Engagement Feature Articles

Mitsui & Co.'s Model for Creating Opportunities alongside Decarbonization by Building Improved Quality Deals

Right: Hiroyasu Koike, President and CEO of Nomura Asset Management Co., Ltd. (Nomura Asset Management)

With "Transform and Grow" as the theme of its Medium-Term Management Plan through 2023, Mitsui is expanding its earnings with the aim of sustainably increasing shareholder value. How is the company confronting the rapidly changing business environment and envisioning new growth? Mr. Kenichi Hori of Mitsui, and Mr. Hiroyasu Koike of Nomura Asset Management sat down to discuss the company's business growth and ESG initiatives.

Securing Profits All Around the Globe

Koike Japan has many excellent corporations, and we have a longstanding desire to attract more attention from investors around the world. It is our company's role to act as a bridge between overseas investors and Japanese companies, and as an asset management company, we aspire to actively pursue measures to ensure that Japanese companies are fairly valued by the market.

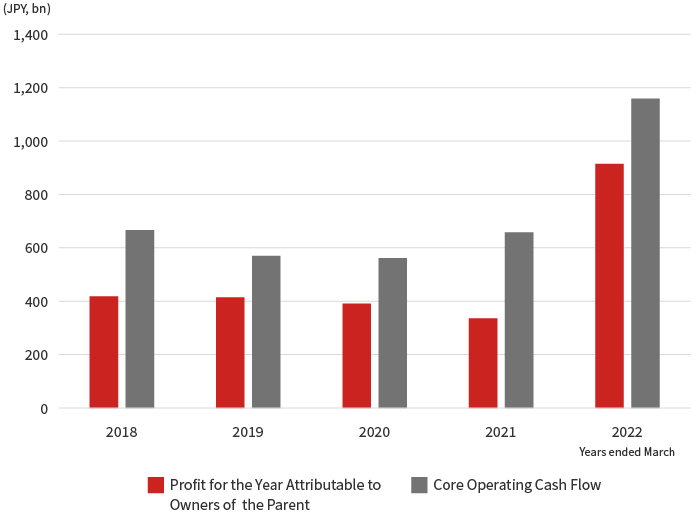

Now, I would like to discuss Mitsui's business expansion and ESG initiatives. To begin, could you provide some background about achieving record highs for both Core Operating Cash Flow*1 and Profit for the Year?

Source: Nomura Asset Management Compiled from IR materials by Mitsui.

Investors | Integrated Reports - MITSUI & CO., LTD.

Hori In the second year of our Medium-Term Management Plan, we have produced strong results that exceeded our targets. While there are various factors behind this achievement, first and foremost is that we were able to secure profits evenly across the globe. Overall, we were equipped with a framework to firmly benefit from the upside brought on by pandemic demand recovery. Markets often focus on commodity prices when they look at trading companies, but the logistics, trade and supply chain management capabilities we have cultivated at a grass-roots level have also paid off handsomely. As supply chains buckled under the pressures of the pandemic and geopolitical tensions, we were able to leverage our longstanding relationships and capabilities to offer robust solutions for our customers.

Koike Our impression is that rising energy prices, such as oil and natural gas, had a positive impact on corporate performance. However, the stock market appears to have recently expressed concerns regarding potential stock price reversals of general trading companies. What is your approach to business in the energy sector?

Hori Mitsui has been a competitive player in energy and fossil fuels for a long time. In addition, in the transition to a low-carbon society, it will be key to simultaneously pursue long-term bridging measures, primarily centered on natural gas, alongside solutions for greenhouse gas (GHG) emissions reduction, such as renewable energy, grid management, and batteries. We believe Mitsui's competitive business portfolio will enable us to do both. Through diligent portfolio management, we will secure profits while growing our business and contributing to new energy solutions. Making progress on both is likely to enhance our company's corporate value.

Koike I think the transition to a low-carbon society could likely result in a gap or time lag, and from a business perspective, may have a negative financial impact. How do you intend to manage this scenario?

Hori We seek objectivity when viewing energy trends by referencing data from external research agencies alongside that from our company. Demand itself is growing around the world, so we can expect a sufficiently reasonable buildup of profits. Moreover, for renewable energy and other businesses related to decarbonization, we will need to involve adjacent industries and form business clusters. We have an abundance of ideas to consider, as well as a commitment to transform them into profitable new businesses.

Building Healthcare Experience in Asia's Largest Hospital Network

Koike Your vision is to expand your business base through decarbonization. I believe the aforementioned profits evenly across the globe are the fruit of past investments. In that sense, I would like to hear more about your future investment plans. Global conditions, including geopolitical factors, remain highly uncertain, and there continues to be high volatility in the financial markets. Are there any indicators that warrant particular caution?

Hori Of course macro financial indicators, such as inflation and high interest rates, are factors that I pay attention to, but I believe there are a greater number of investment opportunities when these indicators signal high volatility. Since each company has a unique balance sheet, restructuring of assets can result in businesses being put up for sale that are complementary with our own. It is important to identify these cases when they occur.

