Engagement Feature Articles

Ajinomoto - Nurturing a Culture Committed to Improving Corporate Value by Promoting "Purpose" and Human Asset Enhancement

Left: Hiroyasu Koike, President and CEO of Nomura Asset Management Co., Ltd.

Ajinomoto has continued to refine its ASV* management practices which supports the creation of both social and economic value through its business. Continuing to post strong performance since 2020, the company published a new "Medium-Term ASV Initiatives 2030 Roadmap". In the past, there have been times when performance volatility and failed plans drew scrutiny, however, the company's management reforms have earned it praise for its ability to achieve its goals and its awareness of share value. Ajinomoto Co., Inc.'s Mr. Taro Fujie joined Mr. Hiroyasu Koike of Nomura Asset Management to discuss in depth how reforms have changed the company.

*ASV: Ajinomoto Group Creating Shared Value

Re-examining Corporate Culture after a Share Price Decline

Koike Viewing your company's stock price, it's clear that it has performed splendidly over the past three years. However, if we reflect on the longer term, we see cycles of growth and stagnation. The last period of stagnant growth began in 2016. Following the publication of a medium-term management plan that aimed to make your company a "global top 10 class food company", you experienced a slowing of growth, and some demanded improvements in the management structure. We at Nomura Asset Management proposed the division of executive officers and directors and the introduction of a governance system to achieve the objective evaluation of business plans and logical distribution of management resources. Revisions to the board were introduced, with the new governance system taking effect in June 2021. It was also around this time that Ajinomoto introduced ROIC management, and began promoting an "asset light" approach alongside DX. Since then, earnings have been strong, and your share price has nearly tripled. Do you think this management reform has contributed to performance improvements?

Fujie Our performance has waxed and waned since 2000, and I don't think we have gained sufficient confidence from investors. When we received NAM's proposal in 2019, we were concerned with our PBR dipping below 1x and had a growing sense of crisis. As a result of discussing the causes, we identified the rigidity of our corporate culture and the silo-ization of work as the largest issues.

I think it is human nature to preserve the status quo and follow the lead of our superiors rather than to try and fail. When the answer is known, it's efficient to follow policies and practices of a vertical organization. Within our management reforms, we are aiming to become a responsive organization that understands the strengths and weaknesses of a vertical organization, while being appropriately equipped to handle changes in customer needs and society. We believe this will increase the success of our products and services.

Koike What specific initiatives do you mean when you say "properly equipped"?

Fujie The first step is to clarify our "will" or purpose. We have defined our will to be "contributing to the well-being of all human beings, our society, and our planet with ‘AminoScience'". We believe that finding an overlap between the ambitions of an individual and the company will lead to greater enthusiasm and more rewarding work. Finding this common ground promotes an open culture where our employees can share their thoughts with anyone, anywhere, and anytime.

Our goal lies in the self-motivated actions beyond that. Our company's IR efforts are a good example. As a result of the IR Group promoting self-motivated activities, our IR activities have shifted from being a forum for statements from management to incorporating the interests of shareholders and investors, and we are able to achieve better communication. We would like to further promote this culture where individuals are motivated to raise their hands and be heard.

