Engagement Feature Articles

Mitsubishi Chemical Group - Back to Core Chemical Roots: Redesigning Profit Structure and Advancing the Green Specialty Strategy

Right: Hiroyasu Koike, President and CEO, Nomura Asset Management Co., Ltd.

The Mitsubishi Chemical Group, a key player in Japan's longstanding integrated chemical industry, is aiming to overcome the sluggish performance of its Chemicals business by implementing business portfolio transformation and profit growth strategies based on three disciplined approaches in business operations and three criteria for business selection. In April 2024, Manabu Chikumoto took office as President and CEO. He and Hiroyasu Koike of Nomura Asset Management discussed the progress of corporate transformation and the roadmap for enhancing corporate value.

Rebuilding Management Starting from a "Fundamentals-Focused Company"

Koike It has been one year since you assumed the position of Representative Corporate Executive Officer, President and Chief Executive Officer. I understand it must have been a challenging start, facing various issues such as restructuring the business portfolio and growth strategies amid increasing external uncertainties. Looking back on your first year as president, what are your reflections?

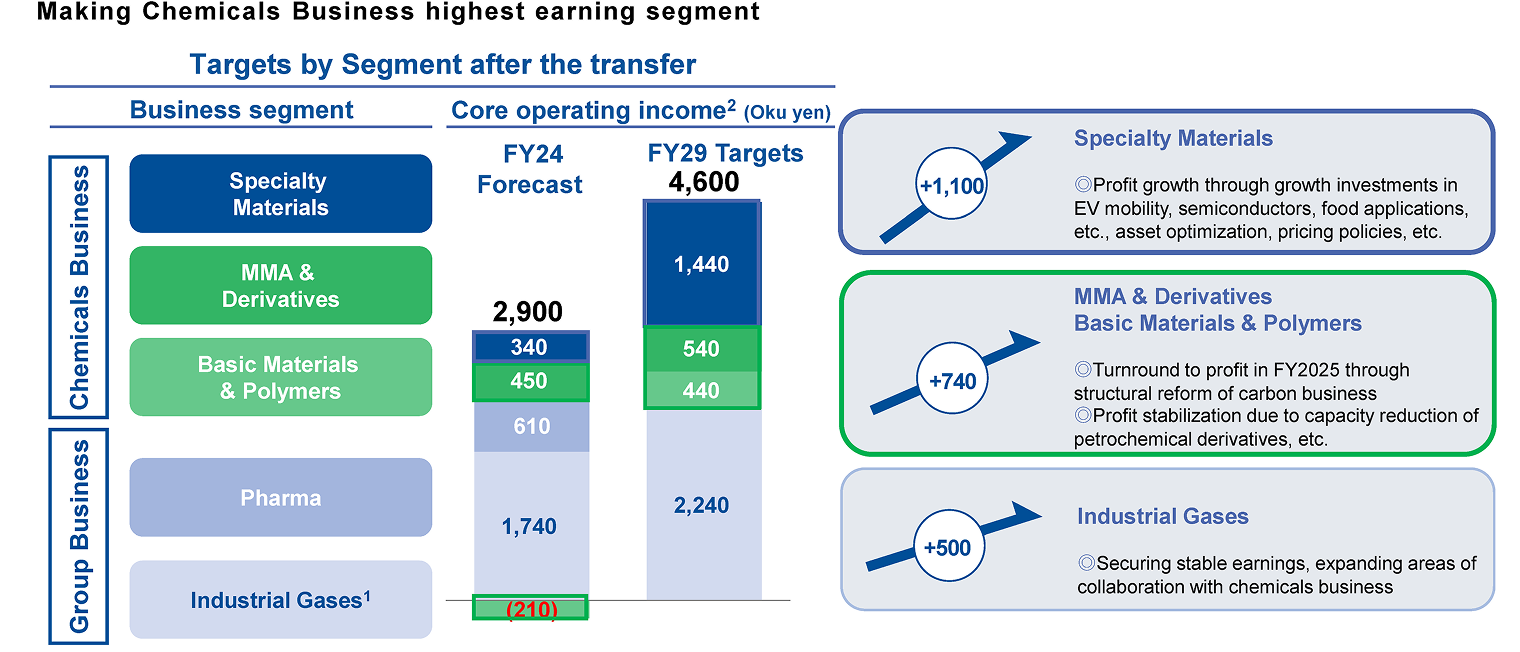

Chikumoto The Mitsubishi Chemical Group was formed after Mitsubishi Chemical was established in 1994, integrating various companies across different sectors such as chemicals, pharmaceuticals, and industrial gases. I believe this accumulated history, for better or worse, reflects the company's current state. When I assumed the role as President and CEO in April 2024, the industrial gases segment was securing stable earnings, and the pharmaceutical segment was carrying its weight. However, our founding chemicals business recorded a loss for the fiscal year ending in March 2024. Driven by a strong sense of crisis, I have been working on restructuring the Chemicals business since taking office. As a result, I believe the chemicals business has emerged from the red and established a foundation for generating profits.

