Engagement Feature Articles

ASICS - Competing with the frontrunners: Japanese companies in a global capital market

Left: Hiroyasu Koike, CEO and President of Nomura Asset Management Co., Ltd.

ASICS Corporation, a global sports brand company from Japan, has been achieving strong growth along with dramatically improving profitability. During the 2010s, the company struggled to achieve its growth targets, but it succeeded in restructuring in 2018 and is now entering a new growth phase. Mr. Yasuhito Hirota, Chairman and CEO of ASICS, who has spearheaded these reforms, and Hiroyasu Koike, CEO of Nomura Asset Management, discussed the path to recovery and growth for ASICS.

Addressing the drawbacks of a vertically divided organization with a Category-based Management Structure

Koike We felt the need to convey the appeal of Japanese companies to overseas investors, so we started talking with influential CEOs as part of our "Project Bridge". We also wanted to showcase the qualities and initiatives of the companies we have been introducing. With the support of ongoing policies aimed at promoting Japan as a Leading Asset Management Center, we are seeing a shift in attitude towards Japanese companies among overseas investors.

Hirota I would like many investors to buy Japanese stocks, including ASICS, but I am conscious of the question of whether Japanese companies can really compete on the world stage when compared to multinational companies overseas. For example, cross-shareholdings carry a connotation of the Japanese market being closed-off. I think Japanese companies need to make efforts to change if they want to be taken seriously on the world stage. ASICS has eliminated its cross-shareholdings entirely and shifted to a shareholder structure without such "stable shareholders".

Koike I think it is very important to demonstrate to global investors Japan's growth and corporate reform efforts. The stock performance of ASICS over the past few years has been remarkable. However, looking back over the past 10 years, there had been periods of sluggish business performance. Hirota-san joined ASICS in January 2018, which coincided with a period when management restructuring was clearly necessary. First of all, could you tell us about the circumstances around your appointment at ASICS?

Hirota When I was serving as General Manager of Kansai Branch at Mitsubishi Corporation, where I worked before, I was approached by former ASICS President Mr. Motoi Oyama as part of his business activities. He asked me if I would consider taking over as president of ASICS. I thought the offer sounded interesting, so I accepted with a somewhat casual attitude. I hadn't worked in the sports sector before, but when I started running at the age of 50, I started to wear ASICS running shoes, as recommended by a sporting goods store. I was inspired to feel a certain connection with the company.

Koike I imagine there were times when you felt there was a perception gap between what you saw of the company from outside and what you saw when you joined ASICS.

