Engagement Feature Articles

Santen Pharmaceutical - Regaining Trust and Pursuing New Growth as a company specialized in ophthalmology

Left: Hiroyasu Koike, President and CEO of Nomura Asset Management Co., Ltd.

Right: Aya Torii, Senior Equity Analyst of Nomura Asset Management Co., Ltd.

As a company specialized in ophthalmology, Santen Pharmaceutical has set out toward new growth. Due to several years of decreased profitability, the company's share price has significantly decline since 2020. Mr. Takeshi Ito, who was appointed as top executive of Santen Pharmaceutical in September 2022 with the mission of structural reform, joined Nomura Asset Management's Mr. Hiroyasu Koike and Ms. Aya Torii, a medical sector analyst, to discuss the company's growth ambitions and reform efforts.

The Path to New Growth

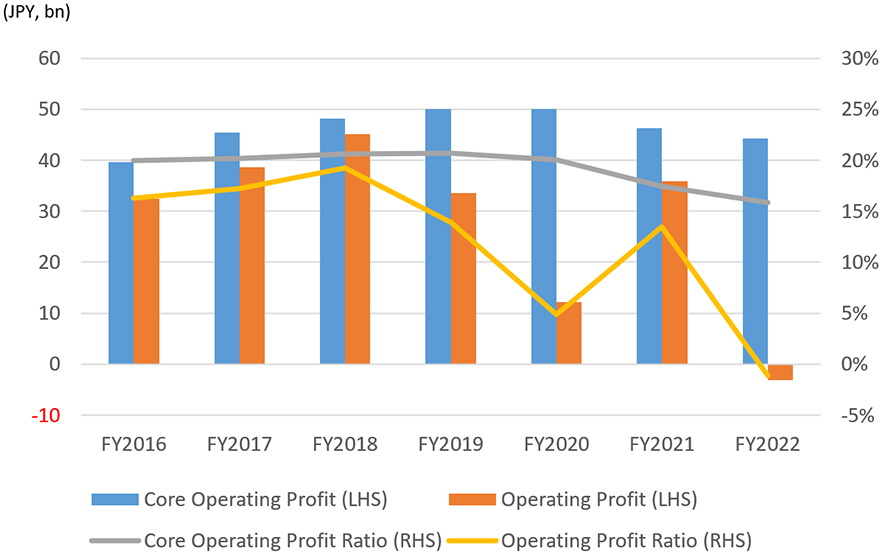

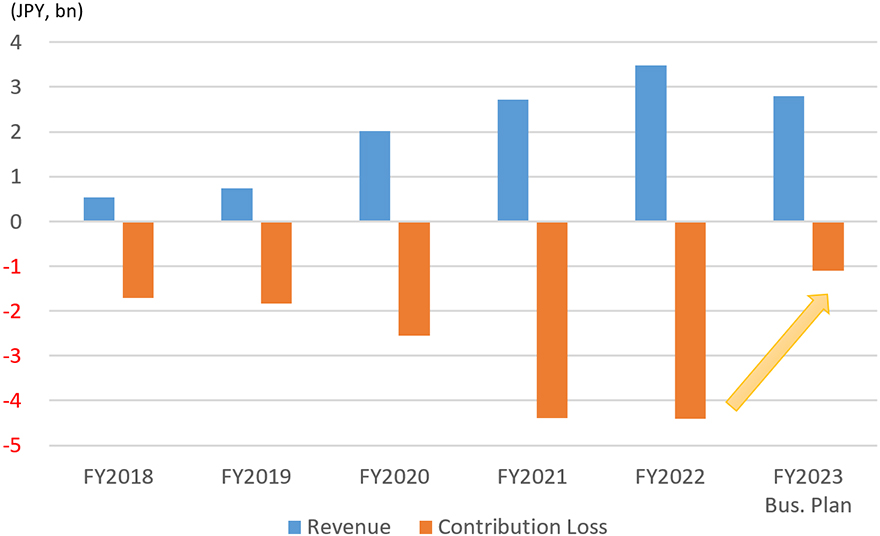

Koike Recently, there has been increased awareness in the stock market of stocks below PBR 1x and share prices. If we look at Santen's share price, though it remained strong until the first half of 2020, since then it has fallen by 20-30%, underperforming TOPIX. Our understanding is that while sales have been growing steadily, profits have been sluggish due to rising costs and impairments, and that your China business, which was a growth driver, has slowed down due to VBP (Volume Based Procurement) and the impact of COVID-19. As a result, investors that had appreciated the stable growth may have changed their perceptions and thus valuation has declined. You were appointed CEO in September 2022, during these difficult circumstances, and began pursuing reforms. Could you share your intentions behind the new growth agenda and your sense of crisis at that time?

