Engagement Feature Articles

Daikin Industries - Provides a variety of air environments that meet people's needs through "Air Value Creation" and Energy Solutions

Right: Hiroyasu Koike, President and CEO, Nomura Asset Management Co., Ltd.

This year marks 100 years since Daikin Industries Ltd. was founded. Over the past 30 years, Daikin Industries has achieved significant business growth through globalization, high value-added, and a transformation into a solution business. However, the company has not changed its attitude to face each management issue in earnest. Mr. Masanori Togawa, Representative Director, Chairman of the Board and CEO (Daikin), and Koike Hiroyasu of Nomura Asset Management Co., Ltd. discussed the growth strategy unique to Daikin, including human resource development and environmental contribution.

Subhead: 30 Years of Focus on Overseas Expansion and Expansion of Air Conditioning Applications

Koike This year marks the 100th anniversary of Daikin Industries. Compared to about 50 years ago when you joined, the company has grown and developed significantly, and I imagine that the scale of operations and business model have changed dramatically. Looking back on the history of the company, what are your impressions?

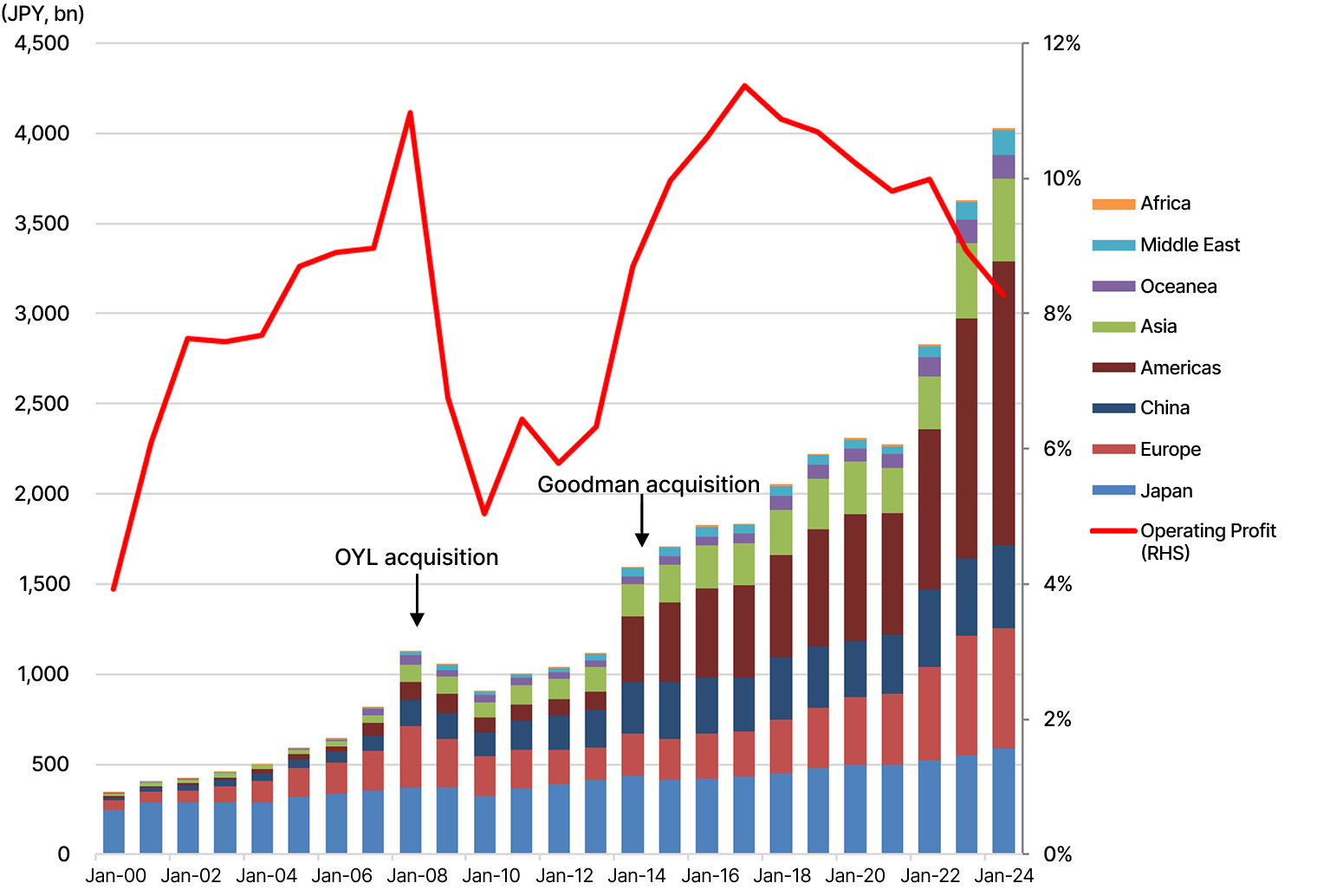

Togawa The biggest change by far has been in the last 30 years: until the early 1990s, the air conditioning business was primarily domestic, with overseas sales accounting for only a few percent of total sales. By application, residential air conditioning was the core business at that time, and packaged air conditioners for commercial use and applied (large-scale central air conditioning) equipment had not yet been developed in a full-scale. In order to diversify from our domestic bias, we focused on expanding our business overseas and expanding the application of air conditioning.

We first expanded our business to Europe and China under the themes of "self-establishment of sales network" through the acquisition of sales agents and "local production for local consumption" to provide products and services matched to each region.

In China, we focused on supplying high-quality products for commercial use and system products for individual use, the products not offered by the 400 local manufacturers. The creation of air conditioning systems that met the residential lifestyle needs of Chinese households, who are very particular about their living rooms and often use oil for Chinese cooking, led to today's so-called "residential multi air conditioning systems.

Koike As for the US, I see that you tried to enter it in the 1980s and 1990s, but were forced to withdraw from the market in both cases.

