Engagement Feature Articles

The 77 Bank - Strengthening our profitability and strongly promoting our growth strategy in order to contribute to local communities.

Left: Hiroyasu Koike, President and CEO, Nomura Asset Management Co., Ltd.

Based in Sendai City, Miyagi Prefecture, The 77 Bank has contributed to the development of local communities since its establishment in 1878. In April 2021, The 77 Bank fixed a long-term strategy called "Vision 2030," and is pushing ahead reforms to carry out its "vision". Hidefumi Kobayashi, President of The 77 Bank, and Hiroyasu Koike of Nomura Asset Management discussed the competitiveness and business prospects of regional financial institutions.

The advantages of being in Sendai city

Koike This is the second time we have visited regional banks for a CEO meeting, following Concordia Financial Group. I think the environment is different from regional financial institutions in the Tokyo metropolitan area. First, could you tell us more about the role of The 77 Bank?

Kobayashi The Miyagi Prefecture - particularly Sendai City - is the center of our activities, and in which we have a strong customer base. Our principal role as a regional bank is to grow as the region grows. Being in Sendai which is one of big cities in the Tohoku region is an advantage, and we are constantly thinking about how to grow based on both the customer base we have built over our 146-year history and the transactions and services we provide there.

Koike In April 2021, you announced your long-term strategy called "Vision 2030" and put it in motion as a 10-year long plan. Could you please tell us more about your thoughts on setting this long-term strategy in the first place?

Kobayashi I took over as president in 2018, and within a little over a year after that, the COVID-19 pandemic hit. After the Great East Japan Earthquake, we focused our efforts on reconstruction, but the idea that we could return to the way we had been before the Great East Japan Earthquake created a sense of stagnation, and before we knew it, we had a corporate culture that did not push too hard and hated mistakes.

As a result, we were very passive in our actions as a banking organization, and the idea that we could set annual targets just a little above the past performance was prevalent. At this rate, the 77 Bank would be ruined. It was the president's job to change this corporate culture, and I was determined to quit my post if I was unable to make a change, so we began formulating a new management plan. In the past, we had formulated a 3-year plan, but since a shorter timeframe can lead to a focus on immediate goals, we have established a long-term vision spanning ten years. By gathering proactive input from outside directors, we have defined what we want the 77 Bank to be and have solidified our roadmap for reform.