Koike As the first step in rebuilding the Chemicals business, what was the most important thing to focus on?

Chikumoto That is to become a "fundamentals-focused company." However, this does not mean to be mediocre; rather, it means to thoroughly implement management fundamentals—allocating resources appropriately and maximizing profits under strict cost awareness from the perspective of management and execution. For example, a leading company in the chemical industry achieves high profitability in two seemingly unrelated businesses: PVC* and semiconductor wafers. In each of these businesses, a shared rigorous cost awareness, responsibility for profit and loss, and high employee motivation translate into strong results and are reflected in the company's overall high productivity. This is what true synergy means and serves as a model to emulate.

Our company has often been described as "a conglomerate discount cluster." Erasing this perception and restoring organizational reliability and execution capability is my greatest mission. By fostering a culture of profitability among our employees—not only focusing on business strategy but also cultivating a culture that generates earnings—we are progressing steadily step by step in rebuilding management.

*PVC: Polyvinyl Chloride

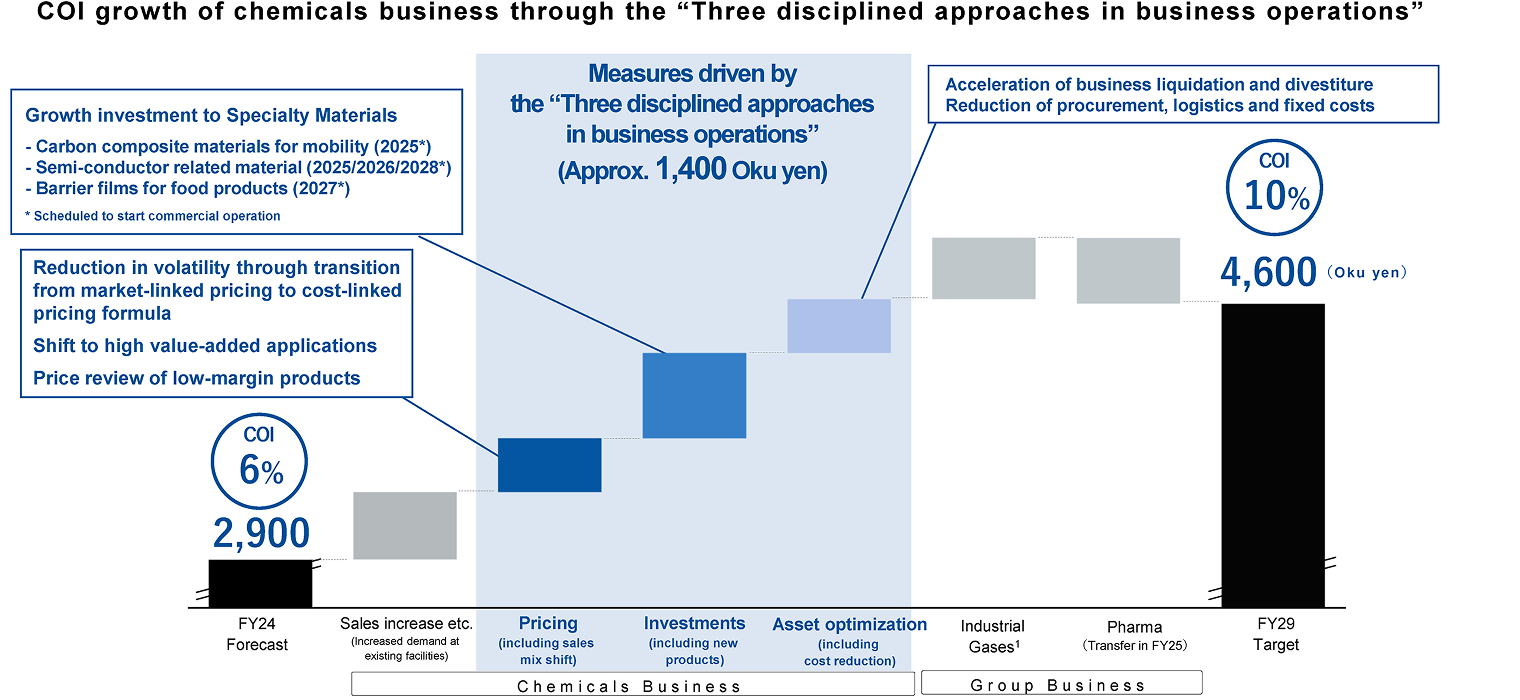

2. The total values include other adjustment items. However, since these adjustment items are not shown in the graph, the segment totals may not match the actual total.

(Source: Mitsubishi Chemical Group Corporation, Company materials)

Transforming Technology into Value: A Market-In Approach Mindset

Koike Since the establishment of Mitsubishi Chemical Holdings in 2005, the scope of your business has expanded significantly through M&A activities. However, when looking at the trend in market capitalization, it cannot be said that your capabilities have been fully recognized. How do you summarize these past 20 years? Also, based on that history, what actions did you incorporate into the medium-term management plan and the long-term vision?

Chikumoto Indeed, while there have been changes in the scale and scope of our business, it is also true that we have not received sufficient recognition from the market as a result. I believe this is due partly to a lack of discipline regarding profitability and capital efficiency. Above all, I place great importance on "fully delivering on our commitments to the capital markets".

