Engagement Feature Articles

JPX Group - Pursuing Competitiveness as an Exchange and Growth as a Listed Company

Right: Hiroyasu Koike, President and CEO of Nomura Asset Management Co., Ltd.

The Japan Exchange Group (JPX Group) is the holding company for the equity market operator Tokyo Stock Exchange, the derivatives market operator Osaka Exchange, and the Tokyo Commodity Exchange. The company is pursuing growth as both the parent company of highly public exchanges and as a listed company itself. How will it achieve this growth? Mr. Hiromi Yamaji, who was appointed Group CEO in April 2023, joined Mr. Hiroyasu Koike of Nomura Asset Management to discuss various management issues.

JPX's Own Growth Strategy is a Necessity

Koike You have served as CEO of Tokyo Stock Exchange since 2021, and you lead the market restructuring. Japan's equity market has received renewed attention due to calls for management and corporate governance reforms and greater consciousness of the cost of capital and share price. On the other hand, viewing JPX Group as a listed company, the company's public nature as an exchange stands out, making it harder to focus on your growth strategy. With your global experience at investment banks, how do you view JPX Group's international competitiveness and growth strategy?

Yamaji The JPX Group has two roles: as a public market operator and as a listed company that is a potential investment target in the public market. The growth strategy of the JPX Group must consider how we can continue to fulfill these two roles.

First, our mission has been unchanged since our founding. When I became CEO, my first message to employees was that we should contribute to the realization of a prosperous society by operating a fair and reliable market and providing an attractive venue and services to investors and listed companies. I believe this mission remains unchanged no matter the time.

As the foundation to continue fulfilling this mission, we need our own sustainable growth and medium- to long-term improvement in our corporate value. In order to operate the exchange, we will need to invest heavily in human resources and IT, so costs are expected to rise in the future. Naturally, if we don't grow, the development of the markets that the exchanges operate will also stall.

Furthermore, money has no borders. We are competing for investment capital with markets around the world. This will probably never change no matter how much time passes.

Koike What elements make up an exchange's competitiveness?

Yamaji We believe there are four elements of competitiveness. The first is the quality and quantity of listed products. For equities, this is listed companies. For derivatives, it is futures and options transactions. The second element is the number and range of investors participating in the exchange. It is extremely important that different types of investors participate in the market. The provision of ample liquidity by a diverse range of investors enables participants to sell when they want to, and to buy when they want to, regardless of market conditions. Third, appropriate trading rules. And the fourth is a user-friendly trading system.

Enhancing Competitiveness as an Exchange

Koike What challenges and opportunities does JPX Group see while pursuing this enhanced competitiveness?

Yamaji Each element has its own challenges. As for the quality and quantity of listed products, we are actively promoting the listing of various products. We are also working to further enhance the corporate governance of all listed companies, for example by disseminating and establishing the Corporate Governance Code. In addition, we support listed companies in their efforts to increase their corporate value over the medium- to long-term, such as by publishing the request for "action to implement management that is conscious of cost of capital and stock price." The expansion of the number and range of investors will be based on the creation of an attractive market in which a diverse range of investors can participate, but the starting point is to make Japanese and global investors aware of the attractiveness of the Japanese market. Therefore, we recognize that strengthening our ability to publicize this attractiveness is one of our most important issues.

The trading rules are revised as necessary to realize a fair and transparent market while taking into account the comments we receive through public consultation. Meanwhile, trading systems are an area where new technologies are constantly being introduced and are being renewed every few years. We aim to make the system more user-friendly by incorporating feedback from participants when renewing our systems.

At present, the Japanese market is receiving high interest from both domestic and overseas investors, and we feel a tailwind. In the Asian market, China has had a large presence in the past, but due to rising geopolitical risks, overseas investors and asset owners in particular are beginning to seriously consider expanding their investments in the Japanese market. The size of Japan's economy, the size and liquidity of its markets, and its stability are being recognized.

The number of individual shareholders in Japan is also on the rise. According to statistics by the Japan Securities Depository Center, the total number of individual shareholders increased from approximately 13 million in FY2020 to approximately 15.5 million in FY2022. As a matter of fact, the number of shareholders of the JPX Group was also around 60,000, but it doubled to 135,000 by the end of March this year. Unprecedented changes in the investment environment, such as inflation expectations and the drastic expansion and permanent implementation of NISA, are encouraging individuals to participate, and I am aware that the Japanese stock market is growing in depth.