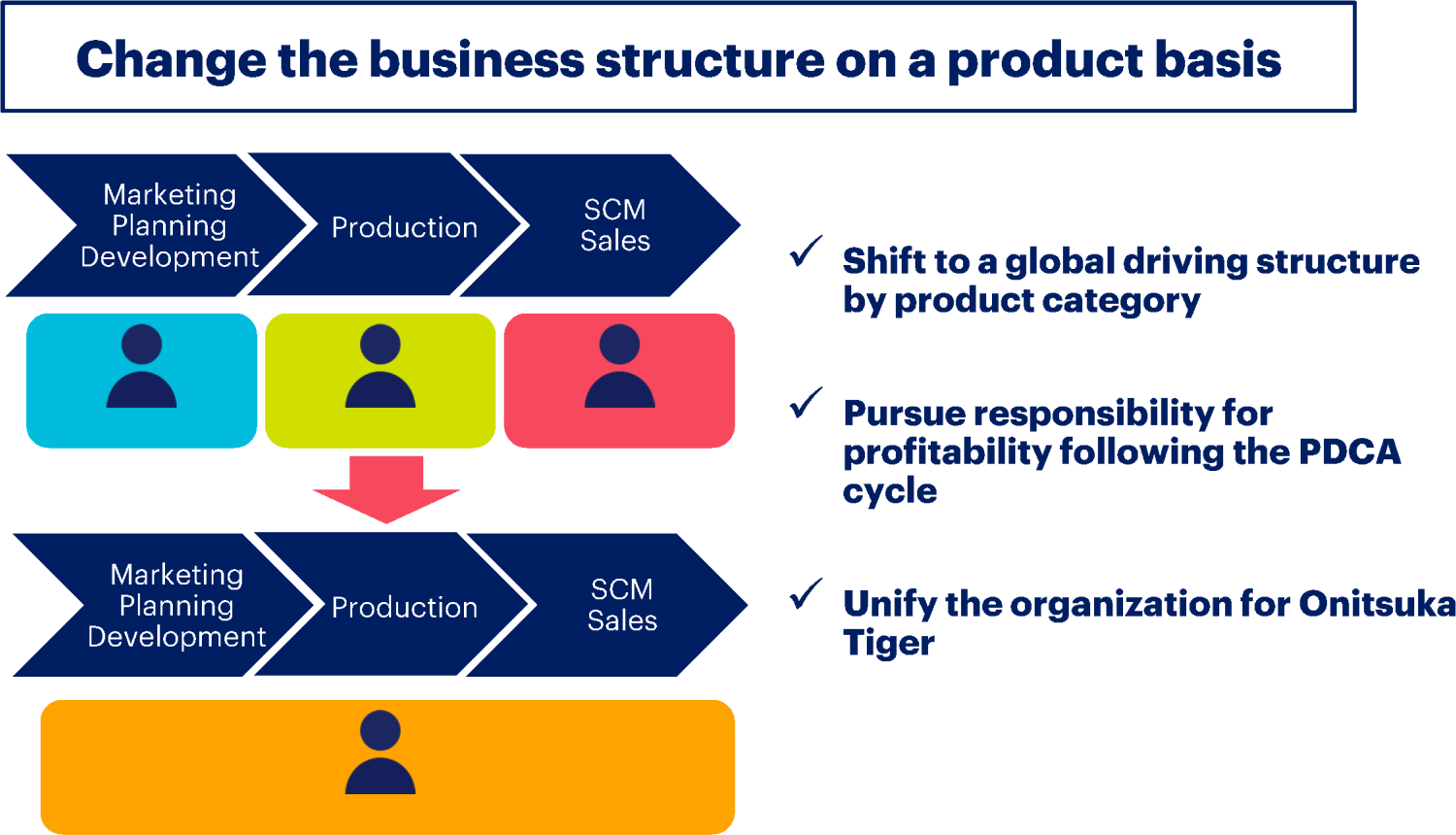

Hirota I knew that business performance had been sluggish for a while before I joined ASICS, but I soon realized that there were deep-rooted problems. The biggest problem was the lack of communication between makers and sellers. When investigating reasons for the slump in sales, the makers criticized the sales methods, while the sellers said that the problem was with the product. The Category-based Management Structure was introduced as a solution to the problem of a vertically divided organization. Products were divided into five categories, and the head of each category took responsibility for everything from manufacturing to sales.

Two-way communication is important for promoting reform

Koike Hirota-san joined the company in January and announced the Action Plan in August. You then switched to a Category-based Management Structure. I think it took a great deal of determination to make a decision on structural reform and then implement it in such a short timeframe.

Hirota Originally, the medium-term management plan had been announced in 2015, and the company set an ambitious target of 750 billion yen in sales and an operating margin of 10% or more by 2020. However, due to slow progress by February 2018, the target was revised down to 500 billion yen in sales and an operating margin of 7% or more. I became president immediately after that, in March, and the board of directors were making an earnest assessment of how to achieve the plan, making it easier for me to introduce a radical change. Alongside the introduction of the Category-based Management Structure, we also strengthened our management personnel in the Greater China area and designated our digital business as a growth driver.

In 2018, we also recorded an impairment loss. There was some internal resistance to the posting of a deficit, but I believe we considered the issue with due care. In the end, I can say that the Board of Directors gave me the backing for my strong determination.

Koike Even if the Board of Directors and the Executive Committee shared the intention of reform, it can be difficult to bring the perspectives of employees in the field into line and to bring about changes in organizational behavior. What have you done to promote reform?

Hirota There are two important phases in transforming a company. One is to change the structure. The other is to change the way we communicate within the company.

As for the latter, since my appointment as president, I have been posting an internal blog every two weeks without fail. At first, I introduced myself with a lot of personal stories, such as how I participated in marathons and how I felt about wearing ASICS running shoes. But I gradually began to share my management initiatives and thoughts more widely. Since the system allows employees to reply anonymously, I received plenty of feedback and many frank opinions. By answering them properly, anyone could learn about management policies and ideas if they wanted to. Two-way communication is very important.

Making the most of our strengths to compete in the world market

Koike Hirota-san had never worked in the sports industry before joining ASICS. What were your criteria for selecting and focusing on your business?

