Engagement Feature Articles

DMG MORI - Global Leader in Machine Tools Evolving through M&A

Left: Hiroyasu Koike, President and CEO of Nomura Asset Management Co., Ltd.

DMG MORI got its start in manufacturing and selling textile machinery in Nara Prefecture's Yamatokoriyama City in 1948. In the 2000s, the company increased its scale through M&A. In 2009, it began partnering with Germany's Gildemeister (DMG) ("AG"), before acquiring a controlling share in the company in 2016. Masahiko Mori, President and Group CEO of the world-class machine tool manufacturer, joined Hiroyasu Koike of Nomura Asset Management to discuss DMG MORI's sustainable growth and its reputation in the stock market.

Machine Tool M&A are an Approach to New Customers

Koike DMG MORI became the largest machine tool company in the world through a business integration with AG in Germany. Since assuming the position of president, I have the impression that you have strengthened your company's growth path by shifting to in-house parts manufacturing, enhancing the service framework, and changing to a direct sales system for the first time since partnering with AG. Could you share the background and your thoughts on these shifts in management policy?

Mori When I graduated from university, I joined ITOCHU Corporation in 1985 where I was in charge of textiles. It was just when carbon fiber started to come out, and I was selling related equipment to major Japanese synthetic fiber companies. As I looked at the efforts of each company in the midst of the severe business conditions, I realized that companies required growth. It was an important formative experience for me.

