Engagement Feature Articles

Isetan Mitsukoshi Holdings - Shifting to a Solutions-based Business built on Trust and IT

Right: Hiroyasu Koike, President and CEO of Nomura Asset Management Co., Ltd.

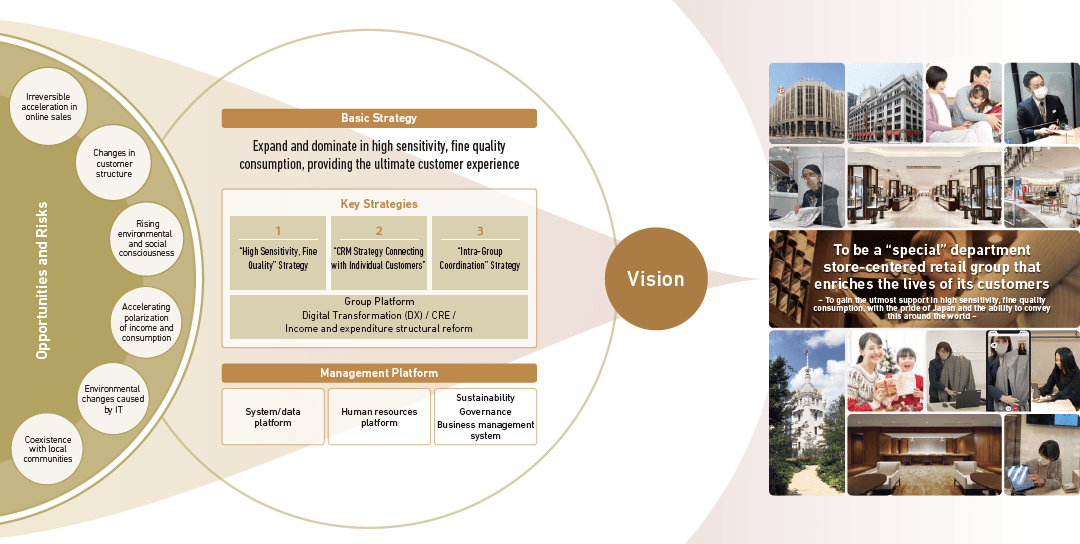

With the department store business facing a difficult consumption environment due to factors such as an aging population and diversified consumption, how does Isetan Mitsukoshi Holdings plan to achieve growth? Isetan Shinjuku main store is showing signs of record profits after the pandemic. Isetan Mitsukoshi Holdings' Mr. Toshiyuki Hosoya joined Mr. Hiroyasu Koike of Nomura Asset Management to discuss recent reforms and related prospects.

Casting Off the Traditional Department Store Model

Koike The Japanese department store business has long had an image of being in decline. However, Isetan Mitsukoshi Group has improved profitability, focused on the flagship store, and is showing signs of new growth. It's clear that we cannot judge the department store business so uniformly. What are your views on the role of department stores and its changes over the years?

Hosoya I think the traditional department store business model has reached its limit. That is the starting point. Under the traditional model, our job was to keep the store clean and prepared for customer arrivals, place weekly advertisements, and attract customers to the store. We would lay out zone defenses in each area and wait for customers to buy products.

This worked during a time of few competitors where the power of products could attract customers. The amount of individual consumption has remained flat, and with retail channels expanding to shopping centers, convenience stores, category killers, outlets, and EC, the traditional model no longer functions when competing for a piece of the pie.

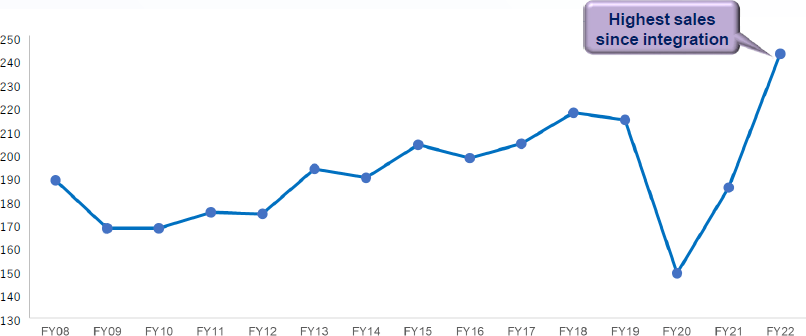

Department store sales peaked in 1997 at 9.7 trillion yen, with more recent numbers having fallen below 5 trillion yen. The industry was unable to shift its model and is losing to competitors. I believe many views department stores as high-class versions of shopping centers. This is about looks, not about sales methods. The key point is how to change our business model from a sales perspective.

Koike You also have a successful experience reforming the management of Iwataya Mitsukoshi. I understand you're applying your knowledge from that to Isetan Mitsukoshi. Can you share more about the reforms at Iwataya Mitsukoshi?