If there are no profits, we cannot be of service to the community

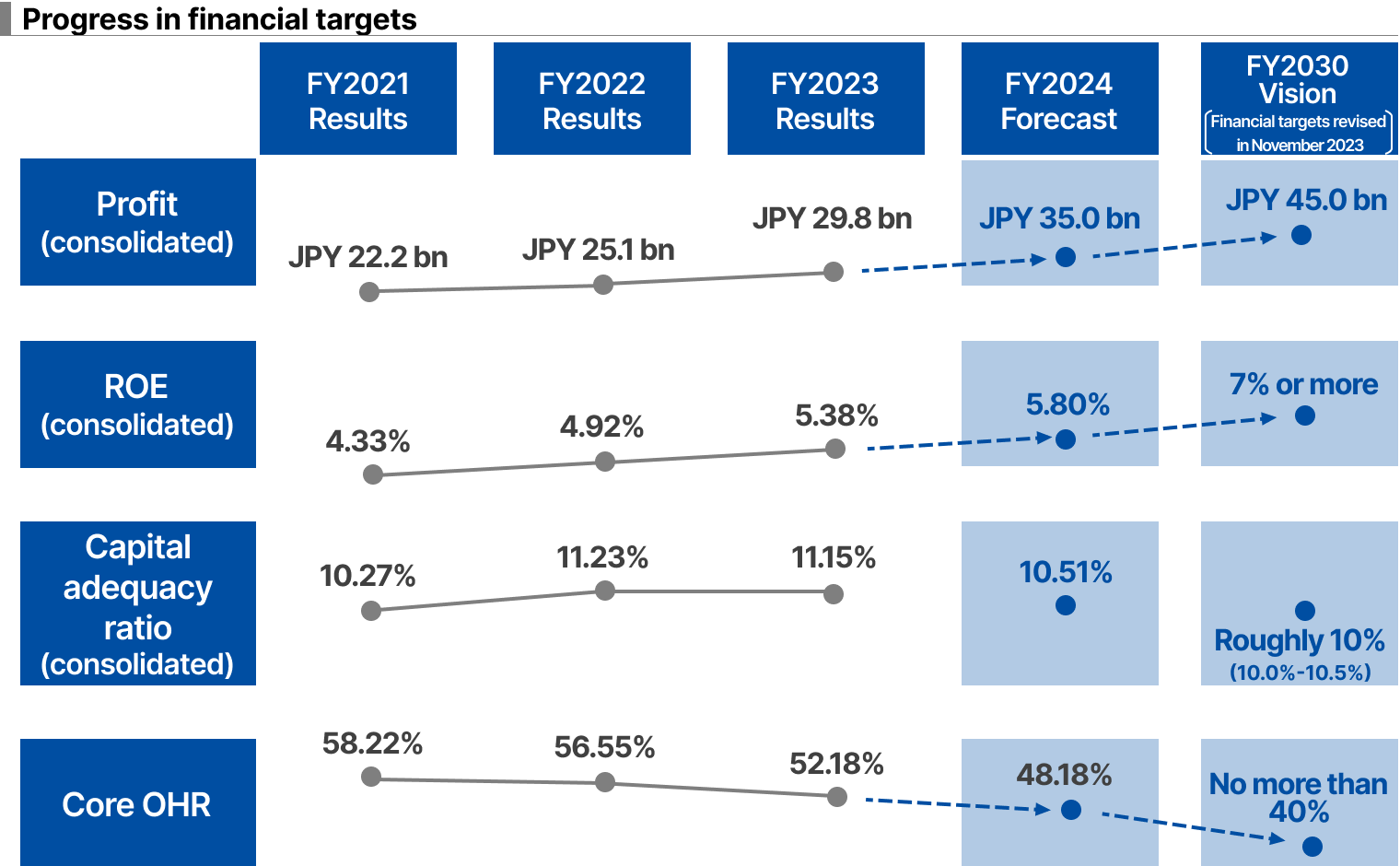

Koike As far as I can see, I understand that the reforms are progressing smoothly, including upward revisions to earnings. How do you feel about the progress accomplished so far and the challenges that lie ahead?

Kobayashi We are making sure to meet our annual targets for our plans to not turn out to be a pie in the sky. It is very important for all bank employees to be informed, but the COVID-19 pandemic has had a positive effect, and I myself have been able to change the mindset of bank employees by visiting each branch, giving explanations and answering questions.

We have entered a positive cycle in which our proposals are evaluated by our customers, ultimately resulting in profits and beneficial outcomes.

We are now in our fourth year, and in order to get closer to our goal of becoming a leading company, we have three levels in our plan to consider. I would say that we are currently at the second level of the three levels, meaning that we believe that we still need to reach the next level to accomplish our vision.

Koike As you used the expression "leading company", do you have any image of what you would like the bank to become or any benchmark?

Kobayashi Each regional bank has its own personality, and there is no specific bank we want to aim for. After all, this process is the result of thinking on our own and aiming for what we should be and what we want to be. The potential of the Tohoku region as a market is seen as low, and we are conscious of the importance of increasing profitability for us to change. Without profits, we cannot help the region; we pay less taxes and we cannot make investments and donations. I have repeatedly explained to bank employees that profits are not just numbers but are a key factor in various situations. In the end, we need to make sure that we produce net income every year.

Before the launch of "Vision 2030", our bank was a regional bank with low productivity despite its size. In terms of improving productivity, the most significant achievements since the launch of this project may have been the promotion of in- store operations, in which multiple branches operate within the same store, resulting in the streamlining of administrative operation and thorough digitalization.

Various projects are underway, and growth is expected in Miyagi Prefecture.