As we also focus on the required valuation, it is important to approach these cases creatively. In this regard, Mitsui has professionals in various industries, and all significant investment candidates are listed to the management level. Naturally, we scrutinize investment potential and prioritize candidates accordingly. Moreover, we maintain an internal culture of openness regarding investment projects, so our staff on the frontline of these deals learn what sets of terms and conditions are generally required to build consensus within Mitsui in each proposed investment idea. This encourages an environment of generating ideas and healthy competition when faced with deals of questionable viability. Such efforts are vital when dealing with investment opportunities.

Koike Apart from the energy sector, are there any other industries or businesses that are likely to be critical in the future?

Hori We are increasing our efforts in mobility, infrastructure, and healthcare. It is also my impression that areas adjacent to chemicals have the potential to generate interesting opportunities. In healthcare, for example, we are working with the largest hospital network in Asia and are gaining important healthcare expertise on a daily basis. By processing this, we can gain knowledge about disease prevention, such as proper nutritional management, and we expect this area to develop into a significant business.

Koike Given Asia's growing population, I can see the potential.

Hori We have received a lot of interest from parties in Europe and the Americas, which could lead to building mutually beneficial relationships. Likewise, this type of information is valuable in industries such as insurance, welfare, and pharmaceuticals. Reducing healthcare costs is a challenge facing various countries, and we expect that this is an area in which we can expand in the future.

Growing Opportunities for GHG Reduction in Forestry Asset Management

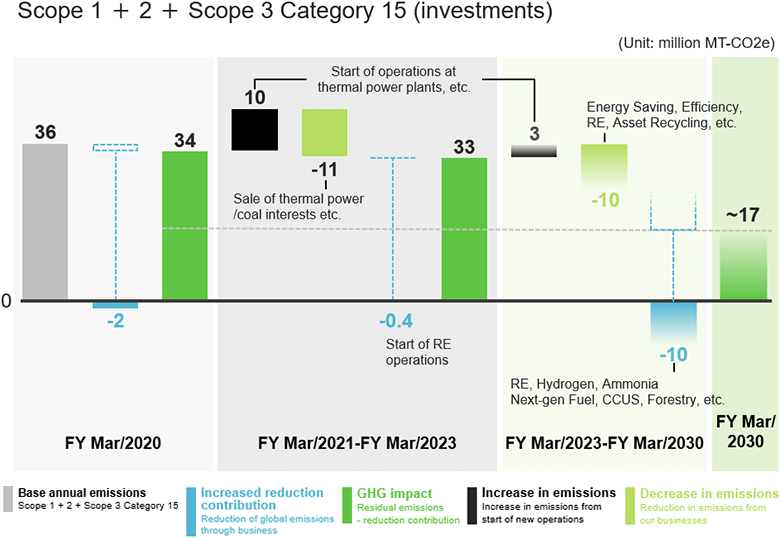

Koike Next, I would like to discuss Mitsui's ESG initiatives. You mentioned the energy transition earlier. I believe that Mitsui's greenhouse gas emissions, including Scope 3 emissions which encompass the entire supply chain, are quite high. Would you kindly share your thoughts regarding Mitsui's Road map to Net-zero emissions?

Hori By the year 2030, we intend to halve our GHG impact (defined as total emissions minus removals and offsets minus reduction contribution) from 2020, and by 2050, we intend to reduce emissions to net-zero while only relying on removals and offsets, without accounting for reduction contribution. We are advancing our efforts while organizing division-level initiatives, and there are a few items I would like to highlight.

The first is taking responsibility when restructuring our portfolio by selling a business or asset. For example, in the case of thermal power generation, we assume that we will negotiate with buyers who will continue our initiatives to reduce emissions, while also clearing certain economic conditions. Another approach would be to promote low carbon measures in existing businesses, without selling them. An example of this approach is carbon dioxide storage technology through the process of ammonia production. Additionally, it is important to expand opportunities to contribute more proactively to reductions. A good example of this is the forestry business. We have decided to increase our stake in New Forests*2, one of the largest forestry asset management companies in Asia and Oceania, to 49% by acquiring additional shares. Nomura Holdings, Inc. has also decided to invest in this company, which we appreciate.

(*2 For further details about New Forests, click here.)

Source: Mitsui's Roadmap for Net Zero

Response to climate Change

Koike Many investors have shown a high degree of interest in forestry as an ESG investment option and as an alternative investment. Nomura Asset Management is responsible for assessing the viability of New Forests and providing options for investment in the forestry business. I also have plans to visit New Forests' headquarters in Australia. While our dreams for the fund business continue to grow, our partnership with Mitsui gives me a great deal of personal confidence.

Hori In addition to supplying certified forest products, we expect New Forests to have additional upside related to carbon credits for carbon dioxide absorption purposes, as the international trading of emissions credits becomes more established. We envision a scenario in which we create a sophisticated financial instrument while leveraging Nomura Holdings' relationships with investors.