Togawa In the US, the culture of ducted air conditioning (a whole building air conditioning system in which cooling and heating equipment is installed in one location and each room is heated and cooled through ducts) was well established, making it extremely difficult to enter the market. However, a turning point came in the 2000s. In 2007, we acquired the OYL Group, a major global air conditioning manufacturer, and McQuay US (currently DAA), which operates the Applied business in the US. In 2012, we acquired Goodman (currently DNA), a major residential air conditioning manufacturer with 60,000 duct-type air conditioning dealers and 900 sales bases across the US. These acquisitions dramatically increased our company's presence in the US for both commercial and residential applications.

In the applied business in the US, a representative distributor or simply a "rep" (equivalent to a Japanese equipment dealer) handles everything from equipment sales to installation. We used to rely on reps for equipment sales, but we realized the necessity to establish our own sales network in order to not only sell equipment, but also energy-saving and other energy solutions that are integrated with buildings. To date, we have proactively acquired reps across the US.

Koike So rather than securing market share through large-scale M&A, it is imperative to approach strategically by acquiring local companies in each region.

Togawa Yes. We have already acquired reps in 13 of the 18 major US cities. As the control of air conditioning equipment is important for energy solutions, we have mainly acquired reps with high instrumentation engineering technology. We are expediting the acquisition of reps in the remaining 5 cities as well as preparing to acquire reps in the 12 largest cities following them. In order to strengthen the cost competitiveness of heat source equipment (air-cooled chillers and turbos), we reviewed our development structure and constructed a new plant in Mexico, where mass production began this year. As for residential air conditioners, we are promoting the introduction of inverters, heat pumps, and other products that utilize environmental technologies. For example, we plan on installing 6 million heat pumps by 2030 in California, one of the most environmentally advanced states where the government recently decided to introduce government subsidies.

An issue in the US is the relatively low operating margin. At present, the operating margin of DAA is at 6-7% and DNA is at around 10% (excluding amortization of goodwill), while competitors are exceeding 15% at the highest level. I believe this is due solely to the difference in the solution ratios, and it will be important to enhance service solutions that meet customer needs in the future.

Making employees aware of issues and participate in management issues

Koike The governance structure and human resource development required for your company must have changed significantly from 30 years ago. At the same time, I believe that Daikin needs to continue its excellent corporate culture. What are your thoughts on human resource development and the succession of your corporate culture in terms of human capital management?