Koike The amount of loans and lendings seems to be growing steadily. What is your view on the economic situation in Miyagi Prefecture and Sendai City, knowing that they are the bases of your business?

Kobayashi The population of the entire Tohoku region is declining, and the aging society situation is becoming more severe year by year. However, due to the concentration of population in Sendai City the situation has been quite stable over the past few years. Various projects are under way, and it is expected that our GDP will increase throughout the prefecture.

For example, Tohoku University has been recognized as Japan's first "University of International Excellence," aiming to become one of the world's top research institutions. Through the university funds established by the government, researchers from Japan and abroad will gather, meaning that we can expect that Research and Development sectors will become more active. We can note that Tohoku University's next-generation synchrotron radiation facility, Nano Terrace, has also started operations.

It's unfortunate that PSMC, a major semiconductor company in Taiwan, decided to forgo expanding into Miyagi Prefecture. However, it can also be said that this highlights the region's potential as a suitable location for the semiconductor industry. Given that the semiconductor industry is a national policy, I hope that we will be able to attract companies through other initiatives in the future. Furthermore, a redevelopment project of the city center has begun in Sendai city. We are currently at a standstill due to the soaring construction costs, but given the deterioration of the buildings, we have no choice but to move forward.

Obtaining business information from sales activities at our branch offices

Koike While the region is expected to become more active by attracting industries, competition among financial institutions is also likely to intensify. Do you have any issues regarding competition within the financial industry?

Kobayashi Focusing on retail customers, large securities companies have been operating in Sendai City for a long time, and we also offer securities business for the High Net Worth clients through our group securities companies. However, Internet-based banks and securities firms pose a threat. Our challenge is to respond to the mass market, differentiating ourselves by making good use of digital convenience and low-cost mechanisms while diverting face-to-face human work to high-value-added work.

Although the number of customers visiting our branches has decreased, it serves as a base for sales activities, allowing us to gather comprehensive information. This advantage positions us favorably against online banks and other banks with branches in the prefecture, making our information capabilities appealing to corporations in the Tokyo metropolitan area looking to expand into Miyagi Prefecture.

Additionally, since our bank has transactions with local companies, many of their employees open salary accounts with us. This is a decisive advantage in attracting retail customers. When it comes to securing stable funds for investment, namely personal deposits, it is important to be involved in transactions, including settlement services. Banks and group companies have a system in place to handle such transactions as stock management like NISA, trust services related to inheritance, insurance for risk preparedness and other matters. However, in order to respond to diverse investment needs, including real estate management, strengthening cooperation across the 77 Group is a priority.

