Engagement Feature Articles

Marubeni - Aspiring to Create New Value atop a Solid Management Foundation

Left: Hiroyasu Koike, President and CEO of Nomura Asset Management Co., Ltd.

While investment is indispensable for corporate growth, it is also important to maintain a balance in terms of financial foundation and shareholder returns. On the tail of announcing the company's 2022-2024 mid-term management strategy "GC2024" in February 2022, Mr. Masumi Kakinoki, President and CEO of Marubeni Corporation, sat down with Mr. Hiroyasu Koike, President and CEO of Nomura Asset Management Co., Ltd. to discuss investment, growth, and other topics.

Corporate Performance Supported by Growth Investments Centered in the US

Koike Marubeni has finished three years of transformation in which it has established a solid management foundation and announced its mid-term management strategy "GC2024". I would like to discuss Marubeni's future strategy.

In FY2021, your company posted record profits and I would like to hear more about the initiatives leading up to this success.

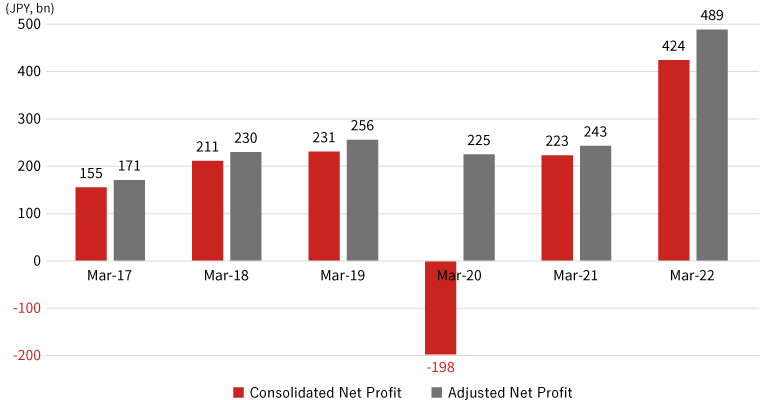

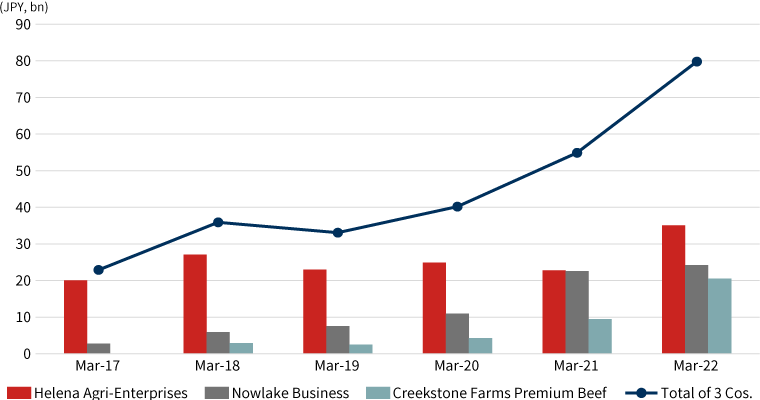

Marubeni has distinguished itself among trading companies with the recent results of its growth investments, which Nomura Asset Management recognizes as contributing to the FY2021 record profits. Specifically, Creekstone Farms Premium Beef (hereafter "Creekstone"), a livestock business acquired by Marubeni in 2017, accounted for JPY 20.5 billion in profit for FY2021. Additionally, used car retail financing company Nowlake Business (hereafter "Nowlake") performed well, accounting for JPY 24.2 billion of FY2021's consolidated profits. Furthermore, Helena Agri-Enterprises (hereafter "Helena"), which the company acquired in 1987, expanded its income base through ongoing capital injections and reached record profits in FY2021. The returns on these investments have been extremely high. Could you share some details regarding the background of these successes?

Realizing Growth through Investments Centered in the US, a Region with a Low Country Risk

Kakinoki All of these businesses are operating primarily in the US, with leading capabilities and competitive appeal. Creekstone is a producer, processor, and seller of beef and other products in the US. It only deals in high quality Black Angus beef, raised on grain-based feed and sells its high added-value products to top-class steakhouses and bulk retailers across the US alongside some exports. In 2017, Marubeni acquired Creekstone based on expectations of a rise in demand for beef accompanying shifting dietary habits in emerging countries. Following the acquisition, the company's stable performance rapidly expanded from 2020 onwards. During the global pandemic, competitors decreased operations and the spread between material costs including live cattle and retail prices expanded. Creekstone was able to continue sales of its products thanks to optimization and improved stability of its factory operations. This operational improvement was supported by Marubeni's know-how, which was cultivated through our experience in Australian beef cattle farming and Japanese poultry processing/sales. In 2021, a drastic improvement in corporate performance led to Creekstone recording single-year profits that are comparable to the acquisition price.