Togawa I believe we have the strength as a company to continue to improve ourselves and do what we need to do to produce results, without hesitating to take on challenges even in the face of various challenges. The foundation of this is "People-Centered Management", and the idea that the source of a company's competitiveness is its people. We have always been mindful of raising the motivation and confidence of each and every employee, and encouraging them to work with autonomy. At our company, for example, we have a corporate culture called "Flat and Fast management," in which we share all management policies and discussions at board meetings with our employees. This is to make employees aware of issues and encourage them to express their opinions and participate in management issues.

Koike I believe the interpretations of the corporate culture can vary amongst employees of different ages, such as those in their 20s and 40s. Meanwhile, there is only one corporate culture and DNA of your company to be conveyed to the employees as a whole. Are you making any adjustments to the way you communicate this message?

Togawa When new employees are hired, there is a training camp program to thoroughly learn about Daikin's philosophy and strengths. The employees then take the time to reflect and think about their own determination to start their corporate life and how they would like to grow. The purpose of the training is to establish intrinsic motivation, rather than a traditional knowledge education. It is true that people's values are changing rapidly with time, and an increasing number of young people choose a company based on how much a company can contribute to social issues such as carbon neutrality during job applications. We believe that sustainable growth cannot be achieved unless we raise social value as well as economic value, and we are actively disseminating this message in our New Year's policy and other measures to raise the sense of belonging amongst the younger generation. I believe this high sense of belonging is reflected in the fact that the employee turnover rate is about 4%, which is lower than the manufacturing industry average.

There is significant scope for further environmental contribution

Koike In terms of efforts toward carbon neutrality, there still seem to be issues to be addressed, including Scope 3. In the case of your company, the growth of the business means that it is providing more solutions to social issues, but GHG (greenhouse gas) emissions also increase in conjunction. In other words, it is likely that the company's current growth plan coexists with risks.

