Engagement Feature Articles

The Daikin Group's Sustainable Management - Providing New Value for the Environment and Air

Striving for Carbon Neutrality by Contributing to Greenhouse Gas Reduction

On the left side : Hiroyasu Koike, the CEO of Nomura Asset Management Co., Ltd.

Reducing greenhouse gas (GHG) emissions is a common global issue. How can companies and investors work together to solve this problem? Mr. Katsuyuki Sawai, Senior Executive Officer of Daikin Industries, Ltd. (Daikin), a leading innovator and provider of advanced, high-quality air conditioning solutions, and Mr. Hiroyasu Koike, the CEO of Nomura Asset Management Co., Ltd. discussed initiatives to achieve carbon neutrality and corporate evaluation methods.

Reduction of net emissions by 50% or more in 2030

Koike Daikin is the world's only air conditioning manufacturer that comprehensively handles both air conditioners and refrigerants. In today's interview, I would like to learn about Daikin's efforts to achieve carbon neutrality (net zero GHG emissions) by 2050.

First of all, could you give us an overview of "Environmental Vision 2050" that your company established in 2018 to achieve carbon neutrality?

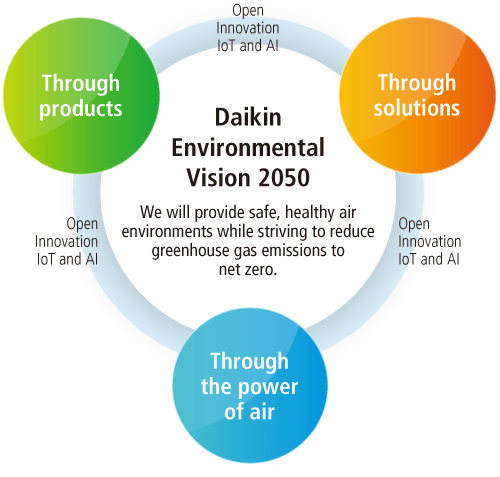

Sawai Our company announced "Environmental Vision 2050" in 2018 to achieve carbon neutrality and expressed support for the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) in 2019. In order to contribute to the resolution of social issues and the sustainable development of society through our business activities, we are making efforts to create new value from medium-, short-term and long-term perspectives. In the short and medium term, we have formulated action plans to assess the impact of our business on society. For the long term, we have formulated "Environmental Vision 2050" based on forecasts and identification of our own risks and opportunities.

"Environmental Vision 2050" aims to lower GHG emissions throughout the entire lifecycle of our products, create solutions that connect society and customers, and work with stakeholders to achieve net zero GHG emissions. We will continue to use IoT, AI and open innovation to help solve global environmental issues while meeting the world's air conditioning needs and providing safe and healthy air spaces.

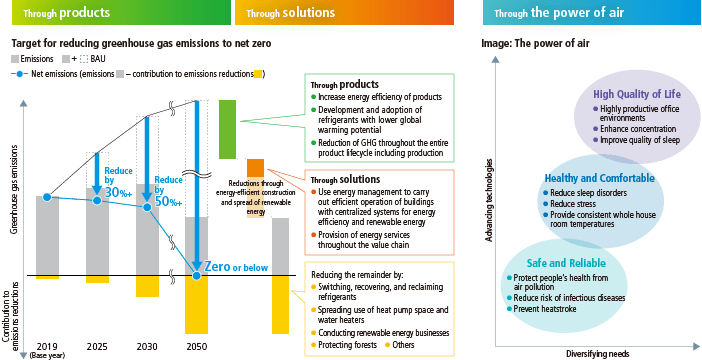

In the medium- to long-term GHG reduction targets for realizing "Environmental Vision 2050", we aim to reduce net emissions by 30% or more in 2025 and by 50% or more in 2030, compared to emissions when business grows without taking any countermeasures (BAU = "Business-As-Usual"), with 2019 as the base year.

