Engagement Feature Articles

Kyocera Corporation - Creating a Medium-Term Management Plan to Accelerate Growth

Right: Hiroyasu Koike, President and CEO of Nomura Asset Management Co., Ltd.

Kyocera was founded in 1959 by Dr. Kazuo Inamori, the so-called "god of management", when he was 27 years old. The company has maintained stable growth based on its fine ceramic technology and strong financial foundation, and has consistently operated in the black. How will Kyocera pursue its future development? Mr. Hideo Tanimoto, President and Representative Director of Kyocera Corporation, joined Mr. Hiroyasu Koike of Nomura Asset Management to discuss current challenges and the company's medium-term growth vision.

Our Code of Conduct Must be Responsive to the Times

Koike In order to help the Japanese stock market break free of its persistent undervaluation, despite high liquidity and Japan's political stability, we at Nomura Asset Management are sharing details of our engagement with investee companies in both Japanese and English as part of an initiative to support the improvement of corporate value. I'm grateful for the opportunity to visit your Kyoto headquarters to speak with you today as part of these activities.

To begin, I would like to ask about Kyocera's founder, Dr. Kazuo Inamori. Kyocera has developed its own management philosophy and methods, such as the "Kyocera Philosophy" and "Amoeba Management," which have supported Kyocera's corporate culture and DNA. Personally, what aspects do you want to maintain and what aspects do you want to evolve?

Tanimoto As established by Dr. Inamori, Kyocera's corporate philosophy is based on "Do what is right as a human being", which we value most of all. The Kyocera Philosophy can be broadly divided into a way of thinking and our code of conduct. We believe that there is no need to change our altruistic way of thinking. However, our code of conduct need to be responsive to the times. For example, there is the idea of "Strive Harder than Anyone Else". During my youth, it was a common misconception that working longer than others was a virtue. Instead, we must recognize that we should focus hard with a diligent work ethic to produce results in as short a time as possible.

The framework through which we teach the "Kyocera Philosophy" was developed by Kensuke Ito, who served as president after the next president from Dr. Inamori. We have an educational system for key points in an employee's career, including when newly joining the company, in the third year, and when becoming a manager. Members of our management teach the seminar for departmental heads directly, in order to communicate our management philosophy in detail. "Amoeba Management" is a unique method that divides a business organization into small groups, runs them with independent accounting systems, develops leaders with managerial awareness. As our sales have grown from several hundred billion yen to two trillion yen, we feel it is necessary to slightly change our thinking and methods while still maintaining the assumption that all employees participate.

An Annual Management Plan Doesn't Fit

Koike Since you became president in April 2017, you have engaged in a series of internal reforms. In May 2023, Kyocera announced its first medium-term management plan to the public. Could you share the background and your goals in this regard?

