Engagement Feature Articles

Furukawa Electric - Changing Corporate Culture through Thorough ROIC Management

Right: Hiroyasu Koike, President and CEO of Nomura Asset Management Co., Ltd.

The Furukawa Electric Group, which has supported the development of social infrastructure in the areas such as optical fiber and electrical wiring, is promoting corporate reforms with an awareness of future survival. The company has identified growth businesses based on backcasting from 2030 and is restructuring its management to be more robust and emphasize ROIC (return on invested capital). Mr. Keiichi Kobayashi of Furukawa Electric Co., Ltd. (Furukawa Electric) and Mr. Hiroyasu Koike of Nomura Asset Management discussed Furukawa Electric's efforts to realize Vision 2030.

An Ingrained Culture of Profit/Loss Based Thinking

Koike Furukawa Electric has been operating under steady management for the past 10 years, and its shareholders' equity has expanded 1.9 times. However, it is difficult to assess whether the share price has sufficiently reflected these factors, and I believe investors expect that investment efficiency and capital efficiency should be improved beyond the current levels. We at Nomura Asset Management agree that improving ROIC is the key. In your medium-term management plan (Road to Vision 2030, the "2025 Mid-Term Plan"), you have set forth the goal of "maximizing profits in existing businesses through a focus on capital efficiency", and you are strongly promoting ROIC-based business assessment. Could you discuss your current initiatives?

Kobayashi In its 138-year history (as of this interview in 2022), Furukawa Electric has established a business model of generating profits by meeting the needs of clientele who maintain national infrastructure such as electric power, telecommunications, and railways, and a culture of thinking on a profit and loss basis has become deeply ingrained. In the previous medium-term management plan, there was a sense that the expansion of sales faced a deadlock. The domestic and overseas sales teams were not aligned. They misread the product life cycle, focusing on factory operations even after the peak, and they failed to generate profits as a result. The situation was an embarrassment.

After taking the role of president in 2017, I wanted to shift our thinking from a profit/loss basis to an ROIC basis.

However, we felt that we did not yet have the resilience to weather the contraction accompanying the shift to ROIC-based management, so we first set off to restructure loss-making businesses and reorganize our product portfolio. We ceased production for operational purposes and generated profit via a shift to high added value.

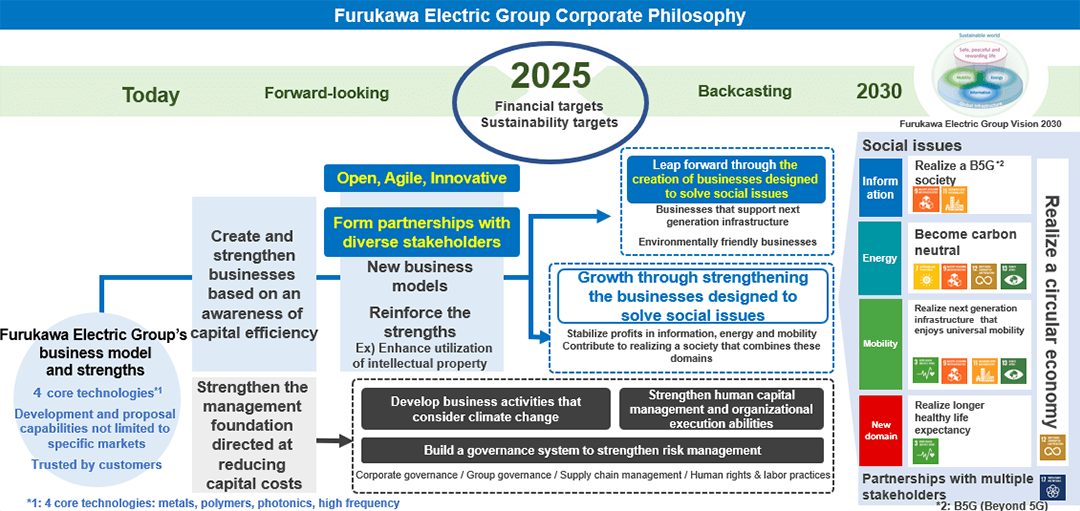

We also worked on creating a vision. Based on Furukawa Electric's DNA of "Valuing employees, customers, and new technologies" and "Contributing to society," we envisioned how the company should contribute to addressing social issues by the year 2030. This is Vision 2030. Setting the first year as 2022, the year in which the ROIC management system was established, we announced a medium-term management plan that we truly believed in.