Koike Under FUSION 20, your five-year strategic management plan that ended in fiscal 2020, you steadily implemented key strategies while making growth investments for the future by thoroughly strengthening your core businesses in air conditioning, chemicals, and filters, expanding your business domains, and transforming your business structure. What was the basis for the formulation of the FUSION 25 strategic management plan, which began in fiscal 2021?

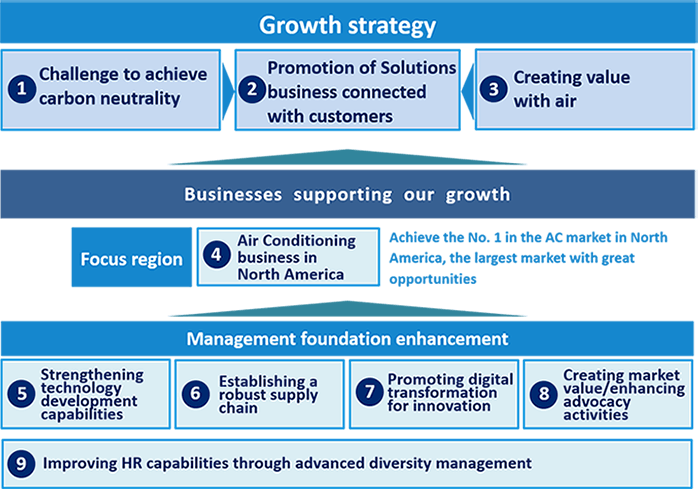

Sawai We plan and implement concrete targets and measures every 5 years to achieve long-term visions such as "Environmental Vision 2050" and medium- to long-term GHG reduction targets. The strategic management plan that forms the core of this strategy is FUSION.

FUSION 25 presents 9 key strategic themes. The three themes of our growth strategy related to the realization of our environmental vision are (1) taking on the challenge of carbon neutrality, (2) promoting solutions businesses connected with customers, and (3) creating value with air.

(1) As we aim to achieve net zero emissions by 2050, we will strive to contribute to solving environmental issues and expand our business by implementing initiatives such as converting combustion heating to heat-pumps, switching to lower GWP (global warming potential) refrigerants and working to recover, reclaim, and destroy refrigerants. (2) Our policy of "promoting solutions businesses connected with customers" is to expand our solutions business by directly connecting with customers and meeting customer needs by application and market, and to contribute to solving issues such as energy conservation and reduction of food loss. As for (3) "creating value with air" we will utilize its unique air-related technologies and products to not only respond to the growing demand for air and ventilation, but also promote collaborative creation with external parties to provide added value such as safety, security, health and comfort.

Koike As for chlorofluorocarbons (CFC) used as refrigerants in air conditioners and in refrigeration equipment, the adoption of the Montreal Protocol in 1987 led to the total elimination of specified CFC which is considered to cause depletion of the ozone layer, and the subsequent promotion of the use of CFC alternatives (HCFC, HFC, etc.).

HCFC, an alternative to CFCs, which became a major refrigerant in the 1980s, also has the effect of depleting the ozone layer. The Montreal Protocol stipulates that HCFC production in developed countries be totally abolished by 2020. On the other hand, although HFCs do not cause ozone layer depletion, they have a greenhouse effect. The use of HFCs, which have a low greenhouse effect, is required to prevent global warming. Under these circumstances, HFC-32 (R-32), for which your company holds a patent, has an overwhelmingly low greenhouse effect compared to other HFCs and has attracted attention as an HFC with many features including environmental impact control. The release of this basic patent for free to emerging countries in 2011 certainly was a positive surprise to the world.

Sawai Thank you for commenting on our company's patent HFC-32 (R-32). Our company's chemical business has been working to develop CFC substitutes that do not affect the ozone layer. In 1991, the company began operating Japan's first mass-production plant for HFCs that have a zero ozone depletion potential. Since 1995, we have been promoting initiatives to prevent the depletion of the ozone layer, such as the development and sale of air conditioning equipment using HFC as a refrigerant in our air conditioning business. Our company released the R-32 basic patent free of charge to emerging countries in 2011 and to the whole world including developed countries in 2015. In 2019, we made a "non-assertion pledge" for the R-32 patent and in 2021, we extended this pledge. We wanted to promote the spread of R-32 air conditioners with excellent environmental performance by freely releasing R-32 patents filed after 2011. Our company has sold more than 28 million R-32 air conditioners in more than 100 countries. Cumulative sales of R-32 air conditioners, including those made by other manufacturers, are estimated at more than 140 million units, and their contribution to reducing GHG emissions is estimated at approximately 230 million tons of CO2 (Daikin Industries estimate as of December 2020).