Koike As an asset management company, we are working to incorporate not only an assessment of GHG emissions but also the reduction of emissions to stock price valuations. We would like to collaborate with Mitsui on the latest reduction technologies and communicate these developments to the equity markets.

Hori Offering recommendations to global fund managers is always a challenging issue, taking into account Mitsui as a stock. As a trading company involved in a wide range of ventures, our business can seem a bit complex and difficult to approach. However, in that regard, since decarbonization is an issue that must be approached from different angles to derive optimal solutions, we believe our business model as a trading company represents a robust framework for opportunities we will see during the transition toward a decarbonized society.

Koike We believe it is our role to convey this, including to overseas investors, and we hope to continue working together in the future.

Aligning Executive and Shareholder Interests via Stock-based Remuneration

Koike As a matter of investor interest, I would also like to inquire about corporate governance regarding executive remuneration. This year you introduced a restricted stock remuneration plan that eliminated share performance-linked conditions that you previously adopted, a performance-linked restricted stock-based compensation plan, and share ownership guidelines. Could you tell us about the purpose and background for this change?

Hori One of the things I thought was important was that management and the executive team act in alignment with shareholders. I believe it is important that the share of such stock-based remuneration be given a reasonable weight, points of which I wanted to demonstrate after approval at the general meeting of shareholders. With performance-linked restricted stock-based remuneration, ROE and ESG are defined as KPIs, and remuneration is determined by the board of directors via the remuneration committee in accordance with the level of achievement. In addition to the introduction of this system, the board's relentless engagement in these discussions have in itself been very fruitful. Of course, the board of directors concurs. In terms of stock ownership, we also have a program in place for executives to purchase shares from their basic remuneration at their discretion, with the goal of encouraging stock ownership and elevating their perspective.

Koike Japanese companies are also putting a lot of effort into IR activities, utilizing the web and other channels to disseminate information quickly. However, it seems that in some cases, investors are not receiving the specific information that they seek.

Hori I think this is an issue that can only be dealt with gradually. For example, there are times where I explain the general trading company business to the boards of partner companies through presentations on decarbonization-related projects. I feel that these opportunities provide a gradual way to foster understanding with not only our partner companies, but also with parties in other industries via the outside directors of those partners. Our stock's valuation is said to be low, but we've had a strong response which will support the current level of earnings, and I personally feel that our valuation will improve.

Koike While investors may understand the confidence of executives, there are also many uncertain external factors that make it difficult for them to agree. Even a single currency move makes it difficult to forecast the yen, and there is also an increasing magnitude of geopolitical risk.

Hori Approximately 80% of our company's profits are realized on a foreign currency basis. Though our share price is yen based, I believe an understanding of the hedging effects should offer some reassurance to investors. In the case of the general trading companies, the circumstances of individual deals tend to garner attention from short-term investors, but I would like to emphasize that those deals are part of a diversified portfolio and do not have as big of an impact as some may worry. I take pride in the fact that Mitsui's business model and portfolio has been carefully constructed over time and cannot be replicated by others.

Pioneering Discussions on Creating Corporate Value

Koike How are valuations determined when you consider investing in, for example, a growth company?

Hori When an investment is valued at a premium according to its EV/EBITDA multiple, I believe we should have moved quicker to invest in the first place. In a case where a certain business is evidently integral to the overall business portfolio, we may occasionally pay a fair premium. If we were unable to take the necessary steps to invest early, we would likely examine other approaches, such as participating as a service provider or recruiting the necessary teams.

Koike Just as in finance, if you don't cultivate talent with investment skills, you won't be able to conduct business effectively on the global stage. The cultivation of personnel with combined intelligence and business acumen is the expertise that forms the core of Mitsui.

Hori Yes, that is a crucial factor. We encourage our people to experience the rigors of deal making early on in their careers so that they can develop quickly into competent negotiators that are respected in the field.

Koike This must be one aspect of Mitsui's unique corporate culture that fosters employee loyalty. As investors become more aligned with your targets, I believe expectations for your business are only going to rise. Finally, I was wondering if you have any additional requests for us, Nomura Asset Management, or other institutional investors as it relates to our engagement initiatives with investors?

Hori Despite the main assumption of ongoing growth, companies are living creatures. As the environment changes, there will be waves in the process of achieving that growth. In that context, I am very grateful and appreciative that investors thoroughly examine the contents of our businesses and offer their perspective. By continuing this dialogue, I believe we will be able to have fruitful conversations about the constantly evolving factors that shape our corporate value. When our company wants to move forward, I believe we can gain the understanding and support of our investors through such dialogue. In that sense, I strongly hope that we can continue our engagement with investors.

Koike The ideal style of engagement in the new Japanese capital markets will continue to be an important topic, and above all, we will continue doing what we can to improve the value of Japanese companies. We look forward to working with you in the future. Thank you for your time today.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: September 7, 2022)