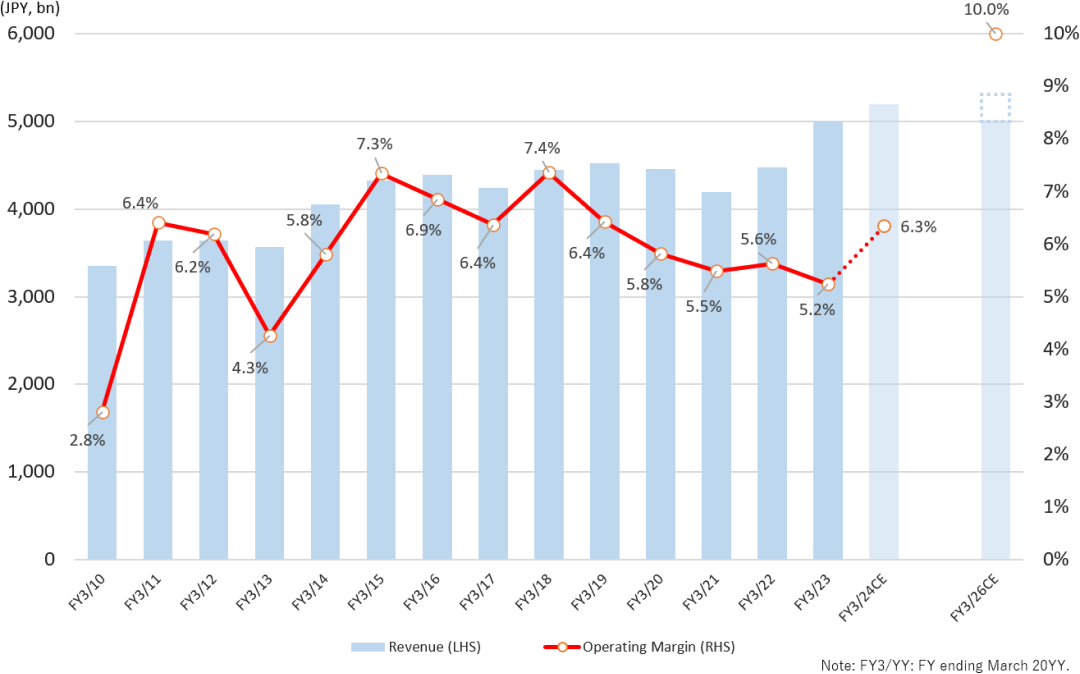

Koike In the Medium-term Management Plan for FY3/26, you have announced targets for 5 trillion yen in sales and an operating profit ratio of 10%. Could you share what responses you've seen to these goals and any challenges?

Uruma In our past medium-term management plan, we aimed to achieve an operating profit ratio of 8%, but we have failed to achieve this goal. Net sales already exceeded 5 trillion yen in FY3/23. However, improvement of profit margins has been an issue.

So this time, first of all, we evaluate our business based on ROIC, that is, whether we add value to the capital we invest. Also we have introduced a business area management system (BA system). We have changed our management structure to four BA systems that laterally support each division. BA owners will allocate management resources from the perspective of investors, aiming to restructure the business and create new businesses. Since April 2023, we have been discussing internal targets for ROIC at each business unit. To achieve this, we will set KPIs and develop various activities based on the optimal segments. As a result, we expect to see a decline in inventories, receivables, and an increase in cash flows.

In FY3/24, we expect to achieve record sales of 5.2 trillion yen, with an operating profit ratio of 6.3%. By thoroughly implementing ROIC management, 8% should be within sight, and we will set KPIs in each business unit to "visualize" our targets and work to achieve the 10% operating profit ratio.

US GAAP until FY3/18. IFRS from FY3/19. IFRS figures are used for FY3/18 in the graph for the purpose of comparison with FY3/19.

Actual figures from FY3/10 to FY3/23. FY3/24 figures are forecasts. FY3/26 figures are targets.

(Source) Prepared by Nomura Asset Management Co., Ltd. based on Mitsubishi Electric Corporation materials

Koike Eliminating conglomerate discounts is a major challenge. I think the introduction of ROIC is very effective for investors who take a negative view on a firm with diverse business portfolios. What are the differences between the BA system and the conventional approach in terms of the way responsibilities are placed? At your company, there is a strong tendency for each division to take initiative, and there are concerns that overall corporate performance will be difficult to improve if responsibility is not centralized.

Uruma The general manager of each division is responsible for sales, profits, and ROIC. BA owners are responsible for shutting down existing businesses and creating new ones by allocating budgets across target business units. For example, infrastructure BA owners have the authority to allocate management resources across three business headquarters: Public Utility Systems, Energy Systems, and Defense & Space Systems.

ROIC targets are set for each business relative to competitors, not on a company-wide basis.

It will be necessary to take measures such as disposing of facilities with low utilization rate, but we will proceed with those in consultation with BA owners. For example, a new plant is now needed in the Defense & Space Systems business, and it is the role of the BA owner to take a scrap-and-build approach together with the factories of other businesses.