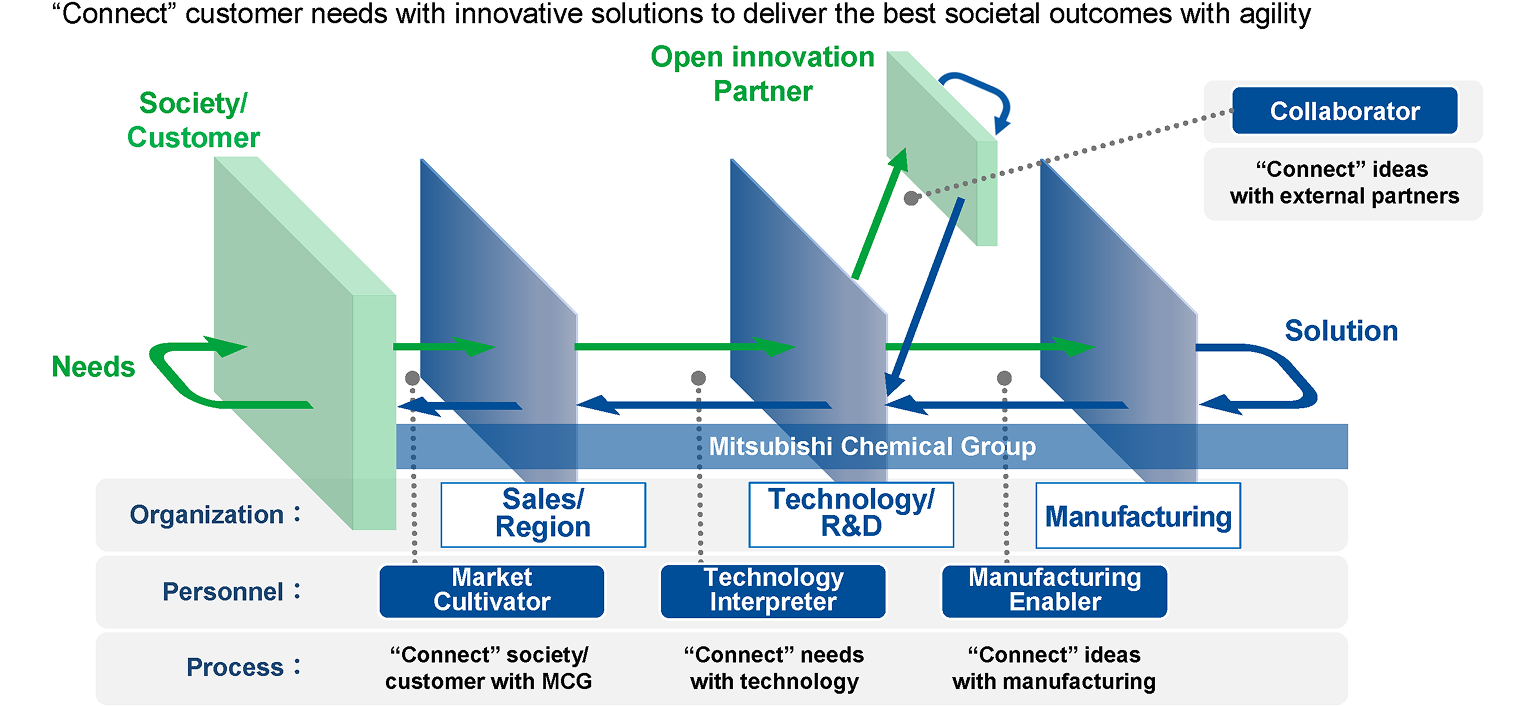

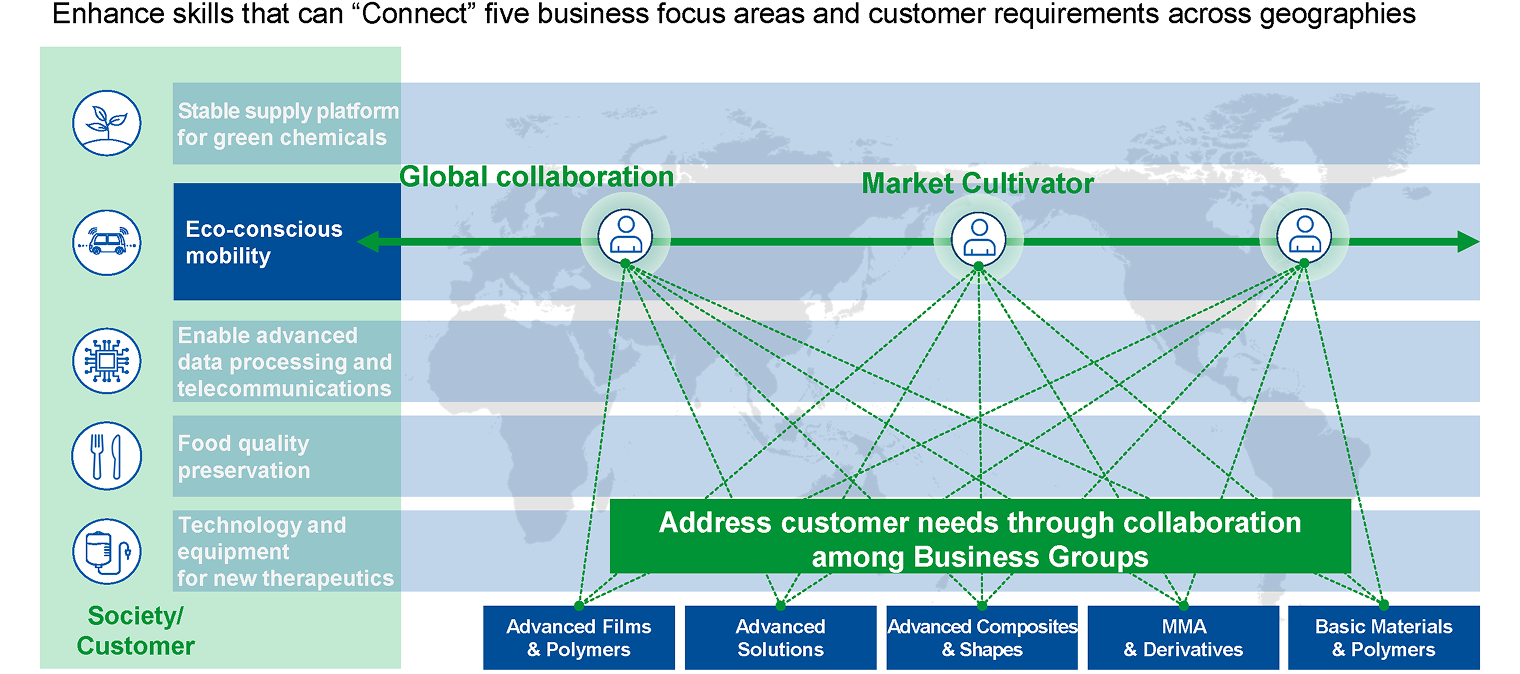

Our company possesses the greatest breadth and depth of technologies in Japan. Going forward, the critical question will be how we organically combine these technologies to solve customer challenges. Simply providing technology is no longer enough; we will share a company-wide perspective on "how to deliver and add value" to brand owners and customers.

