Engagement Feature Articles

Ryohei Yanagi, Phd, Visiting Professor with Waseda University Graduate School - Quantifying the Value of Non-financial Capital should Increase the PBR of Japanese Corporations over 2x

Right: Hiroyasu Koike, President and CEO of Nomura Asset Management Co., Ltd.

As represented by ESG, corporations and investors are increasingly pursuing initiatives to increase corporate value through added focus on non-financial capital, such as human capital, intellectual property, and social contributions. However, the challenge of quantitatively representing non-financial capital remains. Dr. Ryohei Yanagi, Visiting Professor with Waseda University Graduate School and creator of the "Yanagi Model" of linking ESG and corporate value, joined Mr. Hiroyasu Koike, President and CEO of Nomura Asset Management, to discuss what is needed to realize the potential value of Japanese companies.

Dr. Ryohei Yanagi

Visiting Professor with Waseda University Graduate School of Accounting

Senior Advisor (Former Chief Financial Officer), Eisai Co., Ltd.

Financial Consulting and Engagement, M&G Investments Japan and ABeam Consulting Ltd.

The Under-appreciated "Invisible Value" of Japanese Companies

Koike As an institutional investor, we believe that engagement is important for invigorating the Japanese equity market, and as such, I have been conducting interviews with various Japanese CEOs. Today, I would appreciate hearing your broad perspective on the topic, as both the former CFO of Eisai Co., Ltd. and an academic who has contributed to the understanding of potential corporate value.

When speaking with overseas investors, I get the impression that insufficient understanding of Japanese companies is a factor contributing to the long discounted valuations of Japanese equities. Lately, market participants have sought disclosure of concrete measures to address companies whose profitability is below the cost of capital or whose PBR is below 1x. What do you view as the source of the sub-1x PBR issue?

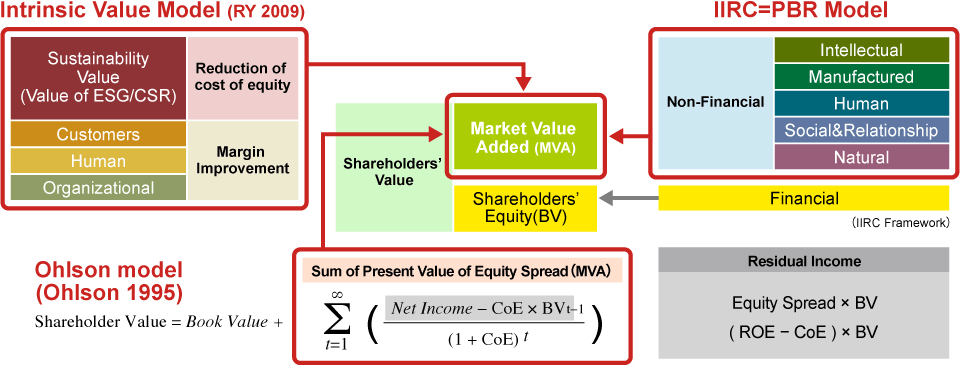

Yanagi While language, geography, and culture are obstacles to overseas investors understanding the potential value of Japanese companies, I believe there are three principle issues. The first is that many companies have low ROE due to excess capital, which can be remedied in the relatively short-term through share buybacks or other measures to increase shareholder returns. The second, an issue which will take more time, is resolving the conglomerate discount via R&D investment or business selection/focus. The third issue, which requires the longest-term perspective, is the lack of quantifiable data reflecting ESG and non-financial capital. I created the "Yanagi Model" based on the hypothesis that the added value of ESG is reflected in the portion of PBR above 1x. I believe there is substantial room for reassessment of the value of Japanese companies through the quantification and disclosure of ESG and non-financial capital information. However, the level of PBR 1x is too low, and it should be more in-line with developed countries at PBR 2x or higher, given Japan's strength as a nation. We must engage companies in substantial dialogue with these high expectations.