Koike From the perspective of growth prospects and profitability, are you considering revising your current business portfolio?

Uruma There is a sense of urgency that our company will not last 10 years if the current business portfolio is maintained as is. That's why we have to backcast from what we should be in a decade to clarify what's missing and develop strategies and processes. At present, the cost of capital in our company is considered to be about 6%, but we need to think about raising returns after taking into account risks that factor in the cost of capital. In order to do so, some businesses will have to be given up, and it is also necessary to attempt new businesses with the resources we have cultivated.

Koike In order to improve your profit ratio through business selection and concentration, it is necessary to have sophisticated skills like financial literacy. I believe this also involves some cultural reform, but what types of initiatives have you pursued?

Uruma The strategic division in our business headquarters was dissolved and consolidated within each BA. For example, employees in the strategic division of Energy Systems have expanded their horizons by looking at multiple businesses simultaneously, including Defense & Space Systems, and Public Utility Systems.

Since April 2023, we have been setting targets for each business and using KPIs based on an inverse tree. We will consider disclosing the ROIC targets of the business headquarters once we feel we can manage it.

Prioritizing Data to Transform into a "Circular Digital-Engineering Company"

Koike I believe you are sharing the perspectives of your business units with investors through disclosures and pursuing improvement measures.

You've established the keyword "Circular Digital-Engineering" for sustainable growth. Is this a business model that emphasizes solutions in addition to your traditional hardware strengths? It feels as though your approach to business is changing.

Uruma Our company has strength in components and we want to deepen it. On the other hand, as DX progresses, we must focus on the data produced by our equipment. Each division is studying the megatrends of the coming decade and what our approach should be. For example, the ability for customers, internal sales representatives, and technicians to share data in a digital space can lead to preventive maintenance of equipment and new solutions.

I would like us to shift to a data-focused approach and further advance our strength in components to increase our business value and collaboration.

Koike Human capital management was an area of focus in 2023. We've reached a time where talent that is experienced with data utilization is necessary. Could you share some of your initiatives for securing and cultivating human resources?

Uruma We plan to gather DX engineers in the Yokohama area in 2024 to create an area for co-creation. Our group has a wealth of personnel in digital-related areas such as energy, FA, and IT systems. I think a lot of things will be created by bringing people together and allowing them to interact with one another. This will also make it easier to educate and to recruit people from outside. We aim for this type of synergy.

Since the capital market demands quantitative evaluation of human resources, we must also consider how to increase the value of human resources for profit contribution. This begins with how each employee intends to pursue his or her own career. In addition to providing opportunities to learn in accordance with their ambitions and willingness to take on challenges, we intend to radically change the HR remuneration system to offer compensation based on performance and abilities.

Aiming for further Share Price Growth via ROIC Management

Koike In regard to ESG investment, we are working to reflect GHG reductions into the valuations of the companies in which we invest. What are your thoughts on this type of disclosure?

Uruma We believe that we should accommodate these demands to the extent possible and proactively conduct disclosures. Since assuming the position of president, I have placed sustainability at the core of our management and we are working to resolve social issues through our business development. Specifically, we have identified five areas to be addressed: carbon neutral, circular economy, safety and security, inclusion, and well-being.

Under the name of "GIST (Global Initiative for Sustainable Technology)" we have gathered 48 people, mainly engineers, from across our businesses headquarters, and we are working to solve social issues and create businesses through a combination of technologies. We intend to conduct disclosures on these areas and our other areas of responsibility and enact ESG-related measures.

Koike Mitsubishi Electric has many products and businesses that can contribute to ESG efforts, and we would like to actively encourage you to contribute in relation to GHG reductions and other areas. In closing, could you tell us your assessment of Mitsubishi Electric's current share price level and your target?

Uruma Over the past year, our stock price has remained strong, and a record high of 2,175 yen is within sight (as of the interview on December 5, 2023). It will be a test to see if we can achieve our financial targets for FY3/24. We can expect further upside of stock value if our ROIC management takes root and we further develop our BS management with an asset light approach and better cash management.

Koike I have a much better understanding on your efforts to reform and change your company. I believe investors will focus on the degree of execution from here. As investors, we would like to continue communicating and offering support as we can. Thank you for today.

Regarding indexes used on this website:

The Tokyo Stock Price Index (TOPIX) index values and all marks and trademarks pertaining to TOPIX are the intellectual property of JPX Market Innovation & Research, Inc. or its affiliates (hereinafter "JPX"). All rights and know-how related to TOPIX including calculation, publication, and use, as well as all rights related to TOPIX marks and trademarks belong to JPX. JPX bears no liability for errors, delays, or suspension of calculation or publication of TOPIX. This product is not offered, guaranteed, or distributed by JPX, and JPX shall not be liable for any loss or damages arising from the creation, distribution, and promotion of this product.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: March 4, 2024)