Hosoya I started the revitalization of Iwataya, based in Fukuoka, in 2018. Iwataya went bankrupt in 2002 and progressed with rebuilding under Isetan, but it continued to record losses. It recovered to profitability thanks to inbound demand, but with 100 billion yen in revenues and 500 million yen in operating profits, even a small reduction in revenue would have resulted in losses. The executives claimed that all possible expenses had been reduced, but when looking at expenses by customer types, we found that there was greater spending for high-volume low-margin customers than there was for high-margin wealthy customers. So, we revised the allocation of these expenses. We increased the number of out-of-store sales staff and buyers by 1.5 times to upgrade the high sensitivity and fine quality shopping experience for wealthy customers, and we enriched our store fronts with flush inventories of rare brands. After reducing excessive spending on high-volume customers, we achieved an operating profit ratio of 3%. Since consumption by wealthy customers is not as sensitive to the external environment, we also improved earnings stability.

Refining the ability to provide "high sensitivity and fine quality"

Koike Even when upper management sets a new policy, I don't believe it is easy to make changes on the ground. It takes a lot of effort and trial and error for individuals to change their mentality, acquire the necessary skills, and autonomously work beyond the organization's structure. What did you do to promote an understanding of the necessity to reform and improve motivation?

Hosoya At Iwataya Mitsukoshi, first we changed the system of communication. We expanded management meetings, which had been attended by only a few members, to include all 20 department heads and held all-day strategy discussions once a week, with decision-making on the spot. I also met with the approximately 300 managers below the department heads to share my vision for our strategy and customer matrix, and I asked them to select a category to which they could contribute. I initially expected them to only choose a few categories, but most wanted to be involved with them all. This trend spread throughout Iwataya Mitsukoshi, increasing what was possible. When we made record profits in only half a year, confidence in the new strategy increased and discussions in that direction became livelier. Our stance changed from waiting for customers to asking about customer needs on an ongoing basis. Through out-of-store sales, we were able to understand the needs of our sophisticated customers and provide a unique shopping experience. This is the type of experience that everyone wants in their lives and honing our skills in this area is the new business model for department stores. The future would be difficult if we became a department store selling common items.

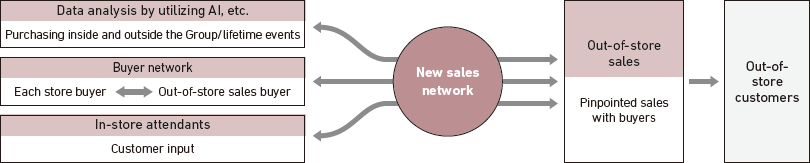

Coordination between Out-of-store sales and Buyers

Koike What steps did you take to improve your relationship with customers?

Hosoya We strengthened our out-of-store sales. Out-of-store sales are unique to Japan, which have the appeal of directly connecting with customers. Our department store has roots in kimono sales, which were often done on credit and were popular through out-of-store sales. However, we faced the challenge of dwindling consumption with aging customers, so we strengthened coordination between our out-of-store sales staff and our buyers. In the past, our out-of-store sales staff would handle customers individually, but we changed our approach to involve a unified team of out-of-store sales staff and buyers from each department. This drastically improved our ability to satisfy customer needs.

For example, once a daughter consulted with Iwataya's out-of-store sales regarding a present for her father's 60th birthday. For such an occasion, the standard proposal would be a red box of Baccarat crystal, but the new team was able to offer around 20 original product proposals which really impressed the customer. Ultimately, the customer chose a Givenchy backpack, but she also expressed great interest in a chair that had been among the proposed gifts. Later, she returned to buy an expensive garden chair. Through these types of interactions, Iwataya's out-of-store sales increased by 1.5x.

We're also applying the same method in Tokyo. In Tokyo, we're utilizing AI and other IT solutions. Out-of-store sales are on course to exceed 200 billion yen, whereas they were 140 billion yen prior to the pandemic. That increase is equivalent to one department store. I feel there's been a revolution in our out-of-store sales. Instead of simply increasing the number of our out-of-store sales staff, we have drawn out potential needs from dialogue with customers and offered valuable solutions to capture new demand. We are not limiting our proposals to any specific form. We sell everything from camping vans to gardens arranged by famous designers. The strength of department stores, which are professional groups, is that they can curate from the customer's point of view.

Generating Financial Results from Applied HR and IT

Koike You're operating a solutions business rather than retail. While I think traditional stereotypes persist, is there anything you do to draw out the creativity of your younger staff? How does that relate to the strengths of your company?

Hosoya We believe that viewing things from the customer's side, rather than the retailer's side, will lead to creativity. We also created a system that allows buyers to compete for high sensitivity and fine quality proposals. It energizes our team. I think our overwhelming strength is the quality and quantity of our customers. Our customers have a mindset of self-improvement, and many have innovative spirits. By dealing individually with these customers and offering rare products and services, the higher volume middle class customers will choose our company when they go shopping.

Our utilization of IT is also a strength. We've released an app that allows for two-way communication with our customers, and has led to large lines at our events, which creates a virtuous cycle as passersby become interested and join the line.

The sales of customers that we can identify (MI card Members, app members, etc.) increased from a little less than 50% to nearly 70%. I feel this trend will continue for the time being. In the past, annual sales at the Isetan Shinjuku store only exceeded 300 billion yen once during the Bubble Era in 1991. However, 2022 is likely to break that sales record. Even though the number of customers in 2022 is about 80% of what it was before COVID-19.