ROIC Target Spread of 1% or More for All Segments

Koike We are focused on strategies to improve ROIC by business from both angles. Could you share some of the specific measures you're taking, as well as the response they've received?

Kobayashi We are enacting initiatives from both angles: operating profit, the numerator of ROIC, and capital, the denominator of ROIC.

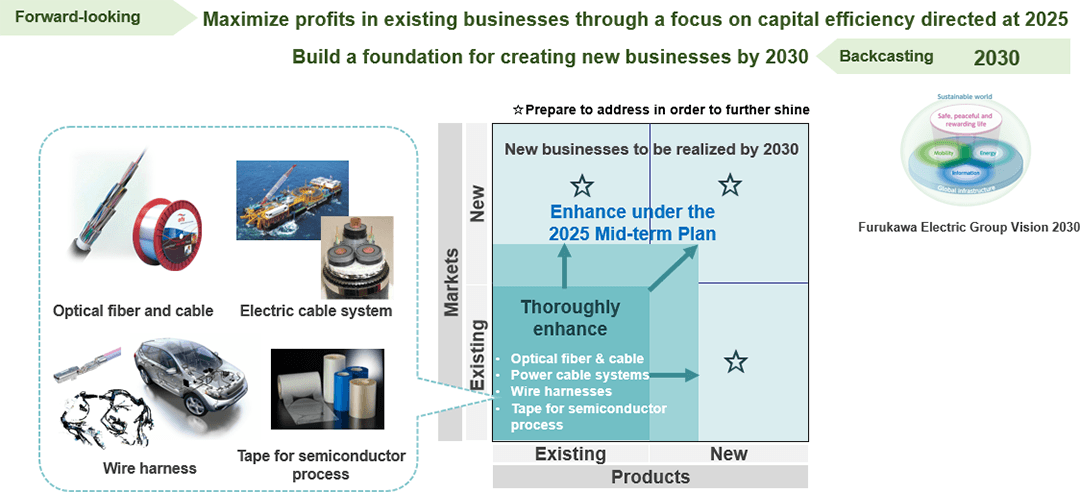

For operating profit, the basic focus is to establish and strengthen related businesses with the aim of addressing social issues in the 4 business areas defined in Vision 2030 (information, energy, mobility, new domain). The medium-term management plan for 2025 is very important in terms of backcasting from 2030 (an approach to thinking of issues from the perspective of the future).

Specifically, we need to strengthen our earning power in three ways. First, we need to strengthen our ability to negotiate prices. We also need to expand our commercial rights and trade areas. Sales have been stagnant since 1985, but in order to overcome this, we need to not only sell existing products to existing customers, but also reorganize our sales organization to attract new customers. In addition, we are further enhancing our ability to reduce costs.

We are also expanding new businesses with a focus on carbon neutrality.

In terms of equity capital, we have advanced just-in-time services for customers while still holding inventory, but ultimately we have been unsuccessful in passing on logistics and warehousing expenses. In the future, we will strive to collect accounts receivable as soon as possible while checking customer inventory and operational levels. It is important to remain conscious of effectively using our assets to generate profits.