We are aiming to achieve a stable realized gain of 1% or more annually

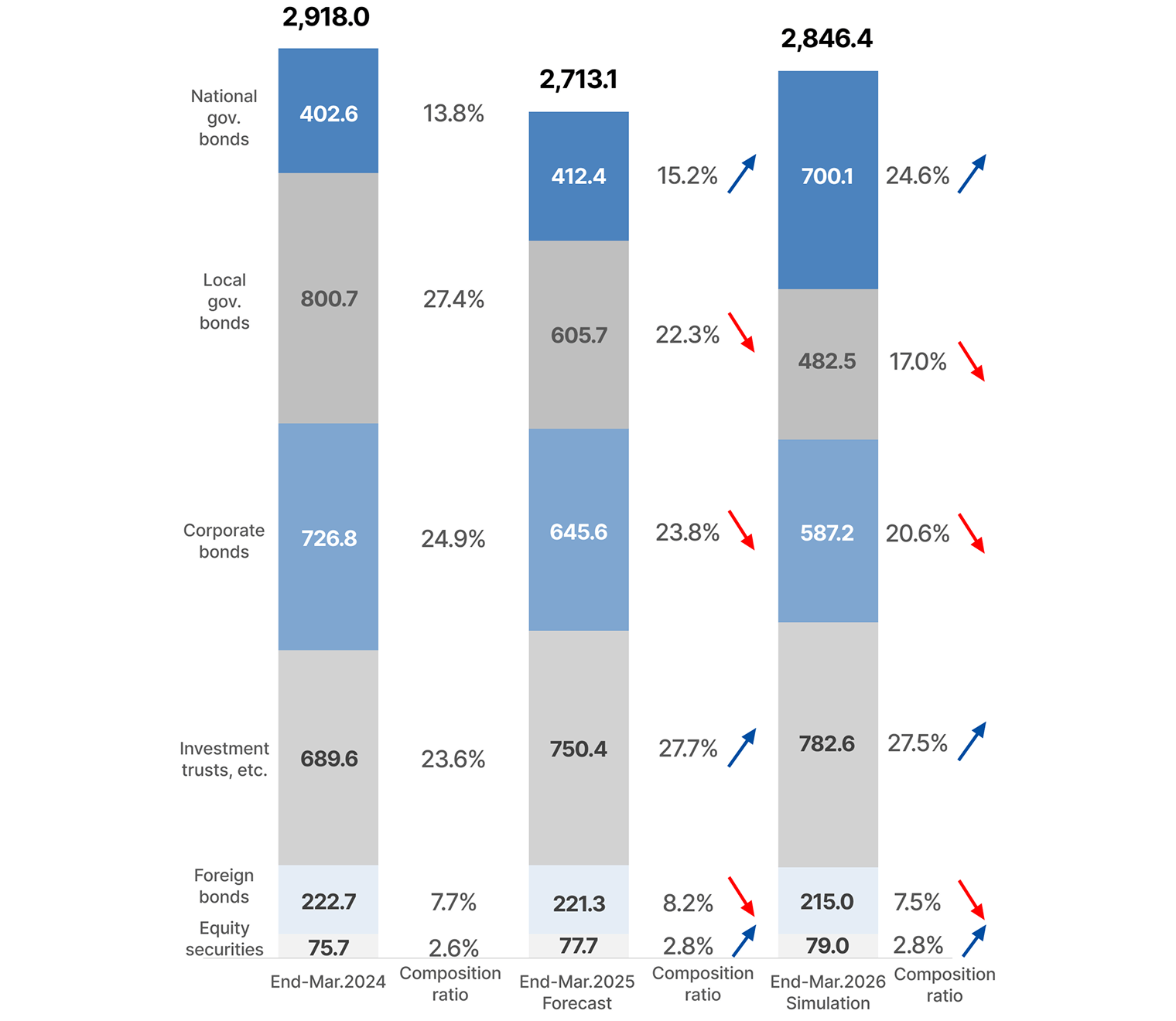

Koike The 77 Bank manages securities investment on its own account, and I understand that it has secured more solid returns than other regional banks. What is your investment structure and policy?

Kobayashi Since we were originally a bank with a low loan-to-deposit ratio, we had a lot of room to invest in securities. At first, we bought Japanese government bonds, but as the size of our investment grew, we needed to review our portfolio. In addition to cash stocks, we have diversified our investments by using investment trusts since investment targets and methods are quite flexible. We aim to achieve a realized gain of at least 1% per year for our overall securities investment. We believe that ensuring stable realized gains will lead to the safety of our financial base. Currently, interest rates are rising, and we have bonds that mature every month, so we are carefully considering the timing of buying and selling bonds while bearing in mind the risk of a negative carry.

The challenge of reorganizing in full scale due to regional differences

Koike I would like to ask about the possibility of cooperation and alliances between banks. There is the TSUBASA Alliance as a wide-area collaboration among regional banks, and the 77 Bank also participates in MEJAR * for its accounting system. Amid talks of restructuring regional banks, Aomori Bank and Michinoku Bank recently merged in Tohoku. What are your thoughts on restructuring banks in the Tohoku region?

Kobayashi Accounting systems are becoming more and more complex, and there is a sense that we cannot cope with them on our own in terms of cost. I think joining MEJAR was a good decision. In addition to the system, we have collaborated with other participating banks, such as the Bank of Yokohama, the Hokuriku Bank, and the Hokkaido Bank. For example, it has become easier for us to communicate with each other when making syndicated loans.