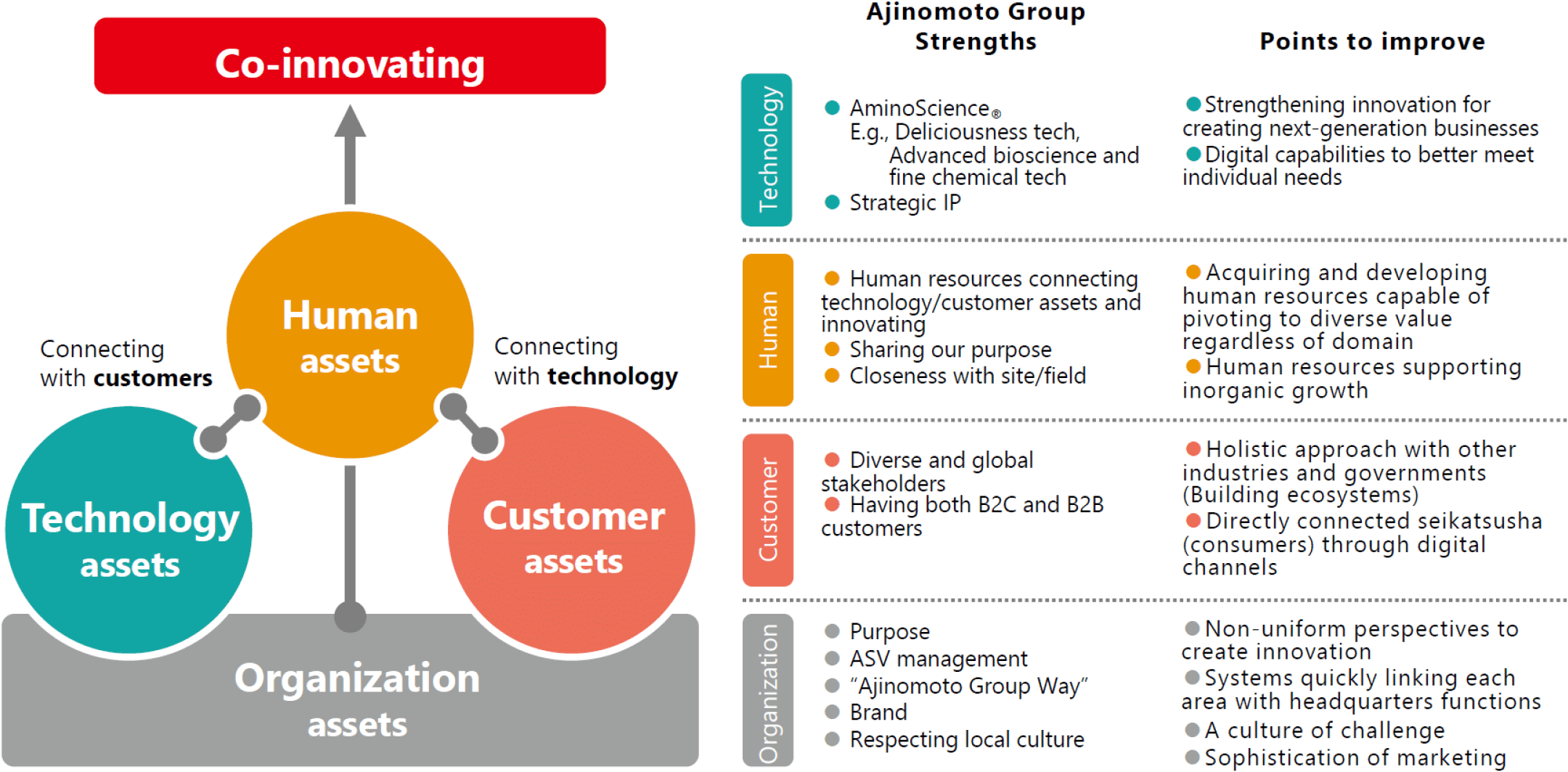

We have identified the technologies, human assets, customers, organization, and other intangible assets possessed by Ajinomoto Group. As ideas to utilize these assets grow in number, new business models and operations that achieve our ambitions are born and will become the driving force of growth.

Promoting Management that Understands Stock Price Formation and Sharing Performance

Koike On the topic of a stagnant share price being the motivation for your reform, was Ajinomoto's management conscious of share price in the past?