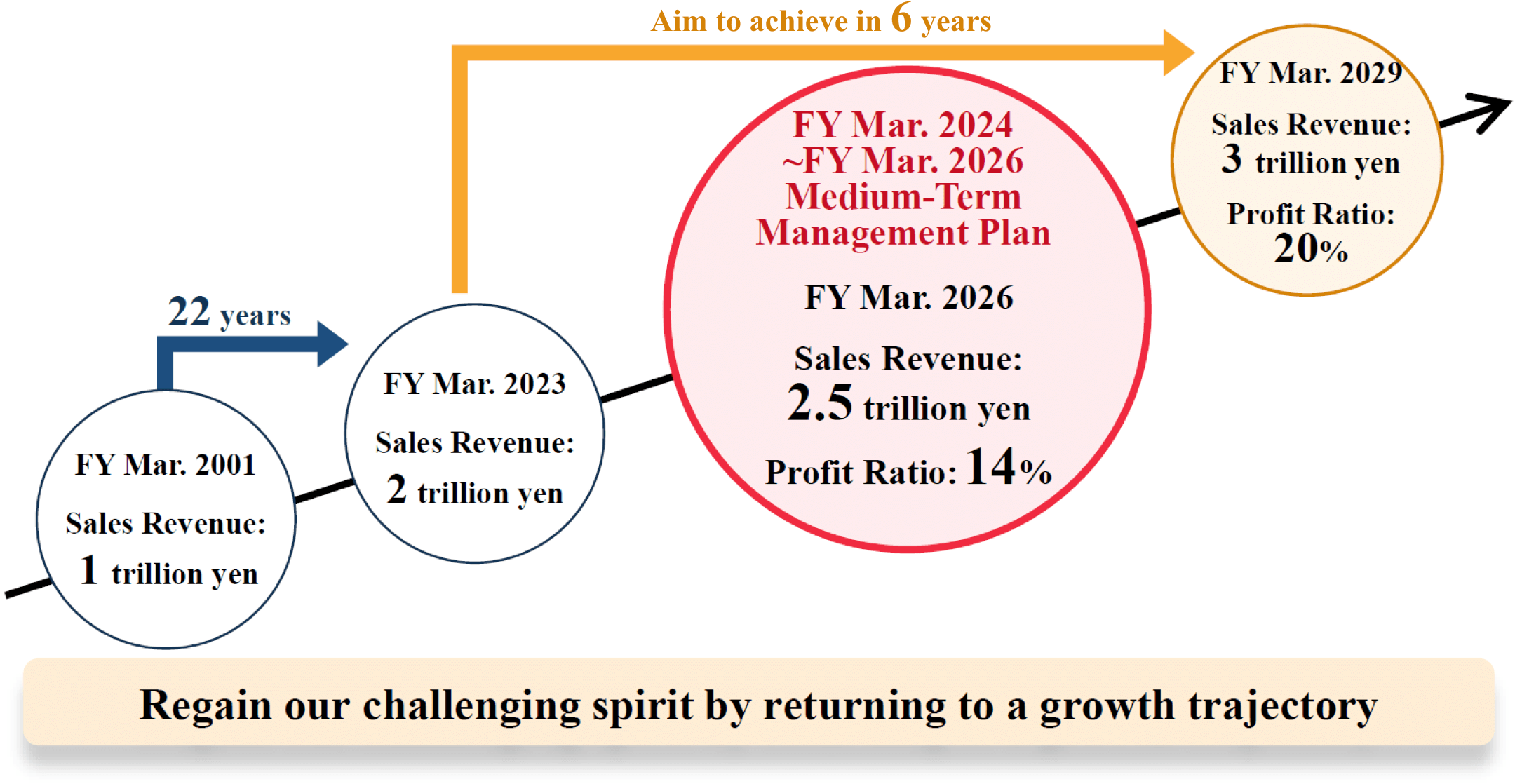

Tanimoto We recognize that since the early 2000s, our growth has been very slow compared to that of our competitors. In particular, we have maintained a conservative management approach since the Lehman shock in 2008. In the future, we would like to focus on key markets and accelerate growth. Originally, Dr. Inamori made his management plan on an annual basis as it used to take about a year to build a new factory to increase production, but now it takes about two years to build a factory and three years from planning to operation if you include installation of equipment. In other words, when you make a focused investment allocation, you need to plan for at least three years. The semiconductor market is expected to double from 2022 to 30. The business for semiconductor-related markets is our strongest, and we plan to make focused investments based on our three-year medium-term management plan.

Improving Capital Efficiency through Growth Investment and Utilizing KDDI Stock

Koike In your medium-term management plan, there is a comment that you would like to aim for sustainable improvement of ROE and link it to improvement of PBR. Investors who are conscious of stock price valuations have become more prominent, in part because of requests from TSE to listed companies to improve their PBR. What is your assessment of Kyocera's current stock price level?