Ito In the previous medium-term management plan launched in FY2021, we set forth a policy to broaden our efforts beyond our strength in ophthalmology into wellness and inclusion. We also further expanded our efforts in ophthalmology to include cell therapy, gene therapy, and advanced devices. While there were initiatives that offered promise for the future, our efforts to realize our vision were dispersed, and there were some that were not necessarily connected to our company's strengths. I had a strong sense of crisis due to our share price's decline when I became CEO. I felt we needed to quickly indicate our intentions for new growth to the stock market. When we announced our first half financial results of FY2022 in November 2022, we set out three measures: "Improving profitability," "Building our growth pillars," "Optimizing our organization."

Koike New investment is necessary for corporate growth, but you started by stripping away parts that were not linked to your main business strengths and reinforcing your strengths. Then you announced a new medium-term management plan (FY2023 to 2025) in April 2023, based on your understanding of a number of issues.

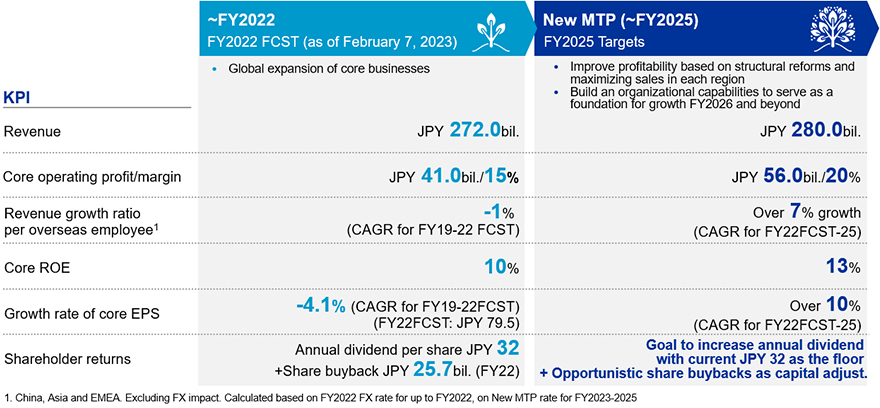

Torii The new medium-term management plan includes company-wide numerical targets and KPIs. The core point is improving profitability and capital efficiency even without significant sales growth. We are hopeful that this is achievable with a strong commitment from management. However, cost reductions could only produce a temporary effect, so the question remains regarding how Santen will achieve sustainable growth over and what it will do for medium- to long-term growth.

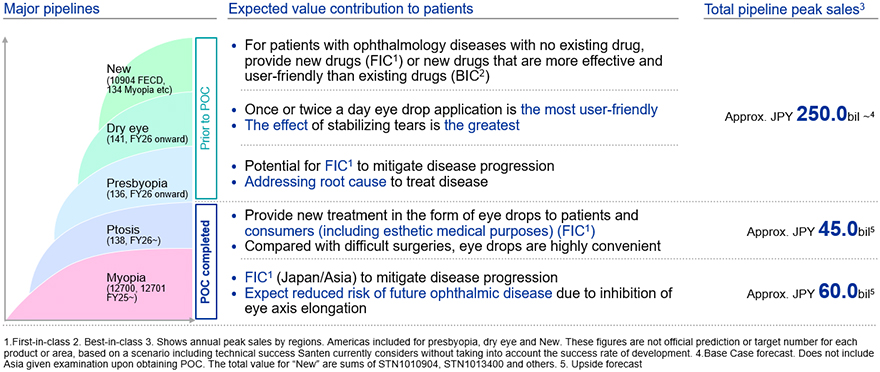

Ito We do not expect structural reforms to reduce future earnings levels. The sales target for FY2025 is 280 billion yen, which is unchanged from the current level, but the figure incorporates the risk of competition from generic drugs due to loss of exclusivity. Even if we do not achieve dramatic top-line growth, we will aim to achieve higher profit levels by strengthening our overseas business. We are developing programs for myopia, ptosis and presbyopia as growth drivers for FY2026 and beyond. Although these are within the ophthalmology field, they differ from glaucoma and antibacterial agents, so how we cultivate these areas will be a challenge. There are also challenges unique to new markets, but from another perspective, we could pursue significant upside and achieve substantial growth depending on our approach. From the perspective of developing new markets and expanding our contribution to patients, we are working with the feeling that this must be accomplished.