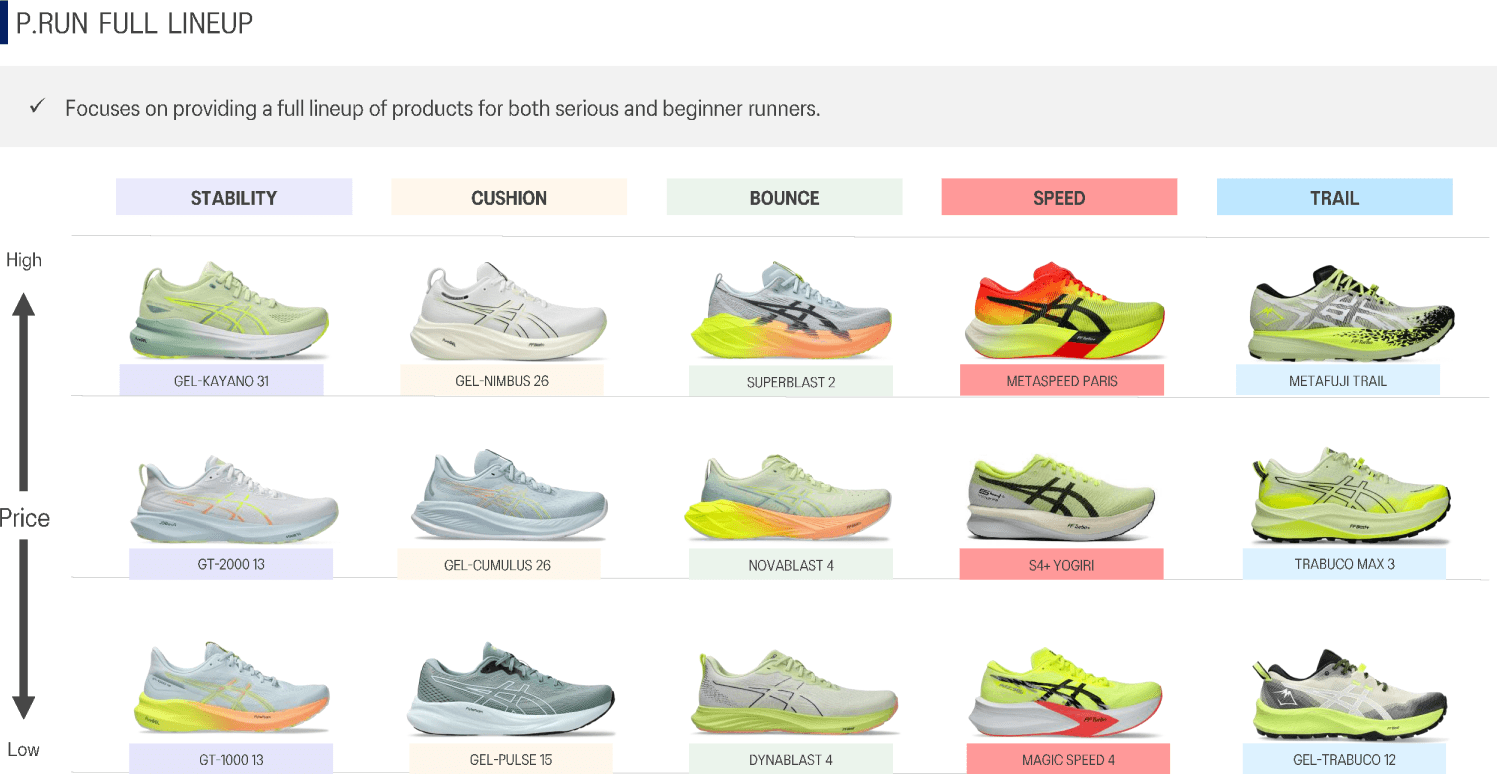

Hirota When we introduced the Category-based Management Structure, we made profits and costs visible in each category. One of the five categories is Core Performance Sports, which develops shoes for competitive sports other than running. However, for this category, we created smaller sub-categories held a thorough review of our business portfolio.

Koike While ASICS has high brand recognition worldwide, I believe you need a competitive advantage strategy in order to compete alongside giant global companies like Nike and Adidas.

Hirota To challenge giants in this industry, it is important to make the most of our strengths. Through our technological capabilities and craftsmanship, we will develop record making products that are safe, secure, and comfortable. This way, we hope to earn the unwavering trust of our customers and compete globally.