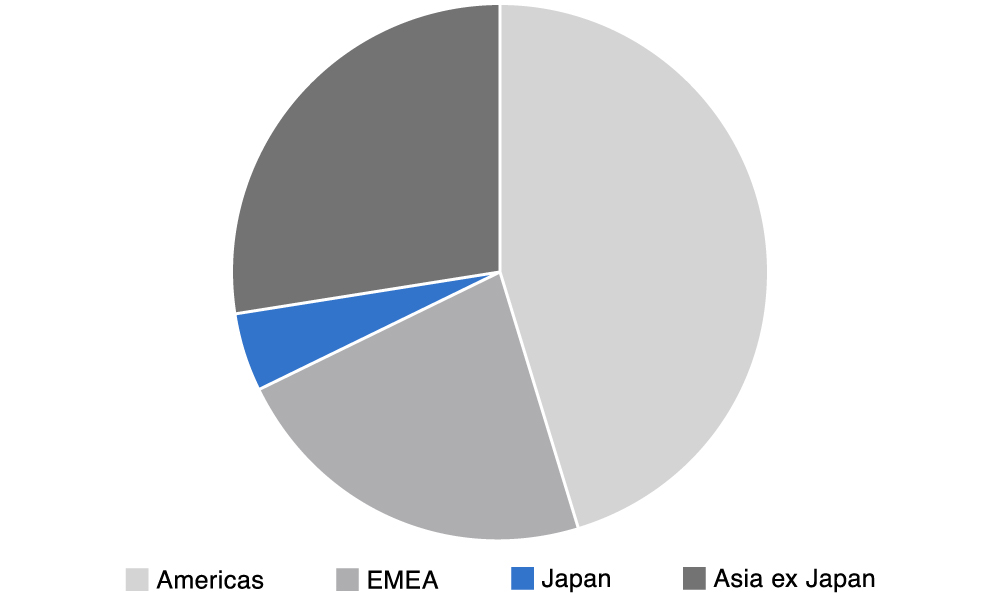

(*2) USD 106 trillion globally. USD 48 trillion in the Americas, USD 24 trillion in EU/Middle East/Africa, USD 5 trillion in Japan, and USD 29 trillion in Asia ex-Japan.

(Source) Prepared by Nomura Asset Management based on World Federation of Exchanges materials

Pursuing Initiatives to Enhance the Functions of the Japanese Financial and Capital Market

Koike It is my impression that the source of competitiveness for global exchanges is monetizing large scale M&A's of peripheral businesses. Do you think that JPX Group should be focusing on Japan, or if it should also be pursuing global expansion?

Yamaji Indeed, exchanges in the US and Europe seem to take such a strategy. Examples include the London Stock Exchange Group's acquisition of Refinitiv, a financial information company, and Deutsche Börse's acquisition of ISS, a proxy voting advisory company.

JPX Group established JPX Market Innovation & Research, Inc. (JPXI) in 2022 to consolidate our data services, such as index business, and digital and IT functions, such as system-related services. The Financial Instruments and Exchange Act defines a strict scope of business operations in which exchanges and clearing organizations may engage. JPXI is able to explore new services and products that are independent of the scope of exchange business operations. We're developing a new culture that is different from the traditional "exchange" while utilizing highly skilled human resources, and flexibly examining various services. Recently, in November 2022, we acquired SCRIPTS Asia, K.K., which supports listed companies in English disclosures, and made it a wholly-owned subsidiary in February this year. In December 2022, we began discussions with trust banks and others to establish joint ventures to build a national infrastructure for the digital asset market. We intend to develop and provide "Progmat*", which services as the foundation for the issuance and management of all digital assets, while also operating the Digital Asset Co-Creation Consortium. In March of this year, we made a 5% investment in BOOSTRY, Inc., a security token platform. Business partnerships with capital tie-ups are a new field for us, but we will continue to actively consider investment and M&A projects in line with our management strategy.

Koike This means that JPXI's expansion of the information business will be a driver of future revenues?

Yamaji Data and digital services are important pillars of our revenue. As I mentioned early, JPXI is primarily responsible for that area of business, but we are exploring opportunities through various studies and initiatives to contribute to the enhanced competitiveness of Japan's financial and capital markets.

Specifically, among data and digital services, index and data services, including index calculation and dissemination, and the provision of various types of data, have a significant impact on the overall market operations of JPX and account for a certain amount of revenue. We believe that steadily carrying out these operations and building a foundation of reliable market operations, a solid "defense" so to speak, is an important point. In addition, we continue to boldly challenge ourselves to create value through the development of new indices and the expansion of our data business as part of our "offense." We are also actively pursuing DX and digitalization initiatives, which we expect will contribute to the overall profits of JPX Group in the future.

