Engagement Feature Articles

Sumitomo Mitsui Financial Group - Create New Value through "Fulfilled Growth"

Left: Hiroyasu Koike, President and CEO of Nomura Asset Management Co., Ltd.

We offer our sincere condolences, as Mr. Jun Ohta of Sumitomo Mitsui Financial Group, Inc. passed away on November 25, 2023.

Paradigm shifts, such as digitalization and changing behaviors, are driving changes in the financial industry. Sumitomo Mitsui Financial Group (collectively the "SMBC Group") aims to achieve "Growth with Quality" in response to these environmental changes. What kind of value can be expected in the future from this major financial group, which operates a wide range of businesses including banking, securities, credit cards, consumer finance and leasing? Mr. Jun Ohta, Group CEO, joined Mr. Hiroyasu Koike of Nomura Asset Management to discuss this topic.

Surviving in a World without Air for the Past Two Decades

Koike We have been conducting dialogues with the top executives of Japan's leading companies through our "Project BRIDGE" campaign. This reflects our desire to bridge the gap between intrinsic corporate value and stock prices by serving as a bridge between companies and investors.

The first thing I want to ask you is about stock prices. Tokyo Stock Exchange is sending a message to companies with Price to Book Ratio (PBR) of less than 1x to make improvements. What is your view on this topic, be it from the perspective of SMFG's share price or the banking sector as a whole?

Ohta As a Group CEO, I feel shame about the market's assessment reflected in our PBR of less than 1x. On the other hand, I also take pride in the fact that over the past 20 years, I have steadily implemented growth strategies and focused on bottom-line profit growth and ROE improvement, while confronting the severe environment of ultra-low and negative interest rates. We have also worked to reduce the cost of capital by eliminating information asymmetry through the enhancement of disclosure, including non-financial information. As a result, our company's PBR has been improving recently, in combination with expectations for a revision in monetary policy.

"Create an Era of Fulfilled Growth" in the Next 30 Years

Koike Could you share the thoughts behind the title of new Medium-Term Management Plan, "Plan for Fulfilled Growth", which forms the foundation of your growth strategy?

Ohta In our Annual Report 2022, I stated that I wanted the next 30 years to be an era of "Fulfilled Growth". For me in my sixties, the first 30 years of my life were a period of high economic growth in Japan. The next 30 years were a period of bubble bursting and subsequent stagnation. Social issues that had been hidden behind rapid economic growth came to the surface at once.

Now that the stagnation is finally coming to an end, I want to make the next 30 years an era in which people can feel fulfilled by not only pursuing economic growth again, but also actively contributing to addressing social issues. This is our goal of "Fulfilled Growth," and our strong determination to achieve this goal is reflected in the name "Plan for Fulfilled Growth."

Koike The negative interest rate environment makes it difficult for banks to generate profits, and I think it is very difficult to formulate a business strategy. Did you consider revising your definition of banking or raison d'etre in order to respond to the changes?

Ohta I believe that the financial industry is a GDP business, meaning the market size is proportional to the amount of economic activity in a country. Therefore, in Japan, where the potential growth rate is low, financial markets cannot be expected to grow significantly. On the other hand, the function of finance itself, regardless of its forms and players, remains essential to society. If banks are no longer in charge of this role in the future, we don't have to remain as a traditional bank. Instead, we believe that we can become the bearers of the financial functions vital to society. We can achieve this by consistently providing high-quality products and services that meet our customers' needs.

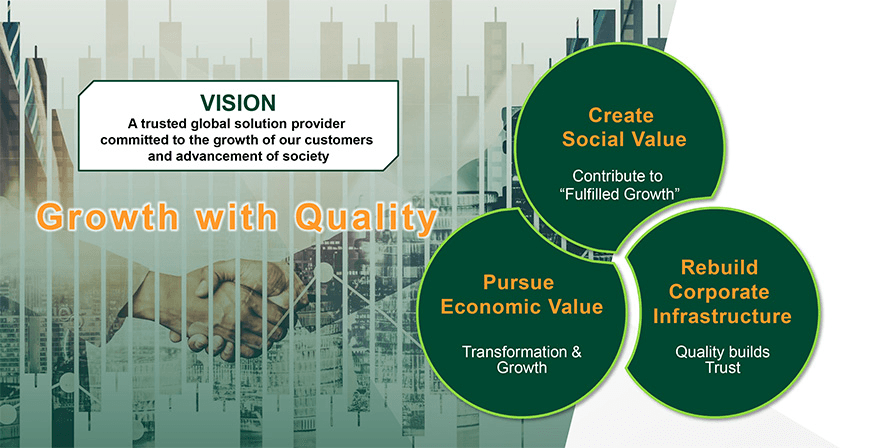

This belief is why SMBC Group holds the vision of becoming "a trusted global solution provider committed to the growth of our customers and advancement of society." We deliberately avoid the word "finance" in this vision. This is because we aim to continue evolving beyond the framework of "banking" or "finance."