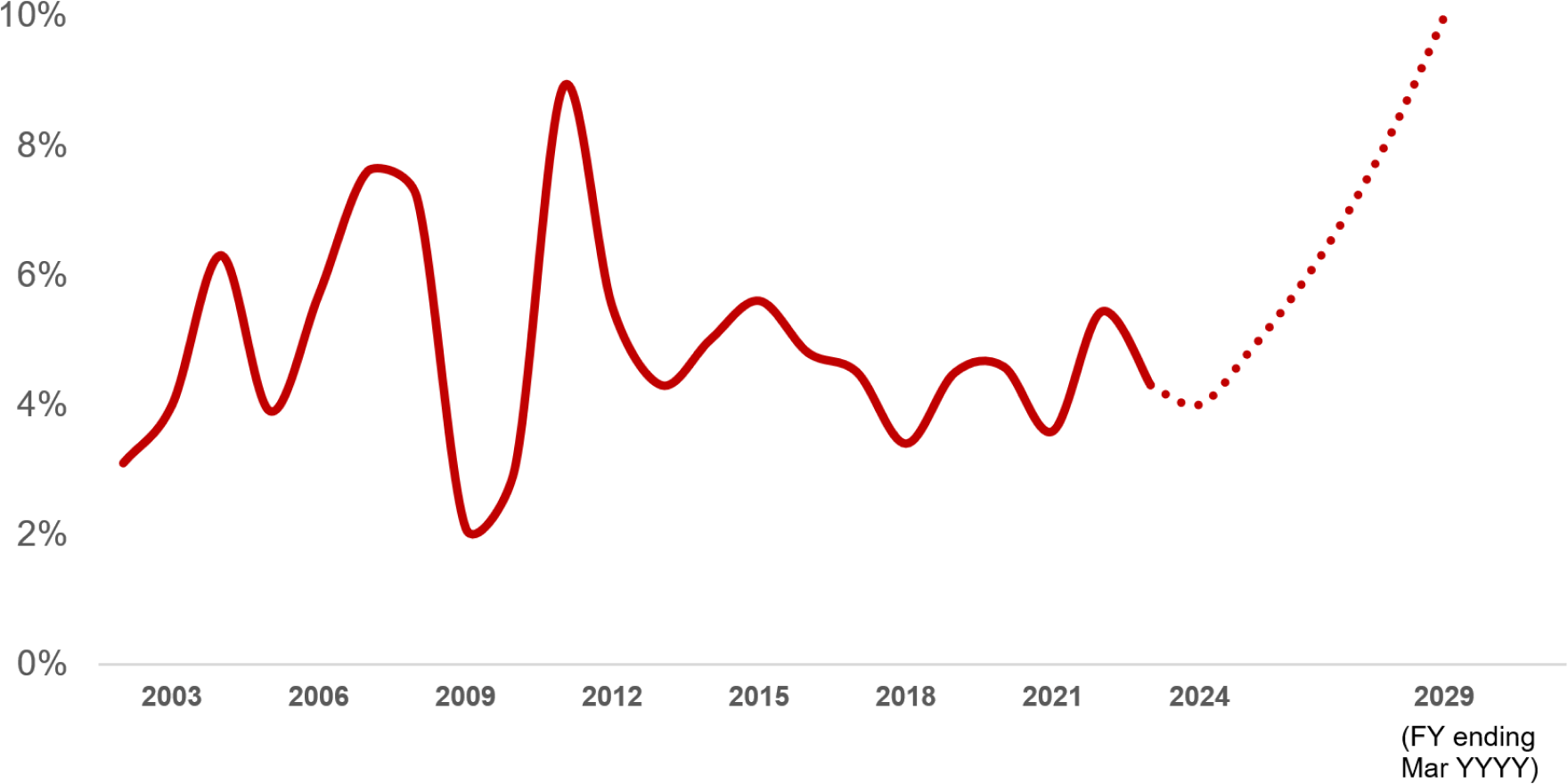

Tanimoto As you are aware, our stock is currently traded at a price below book value. Weak growth has somewhat improved now, but profit margins haven't increased. For the time being, our profit margins are not expected to increase immediately due to the advance investment period, but the plan is to achieve improvements in about five years. The pretax profit margin was 8.7% for the fiscal year ended March 2023, the previous fiscal year, and we plan to achieve 14.0% for the fiscal year ending March 2026.

