Engagement Feature Articles

MS&AD - Contributing to the formation of a resilient society through insurance group's synergies

Right: Hiroyasu Koike, President and CEO of Nomura Asset Management Co., Ltd (Nomura Asset Management)

The MS&AD Insurance Group was formed in 2010 as a result of the merger of the Mitsui Sumitomo Insurance Group, Aioi Insurance, and Nissay Dowa General Insurance. As one of the world-leading insurance and financial groups, it offers a wide range of products and services for both individuals and businesses. As the scale of disasters increases and risks diversify, how is sustainable growth achievable? Mr. Noriyuki Hara of MS&AD and Mr. Hiroyasu Koike of Nomura Asset Management sat down to discuss the company's future prospects.

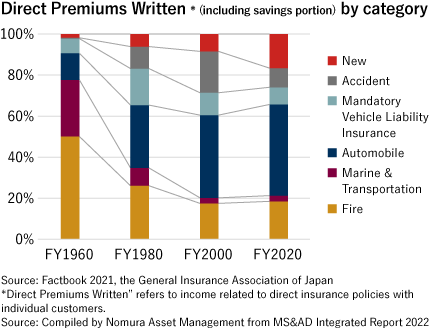

Gradually shift fire insurance policies to new contracts

Koike We understand very well that Japanese stocks still have a lot of potential. However, there is a great deal of information about the equities market that does not reach investors, which renews my sense of the importance of engaging with the companies in which we invest.

Today, I would like to hear about the goals of MS&AD from an investor's perspective.

First, the domestic fire insurance business. Japan has had many earthquakes originally, and the intensification of natural disasters, including the arrival of major typhoons, cannot be overlooked. In particular, how do you view this business environment, which is often viewed with uncertainty by foreign investors?

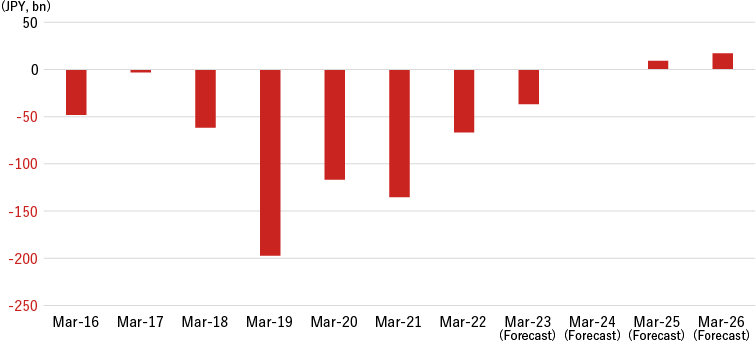

Hara As you say, fire insurance, which has been in the red for the past 10 years or so, is one of the major challenges. These factors include an increase in the number of natural disasters and an increase in the scale of disasters, but there are also product design issues. For example, the subject of payment. All-risks coverage type products, which were not common before, have become mainstream. In the past, the longest contract was a 36 year contract, matching the length of the mortgage contract. Since 2015, the maximum contract period has been gradually shortened to 10 years and 5 years, and new contracts have been able to break even, but there is still a limit to the effect of the revision of product and insurance rates.

The number of cases in which damage occurs due to aging of buildings and equipment is increasing, and the burden of insurance payment is large even though the insurance rate varies according to the age of the building. In addition, specified repair companies that replace insurance claims by mixing aging and disaster damage have become a social problem.

Koike Do you see a path to improving your bottom line?

Hara Right. Proposals for insurance reviews have also been successful, and the portfolio is gradually being replaced. As a measure against specified repair companies, we have tightened the terms and conditions and established a recovery obligation in the event of damage. The disparity in premium rates for flood risk continues to be discussed by the experts' meeting of the Financial Services Agency, but some have raised the issue that the widening disparity may make it more difficult for people to subscribe. Based on the results of rate verification by the General Insurance Rating Organization of Japan, we are currently thinking of changing the system to one that takes into account the cost of capital in the next rate revision.

As long as we ask for an increase in insurance premiums, of course we will do our best to reduce expenses. We are also reviewing agent commission.

(Note 2) Domestic fires only

Source: Compiled by Nomura Asset Management from MS&AD information meeting materials

Koike We are grateful that you are proceeding with the restructuring of your business. However, as an insurance policy holder, with natural disasters becoming this large and the reinsurance market becoming saturated, it is not easy to offer protection with just rate revisions and your own corporate efforts, and it is tempting to think that a move involving the government is necessary.