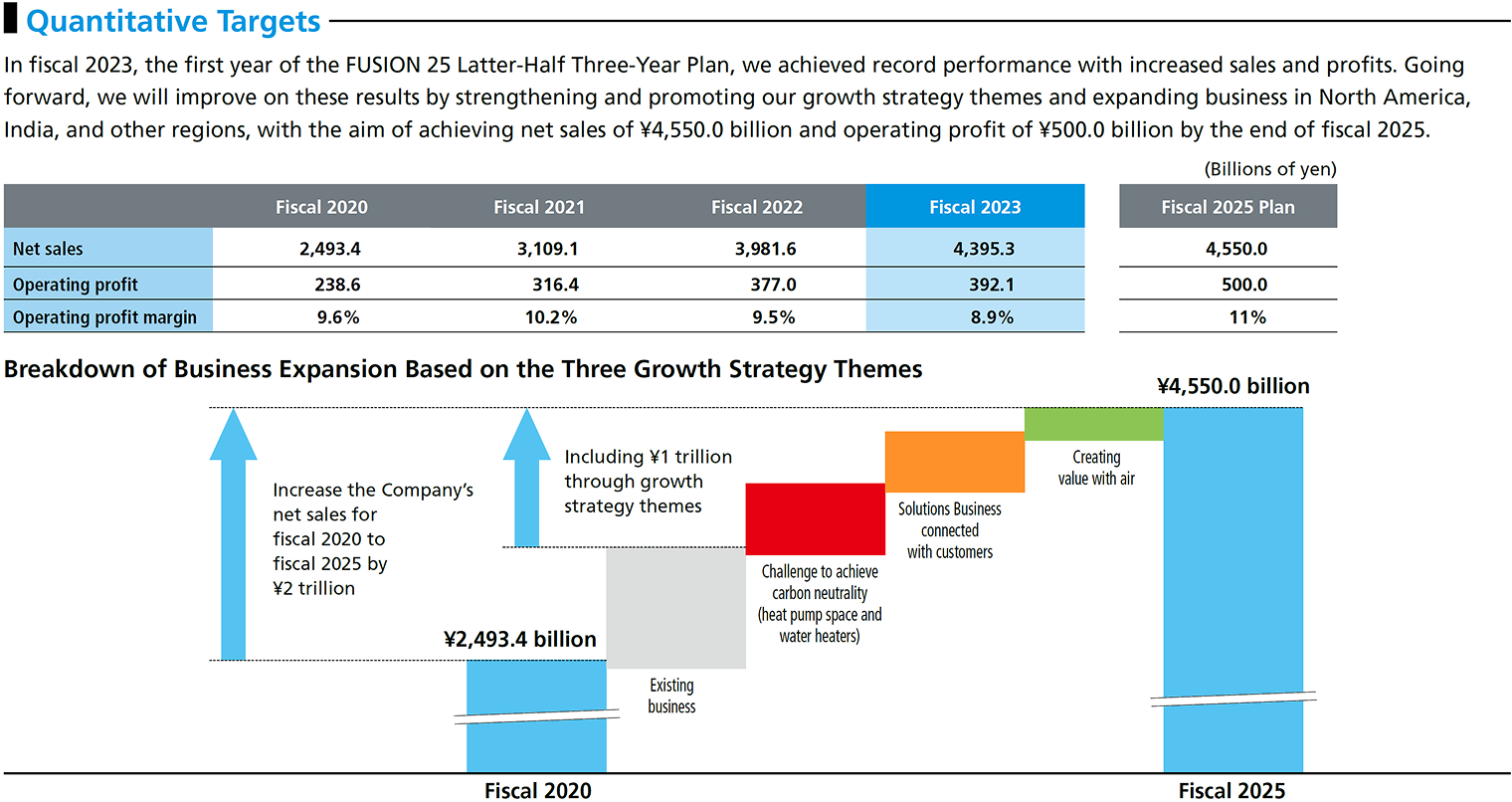

Togawa For the 3 year strategic management plan for 2nd half of "FUSION 25" announced in May 2023, we aim to achieve carbon neutrality by 2050 by achieving a 30% or more reduction in net GHG emissions by 2025 and 50% or more by 2030 compared to the emissions if the business grows without measures, using 2019 as the base year. Our inverter machines, heat pump heating, and hot water supply systems contribute significantly more to CO2 reduction than non-inverter machines and combustion-type heating. We are working towards international standardization of these "Contribution to emissions reductions".

There is a lot of room for us to make further contributions to the environment, such as developing more efficient inverters and replacing combustion heating with heat pump heating for residential use, and saving energy through solutions for large-scale air conditioning for commercial use.

Koike In the future, it seems the environmental contribution, or in other words, the aspect of solving social issues, will become more important.

Togawa According to the International Energy Agency (IEA), economic development in the Global South, including India and Africa, has led to a sharp increase in demand for air conditioning, and by 2050, electricity demand attributable to cooling is projected to triple from 2015 levels. Meanwhile, it is practically impossible to triple the power supply no matter how much nuclear, solar, and wind power is increased. On the other hand, it is probably also unrealistic to expect that the current refrigeration cycle of air conditioning will be able to reduce electricity consumption by a third either. Therefore, we are developing air conditioning technology with a completely different mechanism than the conventional refrigeration cycle, such as magnetic refrigeration without compressor and refrigerant. Including cost, it will probably take about 20 years to put into practical use, but unless innovative innovations are realized, we will not be able to meet the increase in demand for air conditioning in 2050.

Creating Air Value Expands Business Boundaries

Koike As the core technologies of your business model have shifted to inverters, heat pumps, and energy solutions, I get the impression that the value your company provides to the world has changed and the scale of your R&D has also grown.