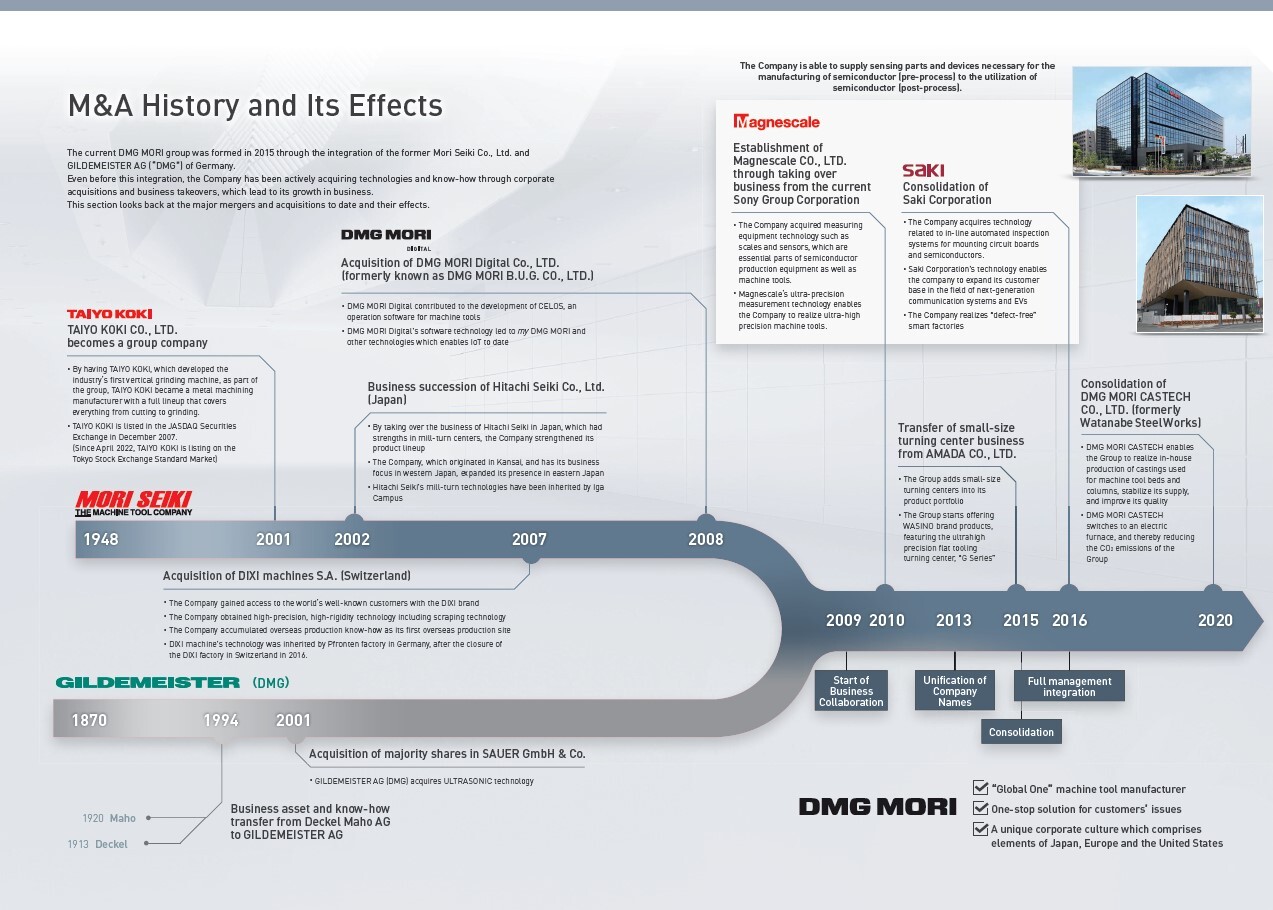

I returned to Nara in 1993 and took over the company from my father in 1999, when I was about 37 years old. Subsequently, a significant turning point was the business succession from Hitachi Seiki in 2002. At the time, Hitachi Seiki was our largest competitor, but it was effectively insolvent, and our company, which had tens of billions of yen in cash on hand through its main bank connection, was to receive the transfer of its business in Japan.

Koike Did you learn anything regarding management through the M&A?

Mori I think M&A in the machine tool industry is about approaching new customers. Our first project following the business transfer was to have Mori Seiki service staff learn to repair Hitachi Seiki machines. As our range of services expanded, repeat orders gradually increased. Through this M&A, we expanded our horizons around the world and acquired DIXI in Switzerland and TOBLER in France, which didn't go immediately as planned.

Maintaining the Diversity and Creativity of Local Staff

Koike Could you tell me what considerations were made during the M&A of Germany's AG?

Mori Around 2008, when the global machine tool industry was being affected by the financial crisis, I began reaching out to German machine tool companies. In most cases, I was rejected, but I was contacted by AG's chairperson at the time, and we met in person and took the time to work out our partnership. We integrated our operations in 2016 and are now moving forward together, but I think the most important thing is not to destroy the diversity and creativity of our employees who are in charge of development and production in Germany and Italy. It is important to recognize their differences and use them as a catalyst.

Management integration also had a positive impact on Japanese employees. In short, we became the best in the industry. For example, we are now able to work with leading companies in Europe, such as Siemens, Rheinmetall and Volkswagen in Germany, from the stage of test processing to delivery. I think it has led to the creation of a fun and exciting work environment for our younger employees.

As a result of the integration, we have also seen the positive effect of diversity in our project contents and regional operations. Consultations on cutting-edge processing and materials in the aeronautics, space, and medical industries come from all over the world. We are currently working with a customer who is involved in the development of race cars to process new engine parts for 2026. In the case of semiconductor lithography, major manufacturers of ultraviolet ray (EUV) lithography equipment are also talking about the production of next-generation models.

Aiming to Improve Corporate Value via Balance Sheet Compression

Koike It's clear that your company has established a level of trust and brand power that makes it difficult for manufacturers not to reach out when developing new products. After completing the M&As, what kind of vision and strategy do you have for the future?

Mori Sales in 2022 were JPY 474.8 billion yen, but I think there is room for about JPY 800 billion in organic growth from 2028, the 80-year anniversary, to 2030. This is due to the fact that machine tool companies are consolidating worldwide. Business through sales agents is on the decline, but we will benefit from the fact that we have a direct sales system and deal directly with customers. This is especially true in the United States and Europe.

The same thing is happening in Japan. We are now in charge of providing solutions including peripherals through direct sales to customers. For example, a framework is being developed to test the operation of an entire automated system, including peripherals, with digital twins. Machine tools also require annual maintenance, such as replacing consumables, and we will be able to capture this demand.