Hara As an industry, we are advancing discussions on individual themes. For example, when it comes to the wind hazard for houses, we had the Building Standards Act reviewed to keep tiles tied to roofs. That will reduce their risks by 20-30%. Also, when it comes to the issue of river basin flood control, it is important to work together with local governments. For example, we are working together to promote forest conservation as a flood control measure for the Kuma River watershed in Kumamoto prefecture.

Koike On the hazard map, working together with local governments to prevent disasters in high-risk areas is likely to reduce their loss ratio. With 70% of Japan's land area covered by forests, there is a great deal of room for technology to be introduced in terms of contributing to local communities and improving business productivity. We are also taking the lead in developing a carbon-neutral business as well as developing alternative investment options in forest management.

Hara If forests are left untouched by human intervention, they will deteriorate further, increasing the risk of wildfire, as in California in the United States. Although there are challenges in terms of players and productivity, it is necessary to take this a step further into business. For example, we have changed our forest insurance policy to cover reforestation costs that could not be paid before. I believe there are solutions that can be found through the efforts of various businesses.

Koike It's an area to watch for the future.

New Risks with Changing Times

Koike I'd also like to ask about car insurance. I have the impression that your group subsidiary Aioi Nissay Dowa Insurance is actively working on telematics type auto insurance that captures driving data in real time through devices attached to vehicles. However, if we look a little further ahead, there are concerns of the car insurance market after it becomes saturated. What is your outlook, including new business pillars?

Hara The number of cars owned in Japan has increased slightly in recent years as well. We expect to earn stable premium income for a while, and we hope to increase our profits with the differentiated coverage you mentioned. However, as you pointed out, in the long run, we cannot avoid a situation where the number of people with licenses will decrease due to the declining birthrate and aging population. Corporate insurance services, such as liability insurance in new areas and additional insurance for workers' compensation, have been growing and we would like to focus on them in the future.

Risks always emerge as technology evolves and times change. The advent of the IoT in automobiles will require cybersecurity preparedness, and the advent of flying cars will drastically change the insurance landscape. It's not limited to transportation like cars. For example, we are already commercializing risks to clinical trials with the advent of iPS cells. Accompanying these developments, for example, in the area of cybersecurity, we have actually started an initiative to sell virus checking software along with insurance.

Koike The new risk response is likely to increase business opportunities. I feel that management such as insurance pricing and underwriting capacity is a big key when taking on totally unknown risks.

Hara The general theory for creating insurance against new risks is to find similar risks. However, there are some parts that are not visible, so we will add a certain safety factor. Ultimately, data is the life of our insurance business. To enhance the power of data, if we don't have it, it's important to think about how to use the data that others have.

Our company's cow accident insurance, which won the top prize in the 2018 sustainability competition, is a symbolic example. At first, the underwriting department said it was impossible, but after collecting data on cow injuries from local agricultural cooperatives and the livestock industry, we succeeded in commercializing the product.

Koike MS&AD has an overwhelming ratio of non-life insurance in its business portfolio compared to global insurance conglomerates. Life insurance margins seem to be rising, but is there room to grow?

Hara Two of our subsidiaries are Mitsui Sumitomo Aioi Life Insurance (MSA Life) and Mitsui Sumitomo Primary Life Insurance (MSP Life). Through its non-life insurance agents, MSA Life targets the layering of life insurance policies for non-life insurance customers. Currently, only 18% of our non-life insurance customers are able to sell on top of each other, and we would like to increase this to 25% under our current medium-term management plan. In addition, there are tens of thousands of group contracts for non-life insurance, but there are still only a few thousand for life insurance, and we would like to aim to win large group contracts by making it easier to subscribe through the development of the internet and intranet.

We also want to enhance the synergy between the two life insurance companies. MSP Life is strong in over-the-counter sales by banks and has relationships with almost all banks beyond its affiliates, and has been number one in over-the-counter sales for three consecutive years. We have started to make our products a little simpler and sell them through MSA Life's distributors, and this is growing. In the future, we would like to expand our sales agents further and explore the demand for inheritance and living gifts through product proposals.

Koike Synergy between life insurance companies is an idea I didn't expect. I'm looking forward to the future.

Aiming to maintain an in-organic perspective on the international business

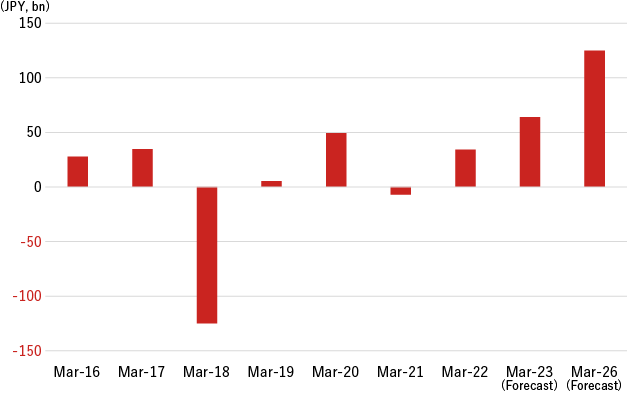

Koike I would like to ask about the international businesses that are attracting attention as investors. MS Amlin, the British insurance company that Mitsui Sumitomo Insurance (MSI) acquired in 2016, had been stagnant in business, but it finally hit bottom and feels that it is becoming a driver.

