Engagement Feature Articles

Daiwa House - Aiming to become Absolute Industry Leader: Promoting a Refreshed Portfolio

Left: Hiroyasu Koike, President and CEO of Nomura Asset Management Co., Ltd.

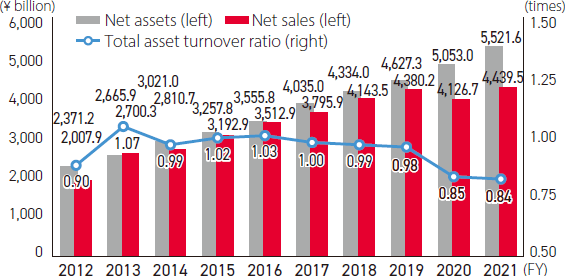

Daiwa House Group boasts sales of 4,439.5 billion yen (fiscal year ended March 2022). Comprising 480 companies as of the end of March 2022, the group has increased its size by approx. six times since 2010. The company aims to create value by expanding its business beyond the framework of a housing manufacturer to include community development and lifestyle businesses. Mr. Keiichi Yoshii of Daiwa House Industry Co., Ltd. and Mr. Hiroyasu Koike of Nomura Asset Management Co., Ltd. discussed the prospects for further growth, the challenges Daiwa House faces, and the triggers for stock price improvement.

Aiming to shift from Overall No. 1 to Absolute No. 1 via Portfolio Refresh

Koike Over the past 10 years, Daiwa House Industry has diversified its business and improved its performance through active investment. In particular, I recognize an eagerness for global expansion, having achieved remarkable profit growth in your overseas business. I understand you have been deeply involved in the overseas business even before becoming president. Please share about your history and future prospects.

Yoshii I was passed the management baton in November 2017. Daiwa House Industry was already the top company in the construction and real estate industry in terms of sales, and we had a strong sense that Daiwa House Industry was always the top company overall. We are not the top in the industry when we look at single-family houses and rental housing, but we have the impression that we are the industry's overall leader, surpassing other companies. Although we possess some top-class businesses such as commercial facilities and environmental energy, we cannot say that we are the absolute leader. In other words, we still have room for growth.

In 2010, I was appointed executive officer in charge of overseas operations. We set a milestone for 10 trillion yen in sales in 2055, with a target of a 3:7 ratio between our domestic and overseas businesses to promote new opportunities. At that time, overseas sales amounted to only 900 million yen. Even in Japan, we have made several mistakes in our development investments, but if we fail in overseas development projects with high inventory risk, our company would be blown over. In addition, I felt that even if we recorded one-time sales under the investment development model, it would be unsustainable. So, I considered what should be done to shift to a stock model.

As a result, we have introduced a system where each division, whether single-family houses, rental housing, commercial facilities, and logistics, business and corporate facilities, is responsible for the overseas market, rather than having a specialized overseas division. I think this has been very effective for our overseas business.

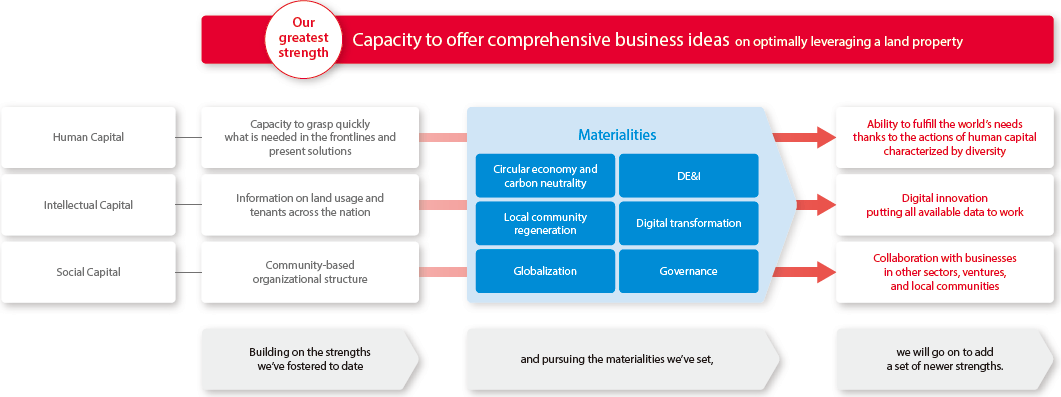

Koike What strengths has Daiwa House Industry leveraged over the years? Also, have any challenges come to light?

Yoshii Even as a development company, we never lost sight of our identity as a "construction firm". If we entrust construction to another company, we won't retain our expertise. By controlling everything, our company can seize new business opportunities. An example is the winning of orders for advanced logistics facilities and data centers. We were able to respond to large-scale development projects in the commercial facilities business.

Regarding challenges, I feel that there is a conglomerate discount on our stock price. As the number of group companies has increased, it has become difficult to see the overall business picture and synergies, making it difficult for investors to discern what kind of company we are. Therefore, when interest rates rise in the United States, our stock price falls due to concerns about overseas risks. When logistics are disrupted, the overall valuation of our Logistics, business and corporate facilities business falls. We see a trend where risks within a part of our businesses are over-emphasized.