Increasing Visibility of "Invisible Value" Deepens Engagement

Koike As a demonstration of the Yanagi Model, in the case of Eisai, you conducted a multiple regression analysis of the delayed penetration effect of the ESG of a single company. From there, how did you become involved in the Impact-Weighted Accounting Initiative (IWAI) led by Harvard Business School (HBS)?

Yanagi I was introduced to an HBS professor and approached regarding joint research at IWAI. Because the Yanagi model is complex and requires insider information, it is difficult to apply to a large number of companies. However, HBS's IWAI can be applied more generally, thanks to their advocacy for a simple method of adjusting traditional accounting information to take into account the various social impacts brought about by ESG.

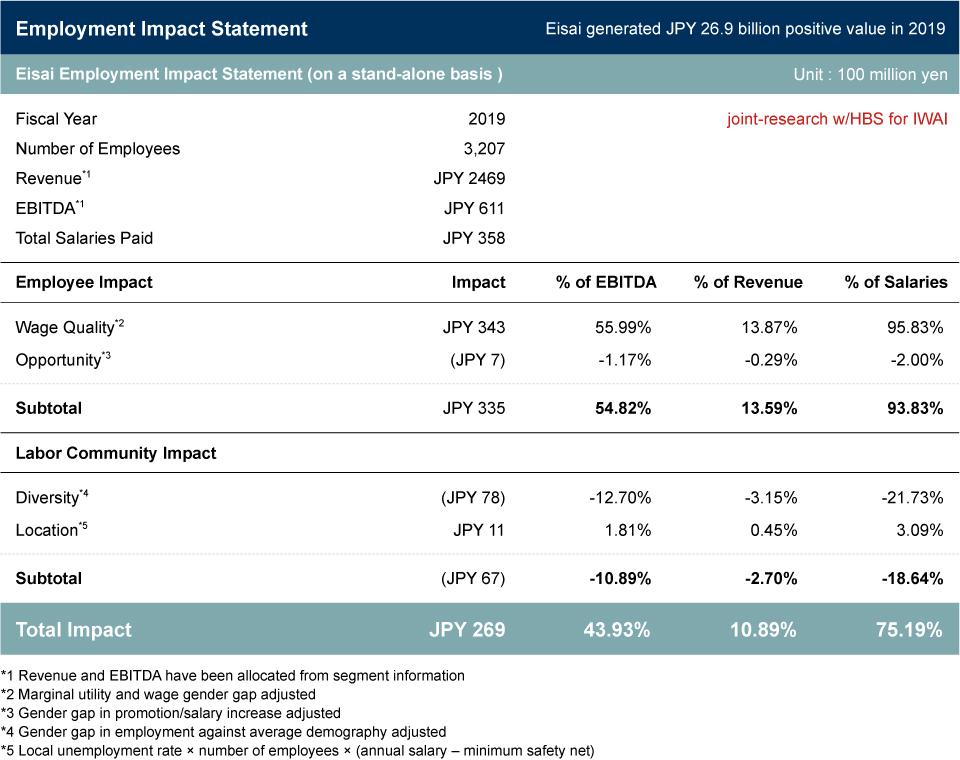

Koike HBS recognizes the first case of IWAI in Japan to be Eisai's employee impact accounting, where the employment impact statement is calculated. Could you share an overview of this?

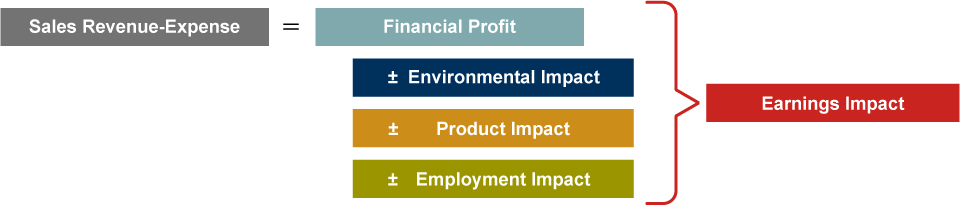

Yanagi For accounting purposes, labor costs reduce profits. However, as shown in the case of Eisai, if an investment in human capital leads to improved PBR in, for example, five years, it would be considered value (social impact) under IWAI, not an expense. Therefore, in accordance with the IWAI format, we calculated "positive social impact creation" by totaling the marginal utility of wages, the gender wage gap, the difference in promotion and salary raises, the ratio of male and female employees, diversity, and contribution to regional society with Eisai's total amount of salaries (35.8 billion yen).