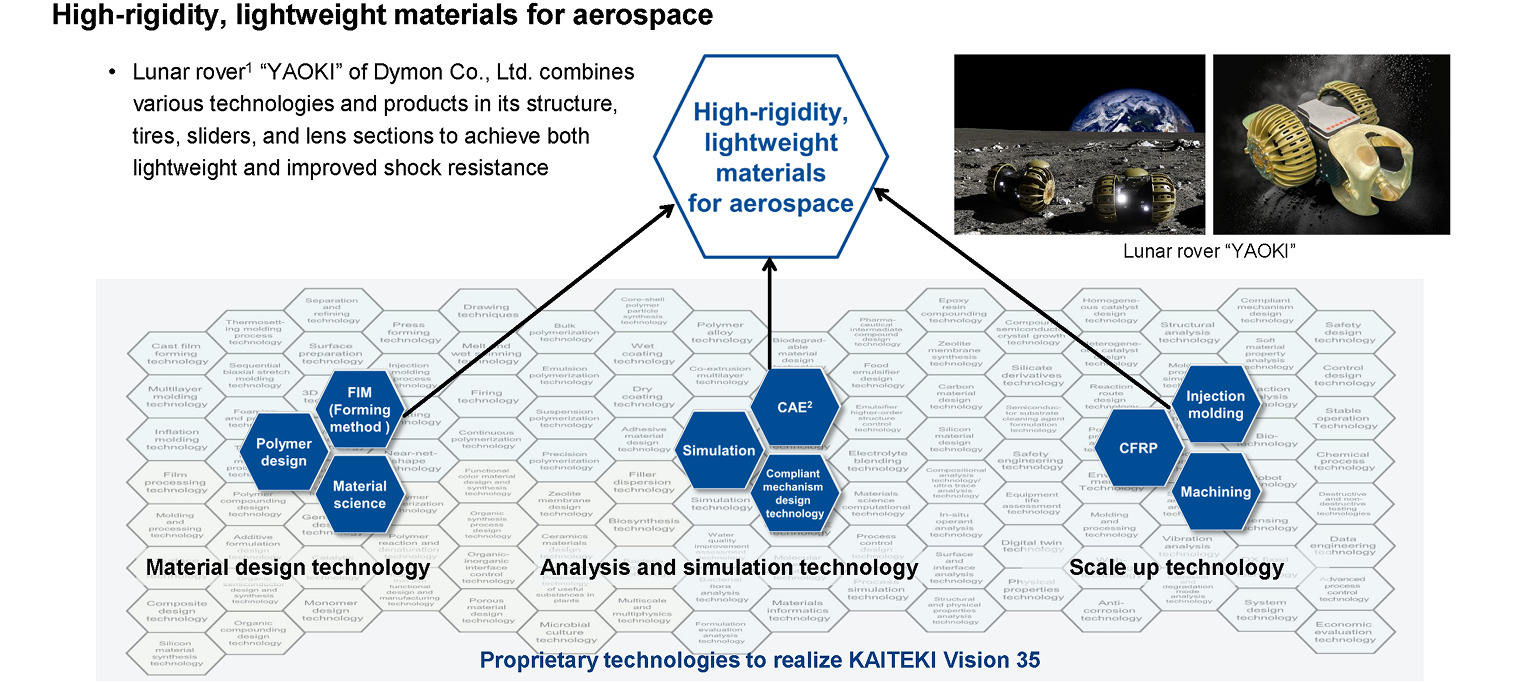

For example, in the development of materials for the lunar rover YAOKI, four business segments with more than ten different technologies collaborated organically to overcome the formidable challenges of the harsh space environment. This symbolizes our "ability to propose and collaborate with external partners" and represents the fruition of our unique, integrated technological capabilities.

Traditionally, we have focused on our "manufacturing strength," emphasizing quality, purity, and stable supply. However, going forward, it is essential to also strengthen our "power to connect"—our ability to propose solutions that connect us with external partners. Over the past year, co-creation with users and brand owners has increased, accelerating collaboration from the development stage onward.

We aim to link these initiatives to the performance indicators set forth in our medium-term management plan for fiscal year 2029 and fiscal year 2035.

2.Computer-Aided Engineering

(Source: Mitsubishi Chemical Group Corporation, company materials)

Transforming into a "Lean and Strong" Organization through Resource Reallocation and Growth Investment

Koike Over the past year, you have taken steps such as exiting certain businesses and reviewing resource allocation. The phrase "fundamentals-focused company" you mentioned earlier seems to carry another nuance from the perspective of the business portfolio. What approach or guiding principles have driven these structural reforms?