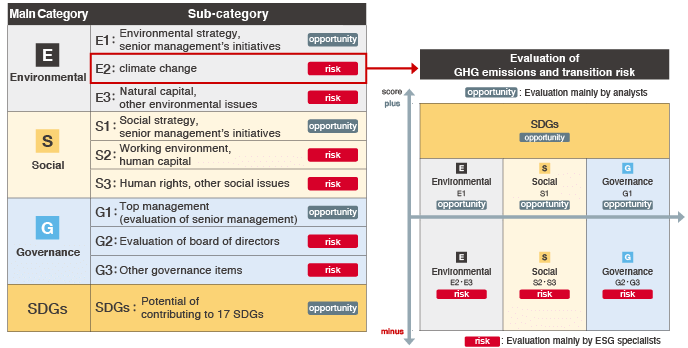

Koike The release of the patent rights for R-32, which has a lower greenhouse effect than other HFCs free of charge, increased the sales of R-32 air conditioners and contributed greatly to curbing global CO2 emissions. By the way, recently, when institutional investors including our company analyze climate-related risks and opportunities in the investment portfolios, they measure the financed emission (GHG emissions of the companies they invest in) and disclose them in their stewardship reports. Of course, we are also interested in the measurement and disclosure of GHG emissions in your company.

Sawai 99% of Daikin's GHG emissions are in the supply chain stated in "Scope 3" of the Greenhouse Gas Protocol Initiatives. A large part of our Scope 3 arises from consumer use of sold products classified as Category 11, that is, emissions from the use of air conditioners sold that includes the air conditioners sold by our company. More specifically, emissions from the use of air conditioners by customers are CO2 emissions from the generation of electricity used.

ESG score reflecting "Avoided Emissions"

Koike As a global trend, investors are increasingly including the analysis of Scope 3 emissions, in addition to Scope 1 and Scope 2, in their evaluations of investee companies. Scope 3 emissions are very useful for analyzing the GHG emissions of investee companies throughout their life cycles and supply chains. However, various issues have also been noted.

Sawai That's right. One of the main challenges is that the more our company sells products like air conditioners, the more Scope 3 emissions that our company measures and discloses. Even if we sell energy-saving products that contribute to global carbon neutrality or replace products from other companies with energy-saving products from our company, an increase in the number of our company products sold would increase the Scope 3 emissions that our company measures and discloses.

The second challenge is that GHG emissions from the use of Scope 3 Category 11 products depend on the energy and electricity conditions in the country or region where our company sells products and our products are used. In particular, many emerging and developing countries, where sales of our company products are expected to increase in the future, still use electricity derived from fossil fuels, and Scope 3 emissions will inevitably increase. If our company measures and discloses more GHG emissions, there is concern that investors' ESG evaluations of our company will decline.

Koike The more we reduce emissions in society as a whole through the sale of energy-saving products, and the more we contribute to achieving carbon neutrality, the more emissions your company measures and discloses, which could lead to a decline in investors' ESG ratings. Are there any effective solutions to these dilemmas?

Sawai Although not included in Scope 1, Scope 2, or Scope 3, there is a concept of "Avoided Emissions", which is estimated to be the amount of GHG emissions avoided (the amount of contribution to the reduction of GHGs other than our own) by using our own energy-saving technologies and products. In the case of our company, by selling energy-saving products, existing products are replaced with our company's products, and a large amount of avoided emissions can be measured and disclosed. According to "The Future of Cooling" announced by the International Energy Agency (IEA) in May 2018, the demand for cooling will increase rapidly by 2050, and the global electricity demand resulting from cooling is expected to triple. As I mentioned earlier, there are issues with Scope 3 Category 11 emissions in relation to the use of air conditioning equipment sold by our company. We anticipate the expansion of the air conditioning market, especially in emerging and developing countries, in the future. Therefore, on the premise of pursuing initiatives to reduce actual emissions, we have set reduction targets that include the avoided emissions.