Koike By quantifying the impact, you can visualize it. Listed companies will be required to disclose human capital information in their financial statements starting in fiscal year 2023. Will this enable more companies to utilize employment impact statement?

Yanagi By promoting the disclosure of human capital information, I believe that companies will be able to use a simplified method that is close. However, it would be difficult to reach the standards of HBS. Companies seeking more precise calculations should pursue joint research with consulting firms.

Koike It's not completely meaningless to use a model less precise than HBS. I'm hopeful that even a more simplified method will provide an opportunity to change the thinking of management regarding human capital.

Yanagi You're absolutely right. There is meaning to management and investors having figures for which they hold a common understanding. Additionally, a simplified method will allow investment institutions to make calculations to compare over time and against competitors.

Koike I think impact accounting is significant not only for quantifying these factors, but also for introducing Japanese corporations to this concept. Impact accounting can be divided into: environment, products, and employment. In the case of Eisai, you also measured product impact in addition to employment impact, correct?

Yanagi Within impact accounting, environment and employment can be calculated in a somewhat uniform format. On the other hand, product impact is unique, and the selection and calculation methods of target products can vary depending on the company and industry. It's important to check if the selection and methods align with the company's purpose and materiality. It would be meaningful when calculating product impact aligned with the company's materiality and examine them in light of the company's purpose.

Koike Do you think it's conceivable for companies to choose products arbitrarily?

Yanagi That's something to consider. Looking at cases other than Eisai, we find some companies select products according to the purpose and materiality, while others place less priority on selection.

Koike That's where investors must enter and give feedback through engagement.

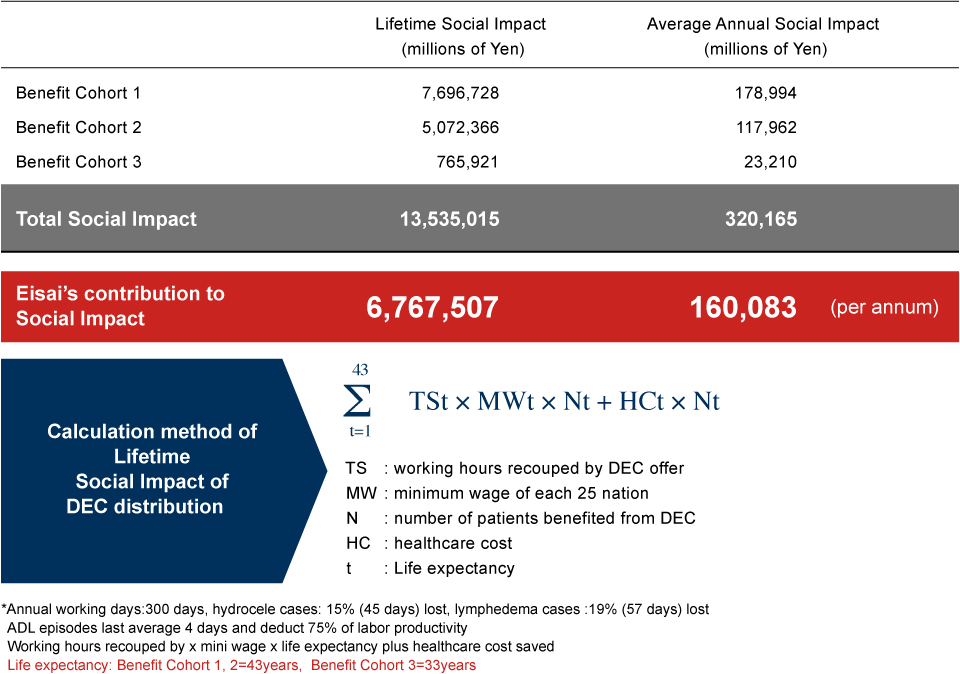

Yanagi Yes, for Eisai's product accounting, we selected DEC tablet treatments for lymphatic filariasis because it aligned with the "efforts to improve drug access". Impact accounting was also applied to the pricing of LEQEMBI (generic name: lecanemab), an Alzheimer's treatment that recently received accelerated approval in the United States.