Chikumoto The phrase "fundamentals-focused company" not only means thoroughly adhering to management fundamentals but also implies imposing clear profit responsibility across all businesses and transforming into a "lean and strong" organization. To achieve this, it is necessary to calmly reassess businesses with poor prospects or low profitability and to be prepared to exit those where restructuring proves difficult.

Accordingly, we conducted a company-wide screening of all businesses and established a clear rule: "Businesses without prospects for recovery within six months will be exited." As a result, approximately 20% of the Chemicals business revenue for the fiscal year ending March 2025 has been designated as non-core and targeted for divestiture, while the remaining 80% is expected to continue.

Some of the businesses marked for withdrawal have been long-standing operations. Although this was not an easy decision, we made a calm, objective judgment based on historical results and the most recent six months' performance.

Koike On the other hand, I understand that you are also advancing investments in growth areas and reallocating human resources simultaneously. When reviewing resource allocation, which fields are you focusing on, and what criteria do you use to make these decisions?

Chikumoto Specifically, we have defined five focus business areas-mobility, semiconductors, food, healthcare, and "green chemicals" that support these sectors-and are concentrating our technologies and expertise on them. The funds obtained from the sale of our pharmaceutical business will also be reallocated to these growth sectors. When making investment decisions, we emphasize not only quantitative criteria such as IRR (internal rate of return), but also hurdle rates tailored to the characteristics of each business and qualitative evaluations. We are redesigning our approach by considering both numerical data and on-the-ground insights. While being mindful of corporate culture and employee motivation, we are advancing the development of a flexible yet resilient organization. By leveraging our accumulated technologies and expertise, we aim to restructure our management resources toward truly valuable sectors.

Koike Since investors pay close attention to capital efficiency metrics such as ROIC, providing clear and concrete policies-for example, how much will be invested in these areas and what level of returns are targeted-would likely give them greater reassurance.

Chikumoto Exactly-that is the core of our current management approach. We regard improving our Price-to-Book Ratio (PBR) as our most important challenge, and in the next medium-term management plan, our target is an ROE of 10% and more. Internally, we use ROIC as a management indicator, aiming to achieve 7% in the near term. This level exceeds our assumed cost of capital and is expected to lead to enhanced corporate value.

Through margin improvements via price management and asset optimization, we are working to enhance capital efficiency from both the denominator (invested capital) and numerator (profit) sides. At the same time, we will communicate these efforts more clearly to external stakeholders.

Opening the Next Decade by Transforming into a Green Specialty Company

Koike In your long-term vision, you've set forth a policy to transform into a "Green Specialty Company." While I believe this is a crucial theme closely tied to the future corporate value, it also seems that ESG investing is currently experiencing a shift in momentum, particularly in the US. Given the challenges often pointed out regarding profitability, isn't the key issue how to establish the green domain as a viable business?

Chikumoto Even if a business aligns with the ideal of "continuing because it's the right thing to do," it cannot be economically feasible if the market does not accept it. This principle applies even to carbon-neutral (CN) related businesses—we base our business decisions on economic rationality. That's why from the outset, we place great importance on whether there is an "exit," meaning actual demand, and we collaborate with branded companies that will use the materials from the development stage. For example, our plastic recycling business currently in a test run at the Ibaraki Plant already has customers and is scheduled for full-scale launch soon.

Furthermore, consumer acceptance of environmental value has certainly changed. In light of the recent extreme heat and the reality of climate change, there is increasing social pressure-regardless of regulatory frameworks-that "we must act." Decarbonization and recycling are no longer optional but unavoidable.

To secure our future competitiveness, collaboration with countries that have advantages in their cost structures is essential. Considering hydrogen and electricity costs, partnerships with regions where renewable energy prices are low will be key. For instance, we are exploring a scheme in which hydrogen is produced via water electrolysis in highly competitive regions like Abu Dhabi, then reacted with carbon dioxide to manufacture chemical products, which are then imported to Japan as intermediate materials. We regard emerging countries and regions with high renewable energy potential, such as the Middle East and India, as prospective new partners. Just as we were once connected by oil, we are now advancing new initiatives centered on hydrogen.

Koike On the other hand, what is your view on the growth potential of the Chemicals business itself?