Meanwhile, Nowlake has developed a used car retail financing business in the US and sits in the top ranks of the industry. In 2011, Marubeni acquired approximately 20% stake (currently 21.7%) in Nowlake (Westlake at the time of acquisition) for USD 250 million. Marubeni is the largest shareholder apart from the founder and has supported the company's management consistently. Nowlake has developed strengths in data analysis and application, such as its automated loan approval system which provides customers with loan conditions and approvals within around two seconds. Additionally, with the global pandemic driving sales of used cars as demand for personal cars increased in the US, the company's business grew significantly with the support of its thorough credit management.

Helena is a major US agri-input retailer, handling fertilizers, crop protection products, seeds, and other products. At the time of Marubeni's acquisition in 1987, the company operated approximately 100 locations in US. Now the company has grown its network to cover 500 locations through new development and M&A, leading to a steady expansion in profits. In particular, the company's community-based consulting business and proprietary product development/sales has allowed it to maintain positive performance even amidst stagnation in the global grain market.

These companies have achieved growth through their capabilities and competitiveness in the US market, a region with low country risk, and they are increasing the stability of their businesses. Marubeni's business portfolio has a low ratio of emerging country businesses, and maintains relatively low risk. Our GC2024 growth investment policy maintains this approach to investing in countries with low country risk, such as the United States.

Investment Policy

Koike Listening to your story, it is clear that part of your company's success has been due to the success of the investments. On the other hand, in the equity market, trading companies are seen as they are set to make investments, and there are concerns of whether they can capture appropriate returns. Could you share more details regarding your company's investment policy and risk management practices?

Kakinoki First of all, we plan our business investment with the intent of success, and proceed with an awareness of the risk of failure. It's important to consider the investment amount and method, so that it does not pose a fatal risk to our company's finances even if the investment should fail. Additionally, we make considerations for the measurement to recover the capital when we create the investment plan. We conduct investments strategically, not simply to acquire profits. We fully employ the information and know-how that we have acquired through trading, which is a common strength of companies like ours. Skepticism on the part of trading companies regarding equity market investment can't be helped in light of past failures. However, Marubeni has worked hard to improve the precision of our investments. In recent years, we have created various initiatives for internal change and we are seeing the results of those efforts materialize.

The Power Business amid a Rapidly Evolving Environment

Koike Marubeni's power business used to achieve greater asset efficiency than its competitors, but in recent years one-time losses have brought it into the red, causing concerns regarding its cash flow stability. With the domestic and international power business evolving drastically due to decarbonization efforts and the rise of sustainable energy, would you mind sharing your thoughts on your strategy within the industry?

Kakinoki There are two sources for the recent losses. In an overseas EPC case, the global pandemic caused issues securing personnel, while additional costs arose from a request for early completion. Additionally, in regard to our domestic power retail business, a rise in wholesale power prices temporarily impacted profits negatively. While our power business possesses high competitiveness and expertise, the competition in the market is becoming quite intense amid the shift to renewable energy production. As a forerunner for renewable energy, we can name Scotland's floating offshore wind farm developer ScotWind as our specific example for our strategy going forward. While we have engaged during the middle of the development process for many large overseas projects in the past, for ScotWind, we are participating from an earlier stage. There is a high level of difficulty associated with participation at this stage, but we view this as an opportunity to add value with the expertise and network that our company has cultivated. I expect stable profit from our power business from now on, since we historically have strength in this market.

More Active Growth Investment in Green Business

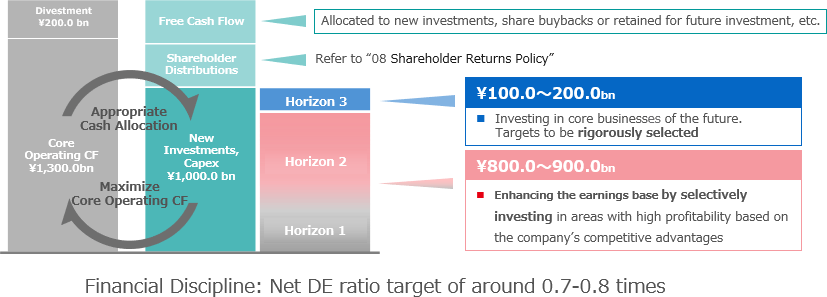

Koike In the three years from 2022 to 2024, the "GC2024" plans for JPY 1.3 trillion in core operating cash flow and JPY 200 billion in fund collection from divestment. Additionally, you collected approximately USD 3 billion from your sale of Gavilon's grain business. Even considering the JPY 1 trillion in planned investments, and shareholder returns, there is a significant amount of free cash accounted for in GC2024. Would you kindly share your plans for that free cash?

Kakinoki Marubeni addressed the rebuilding and strengthening of the financial foundation in the previous mid-term management strategy "GC2021", allowing for greater flexibility of capital allocation in the future. For GC2024, we would like to use the free cash for growth investment. In the investment sphere, we are not only planning extensions of existing businesses, but also considering new fields.