Furthermore, we intend to utilize our KDDI share holdings. As a first step, we have already announced that we will increase our investments via bank borrowing by using KDDI shares as collateral. We plan to set a deadline on determining how to further use our holdings and communicating this to the market.

Although ROE was 4.3% in the fiscal year ended March 2023, in the medium-term management plan we set a target of 7.0% or more in the fiscal year ending March 2026, and we forecast that ROE will grow to double digits when sales revenue reaches 3 trillion yen.

U.S. GAAP through FY2017. From FY2019, the company applies IFRS and FY2018 has been converted to IFRS.

Actual figures for FY2002 - FY2023. Targets for FY2024 onwards.

(Source) Prepared by Nomura Asset Management based on Kyocera Corporation materials

Koike As Kyocera is one of the founding companies behind KDDI, it feels strange to characterize your holdings of KDDI's stock as cross-shareholdings. However, as there is an overall trend of reducing cross-shareholdings, the growing ratio of KDDI's stock in your overall assets does pose a financial risk. Many investors feel a lack of transparency regarding the treatment of KDDI shares, which may affect the valuation of the stock. I hope you will devise a pro-active strategy regarding the efficient use of assets.

Semiconductor-related Business is the Strongest

Koike I would like to ask you about priority investments in growth areas. You mentioned earlier that you want to focus on businesses for semiconductor-related markets. Could you discuss the growth strategies, competitive advantages, and strengths of your business portfolio?

Tanimoto Among our company's products, our ceramic packages for semiconductors and ceramic components used in semiconductor processing equipment have the top class market share. Our company's ceramic packages has advantages in high strength, high heat conductivity and design diversity, and is used in a wide range of fields. In addition, the process of semiconductor manufacturing is conducted in a harsh environment involving high temperatures and strong plasma, and fine ceramics that are resistant to plasma corrosion are increasingly being used in processing where durability is required. Advances in semiconductor performance are also encouraging. We will set up a system to increase production so as not to lose market share.

Although our organic packages for semiconductors are not necessarily the top share, we will focus on cutting-edge growth areas such as artificial intelligence, data centers, and automotive applications. Also, we will pursue a specialized strategy for capacitors that focuses on products that are incorporated into semiconductor packages rather than a broader approach.

Koike In contrast with your growth strategy, I assume that handling unprofitable businesses is also a challenge. How do you view the sale of or withdrawal from businesses from the perspective of restructuring?

Tanimoto Three years ago, we started to discuss unprofitable businesses annually at the meeting of the Management Committee, where our managing executive officers or senior officers meet. Each business is evaluated on three levels: double-digit or higher profit margin, single-digit profit margin, and deficit. Deficit businesses are judged for withdrawal or sale. In the past few years, we have also closed our solar module factory and LCD factory in China. We believe that the decision to withdraw or sell will continue to be necessary depending on the business situation.