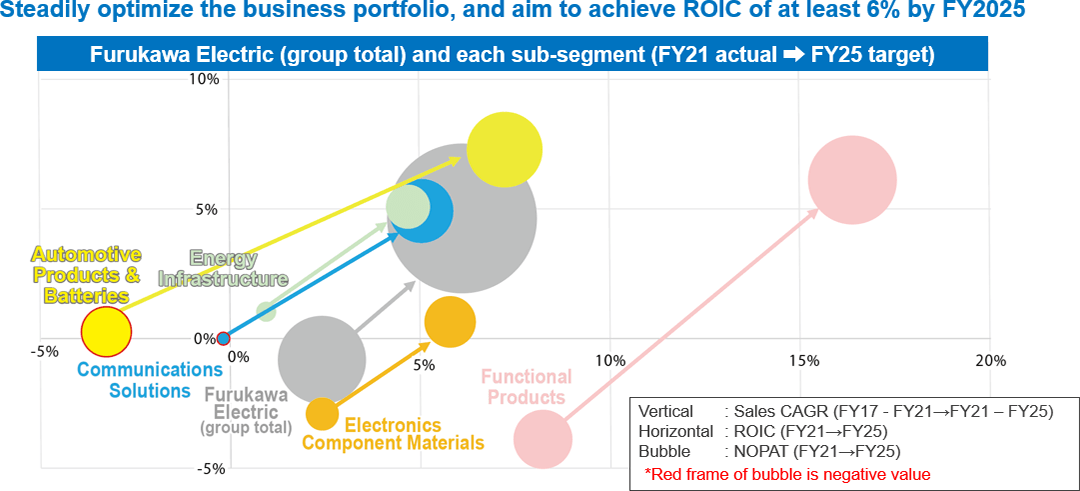

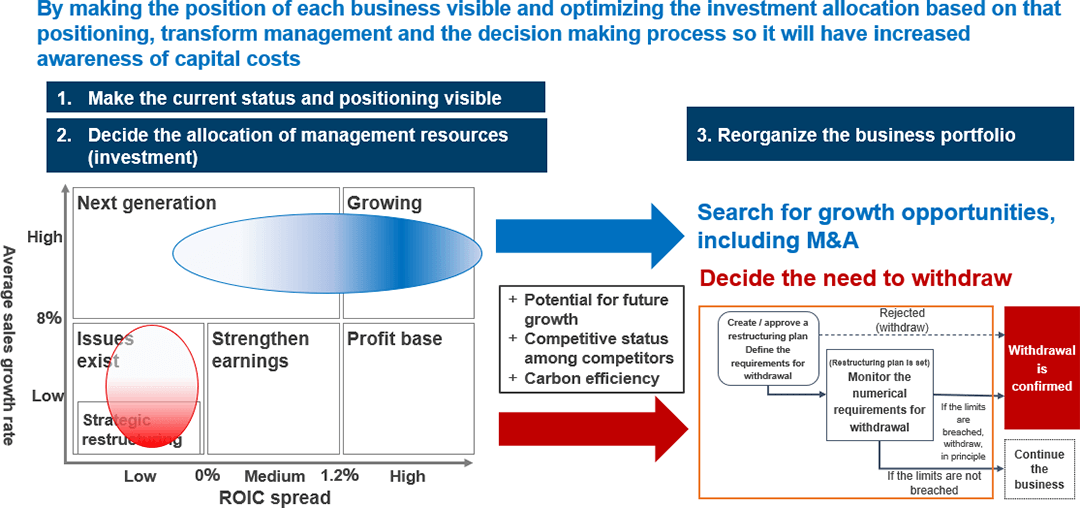

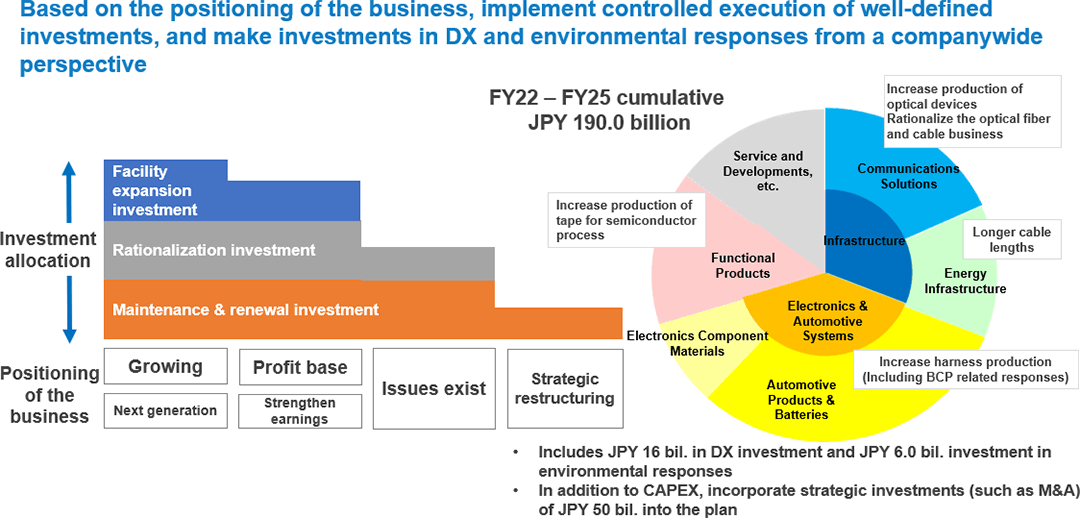

We have 4 business segments, but for internal management purposes, we have divided them into 28 business segments and closely follow how each business generates profits. We established a new Corporate Management Department, established a weighted average cost of capital (WACC) for each of our 28 business segments, and set an ROIC target spread of at least 1%. Based on the ROIC spread and annual growth rate mapping, the Management Committee positions investments in several classes, from expansion to strategic restructuring, and changes the allocation of investments. We are now able to objectively evaluate our business portfolio using FVA (Furukawa Value Added) and ROIC.

Koike Though the process is very understandable, I'm left with the impression that 28 business lines are a rather many from the perspective of focusing your business strategy. Isn't it hard to demonstrate your strengths with such a diversified portfolio?

Kobayashi You're correct. In addition to thinking about what to improve, we are also focusing on what to stop. I withdrew from the business I was involved in because I thought it would benefit the company and the customers. In 2022, we sold TOTOKU ELECTRIC CO., LTD. We had the intention of growing sales and profits of the video cable business, but we decided that, in light of our future policy, we were not the best owner. When it comes to withdrawing from a business, we need to be united in our minds.

Seeking the Spirit of Team Thoroughness

Koike Has the assessment process been thoroughly adopted? Please tell me more about your initiatives related to corporate culture reform.

Kobayashi Management members and representatives of each segment have come on board, and even factory and department heads are finally becoming aware of this. It will still take more time for members of each manufacturing department to change their minds, but it is steadily spreading. The key is the mindset toward people and the organization. In the past, employees of Furukawa Electric placed importance on "individual performance" and "results," but today, we expect a spirit of team thoroughness.

The first step toward achieving this is changing the way our leaders think. This effort was first organized as seven rules for leaders' mindset, called the "Furukawa Seven." Additionally, we created an SNS-like service for the more than 2,000 employees at the team or department head level to share achievements and support.

Positioning Forward-Looking Social Issue Response as a Growth Factor

Koike I often wonder why Japanese companies that emphasize capital efficiency and have strong governance are not more highly valued in the stock market. I don't have the right answer, but I think investors may have trouble imagining the company's growth due to a lack of growth in its top line. Furukawa Electric's sales have been moving within a certain range during the past 20 years. What are your plans for differentiation in order to increase your competitiveness and drive top line growth?

Kobayashi We will further restructure our business portfolio guided by the assessment of our added value. This draws the focus to our range of products targeted at addressing social issues.

For example, in renewable energy, there are power cables for offshore wind. With offshore wind power, there is a demand for jointless cables because the joints can easily cause problems.