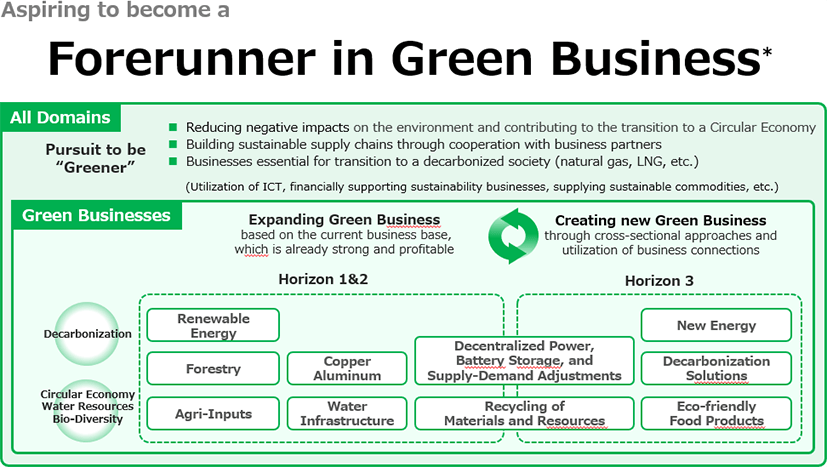

Our company categorizes investments as either "Horizon 1 (Improvement of existing businesses)", "Horizon 2 (Pursuit of strategies in existing business domains)", and "Horizon 3". Investments to further strengthen our competitive business fall under Horizon 1 or 2. Horizon 3 is targeted at "New business models and unapproached business domains". While Horizon 3 investments are also handled by our existing business divisions , we newly established a "Next Generation Business Development Division" in 2019 and a "Next Generation Corporate Development Division" in 2022 to pro-actively pursue investment opportunities. We aim to improve our corporate value by taking an approach to growth which centrally positions Horizon 1 and 2 investments while layering in Horizon 3 opportunities.

- *Sustainable businesses which positively impact decarbonization, the cyclical economy, and environmental efforts, and business required to support such efforts, as well as peripheral areas supplying materials which are difficult to substitute

Taking in New Businesses and Investment Discipline

Koike I am interested to hear more details regarding Marubeni's Horizon 3 investment. I imagine there is a mix of expectation and concern in the equity market regarding the new businesses of trading companies.

Kakinoki In the previous mid-term management strategy "GC2021", we conducted Horizon 3 investments with the intent of planting seeds. In "GC2024", we will be investing with a sense of scale and participating with proportions capable of leading project development and growth.

While we are growing the scale of Horizon 3 investments, we continue to apply strict investment discipline. Currently, our management team is meticulously confirming whether investment candidates are appropriate in terms of our corporate strategy and the probability for growth, etc. On the other hand, we remain conscious not to act in ways that block the pursuit of new initiatives.

Deepening Shareholder Returns while Balancing Financial Discipline

Koike I would like to hear more about your shareholder return policy. In "GC2024", Marubeni announced a three-year dividend payment floor, as well as a maximum share buyback of 35 million shares/JPY 30 billion, accounting for 2% of issued shares. What are your thoughts on these topics moving forward?

Kakinoki In "GC2024", we set the three-year dividend payment floor as JPY 60 per share. This is the first time our company has set a multi-year dividend payment floor. Marubeni is aiming to increase dividends through profit growth, and we wanted to enable shareholders to confidently hold our stock amid the extremely opaque business environment. In addition to considering flexible share buybacks, we would like to consider improvement of shareholder returns, while examining factors such as improvement of credit ratings and handling of perpetual subordinated loans. Our policy is to maintain a net debt equity ratio of 0.7-0.8x through financially disciplined capital allocation. In addition to pursuing a better financial structure, once we strengthen and stabilize our financial foundation, we would like to deeply consider returns to our shareholders and investors.

Koike You've made your policy of improving your financial foundation while strengthening growth investment and shareholder returns very clear. May I ask what types of expectations Marubeni has for institutional investors like Nomura Asset Management?

Kakinoki Marubeni's Horizon 3 investments and those of the Next Generation Business Development Division will require time before realizing profits, and in some cases may require longer than the three years of our mid-term management strategy. I am sure this is already apparent to institutional investors, but the speed at which "cash cow*" businesses breakdown has increased considerably. On the other hand, it remains true that establishing a new business model requires an abundance of time. If we don't pursue new opportunities now, we will not have timely alternatives when our current cash cows eventually falter, causing us to lose ground. Trading companies have continually stayed ahead of change and created value by addressing social issues. Planting seeds for the future is a necessary part of our business. Even if profitability cannot be realized in the short-term, we hope our efforts will be viewed with an understanding of the risks of not pursuing new opportunities.

(*Cash cow refers to businesses that generate ongoing cash flows.)

Koike We at NAM recognize the importance of integrating ESG factors into the investment process. Our ESG assessment incorporates not only risk factors, but also opportunities to create future value. Additionally, our ESG integration places importance on the links between financial and non-financial factors and the impact of long-term profit/cash flow creation. Moving forward, we look forward to continuing our dialogue with Marubeni and other corporations to discuss and assess green businesses and other long-term initiatives. Thank you for joining me for today's fruitful discussion.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: October 28, 2022)