I think we need to promote the fact that we are reorganizing and refreshing our portfolio so our company can be more clearly understood. I have an impression that Japanese M&A often involves buying companies, while selling has not progressed. There is a view that if an M&A elevates the top line, it is justified. However, I have a different view. We're not giving up on any of our businesses, but if we're not the best owner, we should promote the growth of the business by selling it to another company. On the other hand, businesses that could not grow in other companies could realize their potential as part of our group. This kind of metabolism is important. Although we have decided to sell our resort hotel business, we will continue reviewing and refreshing our portfolio.

Leveraging Industrialized Construction as a Strength to Incorporate Overseas Companies and Accelerate Growth

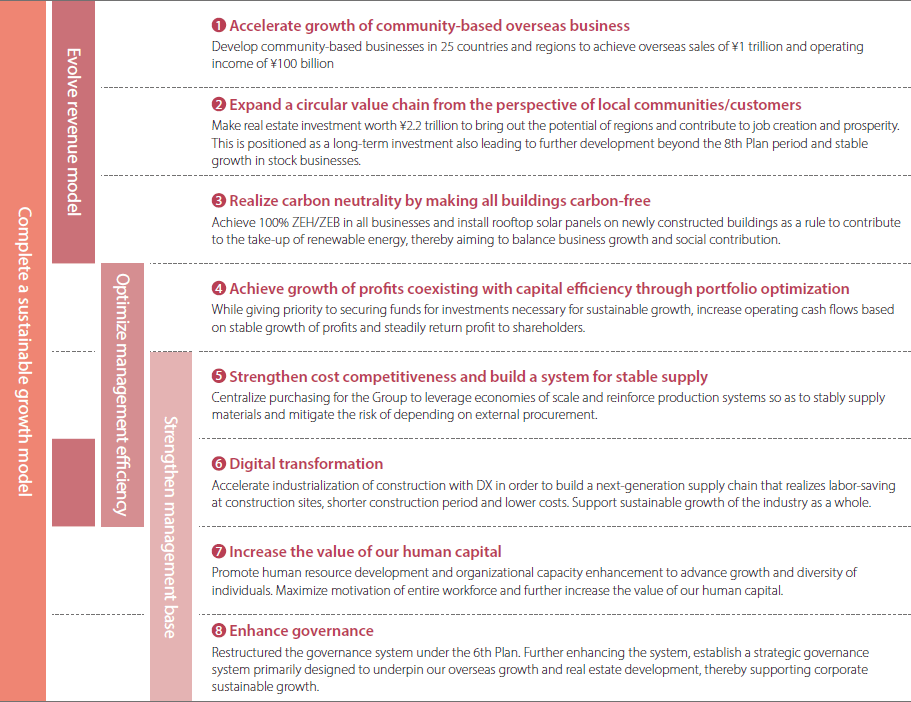

Koike Based on these developments, Daiwa House published its Seventh Medium-Term Management Plan in May 2022. You have set a high target for sales of 5.5 trillion yen and operating profit 500 billion yen in FY2026. Could you tell us about your specific strategies and the initiatives you would like to focus on? In particular, as there are many different areas within the category of overseas business, what kind of development are you envisioning?

Yoshii With regard to the recent medium-term management plan, we intended to emphasize the active development of our overseas businesses, which appears to have given some the impression that we are conservative about our domestic business. The economic environment around the world is very different now than it was when the medium-term management plan was drawn up, with dramatically different circumstances such as the weaker yen, rising U.S. interest rates, and sharply rising material prices. However, we believe that we can achieve sales of 5.5 trillion yen.

In the U.S. business, we spent three or four years looking for a company that was diligent about its business and shared the same corporate culture as us. For example, in 2017, Stanley Martin, which had been developing single family homes in Washington, D.C., joined the group. For more than 50 years, the company has been doing business closely with the local community, and it is actively expanding its business area by imitating Daiwa House Industry's development.

Each company incorporated into the Daiwa House Group has a positive synergy effect. Our Company's strength is its high productivity through industrialized construction. Construction periods overseas can be more than twice those of Japan. By introducing a Japanese-style procedures and industrialization, we've been able to shorten construction periods and more quickly recoup funds. Moreover, we've been praised for our stable standard of quality. We also have the benefit of scale as a group, allowing us to purchase materials at a lower price and reduce inventory insufficiencies. Working through Daiwa House Industry, our group companies are able to borrow funds for expansion from financial institutions at favorable terms, thereby improving their financial position and enabling them to generate profits.

Koike As the number of overseas projects increases, the company's overall foreign exchange portfolio will change, resulting in exposure to area- or sector-based economic fluctuations. How do you view strengthening risk management and governance?