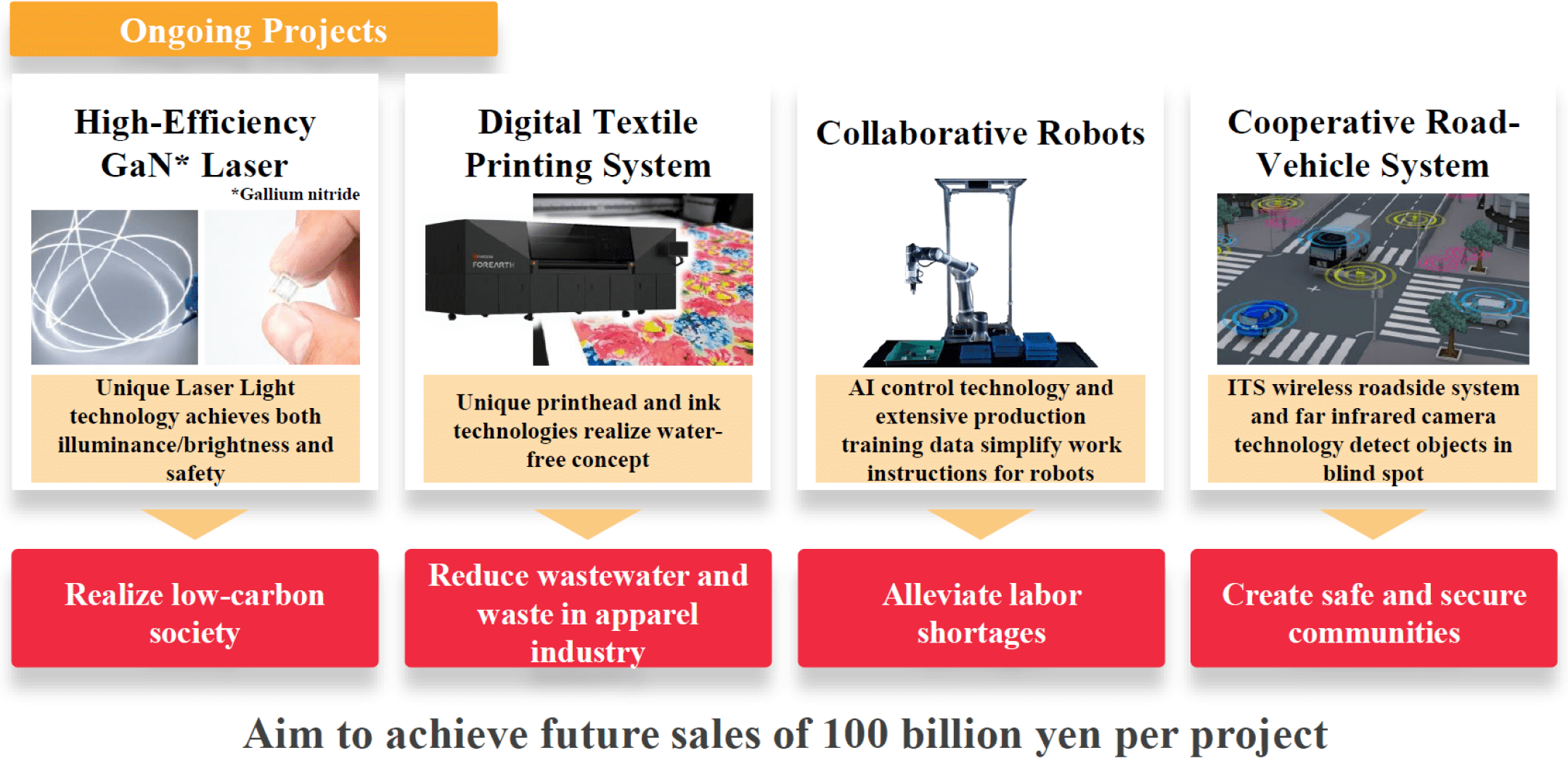

However it doesn't mean that we will always stop a business just because it is in the red. We also consider that projects that contribute to solving social issues such as the expansion of renewable energy should be continued, albeit with patience. Our company has been involved in solar power generation and solid oxide fuel cells (SOFCs) for many years, and in recent years has developed and sold the world's first clay type Li-ion battery. We are working with KDDI and others to promote the business of accumulating renewable energy and selling electricity to RE100 companies.

Koike Within the scope of sustainable management to address social issues, are there other businesses or solutions ripe for expansion?