Koike I get the strong impression that your confidence is rooted in your success and experience growing your business in the Japanese market.

Ito I became an executive in charge of pharmaceutical sales in Japan in 2012, and it was said that Japan was a tough market because of the pressure to lower drug prices. However, as a result of our efforts to improve productivity, we were able to grow our sales in Japan from 90 billion yen at the time to 160 billion yen today without increasing the number of medical sales representatives. This is probably the highest level of productivity in the country. Tough times are also an opportunity, and I am ready to reproduce our success in our overseas efforts.

Focusing on Business that Leverages the Company's Strengths

Torii You mentioned that your initiatives had become dispersed in the last few years. When creating the new medium-term management plan, how did you sort out your company's strengths and the business areas necessary to realize your goal of Happiness with Vision?

Ito It is important that we pursue our vision, and for the past few years we have valued efforts in new fields. However, the means and the ends reversed to some degree, leading us to devote resources to initiatives that do not ultimately connect to our goals. Moving forward, we would like to increase the number of initiatives that catch people's attention while taking advantage of our company's strengths. We have a new drug pipeline for a ptosis treatment, and one of the interesting things about the program is that it encourages people to visit the eye clinic. Ptosis has not only pathological needs related to a narrowing visual field, but also cosmetic needs. We hope that, for example, patients in their 40s or 50s will go to receive cosmetic treatment for ptosis, which will create an opportunity to detect other eye diseases that they were not aware of or increase their awareness of eye health. While it is important to use devices and IT technologies to raise awareness of eye health, we must also be aware that leveraging our strengths and assets will help us achieve our vision and contribute to our patients' well-being.

Koike The eye doctor can be distant for many people, and I find it very interesting that patients seeking treatment can create an access point to the eye care market and a chance to promote your company's strengths.

Torii In terms of business selection and concentration, we are particularly concerned about the U.S. business. Your company first exited the US market in 2003, re-entered in 2016, and effectively exited once more recently. Could you share if you have any plans for a future re-entry? And what are the prerequisites for making such a decision?

*As of date of FY22 earnings and FY23 projections released on May 11th

Ito The U.S. market is very competitive, but in the health care industry, it's a source of innovation and a very large market, so I think it's a region where we want to succeed in the future. The first time, we entered the market with a new antimicrobial agent, but since the needs of healthcare professionals and patients for antimicrobial agents were already quite satisfied, a slight improvement over the existing treatment was not enough to gain traction. For our second entry, we acquired Eyevance as a sales platform to develop new Santen products after building a commercial base early. However, their original products were not competitive, and the business performance deteriorated due to environmental changes, making it difficult to achieve the expected revenue. In order not to repeat the past, we are considering re-entering the market with products that are thoroughly competitive. In addition, we tried to cover all sales and marketing ourselves during the past attempts. In the future, we want to consider whether we should pursue it ourselves or seek a partner, given our portfolio at the time including not only products themselves but also follow-on pipelines.

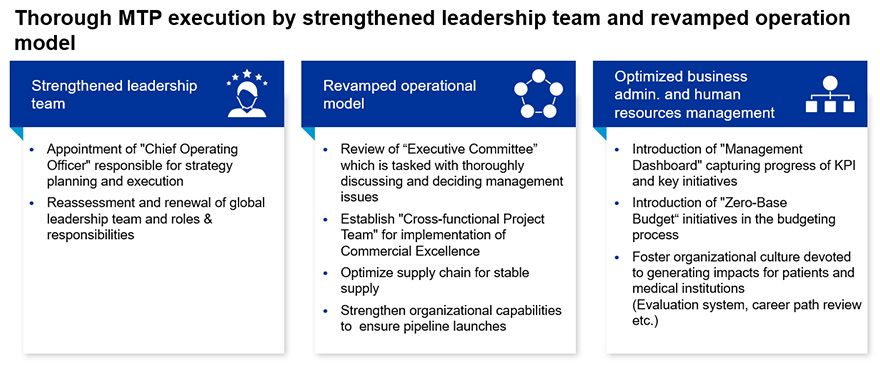

Pursuing Organizational Structure that Ensures the Ability to Act

Koike Looking at your company's past experiences, I believe that ensuring the ability to execute your plans will be the key to success for the new medium-term management plan. You just told us about your experience reforming sales within Japan. Do you believe you can recreate that success overseas with the same strategy?