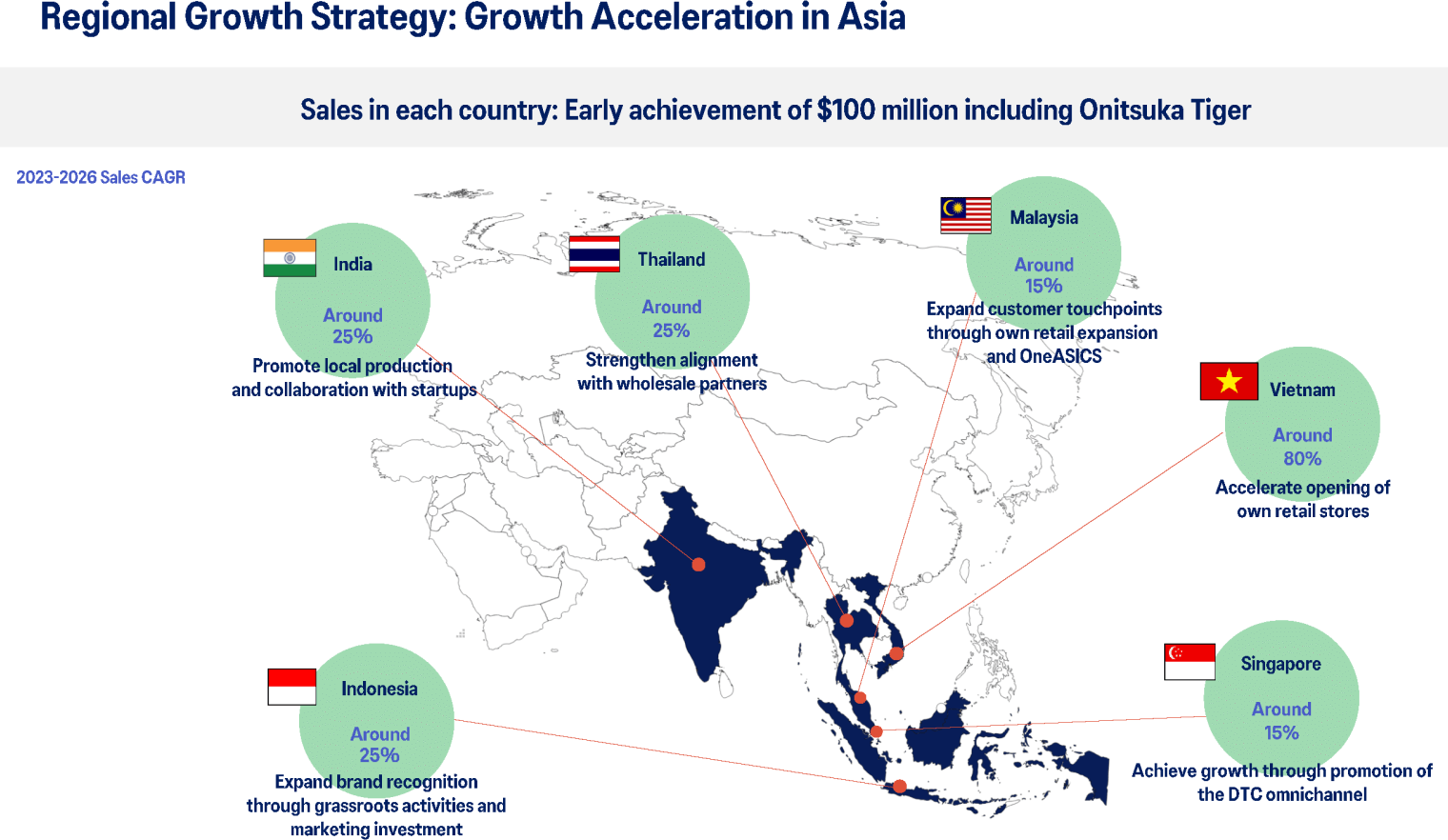

At ASICS, we aim to be a global company, but we emphasize internally that it is not about competing "against" the world, but rather competing "in" the world. When we look at the global sportswear market from various angles, we can see growth potential in several regions.

Koike I think it is wonderful that there are abundant growth opportunities. What if any do you see as the current shortcomings or challenges?

Hirota There are three main areas. The first is strengthening our financial base. Our financial management is robust, but in order to compete globally, we need to secure sufficient funds. The second is a system that allows talented people from various regions to play an active role globally. The third is to develop our digital capabilities. Our digital division is located in Boston, the United States, and our IT division is based in Amsterdam, the Netherlands, but we need to further strengthen our capabilities in these areas.

