Engagement Feature Articles

Misaki Capital - Dramatically Increasing Corporate Value through Shareholder Action to Improve Management

Right: Hiroyasu Koike, President and CEO of Nomura Asset Management Co., Ltd.

Under the banner of "Japan Constructivism®," Misaki Capital aims to create a new shareholder model in Japan and improve the value of the companies it invests in as an engagement fund. The company is an independent investment advisory firm established in 2013 by Mr. Yasunori Nakagami, who has supported the growth of his client corporations as a management consultant for approx. 20 years. Mr. Nakagami joined Mr. Hiroyasu Koike of Nomura Asset Management to discuss engagement practices and the ideal form of corporate management.

Improving a Company's Intrinsic Value will ultimately Improve its Share Price

Koike I've been looking forward to speaking with you, as a specialist in engagement. Your company, Misaki Capital, is known for engagement expertise within the Japanese asset management industry, with an edge in concentrated investment. Could you share the background behind Misaki Capital's founding?

Nakagami After graduating from college, I entered the management consulting industry, where I've worked as a consultant for approx. 20 years. While not always successful, management and external consultants firmly working together on a project can generate change in the company. I've seen many examples where that change is accompanied by an improvement in the company's intrinsic value, which will eventually be reflected in its share price. Those experiences have convinced me that if a company improves, so will its share price.

Under the assumption that if I invested in a company I liked and worked hard as a shareholder, the company would improve and generate returns for my fund, I founded an investment advisory firm in 2005. Misaki Capital's "Japan Constructivism®" approach has not changed.

Koike 2005 was the first activist boom in Japan, where M&A became a popular topic. Do the companies in which you invest promptly understand the concept of "Japan Constructivism®"?

Nakagami When the term "vocal shareholder" first appeared, we were all viewed as the same. Though we explained that we were not activists but shareholders working to improve corporate value, not many understood us. However, our dialogues were not about dividends, share buybacks, or IR. Instead, we focused on expanding business, persisted with our proposals, and gradually cultivated an understanding. I think our team's many former management consultants were one of our differentiating factors.

Many Japanese Companies have Unrefined Management

Koike Please tell me about the overview of your fund. What type of criteria do you use to choose prospective investments?

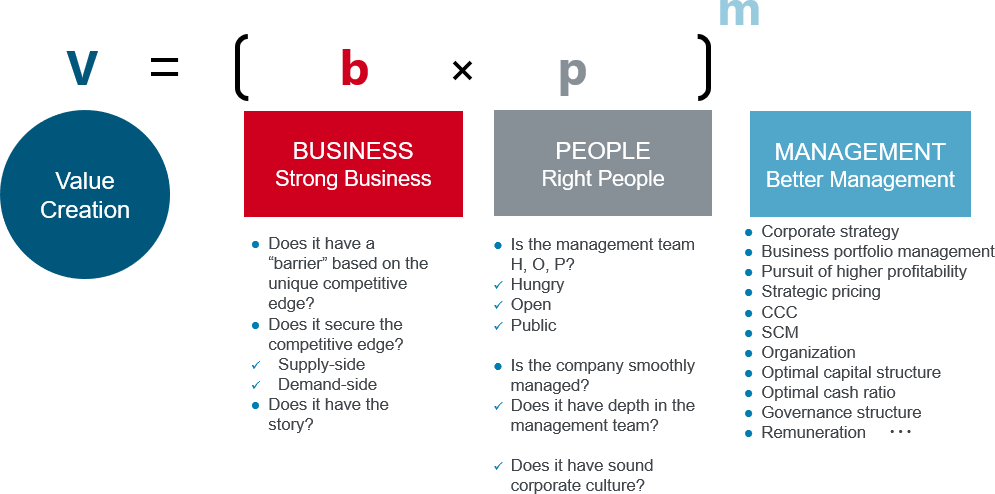

Nakagami The assets under management total approx. 100 billion yen. We conduct highly selective investment in a portfolio of around 10 companies, and form teams of two to three people responsible for engagement with each company. Our investment selection criteria are based on "Misaki's Axiom". Specifically, V = (b x p)m. "V" represents sustainable corporate value growth. "b" is business. "p" is people. While "m" refers to management. This axiom represents our engagement fund's criteria for sustainable improvement of corporate value.

For the first investment criterion, "b", we look at a company's business. However, terms like superiority or differentiation are insufficient, and instead, we look for the existence of "barriers". Even if a company currently has high profitability, we focus on whether there is a strong competitor that can steal that business away. For the second criterion, "p", we believe that regardless of the business, product, or service, results will greatly differ depending on who manages it. In other words, we look at the quality of management. We judge this based on the criteria of H (Hungry), O (Open), and P (Public). We will not invest in a company if it is not hungry for growth and improvement (H), open to engaging in any type of dialogue (O), and public in its management mindset (P). While "b" and "p" cover our essential criteria, "m" is the critical multiplier. For any business or manager, constant refinement of management is indispensable for sustainable improvement of corporate value. Management refinements, such as business portfolio restructuring, supply chain optimization, or bold resource allocation, should significantly increase corporate value.