Ito I think there is no problem there. When we sell a product, we hold high aspirations of the contribution we can make to patients while making a detailed execution plan, and we consistently refine it within our organization through a PDCA process. I think there is a lot of room for improvement if we take into account the essence of what we have done in Japan. We have already started working on plans under our new COO Ms. Nakajima.

Torii Top-down policies are also important for structural reform and changing the culture of the company. However, ultimately, employees on the ground are the ones that must implement change. Is there a system to increase the motivation of employees and regional managers?

Ito Since April this year, after the announcement of the new medium-term management plan, we have provided opportunities for dialogue with all employees at town hall meetings and other venues. We have taken several months to respond to questions from employees and explain the direction we are aiming for at the top level. However, simply talking about our corporate philosophy and vision does not lead to changes in employee behavior, and it is necessary to create an environment in which each employee can experience success. It was this type of experience with our Japanese business that allowed us to keep our motivation high and raise our productivity. I like Mr. Shoyo Tsubouchi's phrase, "Impress rather than give knowledge. Practice rather than impress," and I think it is essential to practice the basic principles in order to have success. Impressions can only be left through actual experience, and it is important that we pursue and practice in the pursuit of even deeper impressions. With a desire to impress others, we want to create a cycle together that accelerates the practices of the organization and the company as a whole by accumulating small successful experiences.

Koike I am hopeful that changing the culture of the company and increasing motivation will help to secure your ability to act. In this sense, governance is also an important theme. Your Board of Directors has secured diversity with the majority being comprised of outside directors. Could you tell us your current thoughts on initiatives to further advance diversity in the future, including the use of personnel with expertise in the pharmaceutical and healthcare businesses overseas?

Ito I believe that the current board structure is balanced in terms of the skills matrix, and I do not believe that changes are necessary right now. However, from the perspective of further evolution, we would like to consider overseas professionals or healthcare specialists in the future.

Setting a Strict Investment-Profitability Hurdle Rate and Increasing the Probability of Success

Koike Thank you. I would also like to ask about your financial strategy. In the new medium-term management plan, the core ROE target is set at 13%, and there is also mention of raising the investment-profitability hurdle rate. What is different from your previous financial strategy?

Ito We recognize that meeting the expectations of shareholders is one of the most important management issues. Therefore, we have a high awareness of financial indicators and are considering a stricter investment profitability hurdle rate than the previous low 8% level. We believe that we need to return to 13% core ROE and 10% ROE(IFRS) as soon as possible, and we will aim for higher levels through share repurchases.

Koike It will be important to determine how to secure your ability to act while seeking growth in the future. I believe you can earn the confidence of investors by, for example, disclosing whether the ROIC of projects is improving and allowing investors to see the effectiveness of your new strategies themselves.

Ito At this point, we are not considering disclosing ROIC, but we intend to fully disclose the necessary indicators in the future while listening to feedback. We want to be as transparent and clear as possible to investors.

Contributing to Society through Business

Koike In closing, could you share your thoughts on ESG and sustainability initiatives?

Ito We will discuss important materialities that deserve particular focus, " market penetration of products with social significance" that will lead to the achievement of the new medium-term management plan and future growth, and " human resource development and promotion" to support and drive business growth. We are working on these two issues as our top priority.

Torii When starting reforms in 2022, I was impressed with the comment "We need to quickly restore the stock price to its previous level in light of the risk of acquisition." We believe that the recent structural reforms have been reflected to some degree in the current share price. On the other hand, a further increase in share price requires an increase in valuation. I believe that will occur once investors can see that the medium-term management plan that you mentioned today has been steadily implemented. I also believe that the disclosure of sustainability initiatives, such as the social impact in terms of number of patients, would contribute to increased valuation.

Ito We expect that there will be various bottlenecks in spreading treatments of ptosis and myopia in the future, but as measures to eliminate these bottlenecks become concrete, we will be able to quantitatively measure socioeconomic effects such as the number of eligible patients and the number of patients who have received treatment. We hope to reach that stage soon.

Koike I am impressed by your passion to create a path for new growth with your leadership. Thank you for today's fruitful discussion.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: September 29, 2023)