In terms of product development, there are still challenges in terms of our ability to create innovation.

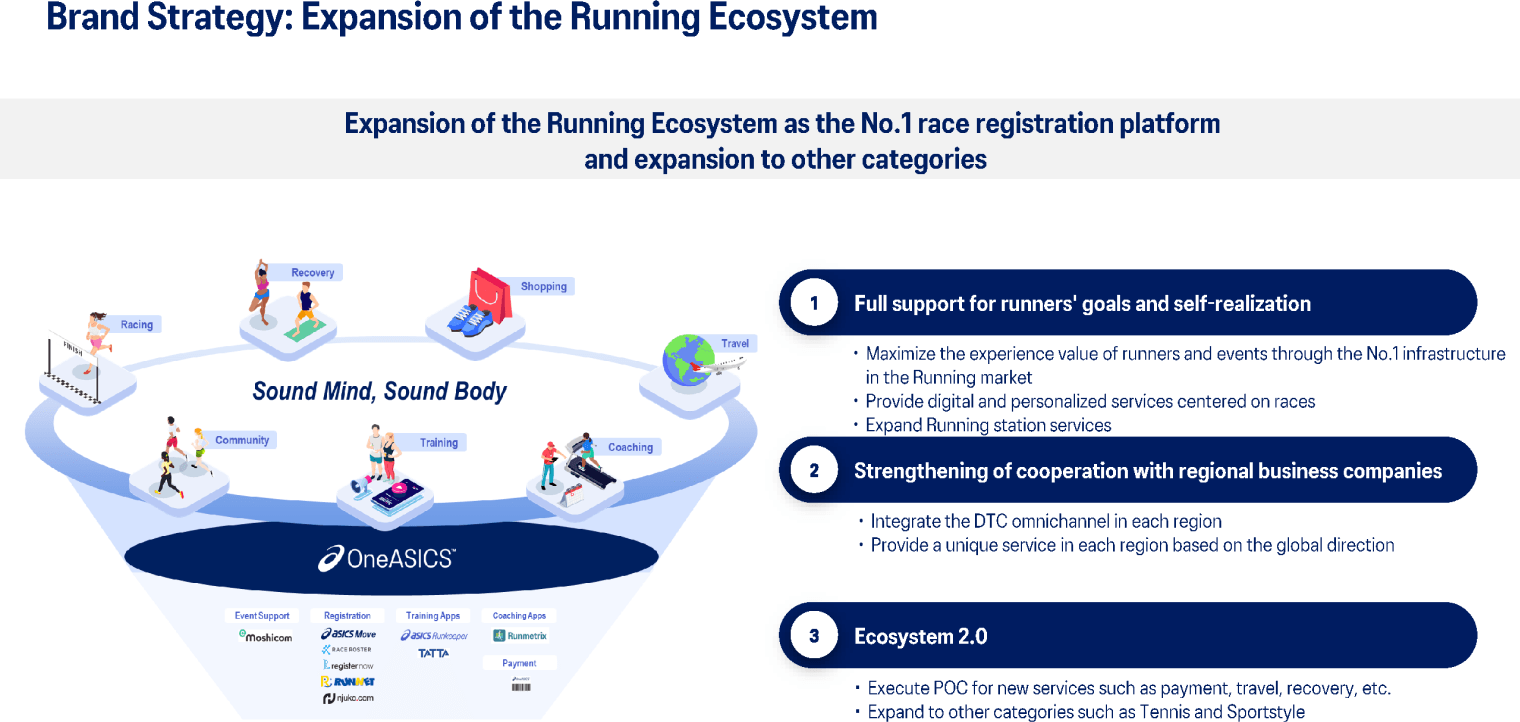

Koike In terms of digital initiatives, in 2020 you announced the launch of a running ecosystem, aiming to create value that goes beyond just direct sales. Will this bring about a change in your corporate concept from a sportswear manufacturer?

Hirota Yes, I think it will. In our VISION 2030, announced in 2020, we set out our vision "to create a world where any one of us can continue to exercise, play sports and remain in good mental and physical health throughout our lives". This is our vision for the future. We aim to build a one-on-one community through the power of digital technology, not just focusing on our products.

There is still much to be done

Koike If you emphasize more strongly the future vision that ASICS is different from traditional sports manufacturers, then investors may change their views and you can expect to develop a new investor base.