Chikumoto While demand for the Chemicals sector is plateauing domestically in Japan, it is expected to experience stable growth globally. For example, PP compounds* used in mobility applications are showing remarkable growth in the US and India. In China, distribution channels for engineering plastics are steadily expanding even to non-Japanese companies. When I visited the region, I was impressed by the rapid pace of technological innovation in Chinese-made EVs. Considering this market momentum, I believe profits earned in China should be firmly reinvested locally.

The semiconductor sector also shows strong demand, primarily domestically, despite some tariff impacts. Many manufacturing sites are operational in China, and semiconductor in-house production is beginning in India. Although at the federal level there are signs of a slight slowdown in green initiatives in the US, some states provide substantial support, allowing for development tailored to regional characteristics.

Koike As you pursue greening initiatives, new technologies different from conventional petrochemicals will likely be required. Where do you see your company's-and Japanese companies' overall-strengths in this regard?

Chikumoto Moving forward, a shift in thinking from "chemistry that breaks down using heat and pressure" to "chemistry that connects" will be required. In this field, materials are reconstructed at the molecular level and linked to circular processes. I am confident that our company's long-developed manufacturing strengths will give us a competitive edge.

*PP compound: Polypropylene resin compound

Strengthening Governance and Maximizing Human Capital through Dialogue

Koike To achieve global growth, I believe it is essential to strike a balance between delegating authority to each regional site and strengthening governance. At the same time, Japanese companies often have a centralized structure with strong control from headquarters. Could you please share specific details about how your company is advancing delegation of authority in the US?

Chikumoto In the past, Japanese personnel often led our overseas sites, which meant local discretion was quite limited. Nowadays, a positive form of "centrifugal force" is at work-we have established management teams in each region and are thoroughly implementing a localized approach.

In the US, we have set up a system that enables independent decision-making, and we plan to roll out a similar structure in Europe. On the other hand, because of significant variations in legal systems across Southeast Asia, headquarters continues to be heavily involved there.

As for China, operations are led by the local management team, with ongoing knowledge sharing and unique forms of collaboration.

Koike Achieving a balance between local autonomy through this "centrifugal force" and appropriate control requires a restructuring of governance. Since you assumed your role, how have you approached reforms in this area? Additionally, how has the perspective of external directors and other supervisory stakeholders evolved?

Chikumoto The most significant change has been in the quality of communication. The executive management team of Mitsubishi Chemical discusses all information openly on an equal footing. Executive officers from overseas regions also participate and are deeply involved in decision-making at headquarters.

Additionally, the executive officers have diverse backgrounds, fostering a culture of frank and open exchange of opinions.

The Board of Directors of the Mitsubishi Chemical Group functions as a monitoring board composed primarily of outside directors, and discussions are substantive and rigorous. Gone are the days when "whatever the president says goes," and thorough preparation is now essential. While I receive many questions, even more are directed towards the corporate executive officers and other members of management, creating a setting where tension and constructive debate coexist.