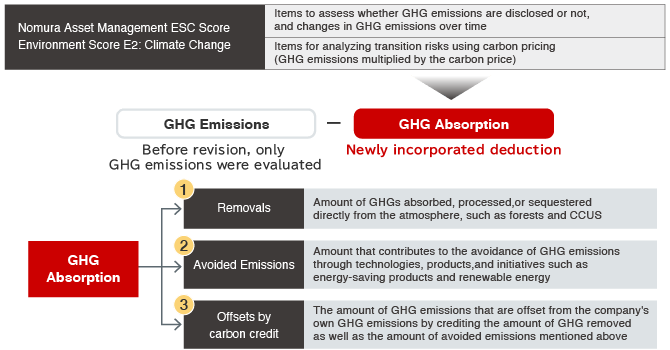

Koike Nomura Asset Management is also aware of the Scope 3 issue and has paid attention to the avoided emissions. In terms of engagement (dialogue) with investee companies, the importance of measuring and disclosing Scope 3 has increased. At the same time, there have been many requests for investors to reflect not only Scope 1 to Scope 3 GHG emissions but also their avoided emissions in corporate evaluations. In response to many requests received, our company's ESG scores for Japanese equities have traditionally been given a positive rating when avoided emissions and other such disclosures are made. From this year, we have decided to quantitatively deduct the amount of GHG absorption, such as the amount of avoided emissions, from the amount of GHG emissions. The amount of GHG absorption in our company's ESG score includes not only the avoided emissions, but also the removals such as forest absorption and the offsets by purchased carbon credits. Corporate efforts to absorb GHGs have the effect of reducing net GHG emissions. Therefore, we believe that such efforts have a positive impact on the corporate value of the investee companies and also are consistent in terms of our corporate value evaluation.

Sawai I was very pleased to learn in the media that your company's ESG score reflects the amount of avoided emissions. I feel reassured to know that you are looking in the same direction, and closely following the reality of the manufacturing industry like our company.

Koike Investors are expected to aim for net-zero GHG emissions in their investment portfolios by 2050. Portfolio emissions account for the amount of GHGs emitted by the investee companies, which are further attributed to the investment assets in proportion to the investor's holdings. In other words, cooperation between companies and investors is essential to achieve net-zero GHG emissions from assets under management.

In the past, the relationship between investee companies and investors was focused on engagement and the exercise of voting rights in addition to capital funding. However, the assessment of GHG absorption, which our company started this year, is a new initiative that will support the activities of investee companies by reflecting their contributions and efforts to reduce GHG emissions.

By the way, I would like to hear your views on the concept of the avoided emissions and any issues you have noticed in this area.

Sawai Although the concept of avoided emissions is widely recognized around the world, I feel that we have not yet reached a situation where we can obtain agreement on how it is reflected in our carbon neutral targets. In addition, there are no uniform rules for measuring and disclosing the avoided emissions, and there is room for improvement in the quality of data. The avoided emissions disclosed by our company has been verified by a third party to improve the reliability of the data. Issues like the creation of global standards cannot be solved by our company alone. We believe that we must solve them in cooperation with investors and stakeholders like your company.

Koike I very much agree with your comment. Reflecting the amount of GHG absorption in our ESG scores is a step toward resolving the issues you pointed out. We will continue to engage in dialogue with companies and contribute to the establishment of corporate evaluation methods that enable appropriate evaluation of initiatives for climate change and carbon neutrality, as well as the creation of rules that will lead to the realization of a decarbonized society. Thank you very much for your spending time with us today and sharing valuable view points on your endeavors.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: May 31, 2022)