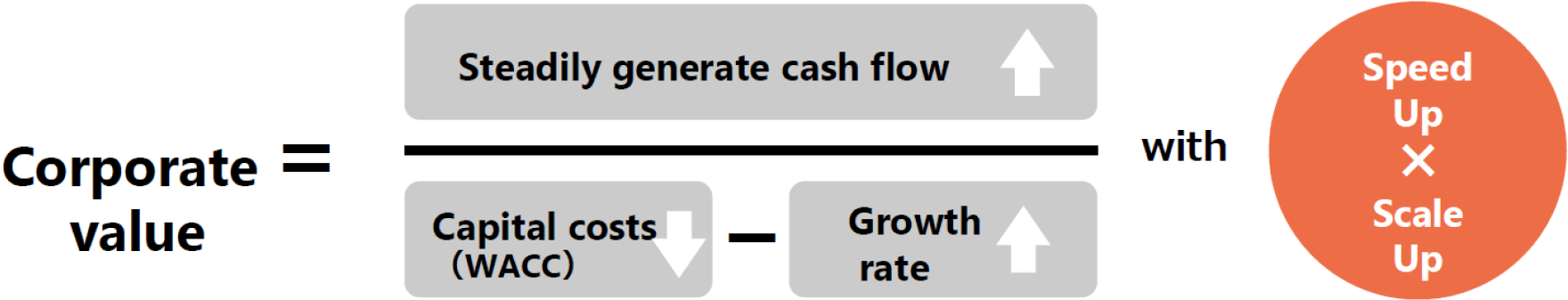

Fujie The phrase "the stock price is the manager's report card" has been in the company for a long time. However, it is difficult to say that we fully understood the mechanism of stock price formation. Since our new system was established in April 2022, we have held 5 executive training sessions to deepen our understanding and better grasp the finer points. In addition to the traditional corporate value formula where "cost of capital - growth rate" is the denominator and "cash flow" is the numerator, we have added our own unique factors of "speed up" and "scale up", and we have come to examine what is needed to improve each factor.

This does not only apply to our management. In 2023, by providing 100 shares of common stock to employees of the 20 companies that are members of the Ajinomoto Employee Stock Ownership Association, the participation rate of Group employees increased from 30% to 70%. We are making progress in promoting a virtuous cycle where the fruits of efforts to increase corporate value are returned through both share price and dividends, in addition to salaries.

A New Governance Framework Supporting Reform

Koike What have been the results of your governance reform?

Fujie Our company transitioned to a company with a Nomination and Compensation Committee, etc. and have reach a majority of outside directors on the board, creating a good sense of tension. In 2023, we clarified the definition of effectiveness for the board of directors. The first factor is determining the direction of management. The second is oversight of executives. The third, which I feel is the most important, is supporting the risk taking of executives.

Koike I'm sure there was some uncertainty regarding outside directors acting as a casting vote for management. Could you share some of the background behind this decision?

Fujie Ajinomoto has excellent human capital and has achieved growth through its internal capabilities. However, as digitalization advances, it becomes more difficult to handle matters with internal personnel alone. In response, we actively recruited experienced individuals, and experienced strong resistance in particular to hiring external executives. We were unable to change our vertical organizational thinking, which was resistant to the idea of relying on external resources and taking external advice. The board of directors played an important role of determining the direction of management in this case, and promoted internal reform by establishing a DX Promotion Committee and Chief Digital Officer (CDO) which would act across our organization laterally.

Koike What role do you expect the nomination committee to play?

Fujie We are currently seeking to clarify the role of executive officers. In particular, it is important to discuss the CEO's succession plan in the nominating committee. When I became president, I felt I should create a CEO Succession Plan myself, so I wrote up a draft and proceeded to discuss it with the nomination committee. Specifically, we plan to select two groups of candidates for the next CEO based on our overall policy and requirements for the CEO. One group will be for the case where the CEO changes within three years. The other is for a succession after the fourth year. The aim is to visualize the candidates' strengths and experiences while allowing them to experience the role on the frontlines, thereby empowering the nomination committee to choose the most appropriate successor. It's extremely difficult, but an important process.