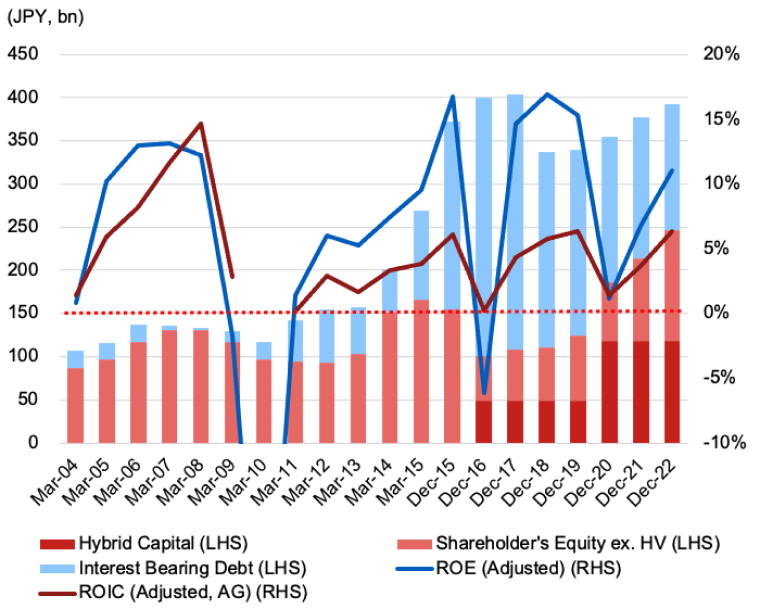

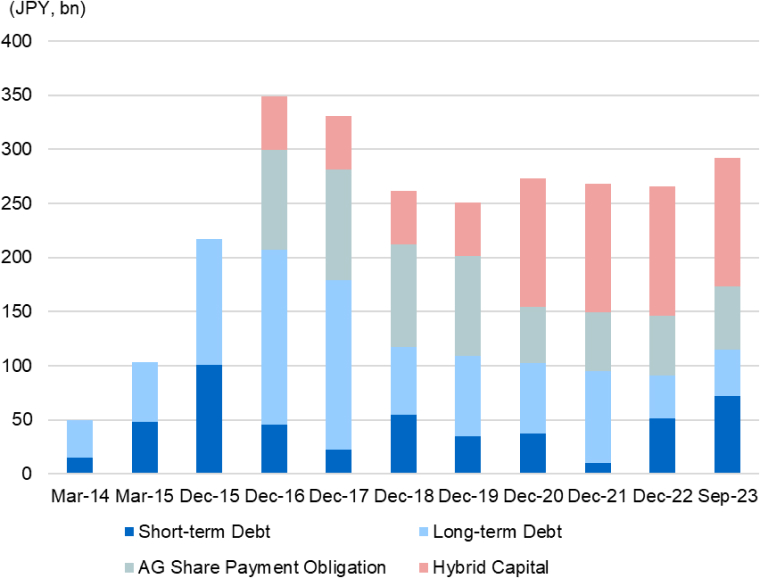

Koike Your company's ROE is close to your target, but its ROIC is relatively low and needs to be improved. Additionally, the current medium-term management plan includes the reduction of interest-bearing debt, including hybrid capital. I believe that it will be necessary to achieve this in order to increase your corporate value. What is your view on the alignment and balance between your growth and financial strategies?

Mori If we set the sales target to JPY 600 billion, I think that JPY 600 billion is an appropriate size for our balance sheet. On the other hand, total assets currently amount to more than JPY 700 billion. We are now in the final stage of consolidation, and it is an irregular situation with various financial burdens. We expect to reduce interest-bearing debt by about JPY 100 billion by 2025, including the redemption of subordinated debt. In that light, I understand your comment.

The expansion of our balance sheet is due to the fact that the lead time of MRP (Material Requirements Planning) was extended by nearly one year due to the shortage of electronic components, and our product inventory is increasing due to the delay in the construction of customer's factories. We assume a 30% deposit contract, so orders are rarely cancelled and there is not much inventory risk. However, we plan to proceed with inventory reduction. Increasing profitability is also an important factor, and we are promoting in-house production of parts and software. Cash flow should improve in line with higher operating margins and balance sheets should converge as planned.

Managers must understand the "Customer's Perspective"

Koike I hope you communicate your story to the stock market. Nomura Asset Management revised the criteria for proxy voting rights on November 1, 2023. We support the transition to a monitoring board, and we believe it is desirable to have a majority of outside directors overseeing management. Can you tell me about governance in your company?

Mori Since 2009, when we held shares in AG, which is listed in Germany, I have been involved in their management and have been on the supervisory board. Since holding more than 75% of their shares and concluding a domination agreement in 2016, I have also experienced shareholder meetings as chairperson.