The new Medium-Term Management Plan, launched in April 2023, sets out three core policies to achieve "Growth with Quality": create social value, pursue economic value, and rebuild our corporate infrastructure.

"Olive": A Thorough Digital Solution

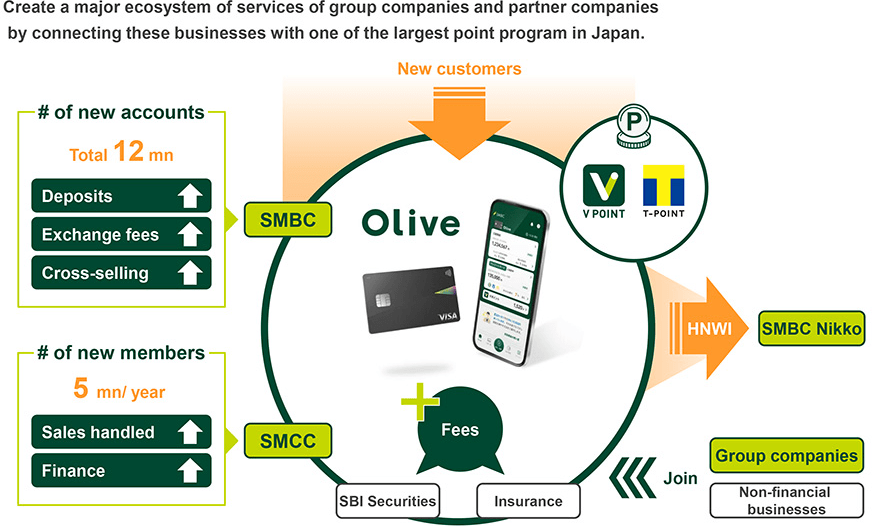

Koike I feel that the mobile integrated financial service "Olive" is symbolic of the future SMBC Group. Are you planning to pursue businesses that will be more profitable than in the past era with interest rates, or are you trying to develop new services with different revenue models?

Ohta "Olive" is a service born from the idea of thoroughly digitizing the retail business in Japan. We hope that by fundamentally reviewing the cost structure of the service, we will lower the break-even point and create a service that generates stable revenues. Furthermore, by enhancing convenience and establishing a point system that is easy for customers to collect and use, it will become a viable option as a main bank account for households, which is expected to lead to transactions with loans and credit cards in the future.

In addition to banking, it offers a wide range of financial functions, such as credit cards and securities, allowing customers to centrally manage their financial transactions via a single app. We will also expand our non-financial services to provide a new financial experience that is distinct from traditional bank accounts. This enables us to pursue convenience for our customers and diversify our revenues.

Having a strong credit card company in the group is a strength that our competitors do not have. With that at its core, we have also added missing features such as online securities and loyalty programs to become more dominant.

Transform 60% of Branches into "STOREs"

Koike Simple bank transactions have been replaced by smartphones, and the opportunities to go to traditional branches are decreasing more and more. However, I think that bank branches will persist in some way as an important part of social infrastructure. What are your thoughts on maintaining and consolidating your physical locations?

Ohta We do not intend to significantly reduce the number of branches. Instead, we plan to evolve our channels to meet customer needs. Specifically, routine transactions will be conducted through smartphones, and ATMs will be placed in front of high-traffic train stations. Our physical branches will specialize in responding to customers' questions and concerns, and will be located in easily accessible places like shopping malls. There is no need to close branches at 3:00 PM; we can stay open in the evenings and/or on weekends. We will evolve our branches into a new type of "STORE" to maintain customer touchpoints.

Under the new Medium-Term Management Plan from 2023 to 2025, we aim to reduce costs by ¥28 billion by converting about 60% of our existing branches into "STOREs".

Koike I would like to ask about your retail securities strategy. Olive is linked to an SBI Securities account. What are the differences between the wealth management services provided by SMBC or SMBC Nikko Securities and those offered by SBI?

Ohta Olive is especially popular with young people and beginner investors because its entry point is digital. As we are conscious of lowering the entry barrier for investment as much as possible, we believe that our collaboration with SBI Securities has a high affinity with these customer segments. On the other hand, SMBC and SMBC Nikko Securities are making efforts to deal with high-net-worth clients and corporate owners with a large amount of assets under management. We intend to strengthen collaboration between our banking and securities businesses while paying attention to compliance.

Not stick to building everything ourselves

Koike Some have noted that your securities business has been behind overseas. What direction are you aiming for in your non-retail securities business?

Ohta The wholesale securities business is a difficult world without global reach, and this is an area where SMBC Group lags behind our peers. In particular, when the corporate bond market boomed during the pandemic, we were not able to fully reap the benefits while our competitors saw significant earnings growth.