However, when it comes to full-scale reorganization rather than collaboration, I have the impression that it will be difficult because of regional differences.

Vertical integration within the same prefecture, such as that of Aomori Michinoku Bank, is likely to be effective in improving efficiency and is a realistic option that can be considered at this point.

The value of a bank does not lie in prioritizing integration or reorganization, but rather in expanding its business by leveraging regional characteristics and enhancing corporate value. However, in terms of future survival and growth strategies, there will be aspects where a focus solely on the region will be insufficient, so I believe collaboration is necessary from a different perspective.

*MEJAR: A core system jointly used by the Bank of Yokohama, the Hokuriku Bank, the Hokkaido Bank, the 77 Bank, and the Higashi-Nippon Bank.

Human resource development specializing in external relations and management

Koike In my opinion, human resources will be a key factor for 2030. I have heard that local financial institutions have difficulties to recruit young people. Can you tell us about the efforts made by the 77 Bank in terms of human capital, such as the recruitment and development of human resources?

Kobayashi There are about 20 universities in Miyagi Prefecture, so there has been no noticeable impact on the hiring of new graduates. However, the absolute number of applicants has decreased. This is partly due to the decrease in the number of young people and the decline in the popularity of banks. The number of applicants has decreased by about 1/3 compared to the past, but it is still more than 10 times the number of new graduates hired. In addition to hiring new graduates, we are also focusing on mid-career hiring to enhance the expertise of the entire Group.

As the population declines, it is fundamental to have people do the work that should be done by people. We will replace administrative tasks such as deposits, lending, and foreign exchange operations with digital technology as much as we can, and we will also use generative AI in headquarters operations.

Nearly half of the bank's staff have obtained IT passport qualifications, but ideally all of them will obtain them. It is important to have a good sense of digital literacy, which will lead to greater work efficiency, productivity, and security awareness. At the moment, we are sending a bank employee to Tohoku University as a candidate for a digital specialist.

We intend to invest in training and education in specialized fields such as external relations and management, which are highly technical and should be conducted by people who would eventually be able to perform high-value-added work.

We need to upgrade our growth strategy.

Koike Listening to your insights makes me sense the significant potential, and indeed, the stock price has increased about threefold over the past few years. On the other hand, the PBR is about 0.5 times, and the stock valuation remains low.

Kobayashi ROE has barely exceeded 5%, and we need to further enhance profitability and steadily increase net income. We will also make effective use of risk assets and strengthen commission revenues. We feel that our appeal to major investors in Japan and overseas is still insufficient, and we need to come up with a growth strategy that will overcome doubts about whether banks in Tohoku will grow.

For example, we have established a corporate sales office in the city of Utsunomiya, Tochigi Prefecture, to attract companies interested in Miyagi Prefecture and promote economic exchanges. As for international business, we will establish a local subsidiary in Singapore to increase business opportunities for Tohoku companies and consider measures to encourage investments from abroad.

Koike When I talk to international investors, even those who have a fondness for Japan, there are times when they do not fully understand the differences between Japanese financial institutions. There is a growing awareness of regional banks as investment targets, and the reason is simple: valuations are extremely low. I often explain that 'investing in regional banks is essentially investing in the region,' and that seems to resonate with them. Once they reach the understanding that 'there are no significant differences in business models and that each institution operates alongside the development of its region,' they finally begin to take an interest in and start learning about regional characteristics.

In your case, I think the key is to make it easy to understand the characteristics of regions that have potential, particularly in the manufacturing sector. Industry-academia collaboration is commonplace internationally, so bringing up Tohoku University, an "international university of excellence," serves as an effective appeal.

Kobayashi I would like to increase the number of investors visiting Miyagi Prefecture, combining their visits with tourism. We have been raising our dividend payout ratio, and if profits continue to increase, so will the dividend amounts, which will enhance the attractiveness of our shares. To further strengthen our position as a leading company among regional banks, we are also pursuing initiatives in new business areas, so I hope you will keep an eye on us.

Koike I'm looking forward to seeing what the future holds. Thank you very much for taking your time today.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: March 26, 2025)