Koike What is your engagement style? Please tell me about your core thinking.

Nakagami Instead of using the usual dichotomy between labor distribution and shareholder returns, we examine how to enlarge the overall pie. This is to say, we think about increasing the value produced by the company itself. The discussion of distribution comes later.

Though we sometimes aim for delta (change) in "b" and "p", our core business as an engagement fund is seeking delta in "m", or progress in management. In Japan, though companies generally have a solid business domain and a high level of management consciousness, I have the impression that many have unrefined management. As investors who closely examine the management of companies across a wide range of industries and countries, we should be able to identify areas where management is lacking. Therefore, by generating delta for "m", I believe we are able to generate exponential improvement in corporate value, as expressed in "Misaki's Axiom".

Using Waterfall Charts to Calculate Individual Engagement Outcomes

Koike Institutional investors are expected to conduct effective engagement. However, it is difficult to measure whether engagement has contributed to corporate value improvement, and I think about how to best communicate this to our investee companies and what I should personally do. How does Misaki Capital assess the outcomes of its engagement?

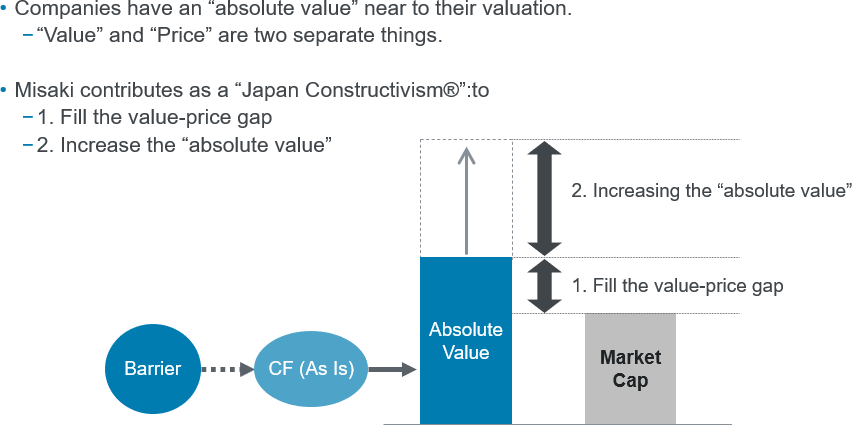

Nakagami We use waterfall charts for individual companies to separately analyze the gap between intrinsic value (absolute value) and current share price and consider the value created via engagement. While there are a variety of engagement methods, for example, if it appears that CCC (Cash Conversion Cycle: a financial indicator representing the number of days from purchase to cash collection) or labor productivity can be improved, we try to quantify how much value will improve from success as much as possible.

As an example, we invested in a niche chemical manufacturer with high global share and profitability, alongside a sales growth rate of 6% and a CEO that sought even further growth. Ultimately, it was determined that there was no choice but to create a new business, and the company sought to apply existing technologies to develop a presence in the medical/pharmaceutical field. The company developed a strategy to first create an industry foothold through M&A, then expand its business. At present, the new business accounts for 40% of EBITDA and sales growth has more than doubled to 15%.

Koike From the perspective of a comprehensive asset management company like us, a concentrated engagement fund like Misaki Capital is attractive. However, when considering the strict management of voting rights and conflicts of interest, there are barriers and restrictions that make it a difficult field to enter. For example, there could be issues regarding inconsistent exercise of voting rights if a passive fund and an active fund are investing in the same company.

Nakagami There are an increasing number of styles of active funds, including concentrated investment funds, which were taboo when diversified investment was the gold standard, and ESG engagement funds. We would like to see an industry leader like Nomura Asset Management try its hand in this field.

Promoting the Technical Value of Human Capital

Koike Next, I would like to ask about corporate management. The Tokyo Stock Exchange has been asking listed companies to take measures to realize management that is conscious of capital costs and stock prices. This is often discussed as the issue of falling below PBR 1x. Please tell me your thoughts on this issue. Additionally, how do you view the progress in Japanese corporate governance reform from your position as an engagement specialist?

