Engagement Feature Articles

Concordia Financial Group - Maintaining Strong Regional Roots while Going Beyond the Regional Framework

Left: Hiroyasu Koike, President and CEO of Nomura Asset Management Co., Ltd.

Concordia Financial Group, which plans to evolve into a solutions company, is highly valued by investors for its clear vision and advanced information disclosure aimed at enhancing corporate value. Mr. Tatsuya Kataoka, President and Representative Director of the company, joined Mr. Hiroyasu Koike of Nomura Asset Management to discuss how Concordia will build its presence as the financial institution of choice for clients and investors, as interest rates are expected to rise hereafter.

Shareholder Expectations for Improved Corporate Value

Koike Over the past year or so, I have the impression that there has been considerable change to the way in which regional banks talk to and deal with investors. One factor influencing this is the TSE's request to companies with a sub-1x PBR to enact improvement measures, and another is the entry of overseas activists. Amid this shift, Concordia Financial Group has laid out a clear vision for enhancing corporate value at investor briefings. I think it's very compelling from an investor's perspective. What was the reason you decided to take this stance?

Kataoka This is something I've felt since I was in charge of IR. The ratio of foreign shareholders in our group is over 30%, which is quite high. Until the fall of 2023, an investor called Silchester was the largest shareholder. For foreign investors, it is common to say, "Since we are relying on management, they should do as shareholders say". From that point of view, while our regional communities and employees are of course important to us, we must also be very conscious that shareholders are another set of stakeholders that rely on us to improve our corporate value.

In 2018, we created the Risk Appetite Framework (RAF), a framework for business management, and discussed how to allocate capital efficiently, i.e., where to take risk and where not to take risk. And we have continued to discuss how to link that with our management plan.

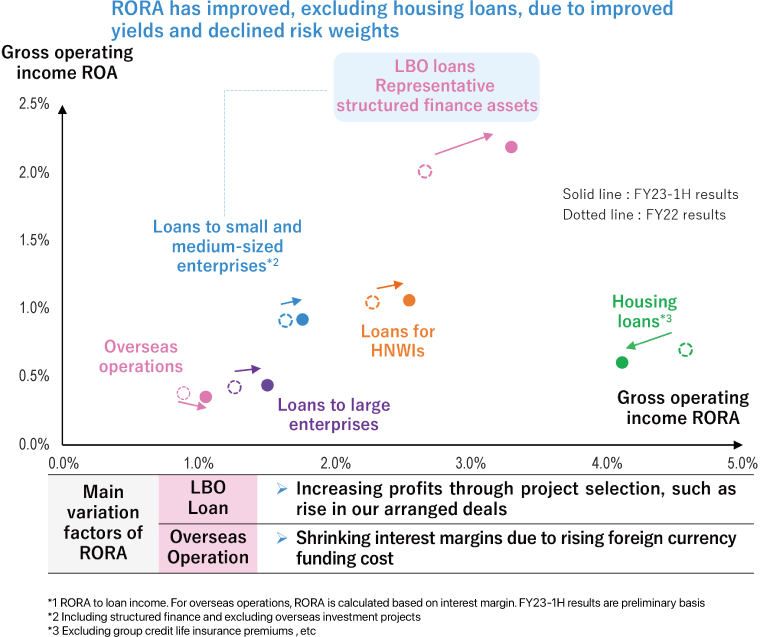

Koike At the information meeting that Concordia held in May 2023, you demonstrated advanced information disclosure by showing measures to improve corporate value in a logic tree. In order to improve ROE, you presented figures for each business to improve RORA (Return On Risk Assets).

Kataoka The cost of equity that we have independently calculated using the capital asset pricing model (CAPM) is about 6%, but the figure that investors calculate based on the return on equity is at the level of 9~10%, resulting in a discrepancy. I think it is futile to discuss the method of calculating the cost of equity, so the question is what we will do to achieve the level that investors expect. We felt that we would have to drill deep to persuade investors on improving our corporate value, so we presented the ROE logic tree.

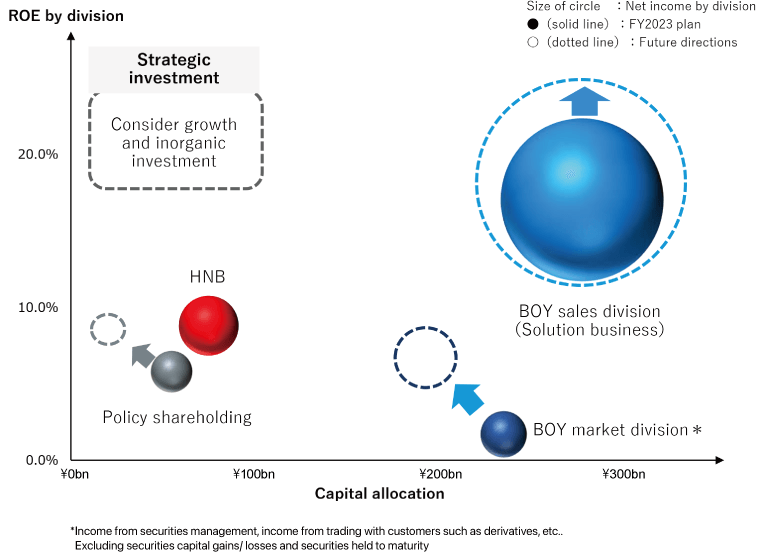

We originally prepared RORA by asset class as a document for the board of directors to consider where to allocate capital. Based on the RORA and ROE distributions, we determined the asset allocation of all business portfolios, not just securities, and provided the figures. We thought that presenting this would offer a deeper understanding of our capital allocation. For example, the distribution of ROE and allocated capital by sector shows that cross-shareholdings are not capital-efficient. This led to a discussion about why we need to reduce our cross-shareholdings, which was a good stimulus both inside and outside our corporate group.