To address this issue, we are strengthening our collaboration with Jefferies, one of the largest investment banks in the United States, to advance our global Corporate & Investment Banking (CIB) business.

Jefferies and our company have completely different areas of expertise. SMBC Group has reasonable strength in lending and debt capital markets, but not enough capacity in M&A and equity capital markets, which is an area of strength for Jefferies. That's why we decided to not stick to the idea of building everything ourselves and instead to multiply each other's strengths. Through joint marketing to clients of SMBC Group, we will steadily establish track records of our collaboration and further deepen our alliance.

Koike Let me ask you about your financial strategy. I understand that you plan to accelerate the pace of reduction of equity holdings. I think it's a topic of high interest for investors. Could you talk about your progress?

Ohta The original plan was for a ¥300 billion reduction over 5 years from FY2020, but we have revised it upward to a ¥380 billion reduction over 6 years in order to align with the new Medium-Term Management Plan. In addition, we plan to reduce the ratio of market value to consolidated net assets to less than 20% during the period of the next Medium-Term Management Plan from FY2026 to FY2028. However, this is not the ultimate goal and we will continue to pursue reductions even after we have achieved this plan. Though there are some customers who oppose the sales, the awareness of customers has changed considerably due to widespread adoption of the Corporate Governance Code. We believe that by taking the time to negotiate and deepen dialogue with customers, we can gain an understanding of these reductions.

Maximize the Potential of Human Capital

Koike To promote human capital management, SMBC Group has established a Human Capital Policy. With so many group companies, how do you think human capital should be utilized as a whole?

Ohta It is crucial to acknowledge the values of Generation Z. This generation is not constrained by traditional views of work and life. They are more focused on how their employer contributes to society and how they, through their work, connect with the wider community. The conventional ambition of working hard to get promoted and become a president is becoming less prevalent. On the other hand, there is a growing diversity of human resources, each requiring individual engagement and diverse work styles. My task is to amplify their capabilities to strengthen the entire organization.

Engagement surveys are conducted within the Group to address these needs. Additionally, we've launched a joint venture with Atrae, Inc., a human resource development company, to extend similar services to our customers and other companies.

For innovation to occur, we need a diverse mix of individuals, regardless of gender or nationality, who can spark inspiration in each other through mutual respect. Therefore, consciously promoting diversity and inclusion is necessary. It is also important to set KPIs, enabling management to communicate their intentions and transform them into tangible results.

Technology Development is the Key to Scope 3

Koike Especially when seeking to expand globally, you can't attract human resources without a policy serving as the foundation. Finally, let me ask you about ESG. First of all, please tell us about your efforts as a financial institution to address environmental issues, including exchanging opinions with environmental organizations.

Ohta Environmental initiatives, including responses to climate change, are one of the materialities of the SMBC Group. We are committed to achieving carbon neutrality in Scope 1 & 2 by 2030 and Scope 3 by 2050. However, these are not easy goals. Scope 3, in particular, cannot be achieved without dialogue with clients, and the development and introduction of new technologies is key. While our ultimate goal is clear, our path and speed may change. We sometimes have disagreements with environmental groups regarding the route design. We are steadily aiming for our goal while being flexible in our approach, and we will continue our dialogue to help people understand our stance.

Koike I feel the problems such as the incident at SMBC Nikko Securities are largely due to employee culture. What preventive measures do you envision, including strengthening governance?

Ohta In response to this incident, we have already compiled and implemented measures to prevent recurrence. However, as you mentioned, we need to change the corporate culture itself in order to prevent similar situations from happening again. In the Retail Business Unit, for example, we are promoting business operations from a long-term perspective by changing the evaluation method to emphasize assets under management. We believe it is important to thoroughly reform our corporate culture from these initiatives and establish clear policies.

Transforming the corporate culture cannot be achieved overnight, but SMBC Group will continue to strengthen governance and reform corporate culture.

Koike At the beginning, you talked about solving social issues, and I think the main feature of this new Medium-Term Management Plan is that one of its basic policies is to create social value. Could you share your thoughts on this point?

Ohta I believe that in the forthcoming era, the creation of social value will become increasingly important alongside the pursuit of economic value. Companies that cannot create social value will not even qualify to pursue economic value. Society is the foundation of our business, and sustainable corporate growth cannot be achieved without its development. This is why we have chosen "creating social value" as a pillar of our management strategy and are actively engaged in areas that may not directly contribute to economic value in the short term. SMBC Group aims to lead economic growth while addressing social issues, thereby contributing to "Fulfilled Growth" for everyone.

Koike I'm very grateful to have this opportunity to hear your thoughts on so many topics. Thank you for your time today.

This report is not intended as solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: November 24, 2023)