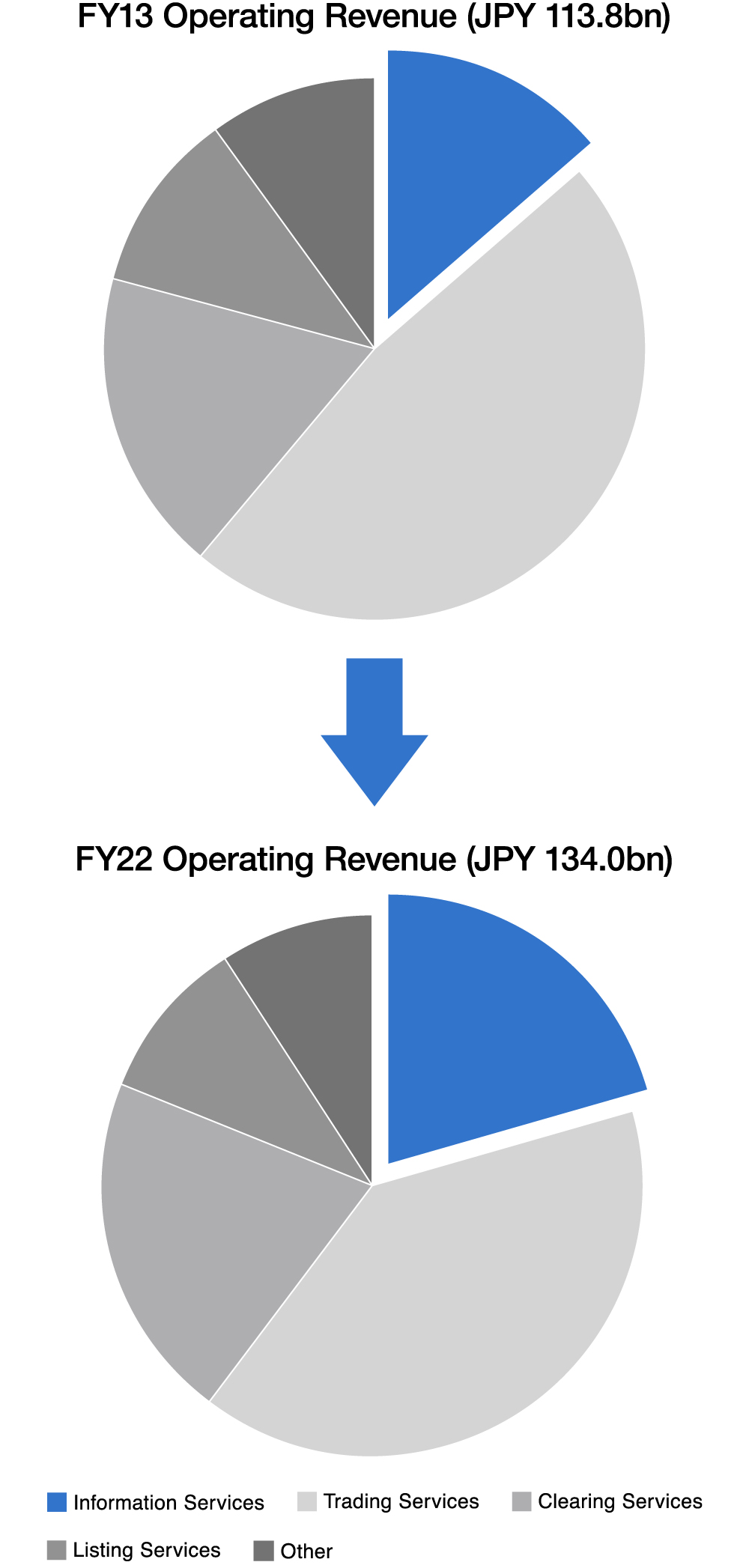

Trading Services revenue - revenue from trading participants (securities companies, etc.)

Clearing Services - revenue from clearing participants (securities companies, financial institutions, etc.)

Listing Services - revenue from listed companies

FY2013 - JPX formed from TSE/OSE merger

(Source) Prepared by Nomura Asset Management based on Japan Exchange Group materials

The First Signs of Market Revitalization

Koike The traditional exchange business involves increasing added value through the number and amount of listed products, and growing revenues by increasing the number of investors participating in the market. However, I have heard critical voices saying the metabolism of the equities market is insufficient.

Yamaji Criticisms of insufficient metabolism may be due to the lack of active reorganization and M&A, including delisting, and the lack of market discipline. Indeed, in the past, out of about 70 companies delisted annually, only 30 were delisted due to reorganization or M&A, so it was relatively small compared to overseas. However, since a few years ago, the number of delistings by corporate action has increased, and recently about 80 companies are delisted per year. Because of differences in corporate culture and social and economic conditions, it is generally difficult to compare our operations with those overseas. However, there is no doubt that organizational restructuring is an important management option. We have called on listed companies to manage their business with a consciousness of the cost of capital, and we expect that they will review their business portfolios to achieve sustainable growth. I believe that the market as a whole will be gradually revitalized by listed companies actively working to realize the appropriate allocation of management resources, including organizational restructuring and M&A.

Koike In terms of listed products, I feel that we are constantly seeing the arrival of new index products, which have become quite numerous. For TOPIX alone, there is much variation, which can't be easy for investors to parse. Do you see any signs of "scrap and build" activity?