(Source) Concordia Financial Group materials

All Employees in the "Same Boat"

Koike In addition, your management is communicating with employees in a way that is conscious of corporate value. This is also unusual for financial institutions, especially regional banks.

Kataoka I have told customers that our regional ties are important, and I have also told investors that we will improve our corporate value. It's not a contradiction at all, but I'm acutely aware of the fact that the two are not interlocked. In order to improve corporate value, each employee must consider where he or she can contribute to the logic tree based on the policies set forth by management. To address this issue, we conducted briefings and questionnaires on the theme of enhancing corporate value for all group employees, including at our affiliates.

I think our understanding of the importance of improving corporate value has greatly increased. However, it does not happen overnight and recognizing how to work toward improving corporate value in our daily duties will take time. Moving forward, I will continue to need branch managers and department heads to communicate in a way suited to their own workplaces and raise awareness among employees. By creating such awareness, it is important that all employees, not just management, get on the "same boat".

Broad Space for Providing Strategic Solutions

Koike Now that we've reached about a year and a half since you began your new medium-term management plan, can you share the direction and progress of your business as outlined by the plan?

Kataoka Traditionally, we operated more of a "product-out" business. As the environment surrounding our customers changes drastically, we must shift our business to "market-in", with a focus on solving customer problems. In this medium-term management plan, we defined our vision as being "a solutions company rooted in communities and selected as a partner to walk together". There are three meanings to this. The first is that the employees themselves will communicate more about their commitment to the areas of Kanagawa and Tokyo.

Second, since we are doing business in such a prosperous market, it means that we should take pride as the head of a regional bank. The third is that we will evolve into a company that earns our profits not only from deposits and loans, but also from the solutions we provide via consulting.

Due in part to the rise in U.S. interest rates, which we did not anticipate at the outset, we had difficulty in managing securities investments. Our losses in foreign bonds have finally been resolved through portfolio restructuring, and we have made progress ahead of schedule. In addition, we have integrated our operations with the Bank of Kanagawa and are establishing a system to further commit ourselves to customers in Kanagawa Prefecture. In total, I feel things are going according to plan.

Koike I would like to ask you about your individual business initiatives. Structured finance is highly profitable, and I think it is an area that has been growing for several years. How do you see the sustainability of these solutions businesses?

Kataoka Structured finance for SMEs, mainly LBO loans, and overseas investment projects have relatively high RORAs and will continue to be a focus area. There are many listed companies in our corporate business area, and many customers, both corporate and individual, deal with us as their main bank. Recently, there has been an increase in the number of projects related to sustainable finance and SDGs, and in response to the TSE's efforts regarding sub-1x PBR, we have seen an increase in consultations regarding capital policy and financial strategy. In this sense, there is a lot of room for us to provide strategic solutions that are deeply involved in the management strategies of our customers.

Koike Structured finance is a special type of business that requires expertise, and it also requires the training of people with discerning know-how. Is that an issue for the future?

Kataoka Since April 2023, we have been increasing our investment in human resources as part of our Group human resources strategy. We have been working to improve our skills through rotation, such as training and secondment, and the quality of our human resources has steadily improved. However, since human resources are becoming more and more mobile, the challenge is rather the number of people. If we can't secure an adequate number of people, we can't achieve adequate coverage regardless of how much market share we capture. This is not limited to structured finance, but also applies to traditional banking transactions such as senior loans. In the solution business, it is important to have a certain degree of relationship with the client. Securing human resources who can firmly establish relationships with corporate and individual customers is the most important issue.

Leading Profitability through Ability to Attract Deposits

Koike Moving on to retail, recently, with the evolution of technology, financial transactions through the Internet and online banking are increasing. What are your thoughts on these changes in the world?

Kataoka In terms of a sense of direction, I think we will see a shift to "a world with interest rates". The biggest change is in deposits. Up until now, we have not been actively pursuing our own efforts to collect deposits amid the low interest rates resulting from BOJ's monetary easing policy. From now on, the profitability of banks will differ depending on their ability to attract deposits. Online banks and securities are still a threat as competitors, but they are even more so in a world with interest rates. The function of a settlement account is important in order to receive core deposits, but especially for individual customers, convenience and a sense of value are important when choosing a settlement account. As an extreme, aside from ATMs, we will have to shift all the operations that were done at our physical locations to smart phones. If we can't offer complete services there, our customers will go elsewhere. Internet banks and securities companies are competitors that we need to be very aware of, and we also need to increase our investment in digitalization.