At the Edge of a Corporate Valuation Paradigm Shift

Koike I believe that companies adopting impact accounting with clear purpose and materiality will lead to improved corporate value.

Yanagi Additionally, we must have a paradigm shift from "corporate value = financial value" to "corporate value = financial value plus non-financial value (impact value)".

Koike I feel we're at the edge of a paradigm shift, but companies and investors have not fully digested the situation.

Yanagi Disclosure is one of the issues on the corporate side. In terms of information, we need not only that in accordance with the future standards of the International Council for Sustainability Standards (ISSB), but also free performance matters that reflect the company's personality. In any case, without a certain level of quality, we cannot conduct comparisons through time or against competitors, so the basis of calculation should be published in some form. On the other hand, for a company's efforts to be rewarded, long-term investors must recognize non-financial value and incorporate them into their investment decisions. In addition to the challenge of creating an investment model that can demonstrate the statistical significance of incorporating non-financial value and impact accounting, it is important to examine whether discussions based on quantitative data like impact accounting can deepen dialogues while engaging with individual companies.

Engaging to Improve a Company's Intrinsic Value

Koike At Nomura Asset Management, we are also strengthening our engagement with companies in order to improve corporate value and enhance the attractiveness of Japanese equities. In the past year, I have had many opportunities to meet directly with top executives, as well as engage in dialogue with analysts.

Yanagi I think investor engagement is the last hope for changing corporate Japan. Companies can change significantly based on the commitment of top management. Of course, analyst engagement is also necessary, but dialogue at the top is vital.

Koike Do you have any topics or approaches for engagement that you would like to see from asset managers?

Yanagi As I mentioned earlier, I would like to see you calculate corporate value using both financial and non-financial value, and leverage that in your engagement activities. Additionally, because investments in human capital and environmental measures are a negative factor for short-term accounting profits and cash flow, despite being beneficial to corporate value in the long-term, I would like to see you take a strong stance on long-term time horizons. Also, I would like you to keep in mind quantification when engaging with companies. Discussions become qualitative the closer you get to the top, but without numbers, you can't account for these factors in corporate value. So, I think a quantitative approach is preferable.

Koike We are conducting engagement with the mentality that institutional investors must take the lead in market revitalization, and we feel some difficulty in the current framework of engagement in Japan.

Yanagi Engagement is often expressed as "dialogue or conversation". But personally, I believe it is "shareholder's serious involvement to improve corporate value", and must be achieved from time to time through exercise of voting rights or shareholder proposals, and, in its extreme case, via hostile takeovers, in addition to friendly discussion. As you say, there are difficulties, such as how far investors can go in transforming a company's business structure. However, I would like to emphasize that, among all, non-financial value and impact accounting can help when having a serious, in-depth discussion about a company's intrinsic value.

Koike Thank you very much. In closing, do you have any expectations or advice for Japanese CFOs or management based on your experience?

Yanagi The CFO is responsible for maintaining a company's value. If a CFO is able to quantify both financial and non-financial information and speak about it, they will be able to achieve a PBR beyond 2x. The key to achieving that is engagement between motivated CFOs and knowledgeable investors. I hope you will do your best.

Koike I will. Today's discussion was very enlightening. I hope you will continue offering your guidance to invigorate the Japanese equity market.

(References)

Yanagi, R. 2021. Disclosure in Integrated Report of Employee Impact Accounting. Monthly Investment Market No. 433

(Source) Yanagi, R. 2022. ESG Accounting for Drug Donation of Neglected Tropical Disease Medication. Monthly Investment Market No. 445

Yanagi, R. 2018. Integrating NON-FINANCIALS to Create Value. Strategic Finance (IMA)

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: May 19, 2023)