Tanimoto Our company is developing and producing inkjet printheads for commercial digital printing using fine ceramic technology. In particular, there is a certain demand for high-definition on-demand printing in small batches. A digital printing system for printing on textiles such as clothing is being developed by integrating these technologies. The unique pigment ink uses little water and can be printed on a wide variety of fabrics. In the global textile and apparel industry, the use of large amounts of water and water contamination are considered to be problems, and mass disposal due to overproduction is also an issue. We have already received a number of inquiries, which we hope will contribute to resolving these issues.

In areas where we can make use of our strengths in fundamental technologies and materials, we believe there is great potential not only for sustainability but also for profitability. SLD Laser, a U.S.-based company that became a wholly-owned subsidiary in 2021, is a world leader in the commercialization of highly efficient laser light sources. We use a crystal called gallium nitride as a base material, and we expect to contribute to the realization of a low-carbon society by providing highly reliable laser light technology through our unique manufacturing technology which results in few defects.

"Reskilling" for Elder Employees is a Challenge

Koike I would like to hear about any developments in regard to human capital management.

Tanimoto The Kyocera Philosophy and its in-depth educational programs are as I mentioned at the beginning, but now that digitalization of internal operations has become essential, I feel it is necessary to develop human resources capable of processing data. First of all, we are intensively training engineers to handle data, and we have trained them to a level that they can teach others internally, and now we are increasing the opportunities for digital education.

Four years ago, we started a new business idea startup program that teaches students not only education and data utilization but also the process of commercialization itself. The first female employee to use this system has created a business, although small, in providing meals to people with food allergies, an area completely unrelated to our existing businesses.

Human resource development is becoming quite fulfilling, but there are challenges, such as reskilling for elder employees. In 2023, our company introduced a system that allows employees to work until the age of 70 if the work style they want matches that of the company. However, as the nature of the work changes, a certain percentage of these people will not be able to adapt using their existing skills alone, so re-education is necessary. The challenge is whether we can actually produce results.

Still Traversing the Path to Kyocera's Future

Koike For corporate governance, our company recommends transitioning the Board of Directors to a monitoring board. In other words, more than half of the board members are outside directors and the board fulfills the role of overseeing management. Kyocera is a company with Audit & Supervisory Board. Whereas many companies set the term of office for directors at one year, Kyocera's directors serve for two years.

Tanimoto Our company uses these conversations with investors as a cue to make changes as needed. We recognize that the term of office of directors is a matter for consideration. The number of outside directors at our company is 1/3 of the total, but we would like to further discuss whether it should be half. As for outside directors, the number of persons with experience in corporate management has increased, and discussions on business objectives and future development have become active at board meetings. In the past, representatives of overseas affiliates were directors of our company, but currently there are no foreign board members. The promotion of foreigners is an issue we are examining.

Koike How far along are you on the path to realizing the future of Kyocera as you envision it?

Tanimoto I think we are about 50 or 60% of the way there. The management philosophy "To provide opportunities for the material and intellectual growth of all our employees, and through our joint efforts, contribute to the advancement of society and humankind" created by Dr. Inamori is a fully realized concept that we should continue to observe. The organization has always had a strong top-down orientation, but since I became president seven years ago, I have wanted to change the atmosphere to make it easier for young people to contribute. The challenge for the future is to think about how we can make the work of senior employees more rewarding given that their ratio of the workforce will inevitably increase.

Koike The Japanese government is promoting the idea of "a nation facilitating asset management" whereby individual financial assets are mobilized from bank deposits to asset management. We at asset management companies want to further promote Japanese stocks to both domestic and overseas investors. In conclusion, do you have any requests for institutional investors like us?

Tanimoto When conducting IR activities, it is noticeable that overseas investors have very high demands. I think Japanese institutional investors should be more inclined to strongly express their opinions. Of course, while some investor demands may be feasible to implement, others may not. However, there are many issues and viewpoints that can be discovered via dialogue. Since we enjoy the proximity of being in the same country, I hope we can engage in even greater dialogue in the future.

Koike We and our analysts will work to engage in deeper communication and increase the opportunities to express our opinions. Thank you for the valuable discussion today.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: December 11, 2023)