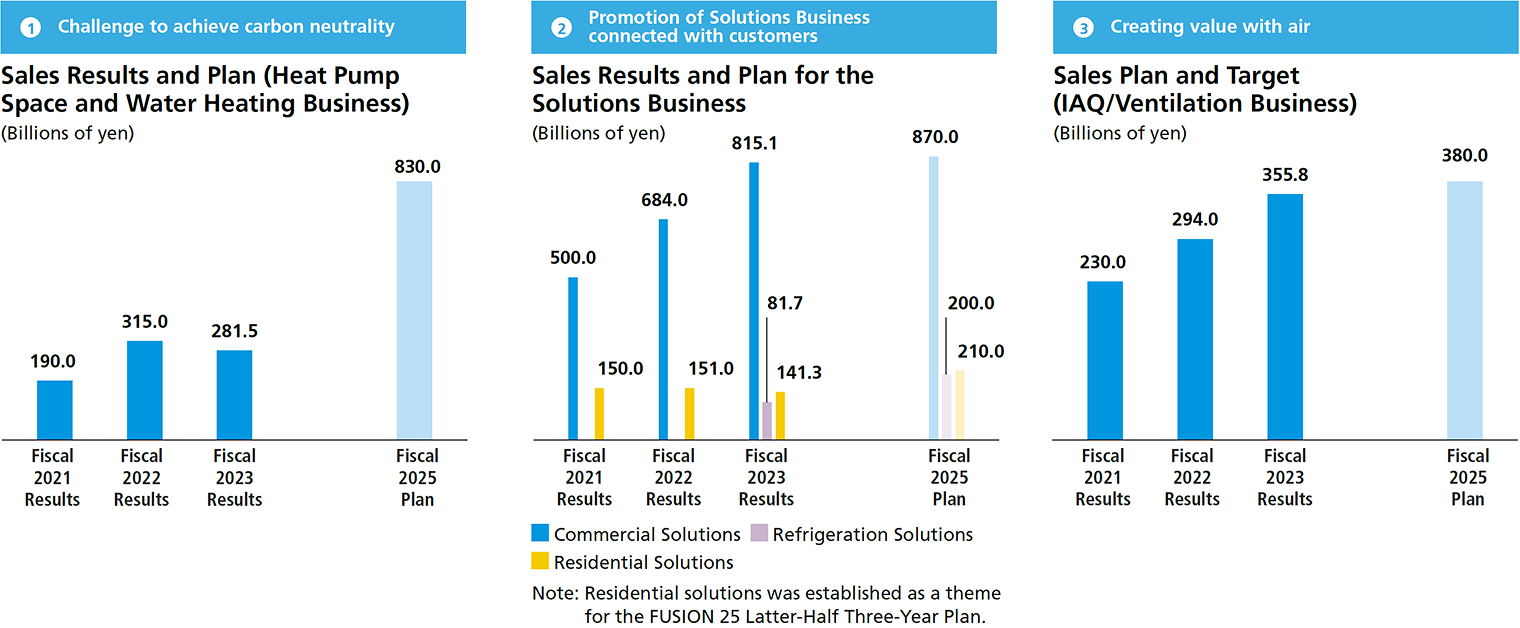

Togawa "FUSION 25" includes three growth strategies: "Challenge to achieve carbon neutrality," "Promotion of Solutions Businesses connected with customers," and "Creating value with air". The third strategy, creating value with air, is how to create a safe, secure, healthy, and comfortable air environment. For example, research shows that when indoor temperatures and airflow are constant, people have difficulty concentrating. Currently, we have a joint research project with NEC that uses facial image data detection technology to identify the state of the person in the room, and then adjusts the temperature, airflow, and oxygen concentration of the air conditioning system accordingly to improve concentration. We are considering whether this system can be introduced to cram schools as a starting point.

In addition, we aim to provide a variety of air environments that meet people's problems and needs, such as spaces that eliminate indoor allergens to relieve pollen allergy symptoms, and spaces that regulate autonomic nerves to reduce stress and promote comfortable sleep. However, there are issues of cost performance, which makes early monetization difficult, and how much vital data can be acquired. In particular, sensing technology is required which has certain restrictions on the use of data.

Koike If we look at it in terms of air environment, it seems that the business domain will expand infinitely. In that sense, digital data and AI may be the key to further growth in the future.

Togawa In 2017, we established Daikin Information and Communications Technology College (DICT) in collaboration with Osaka University as one of our efforts to increase digital and AI human resources. Through the university's training programs and literacy improvement measures, the number of AI professionals has increased to about 1,300, with the goal of eventually reaching 1,500. AI professionals have already shown great power in process innovation, such as development and production, but the challenge from now on will be to monetize their skills. It is important to establish a cyclical solution business that connects customers with data, including the renewal of equipment, while increasing the number of AI personnel who understand the business. In the "Fusion 30" plan that we are currently discussing, we will set growth themes for the next five years by back casting, looking ahead to the changes that will take place in the next 10 to 20 years.

Addressing Specific Management Issues is the Shortcut to Improving Profitability

Koike One of your company's core businesses is its chemical business. For example, regulations on PFAS*1, which is difficult to degrade by fluorochemical processes, is increasingly regulated mainly in Europe and the US. This could pose a risk to your future business development. What are your current actions?