In Germany, legislation has been enacted to reflect the views of minority shareholders and to promote female directors, and each company has developed and implemented a plan to implement these changes. I would like to incorporate it as it is.

On a personal note, I am a member of the management council of my alma mater, Kyoto University, and a trustee of Todaiji Gakuen. I believe that the process of gathering opinions in order to include various individuals and promote the overall organization is the same in corporate management as it is there.

Koike Looking at the members of the board in the past, I feel strongly that your company understands the importance of diversity. I would also like to ask your current thoughts on the succession plan following your tenure.

Mori I think 2028, the 80-year anniversary, will be the beginning of the succession. I think there is a high possibility that an executive officer who is in his 50's or so will be a candidate.

The quality we look for in a manager is a firm understanding of the "customer's perspective". Knowing where and what customers are and how they use machine tools to do business. We define ourselves as "craftsmen and merchants." In other words, we are not just a manufacturer or a trading company, but rather a company with vertically integrated business structure. We want people who can see the whole thing from a bird's eye view, and we are focusing on in-house training for that purpose.

Unique Human Capital Management

Koike I understand that your succession plan is built as part of your growth strategy. If you were to raise any challenges or risks for management, what would they be?

Mori There is the risk of violating export control laws. Machine tools are products that can be used for both civilian and military applications, so caution is always required in end user and application verification. Of course, the contents of applicable export control laws and regulations and the positioning of administrative guidance differ from country to country, and our company needs to follow the rules of each country. The important thing is to respond honestly and sincerely. There are reports of the illegal reselling of our company's machines, but we must not run away when such cases occur.

Koike As for sustainability management, based on the integrated report published in 2019, it seems that you have had an awareness of it from a relatively early stage, taking into consideration the environment and health. In particular, the medium-term business plan calls for "further investment in human resources to enable the provision of high-quality products and services." What is your view on human capital?

Mori Shortly before 2019, one of our employees died, and the fact that I was furiously remorseful is the starting point of our efforts. We were working on the system design such as taking a vacation, but we still didn't have enough spirit. We are determined to thoroughly reinvent ourselves as a progressive and good company.

In our company, we have regionally based employees, cross-regional national employees, and global employees who work across borders. Each plays an important role. Understanding and educating people about their roles will add value. For example, a set of capabilities that customizes machine tools to customer specifications and provides a combination of software and peripherals. These abilities are not something you can acquire at a university or an MBA, but only at DMG MORI. We will thoroughly train our employees and push them deeply into their own strength. Just as airlines train pilots and medical institutions train doctors, our social mission is to expand technology around machine tools, which is directly related to human capital management.

We learned a lot about human capital from AG. The symbolic thing is the rate of paid vacation. Germans are committed to increasing productivity while reducing overtime hours. It is also a nod to the global ranking of GDP, such as the discussion of a four-day work week across the country.

90% of our sales revenue is overseas. Our company can demonstrate its value by doing something different at a group of machine shops, so I don't mind being different from a normal Japanese company.

The Challenge of Eliminating the Machine Tool Industry's Discount

Koike What is your impression of the stock market's assessment of your company?

Mori Our company's PBR is about 1.3x, whereas other machine tool manufacturers are below 1x. I think the stock price (equity value) will go up if further reduce debt. The challenge is the poor evaluation of the machine tool sector. Indeed, we are more highly valued in the stock markets of the United States, Britain and France, which no longer make machine tools. Especially in the case of our company, considering the value of the German business (AG shares), I don't think our company is fully appreciated.

Koike I understand very well. We hope to create a virtuous economic cycle through investment by communicating the merits of Japanese companies to the world. Today's dialogue is part of our efforts, and we hope that this will generate interest in the world of machine tools and DMG MORI.

Do you have any requests for us as institutional investors.

Mori In the machine tool industry, there are still many companies, and I personally feel that M&A is necessary to increase competitiveness. The Ministry of Economy, Trade and Industry has also set guidelines for promoting M&A, but there remains a problem with incentives for managers on the selling side. The treatment of special retirement benefits for managers is an example. I hope that institutional investors will encourage M&A guidelines that support managers who make decisions based on the future of their employees.

Koike DMG MORI is a globally recognized Japanese company, and I hope the story of your success with transformation and sustainable growth will reach investors around the world. Thank you for today's valuable discussion.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: February 6, 2024)