Koike Generating a virtuous cycle via a strategy focused on high sensitivity and fine quality consumption is exciting from a corporate value improvement perspective. Even as earnings are improving, from a financial point of view, your company's ROE is low. If you can improve ROE and other financial efficiency indicators, I think it will be appreciated by the capital market.

Hosoya I'm quite conscious of this issue. We have introduced a scientific perspective to our department store management, but it is still not enough. I think we should listen to investors and analysts in the same way that we engage with our customers.

We are also promoting structural reforms in our financial management. For example, instead of managing expenses compared to last year to improve profitability, we created a P/L for each customer segment. This has greatly changed the way we think about advertising, business consignment, and other expenses. In the future, we will extend this approach to each of our regional stores and use the PDCA cycle to change our corporate culture.

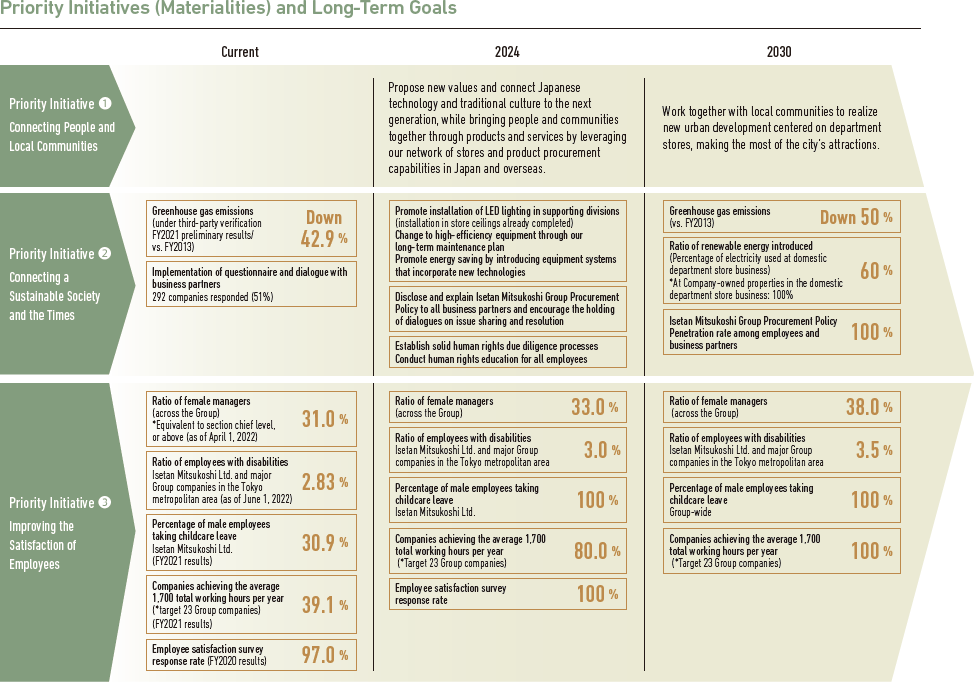

Taking Action to Deepen ESG Management

Koike Looking at group company earnings, there are many subsidiaries with low profitability, which contributes to low ROE. At present, the results of Group management cannot be clearly ascertained from management figures. As a group strategy, you have the option of reviewing your business portfolio and forming partnerships with stronger external companies for each function.

Hosoya Of course, there is. Stores that cannot switch from the traditional business model need to consider structural reform. If we own land, changing to an office or condominium is also an option. But dividing things too vertically can be a problem. Looking back on past closures, I sometimes wonder if they were the correct decision. A store with sales of 20 billion yen has about 100,000 customers. Credit card fees alone are substantial income, and the security and cleaning services provided by group companies are also a source of income that cannot be seen from the profit and loss of the stores. In any case, we do not believe that the low-profit businesses will remain as they are.

Koike I can see that you're approaching enhancement financial efficiency by incorporating various options and the viewpoint of group management. How are you responding to sustainability requests?

Hosoya Two years ago, when I became president, I felt that sustainability was viewed superficially within the company. I am aware that we cannot survive in the future unless we change our thinking and make sustainability a central part of our management. We are having a thorough discussion about what we can do now.

Based on customer feedback, we have started a purchasing service called "i'm green". Though we only set up small sections in Nihombashi and Shinjuku, we have achieved better results than expected. I feel the needs of customers who want a trustworthy company for this type of service. We believe that the word "trust" will be a great clue for our future business and sustainability.

Koike We also hope to have more of these dialogues to contribute to the improvement of corporate value and reinvigoration of the Japanese capital market. In conclusion, do you have any requests for institutional investors like us?

Hosoya When I was the General Manager of Corporate Planning Department in 2017, I had the impression that institutional investors had blamed me in various ways, but I feel that the atmosphere has changed significantly in recent years. Now the discussion is centered on how to improve corporate value and what the stock market wants. I really appreciate your advice. I hope we will continue to have a warm dialogue.

Koike I feel the same. Thank you for today's valuable discussion.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: May 10, 2023)