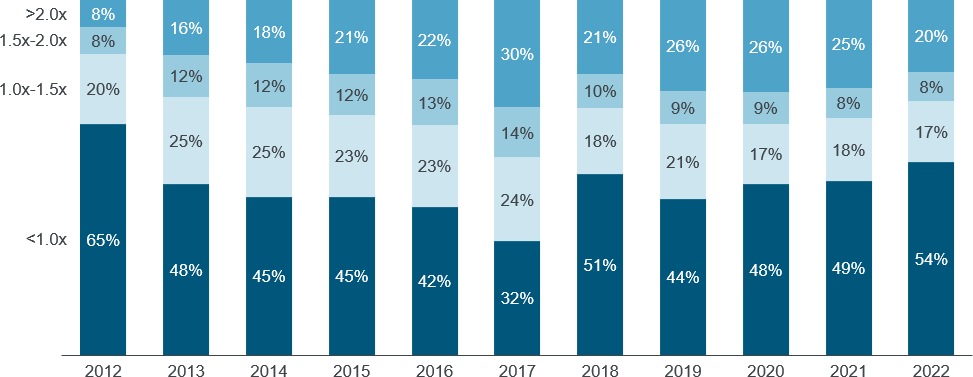

Nakagami Regarding PBR, this is not a new issue. Following the trends of the past 10 years, approx. 50% of companies have a PBR of less than 1x. Even if many people make mistakes in the short-term, it is not normal for that many people to make mistakes in the long-term. This is to say, the prolonged PBR issue is a representation of Japanese corporate management. Japanese GDP growth has been stagnant for a long time, which is synonymous with a lack of overall added value by corporations. Economic growth engines are not households or the government, but corporations. GDP growth is defined by how much value corporate management can generate. Surprisingly, if we set the cost of capital at 8%, only 1/4 of all listed companies have exceeded that figure in the past decade. The remaining 3/4s are destroying shareholder value. This will neither result in greater GDP, nor outperformance of the equity market. Increased corporate capital productivity is necessary for the national economy, which must be the root of governance reform.

Looking further, the source of Japan's low ROE is not total asset turnover or financial leverage, but the low "earning power" of net profit margins. That is why I believe it is truly vital for institutional investors to continuing engagement activities to improve that.

Koike We also need to improve the quality of human capital investment. How to reflect that quality in corporate value is also a major issue. From the perspective of overseas investors, Japan is a country with a shrinking economy due to the declining birthrate and aging population. Therefore, there is a strong need to promote Japanese companies in a way that includes their non-financial value. I feel strongly that this type of approach should not only be conceptual, but also include quantitative factors. I think that institutional investors need to create a solid model in this regard.

Nakagami I agree. In addition to the issue of accounting for human capital in corporate value, the quality of human capital in Japanese companies also must be elevated.

Unfortunately, engagement indicators like job satisfaction and enthusiasm are low in Japan, and I believe there is still an insufficient level of investment in human capital. In the American consulting firm I joined after graduating from university, new hires from around the world gathered at the US-based headquarters for a month of intensive group training. Afterwards, for the first five years until you become a manager, annual training sessions at the US headquarters lasted about a week each. In doing so, we were able to network with our colleagues from around the world, which proved very useful. Japanese people are known for diligence and a sense of group identity, and I think we can expect more from human capital investment.

(Source) Corporate materials from Misaki Capital, Inc.

Japanese Managers Require Greater Capital Market Literacy

Koike In terms of governance, the importance of engagement with outside directors has been recognized, but until now, it has been limited to dialogue occurring following scandals or similar issues. In addition to your engagement activities, you also serve as an outside director for Marui. How do you view investor actions related to outside directors?

Nakagami Whether they are internal or external, directors are chosen by shareholders, and thus it is strange for them not to be open to dialogue with shareholders. Within the board, outside directors serve the role of supervision rather than execution. In that role, they are close to the position of shareholders, and thus should have greater levels of interaction. Some companies are still wary of interactions between outside directors and shareholders, but I believe we are still in a transitional period, and things will eventually trend in the right direction. Meanwhile, I believe institutional investors also have a role in engaging in dialogue with outside directors to encourage them to properly supervise executive directors and promote evolving mindsets.

Koike In closing, would you like to share your expectations for Nomura Asset Management or myself, or perhaps some advice?

Nakagami I believe it is incredibly important for the leaders of asset management companies to engage in dialogue with the leaders of businesses, which I don't often see from other companies. As such, I'm very impressed with your CEO engagement efforts. Reading past reports, I can see no shortage of harsh commentary. While dialogue between analysts or fund managers and corporate management is important, CEOs will also have insights to offer as those responsible for the businesses. This is particularly true for the CEO of Nomura Asset Management. There are difficult matters for an independent asset manager like me, so I appreciate that you do not skirt around pain points in your discussions.

Koike Japanese managers need greater capital market literacy. That includes their awareness of their share price and how shareholders are rewarded. Though the United States has been criticized for taking capitalism too far, Japan has not reached that level yet. If managers do not think about their stock's valuation themselves, there can be no dialogue with overseas investors. I would like to sound out how concerned top management are about the issue of their share price.

Nakagami Nomura Asset Management has a significant presence in the Japanese capital market. I hope you will play a leading role in moving the "mountain" of Japanese capital productivity to greater heights.

Koike We'll do our best. Thank you for today's fruitful discussion.

This report is not intended as solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: May 15, 2023)