Forgoing a Detailed Three-Year Plan for Management that Hones its Execution in Growth Areas

Koike I would like to hear more about your business. You've primarily developed business in the field of AminoScience, but what will be your growth driver moving forward?

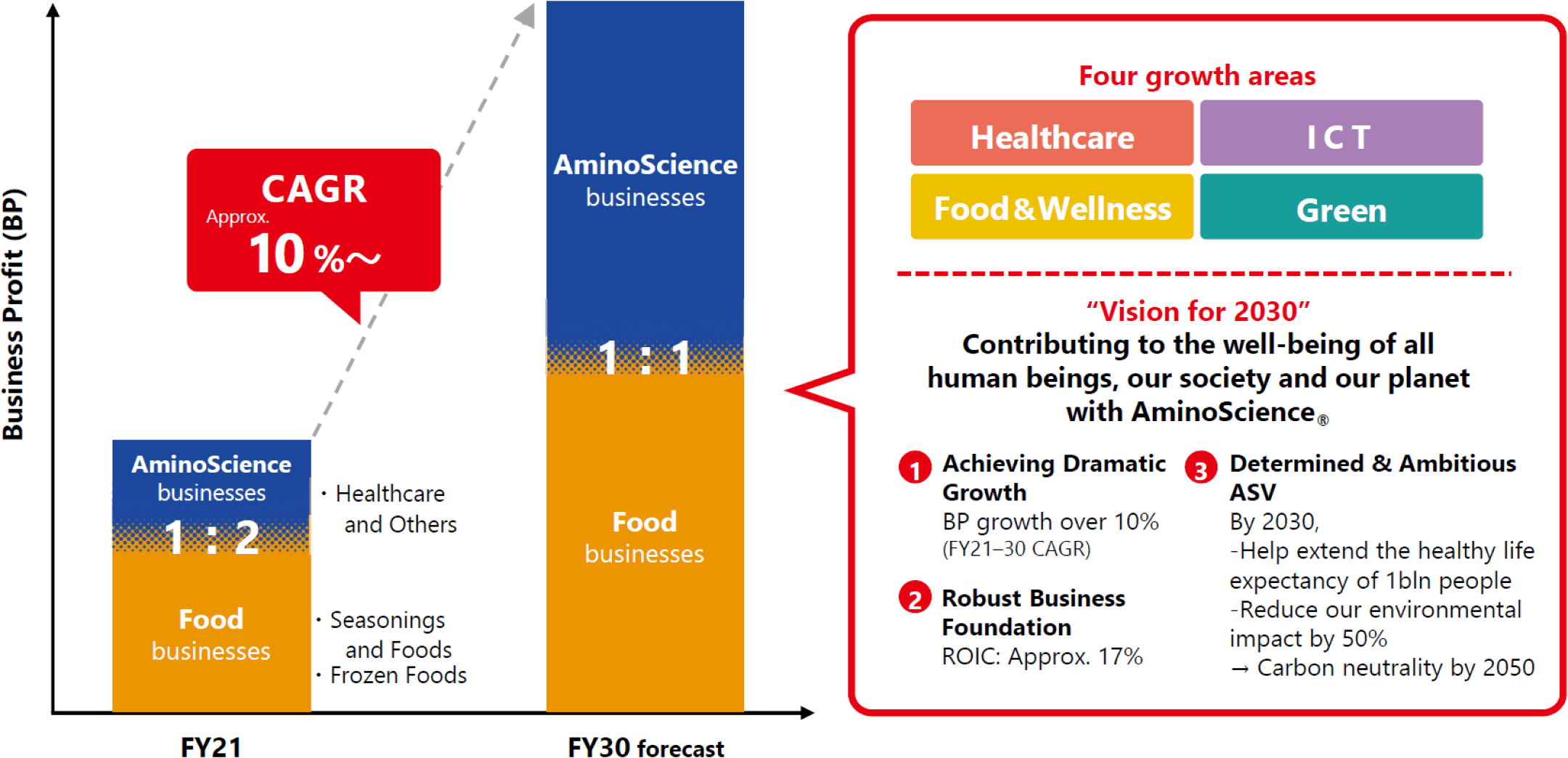

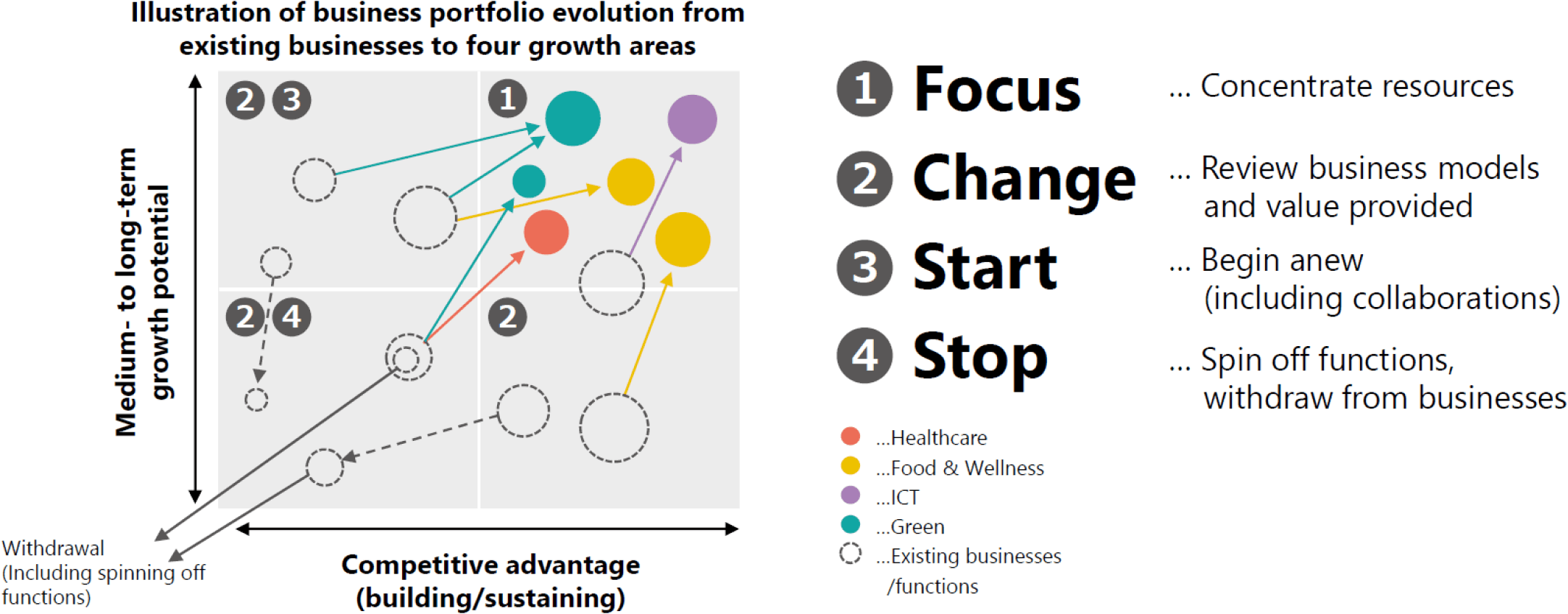

Fujie We believe that 5% organic growth per annum is sufficient for our existing businesses. Looking ahead to 2050, we have engaged our younger employees in discussions regarding where we can leverage the strengths of the Ajinomoto Group. We have identified four strategic growth areas: Healthcare, Food and Wellness, ICT, and Green. We will concentrate our human capital and funds in these areas.

Our key phrase is "Scaling Mt. Everest". Whereas you can climb Mt. Fuji in the right season with a little training, Everest is a different story. You need a long-term roadmap that includes gathering gear, collecting funds, creating a team, and a training routine.