Yamaji We believe it is important to provide attractive indexes for investment purposes. I think a scrapping approach is difficult as there are many existing users of these products, but we are progressing with necessary reviews. Currently, TOPIX has more than 80 trillion yen in linked assets, but we are reviewing it to enhance its functionality as an investment target. In addition, we continue to work on the development of new indices, including the calculation of the JPX Prime 150 Index, which began in July this year. Since it is difficult to meet all investment needs with a single index, we must develop indexes that are tailored to the needs of investors. JPXI will be pursuing these initiatives as well.

Contributing to Japan's Overall Carbon Neutrality

Koike Your company completed a business integration with Tokyo Commodities Exchange (TOCOM) in 2019. Precious metals and rubber trading was transferred to Osaka Exchange, leaving TOCOM as a specialized energy futures commodities exchange. What changes have you felt since the merger?

Yamaji Three years have passed since we launched as a Comprehensive Exchange. We have been able to stably operate the commodity futures market and we are very grateful for the cooperation of all involved. As for the commodity futures market, there are still many challenges, but the main point is how to expand the market. While there is some impact from market conditions, we are seeing increasing volume from overseas investors. We haven't been able to achieve significant synergies yet, but we do feel there is high potential.

We are also working to establish markets that are different from the so-called listed stock and financial derivatives markets. Tokyo Stock Exchange is promoting the opening of a carbon credit market in order to contribute to carbon pricing in Japan. The government has set a goal of carbon neutrality by 2050. In February this year, the Basic Policy for the Realization of GX included mention of introducing an emissions trading system for carbon pricing. In FY2022, Tokyo Stock Exchange was commissioned by the Ministry of Economy, Trade and Industry to conduct a technical demonstration project on the carbon credit market. Based on the results of this demonstration project, Tokyo Stock Exchange is now accepting registrations from market participants. As the market expands, interest in derivatives for hedging should naturally grow. I believe that the cash market and the derivatives market operating under the same corporate group will also lead to a sense of security for market participants.

Japan has a large amount of electricity generation and consumption, and the existence of an electricity market (a power wholesale market) is very important for stable energy supply. Electricity is generally produced locally for local consumption. The domestic futures market sees relatively limited use compared to the power wholesale market, and we plan to work to reinvigorate it as soon as possible.

Koike How is JPX Group pursuing sustainability, including its own carbon neutrality and Scope 3 emissions?

Yamaji The Sustainability Committee that directly reports to me, formulates and implements basic sustainability strategies such as our group's response to environmental issues and human capital management.

Our current medium-term management plan declares that we will achieve carbon neutrality in FY2024. To achieve this goal, JPX Group itself has renewable energy generation facilities such as solar and biomass, and is implementing initiatives to create environmental value. To fund these efforts, in June 2022 we issued digitally tracked green bonds, Japan's first corporate bond security token using blockchain infrastructure.

The overall stock market uses a lot of electricity to operate its data centers and trading systems. From a long-term perspective, we have established Target 2030, a long-term vision that we aim to achieve by 2030. By 2030, we aim to achieve carbon neutrality in relation to the operation and value chain of the securities market. We aim to use renewable energy to cover the electricity consumed by transactions in the market, including trading, clearing, and settlement.

We plan to significantly improve the sustainability of the market by reducing greenhouse gas emissions from market operations and by using renewable energy for electricity. I would like to see JPX Group take the initiative and work with market players to shape the future as an essential part of social infrastructure.

JPX Group regards human capital as one of the most important management resources in its sustainability strategy. Therefore, investment in human capital and human resources is essential for us to improve the company's corporate value over the medium- to long-term. Toward that end, the basis of our human resources strategy is to hire and develop not only people who will underpin the further stabilization and sophistication of traditional exchange operations, but also those who will pioneer into new sectors and fields, as well as creating an environment in which all employees can demonstrate their abilities.

Koike In conclusion, may I ask what you expect from institutional investors like us under Corporate Governance Reform?

Yamaji Institutional investors are key players in engaging listed companies in dialogue, so I hope you will actively engage with them to achieve sustainable growth and enhance corporate value over the medium- to long-term. I would also like to see you take a pro-active role as an opinion leader, sharing your deep knowledge and views as an asset owner. I understand that you, personally, speak directly with investors and asset owners around the world. I think it would be interesting if you shared information via your homepage or other means regarding investor views on Japanese companies and the Japanese market, and also your engagement with individual companies.

There is much variety among listed companies, including differences in engagement initiatives and attitudes. I believe the overall Japanese market would be reinvigorated if the overall level of listed companies and investors was raised. We look forward to Nomura Asset Management's efforts.

Koike Thank you. We'll do our best.

This report is not intended as solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: September 27, 2023)