Togawa PFAS manufactured by our company or used in the manufacture of products has been approved by regulatory authorities such as the Ministry of Economy, Trade and Industry Japan (METI), the US Environmental Protection Agency (EPA), the US Food and Drug Administration (FDA), and the European Chemicals Agency (ECHA). Our company has completely phased out PFOA*2 at all of its domestic and overseas sites by 2015. However, at sites where PFOA was manufactured and used prior to 2015, leakage into groundwater has been a problem. To address this issue, we are pumping up and purifying groundwater. In addition, we are strengthening our countermeasures by installing an impermeable wall to keep groundwater within the site. We have also established opportunities for communication with local residents, and we are aware that we have gained their understanding.

In the past, fluorochemical subsidiaries in the US used PFOA as an auxiliary material in the production of fluoropolymer. In the US, there have been class action lawsuits filed by local residents against other chemical manufacturers, and our company has also been added as a plaintiff. However, we believe that the impact is relatively small because of the small amount of PFOA we use. Nevertheless, there is a risk of litigation, and we are working to respond by setting up a legal team dedicated to this matter.

Fluorochemistry is an important business that supports today's cutting-edge industries, such as semiconductors, automobiles, and information and communication terminals. However, it seems that the understanding of fluorine chemistry is not well advanced in society. For example, fluorine compounds with low molecular structure, such as PFOA, tend to accumulate in the human body, while fluorine compounds with high molecular structure, such as fluororesin, do not accumulate in the human body. Therefore, it may be necessary to make efforts to publicize such scientific evidence. We are also considering developing business in materials other than fluorine with a view to the future.

*1 PFAS: A general term for organic fluorine compounds

*2 PFOA (perfluorooctanoic acid): A type of PFAS. Due to its water-repellent, oil-repellent, and heat-resistant properties, PFOA has been used in a wide range of products, including semiconductors, cookware, and waterproof sprays. Since the early 2000s, there has been a worldwide movement to regulate PFOA, as it is difficult to decompose naturally and may accumulate in the human body. In Japan, the production, import, and use of PFOA have already been banned.

Koike Your company does not fall under the PBR of less than 1x, and your ROE has remained 10% or above. However, as a company that has achieved significant growth, I would like to see your company disclose more proactive information on capital efficiency amongst others, and become a model for listed companies in Japan.

Togawa Looking beyond FUSION25, one of our company's major challenges is the declining profitability. In the fiscal year ended March 2024, with demand in many regions and businesses falling more than expected, we made efforts to propose products and services that lead to carbon neutrality and energy conservation, as well as to reduce costs. As a result, we were able to achieve record highs in net sales of ¥4,395.3 billion and operating income of ¥392.1 billion. However, the operating margin declined from 9.47% in the fiscal year ended March 2023 to 8.92%, and ROE declined from 12.26% to 10.68%. Particularly significant were the stagnation of heat pump heating in Europe and the slowdown in profits due to the real estate recession in China.

In Europe, subsidies for switching from combustion heating to heat pump heating have been reduced. In addition, installation costs are nearly 1.5-2 times higher than those of equipment, which is another reason why consumers are hesitant to buy. In order to improve the subsidy-dependent situation, we are working to reduce construction costs by reducing production processes. In Europe, there are many installers who deal with combustion heating, so we will be the first to build our own network to differentiate ourselves by providing training on installation of heat pump heating and hot water supply system.

In China, the real estate recession is expected to continue, so it is important to further differentiate ourselves by offering housing system products and air value proposals. The Chinese government has been making investments toward carbon neutrality, even in a time of severe fiscal conditions, and demand for carbon-neutral air conditioning for industrial applications is growing. In May of this year, our company entered into a capital and business alliance with Miura Co., Ltd., an industrial boiler manufacturer. By combining our air conditioning technology with Miura 's steam control technology, we plan to fully develop products for industrial applications in China and Japan. In the end, I think that clarifying specific management issues and steadily taking measures to address them will be the shortest way to improve profitability.

Koike I think today's talk contained a lot of content that will provide solutions to common management issues for Japanese companies operating globally. I look forward to the future growth of your company. Thank you very much for today.

This article is not intended as a solicitation for investment, nor does it suggest any increase or decrease in the price of any particular stock.

(Published: December 3, 2024)