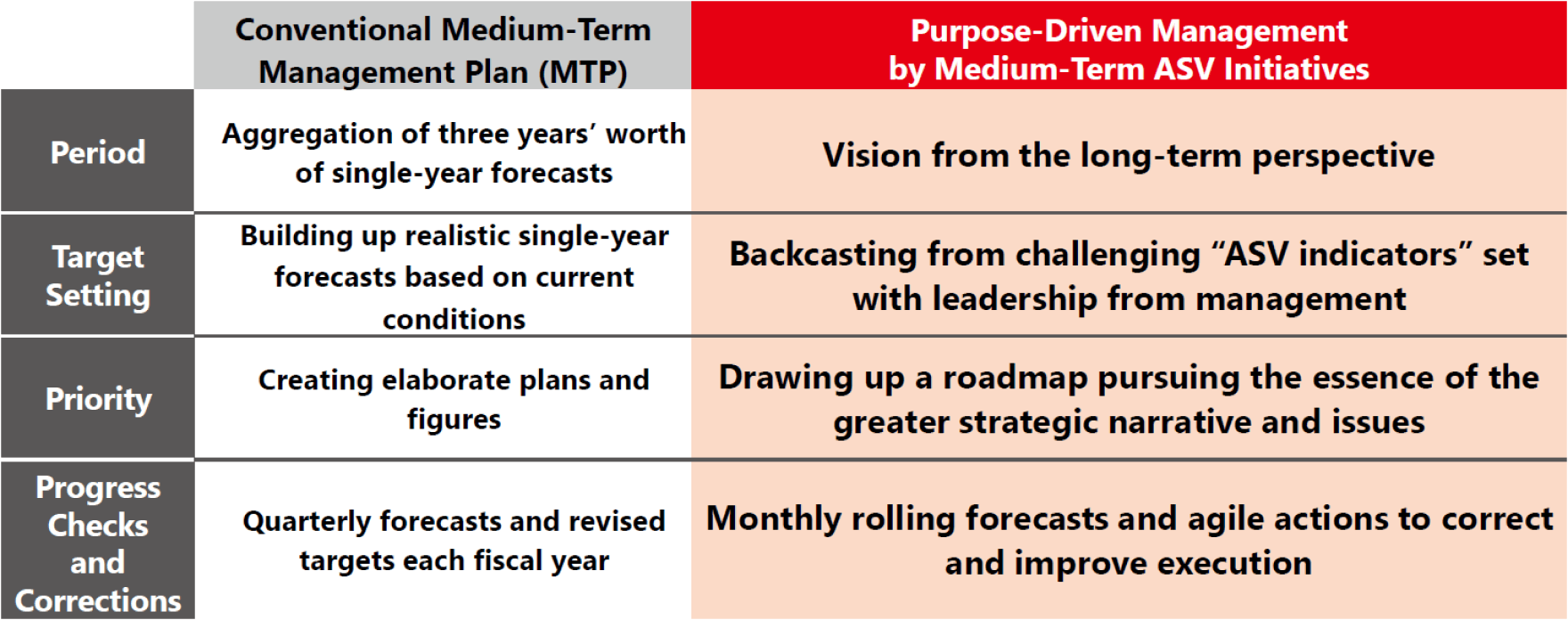

While serving as president of our overseas subsidiary, I realized that even though the business environment is bound to change, creating a detailed three-year plan could hinder growth, which led me to end the practice. In these times of rapid change, we abandoned excessive planning and adopted a management style that hones its ability to execute, and with our sights set on scaling Mt. Everest, we published the "Medium-Term ASV Initiatives 2030 Roadmap".

Koike Alongside our expectations for your strategy for 2050, as investors, we would like to see some KPIs through which we can judge progress.