As the distance from the wind turbine to the shoreline is about 30 km, we identified that a turntable capable of winding 7000 tons of ultrahigh-voltage power cables could accommodate the distance, and we have been investing in such facilities. Meanwhile, there is demand for replacing the many facilities in Japan that have been in use for more than 50 years, but we do not intend to enter the market if the profit margin does not reach a certain level. To realize a "Beyond 5G Society", I believe there are many business opportunities to be found by backcasting from the keyword "simultaneous realization". Information infrastructure is in place to send extremely large amounts of data with low latency, but there remain many challenges in this area. Speeds are so fast now that to guarantee fair competition in the world of e-sports, a 0.8 second delay is set intentionally. This speedy information infrastructure will be necessary in the future for the spread of mission-critical fields such as autonomous driving and telemedicine.

We are focusing our efforts on optical fiber cables, which are an essential component to the concept of "simultaneous realization". In particular, the ultra-thin rollable ribbon cable, which boasts the world's highest core density, contributes to high efficiency by being able to be wound 1.6 times over within the standard drum. By concentrating not only on manufacturing, but also on R&D and marketing and embracing the entire supply chain, we are creating a strategy that can capture the so-called "smile curve".

Using Sustainability Activities as a Driver of Corporate Value

Koike The targets for 2025 include a 70% share of sales of environmentally friendly products, a 28% reduction in greenhouse gas emissions (Scope 1 and 2), and enhanced risk management such as employee engagement scores. Your company is also active in carbon neutrality initiatives and other sustainability activities, and you are planning with a multifaceted approach to improving the profitability of existing businesses, developing new businesses, and giving consideration to the environment and society. I am interested to hear how these elements will be integrated to improve corporate value.

Kobayashi The basic concept of carbon neutrality is to "not emit CO2," "reduce CO2," "store emitted CO2", and "change". The Furukawa Electric Group uses 17% renewable energy in Japan and more than 10% globally. We believe that contributing to a cyclical society will lead to business opportunities as well as global warming countermeasures.

One example is electrolytic copper foil. Electrolytic copper foil is a very important material used in EV batteries and electronics substrates, but the ratio of electricity cost to manufacturing cost is high and carbon efficiency is not good. As such, we have decided to produce electrolytic copper foil with 100% recycled copper and with fully renewable electricity. We have installed solar panels at our manufacturing plants and implemented an all carbon neutral policy. In other words, by purchasing copper foil from Furukawa Electric, our clients will have zero Scope 3 emissions. We were also able to obtain UL 2809, which is an international standard used in the United States, in a short period of time.

Additionally, we can synthesize green LP gas from methane using our unique catalytic technology. We have also acquired business patents as part of our intellectual property strategy. At the National Sports Festival held in Tochigi Prefecture in 2022, we are using LP gas derived from the excrement of local cattle to realize our goal of "local production and inheritance" (the succession of local resources and culture to the next generation).

For human resource management, I believe it is not just about setting a "people vision", but also changing the way employees think and act by improving their relationships, and as a result, promoting a change in quality. For example, in the six years since I became president, the number of total accidents has decreased by 60%. I think this is a good example of re-skilling, in which managers and others have engaged in dialogues about safety, and have achieved standardized practices through their own experiences.

All That Remains is Results

Koike I can see that you've addressed a variety of management challenges with a high level of awareness. In closing, could you share your thoughts on Furukawa Electric's share price, which has been in a downward trend since its 2018 peak?

Kobayashi Since the formulation of Vision 2030, we have invested in research and development and human capital expansion. We have received criticism for capital expenditures that exceed depreciation costs. Please understand, however, that this is to realize the vision that was created by the members who will play a central role in management in 2030. Achieving milestones in line with the roadmap will both lead to their confidence and Furukawa Electric's growth. I hope you can understand our management's belief.

I tell my employees that if they're doing what they can, all that remains is results. I also emphasize that they should be frustrated with the share price, but not to think that it is improperly valued. Once we have created the conditions where ROE exceeds 10% and PBR exceeds 1, we will gain the recognition of investors.

Koike Thank you for today's valuable discussion.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: February 22, 2023)