Yoshii Its importance has been pointed out by outside directors. We have established a robust system, including auditing firms at overseas bases. The system is finally in place, and all we have to do is update and improve. The housing market in Europe and the United States has basically continued to grow at a moderate pace, except during subprime loan crisis and the Lehman shock. I think the impact of the rise in interest rates is limited. Even if there is a decline, we believe that the domestic market will be sufficient to cover it because it will only reduce our net income for the period, and it will not be a major impairment loss due to stockpiling as in the case of development.

New Business Cannot Grow Without Weathering a Plateau

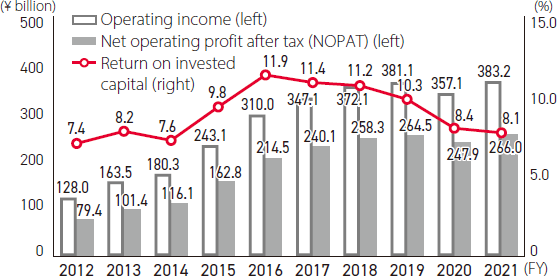

Koike That's very encouraging. I can see that your company is firmly on the growth track. I see no incongruity in your strategy of aggressively investing in excess of your cash flow while aiming for high profit growth. On the other hand, I am concerned that capital efficiency indicators such as total asset turnover and ROIC have been declining over the past five years or so. Daiwa House's share price also seems boxed in and not valued as a growth company. What type of catalyst is necessary to trigger a rise in share price?

Yoshii The creation of new businesses has driven our company's growth thus far. Though we have laid and hatched eggs, there are a variety of issues thereafter. I believe that new businesses cannot achieve later growth without first weathering a plateau. We are currently in the phase where we solidify our footholds. In terms of ROIC, it can be viewed on both the overall company level and on the individual business level. I believe businesses should be weighted according to their ROIC, rather than viewed uniformly. For example, in our medium-term management plan, we plan to invest 1.5 trillion yen in real estate development in logistics facilities and data centers. We believe that, with careful explanation of our reasons for prioritizing this investment, investors will understand our intentions.

Working to Address the "Vacant House" Issue

Koike In terms of ESG, we are leading the industry in terms of initiatives like obtaining SBT certification. However, I would prefer greater explanation of how business performance is improved while actively pursuing ESG. I believe greater information disclosure would serve to persuade investors and result in improved corporate value.

Yoshii We publish non-financial information related to sustainability and financial information based on our portfolio management, but I believe that it is lacking in consistency or sense of uniformity. For example, we set limits in our investment standards based on interest rates. However, we allow for investment that falls short of our standards if, for example, it would clearly leads to the creation of a livable city for the elderly, children, or women. We will make judgments based on social significance. We hope that this will result in greater overall capital efficiency.

As long as we are involved in urban development, addressing social issues is a major theme for us. A significant issue is dealing with vacant houses.

We have developed large housing complexes and towns, but the number of aging and vacant houses is increasing with time. I have great reservations about creating new communities while leaving such existing communities as they are. One of the projects we are working on to promote a return to such communities is the revitalization of Kaga Matsugaoka Neopolis, developed in Ishikawa Prefecture in the 1970s. It's about 3,000 units in size, but we're considering buying back all the vacant lots and houses and building new homes in their place. It is a way of working through the community's circular economy, so to speak. This is expected to be a long-term initiative, but with limited time as the population ages, we felt we should act on it immediately.

Though difficult to express in writing or in words, I think it is necessary to quantify these types of non-financial values.

Employee Action is a Strength, a Company's People are its Treasure

Koike Trust from the community is a significant intangible property. Your company's corporate philosophy is to "develop people through business". In your CEO message in the Integrated Report, you stated "The development and acquisition of human resources is currently one of the Group's most important challenges." I can see that your company places great importance on human resources. As a representative of an asset management company, I communicate to our employees the value of using our business, not only for profit, but also to contribute to society. Your message resonates with me.

Yoshii We discussed the theme of side work within the company, and lifted the ban on it after about three to four months. At first, we permitted teaching jobs, but there were many employees who wanted to become involved in community revitalization. I am truly impressed with our wonderful employees expressing their desire to get involved and help others.

"Kamigo Neopolis" in Kanagawa Prefecture is another example of a successful revitalization of an aging housing complex. I think this is the result of acting for the sake of the region, rather than focusing on profitability. It took time, but the residents have come to accept it. As a company that has created something out of nothing, our employees' willingness to act is our strength and our company's people are its treasure. Moreover, we are able to immediately change our conduct when necessary. This is a corporate culture I want to preserve.

Koike When seeking and creating assets, the ability to exercise sound judgment is necessary. I feel that one of our roles as an institutional investor is to support these non-financial aspects and share that message.

In closing, could you tell us what your expectations or requests are from institutional investors?

Yoshii I would appreciate if you consider a period of five years when assessing a company, instead of just one. In particular, properties under development have investment and payback periods, and assessments based only on a single-year constrain our ability to maximize profits. My goal is to record our maximum profits in the final year of our medium-term management plan. Additionally, we have set a lower limit of ¥130 for dividends and increased shareholder returns by linking dividends to business performance. We would like to reward our long-term shareholders.

Koike Thank you for today's insightful discussion.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: March 15, 2023)