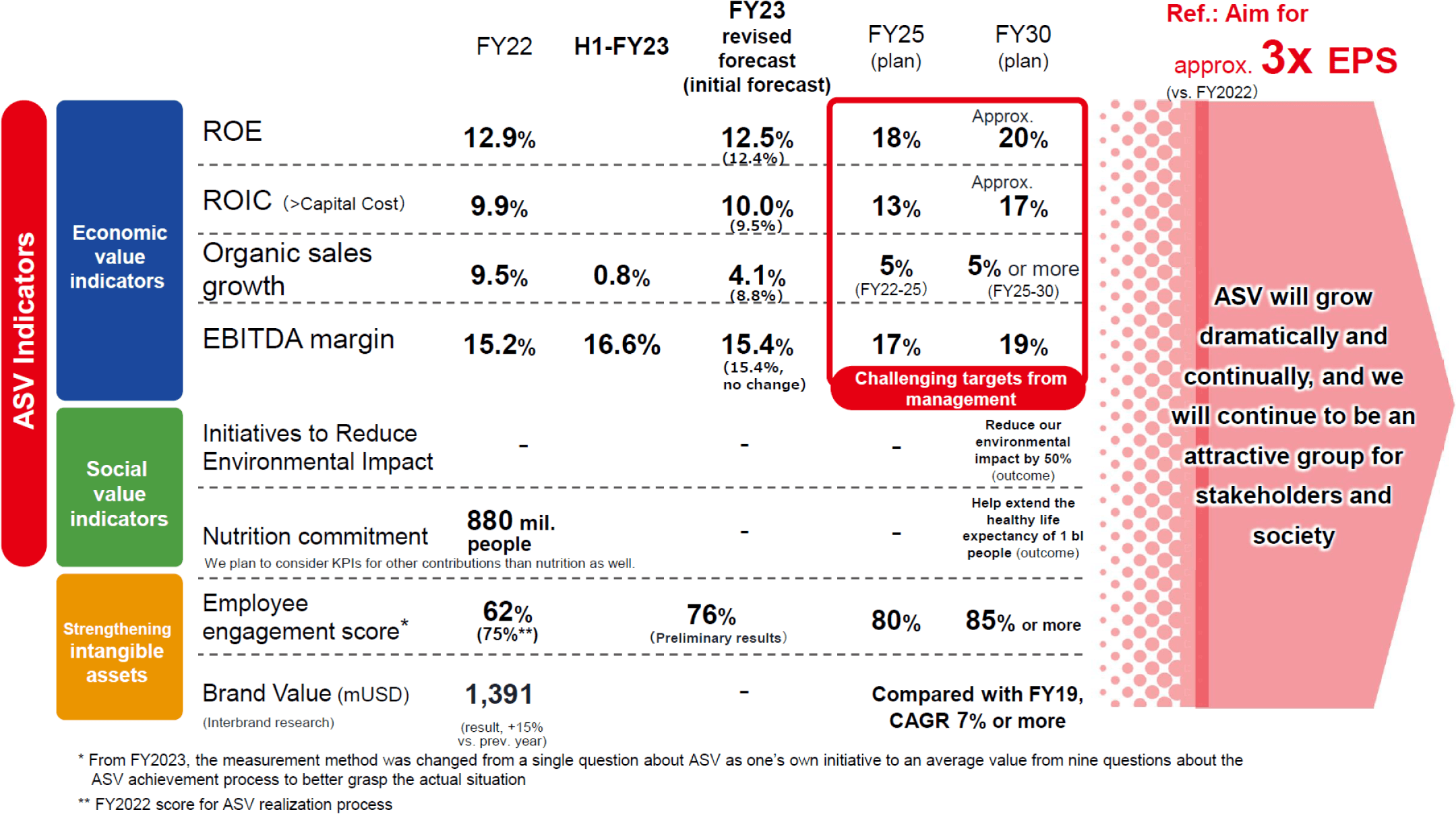

Fujie In the 2030 Roadmap, we have established ASV indicators consisting of economic value indicators and social value indicators, and we have provided not only targets for FY2030 but also milestones for individual fiscal years and the medium-term. We aim to achieve an ROIC (return on invested capital) of approximately 17% and an ROE (return on equity) of approximately 20% by FY2030. We plan to increase EPS (earnings per per share) by 3 times compared to FY2022. From now on, we will work hard to earn investor confidence in our ability to achieve our goals.