Hirota Our President and COO, Mitsuyuki Tominaga, has spent most of his career at IBM and SAP, and he is skilled in digital technologies. I think we have high expectations. I believe it is essential to monetize the "Running Ecosystem" in order to earn greater appreciation from investors.

Koike In terms of business performance, you have overcome the damage caused by the COVID-19 pandemic and achieved remarkably rapid growth. Was there anything you focused on especially to turn a pinch into an opportunity?

Hirota Two measures that we had focused on even before the COVID-19 pandemic have played a major role since then. One is strengthening our e-commerce initiatives. We were able to capitalize on the trend towards greater e-commerce penetration during store closures. The other is the development of new products for top athletes. Before the COVID-19 pandemic, the running shoe market was dominated by Nike's platform shoes. We launched the "C-Project" in November 2019 as a countermeasure. "C" is an acronym for the "Chojo" or "summit project" named by our founder, Kihachiro Onitsuka, as a way to win. We were able to launch a powerful range of new products during the COVID-19 pandemic while receiving feedback from top athletes. We were able to benefit from the tailwind of expansion in the running shoe market due to rising global health consciousness.

Koike Your operating profit margin forecast for 2024 has been revised upward to 14.4%. What is your outlook for future earnings?

Hirota It is hard to give a definitive answer, but I think we can continue to achieve record profits. There is still much work to be done. For example, India and Southeast Asia, which have large populations, are growing markets because many more people are starting to play sports. Even in the US market, where we were relatively weak, momentum is building for a comeback. Our Onitsuka Tiger fashion brand's appeal is also gaining popularity. In addition to these natural growth factors, if we can monetize the Running Ecosystem, we could expect to see stronger business results than are currently expected.

At ASICS, we have a slogan for our employees every year. After experiencing the humiliation of having zero athletes wearing ASICS shoes in the 2021 Hakone Ekiden, a regular new year event and one of the most prominent relay marathon races in Japan, the following year was marked by the sentiment: "Can we end up losing without a fight?" The year after that, as things began to improve slightly, it was expressed as, "Far more than this." And this year, the message is, "Never stop moving forward." I still sense that there is much more we can achieve given the positive spirit within the company.

Aiming for higher market capitalization

Koike It's a powerful slogan that reflects the culture of a sports company. Do you also believe "Far more than this" regarding the share price levels?

Hirota Yes I do. First of all, we always have to exceed the 2,442.5 yen offering price that we announced in July 2024 when we dissolved our cross-shareholding. This is a high level in recognition of the upward earnings revision, but I think we can still make the share price more attractive. In order to raise awareness, we encourage employees to own shares. We changed the compensation system so that a portion of the after-tax profits exceeding the cost of capital is returned to employees; and for General managers and above, this is provided in the form of stock.

Koike I am very hopeful. Many overseas investors point out that when Japanese companies take the world stage in capital markets, their share price targets and business strategies are not well aligned. If someone like you, Mr. Hirota, who has a clear strategy and can lead the way, it will have a positive impact on the Japanese stock market as a whole.

Hirota Thank you. In 2023, the market capitalization exceeded 1 trillion yen. Only about 4% of Japan's listed companies exceeded 1 trillion yen. If you compare the top 4% to a marathon, it is equivalent to breaking the 3-hour race time, which is called a "sub-three". When we encouraged our employees to say, "We achieved the "sub-three"," we were able to break the 2 trillion yen record this year. This is equivalent to breaking the two and a half hour time, which is said to be the top 2%.

In talking with investors, I think it is important for senior corporate management to talk about the company's vision and dreams. If you see ASICS as an attractive company, it will motivate you to own shares. I would like ASICS to become a front-runner in the capital markets, just as we are in our business.

Koike As institutional investors, we would like to share management related issues with companies and place greater importance on dialogue, including advice and support. This can help us to promote Japan as a Leading Asset Management Center. If you have any opinions about NAM, please share them with us.

Hirota I look forward to meeting with your company regularly. Even before I became President, Nomura had been monitoring changes at ASICS over the years and sometimes offered some tough feedback. Even if investors are addressing issues that we are aware of, having them explicitly pointed out, can resonate with us as corporate leaders. I remember what has been said, and I believe that holding sessions to report progress and results will help to encourage management reform. You have a significant presence in the industry to foster a constructive relationship with investee companies and to strengthen Japan's capital markets.

Koike This also serves as a reminder for us to stay focused and committed. Thank you for sharing your valuable insights today.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: November 7, 2024)