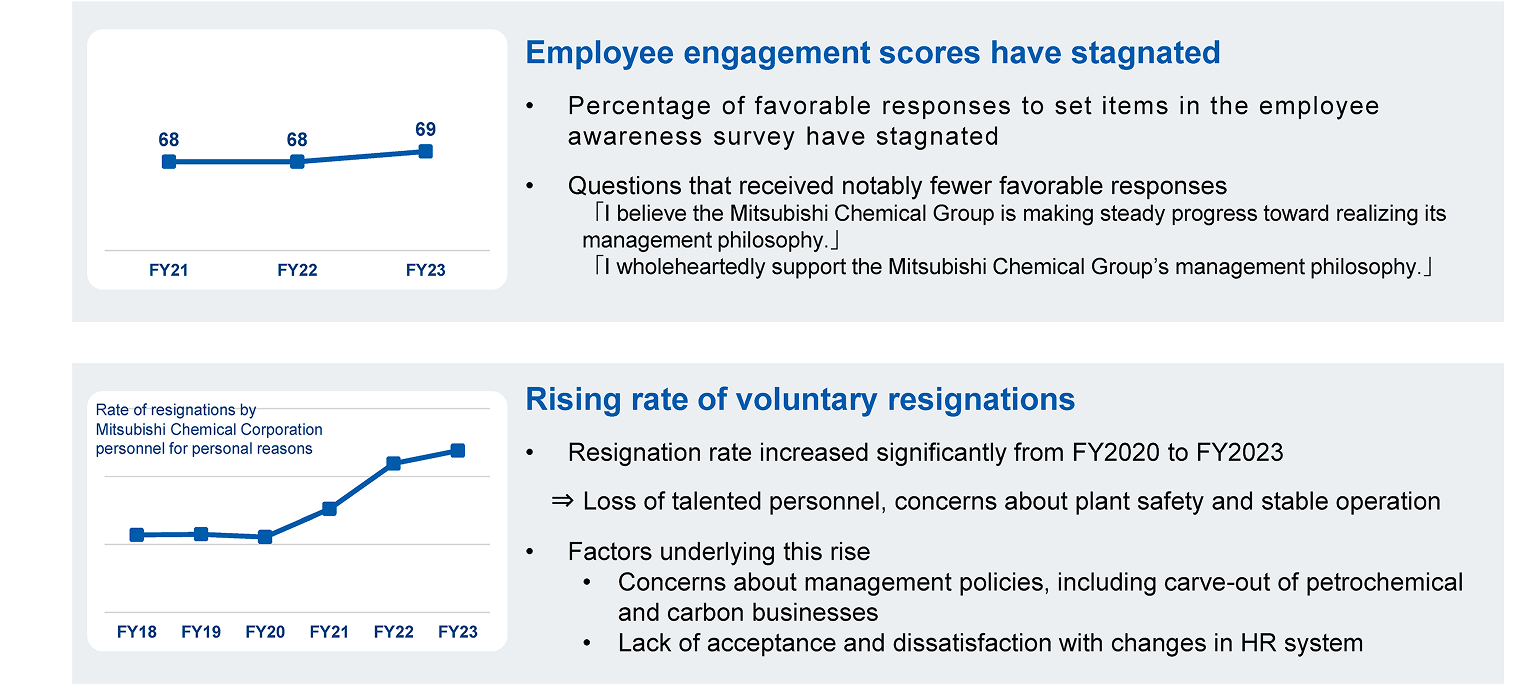

Koike That is indeed the driving force toward becoming a "fundamentals-focused company." On the other hand, I have heard that there was a period when employee engagement declined.

Chikumoto Employee motivation had declined in the past, and some employees left the company; however, our survey last autumn showed significant improvement compared to two years ago. As a manufacturer, revising the compensation and working conditions of operators was particularly important, and raising these to a level comparable to other companies contributed to improved engagement.

Additionally, we have begun developing managers and next-generation talent. There are about 25 candidates who could be promoted to executive positions within one to five years, and approximately another 25 candidates who could reach executive level in six years or later. Our executive team is directly involved in formulating development plans for these leadership candidates, and we have been actively pursuing these initiatives since the start of this year.

2.The percentage of favorable responses to specific items in the employee engagement survey.

3.pp = Percentage points.

4.Ratio of board members (excluding outside directors) and highest-grade employees who meet one or more of the following criteria: international background (foreign nationality), female, or multi-career (career hires).

(Source: Mitsubishi Chemical Group Corporation, Company materials).

Toward Stock Price Recovery through Capital Efficiency Reform

Koike Currently, the stock market directly reflects evaluation of capital efficiency and growth investments in share prices. While your company has carefully disclosed metrics such as ROIC in materials such as the medium-term management plan, it seems that these changes have not been fully reflected in the stock price.

Chikumoto Even compared to around 40 years ago when I joined the company, the stock price has hardly changed. Although we have gone through mergers and other transformations, it is true that there has been no significant increase. Our Price-to-Book Ratio (PBR) has occasionally fallen below 0.6, so we aim to at least restore it to 1.0. We also plan to raise our ROIC to 7%. I believe that once these results become visible in the numbers, the market will recognize and evaluate our efforts accordingly.

Koike The Japanese government is intensifying its policies on promoting Japan as a "leading asset management nation," and your company, as a domestic asset management firm, is strongly committed to this effort. Lastly, could you briefly share your thoughts on initiatives aimed at supporting employees' asset formation?

Chikumoto I believe that utilizing stocks for long-term asset building is important, and while we have established a subsidy system for our employee stock ownership plan, participation rates remain low. Therefore, we recognize the need to continue efforts to strengthen trust in the company. Going forward, we aim to explore systems that enable employees to grow together with the company.

Koike I look forward to your future endeavors. Thank you very much for sharing your valuable insights today.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: July 31, 2025)