Establishing New Standards for Business Portfolio Management and Problem Solving

Koike While advancing your growth strategy, I think you also need to review your business portfolio. For example, your frozen foods business seems to have relatively low capital efficiency. What are your policies for managing your business portfolio?

Fujie We have completed more than 90% of our original asset light plan, but we will never stop reviewing our business portfolio. We also changed our business evaluation criteria. In the past, the vertical axis was defined as growth potential and the horizontal axis as efficiency, but now the vertical axis is defined as medium- to long-term growth potential and the horizontal axis is competitive advantage. For business that are low on either axis, we will implement stage gate management.

Since we operate multiple global businesses, there will always be difficulties somewhere. We handle issues with a three-step process. The first step is the corporation concerned, then the regional headquarters, and finally, if the management council certifies that the business requires attention, we will deal with it at our global headquarters. The frozen food business in North America was temporarily in the red due to the impact of the coronavirus, but the situation is currently improving significantly as we support the turnaround by recognizing it as a business requiring attention at the management council level.

In addition, we provide monthly visibility of performance management including TDC (Total Delivered Cost). People appreciate having their efforts represented in numbers and recognized. Furthermore, we can accelerate improvements by reflected achievements in compensation.

Koike Area expansion and M&A are necessary tools when strengthening a business portfolio. Could you share your basic policies on each?

Fujie For area expansion, the criteria are medium- to long-term growth potential and competitive advantage. Ajinomoto has strengths in Southeast Asia and South America. The region is developing an asset-light management model for frontier development, and in Laos, Bangladesh, and Cambodia, even small scale corporations can turn a profit. We would like to establish a model to expand the scale while maintaining profitability and achieving lateral expansion.

In our food business, we have had a series of failed M&As in the past. By learning from the methods of other companies and our own failures, I have identified two main problems. One is a division between the people who make decisions and those that execute them. The other issue is insufficient validation due to haste. Moving forward, we will thoroughly evaluate the competitive advantages of both our own company and our counterparts, identify synergies, and make decisions based on mutual understanding.

A Virtuous Cycle of Price and Wage Raises

Koike Ajinomoto is revising prices alongside increased costs. In Japan, many companies are resistant to both price and wage increases, which is often taken negatively by overseas investors. What is Ajinomoto's basic stance on this topic?

Fujie I experienced a failure when I was president of our subsidiary in the Philippines. Amid rising costs, we held out for price increases and waited for the situation to improve. As a result, we missed the timing to increase our prices and struggled to recover our business performance. A price increase needs to ride the wave from an early stage. If you miss your window, you have to wait for the next wave. It is also necessary for top management to clearly communicate that prices should be raised. Value determination is the central role of management.

I think it is important for society to have a virtuous cycle of price matching value, featuring moderate price increases and wage increases. Regular wage increases and the consumer price index (CPI) are the starting points for wage increases, and it is common sense that the degree of base pay increases is based on corporate performance. We will continue our efforts to make the virtuous cycle of price and wage increases more acceptable in Japan.

Koike In conclusion, in order to reinvigorate the Japanese capital market, what is your ambition as the manager of an over 3x PBR company?

Fujie There is still a gap between our PBR and those of the top global food companies. In order to bridge this gap, we need to act based on our corporate value equation (see previous figure for more details). In particular, we must raise our expected growth rate. The driving force of that is human assets, and we hope to raise our employees' enthusiasm for ambitions based in ASV.

Koike Thank you for that powerful message. I felt today's discussion was a guide to capital market literacy. I'd like to use it as an introduction to the best practices in ESG management.

Fujie Thank you for this opportunity.

This report is not intended as solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: December 25, 2023)