Hara We have caused some concern to investors about MS Amlin. An impairment was incurred due to the restructuring of unprofitable businesses, but regional holding companies were abolished and the international division of MSI was restructured to supervise local subsidiaries. MS Amlin has three business entities: Lloyd's Syndicate, reinsurance, and direct insurance for European SMEs. They had a culture of building their business on the basis of their ancestral Lloyd's syndicate, and they used its reinsurance company as a supplement. Instead, we have adopted a policy of aiming for growth through a business model that suits each business style. We also replaced all the management.

Koike Restructuring the business and changing the management seem to have worked, but where do you feel the essential challenges were?

Hara I think there were some complex backgrounds. MS Amlin's insurance business was one area where CAT (major natural disasters) excelled. MS Amlin was particularly strong in the Midwest region in the US, once the envy of other Lloyd's syndicates, but in recent years the path of hurricanes has changed and flooding has increased. And with inflation, the attachment point for insurance payments is changing. There are two main reasons why we did not respond well to these changes, and the strong top-line orientation in the CAT business made management's decisions on whether to underwrite insurance more lenient. We will provide coverage of natural disaster risk to our important clients, but first we will consider how to structure our portfolio and establish a solid foundation, so that we can generate a net profit of about 30 billion yen in FY2025, the final year of our medium-term management plan.

Koike Oh, I see. In the United States, you acquired Transverse as a non-CAT business. What are your expectations?

Hara The U.S. has a market size of about 90 trillion yen in premiums, and 10% of that comes from the so-called Managing General Agent (MGA), the sole agency responsible for designing, managing underwriting and offering insurance. Transverse is a fronting company that brokers MGA underwriting contracts to reinsurers. There are many MGA companies that excel in growing areas called niches and specialties. In fact, the MGA market has grown about 30% in five years, and the business of fronting the reinsurance market has grown about 10%. Transverse is a young company, but it scrutinized its business plan and went ahead with the acquisition on conservative grounds. We hope that getting our credit rating will also open up business opportunities for them.

Koike We as investors are aware of the growth potential of these international businesses, and this is why we feel that there should be more global and in-organic strategies with different angles.

Hara The U.S. market has a lot of potential, so I don't want Transverse to be the end of the line, but I want to keep the insurance companies in specialty lines on my watch list and communicate with them to see if we can work together again. For the international business, we will continue to maintain an in-organic perspective, including our business in Asia.

Synergies from a diverse range of life and non-life insurance companies

Koike I would venture to say, from the relationship we have had over the years, that among Japan's mega-nonlife insurance groups, MS&AD's stock valuations have been stagnant. Could you please tell us your assessment and competitive advantage in this area?

Hara Unfortunately, we can't deny that our stock price is stagnant. One point is MS Amlin's struggles in the international business that we talked about earlier. I think that was significant. Our goal in this medium-term management plan is to increase the ratio of earnings outside the domestic non-life insurance business to more than 50%, and to that end, I believe that expanding our international business is a prerequisite. With the support of our investors and shareholders, we will continue to build a solid track record.

MS&AD is characterized by a diverse range of business entities, with a focus on life and non-life insurance. That's why we should be able to generate more synergy. For example, in the "1 (One) Platform Strategy," we are boldly promoting the commonality of middle and back positions outside the sales of MSI and ADI in an effort to further increase productivity. I believe this effect will be appealing in the next medium-term management plan. We are in the process of developing an IT system for damage services and integrating back offices, and we should be able to achieve significant cost benefits from the volume of the organization.

Koike Thank you. We have a great interest in stock prices and would like to support your company's growth as an institutional investor. We want to continue to focus on these engagement activities, starting with analysts. If you have any expectations for institutional investors, including our company, could you give us some final advice?

Hara I think the opportunity to explain our strategy one-on-one is very important. Business in our company has an impact that is inseparable from social conditions, including new coronavirus, natural disasters and geopolitical risks. So there are fluctuations from year to year, but it certainly drives long-term growth. We would be grateful if you could give us any suggestions or advice from that perspective. I would like to contribute to the formation of a resilient society by working with many of our stakeholders to resolve issues in the world.

Koike Thank you for this valuable discussion. We look forward to working with you in the future.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: September 30, 2022)