Koike How will the existing physical location strategy change as digitalization efforts progress?

Will there be a significant shift from in-person services to digital? Or are there specific functions for in-person interactions, while digital progresses simultaneously?

Kataoka Compared to a decade ago, the number of customers visiting our physical locations has clearly decreased. At the same time as the cashless market is increasing, transactions on smartphones and the Internet are also increasing, which means that the need for customers to visit in-person is decreasing. As banking operations will increasingly shift to the Internet, there will be no increase in the number of branches in the future, and existing branches will need to be more efficient. However, face-to-face relationships are still very important when conducting our solutions business, including personal asset management. I think our physical locations will change their roles from traditional office bases to hub bases for consulting and sales, for example.

Selection as a Constituent of New ESG Indexes

Koike You mentioned earlier that U.S. interest rates rose and your securities investment management did not go well. In order to control the cost of equity, it is important to reduce business risk. However, if investment volatility is large, there is the risk of investors discounting your share price. Do you intend to strengthen and improve your investment management in the future?

Kataoka As of the end of September 2023, the outstanding balance of our securities investment management was 3 trillion yen, but I believe that the current returns are not worth the amount of capital allocated. In the future, for example, as we increase the amount of capital allocated to the corporate solutions business, we will reduce the allocation to the market sector in consideration of the overall balance. On the other hand, we are thinking about upgrading our operations. In the past, management was left to the market division, but now, every month, the ALM (Asset and Liability Management) Management Conference and the board of directors discuss the management policy with the market division. Specifically, we are working on three portfolios: the Valuation Portfolio, which accumulates valuation gains mainly on stock investment trusts; the Real Portfolio, which secures real gains and losses through flexible operations and diversification in accordance with market prices; and the Financial Portfolio, which is designed to secure stable financial returns. We are also hiring specialized personnel.

Koike With regard to ESG, you are committed to the advancement of sustainable management, and I believe that this is one of the solutions offered to your customers. A typical example is sustainable finance. What would you say the strengths of Concordia Financial Group are and what has been the response?

Kataoka In the past year or two, our customers' awareness of sustainable management has changed significantly. With regard to Scope 1 and 2 GHG emissions, we switched all contracted electricity from the Bank of Yokohama and the Higashi-Nippon Bank to renewable energy, achieving a 72.9% reduction in FY2022 compared to FY2013. However, decarbonization of investment and loan suppliers is still in progress, so we are working to establish priority industries to address and raise awareness. In addition to automobiles and parts, from this fiscal year we have expanded our focus to include metals and mining, and personnel and sales representatives from our head office have gone to the our counterparts in these areas to calculate GHG emissions and propose transition financing to support decarbonization. A considerable number of employees, including those in charge of sales, are now able to share their knowledge of sustainable management with customers, and I feel that this is a great opportunity.

Since the amount of sustainable finance execution already exceeded the FY2030 target of 2 trillion yen, we revised the target upward to 4 trillion yen. Now that we have been selected as a member of the global ESG index and the two Japanese ESG indices adopted by Japan's Government Pension Investment Fund, we realize that our ESG initiatives are being communicated to investors and analysts.

Importance of Unique Business Lines for High ROE

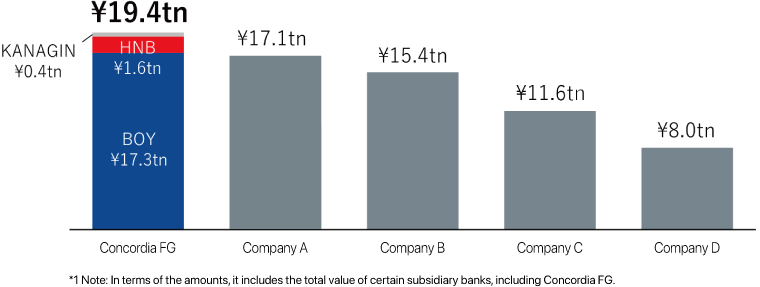

Koike Your company is a regional bank in the sense that it is rooted in the areas of Kanagawa Prefecture and Tokyo, but it has grown beyond the scope of a regional bank in terms of scale and business content. While there's no need to become a megabank, if you work to differentiate your positioning against other regional banks, I think the market would recognize your efforts.

Kataoka Megabanks fulfill the role of strengthening Japan in the global arena. We cannot take their places. I believe that our mission is to strengthen the region within Japan, domestically. But certainly, as you just said, with all this capital and market, some might think that we could do more.

We need to be the preferred option within the framework of regional banks. The uniqueness of our business lines is still important for this purpose. We currently have about 100 billion yen in unused economic capital, and the allocation of that capital will be a major point of our next medium-term management plan. Investors will probably be looking for a higher return on profits. However, since investments in existing businesses will only result in similar profitability, we must create business lines that are capable of higher ROE. If we are successful in that sense, I believe the impression of investors will change.

Koike I look forward to seeing such developments. Thank you for today's valuable discussion.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: March 7, 2024)