Engagement Feature Articles

Dai-ichi Life - Pursuing Customer Well-Being Beyond Life Insurance

Left: Hiroyasu Koike, President and CEO of Nomura Asset Management Co., Ltd.

Dai-ichi Life Holdings recently celebrated its 120 year anniversary. In 2010, it became the first major life insurance company to be incorporated and listed on the Tokyo Stock Exchange. Since then, Dai-ichi have been working to create new value through its business while maintaining a dialogue with investors. How will they achieve growth from the saturated domestic life insurance market? Mr. Seiji Inagaki, President and Representative Director (CEO) of Dai-ichi Life Holdings, Inc., joined Mr. Hiroyasu Koike, President and CEO of Nomura Asset Management Co., Ltd. to discuss Dai-ichi's initiatives toward reaching a new stage in its business.

Asking to "Think about your Life"

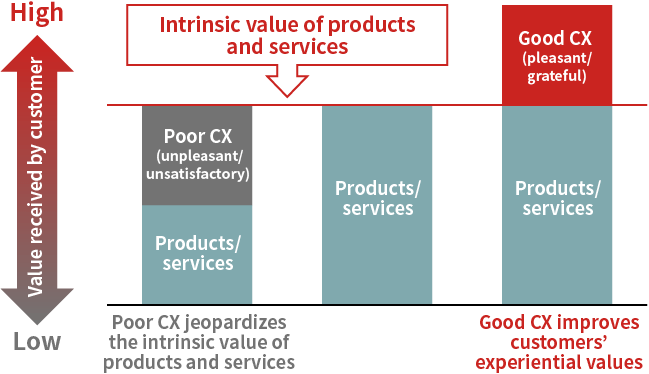

Koike The pursuit of customer experience value (CX) is at the core of your medium-term management plan from fiscal 2021 to 2023. What is your CX design strategy?

Inagaki The nature of insurance changes with the times. We are at the starting point of redefining the value that a life insurance company should deliver to its customers. Our hope is that our customers enjoy better lives. We view CX as advice and services that help customers build life assets, such as retirement/savings, health/medical care, and social connections in addition to financial protection. We focus on delivering the best CX to our customers. Through these initiatives, we aim to earn the trust of our customers and become the preferred insurance company.

Koike This gives me the impression that the traditional Japanese life insurance sales that I'm familiar with has changed significantly. However, the idea of comprehensive life planning consulting is not so simple. I believe this requires an improvement in the quality of marketing/sales staff and a shift in human resources strategy, does it not?

Inagaki You're correct. Investing in human capital is a major theme for fiscal 2022. Customers' expectations are constantly rising, and CX cannot improve unless we provide consulting that exceeds their expectations. We are working to reform the way we provide consulting services, and changing the recruitment management and salary systems of our sales representatives. For example, we have changed our recruitment policy from a focus on securing a larger number of employees nationwide, to one in which the head office controls the number of new hires and emphasizes basic skills and aptitude. In order to ensure that the new hires can focus on providing consulting services with peace of mind, we have increased the percentage of fixed salary for the first five years of employment from a commission basis, and raised the salary level itself.

Koike The policy of narrowing down the number of "Total Life Plan Designers" who are sales personnel over the long-term seems to be a quite major shift in strategy.

Inagaki Consulting by Total Life Plan Designers is exactly the value we provide to our customers. It's not as generic or visible as a factory-made product, so to increase its value, we need to be selective about recruitment and be strict about the quality we require from new hires. Our retention rate is also improving, and I believe that if we pursue quality first, quantity will follow.

Koike What was the background to the idea of reorganizing the sales structure around CX?

Inagaki Especially in Japan, the life insurance market is mature, and almost 90% of people have some kind of insurance. In the reconstruction era following World War 2, sales were made by holding seminars, talking about the risks in life and proposing life insurance as a solution. Although there is no change in existence of risk at any life stage even now, there are still many people who are not fully aware of the risks associated with longevity in the future. This is also the responsibility of protection providers including ourselves. Moving forward, we are changing our approach to propose insurance products via future-oriented consulting that asks our customers to think about life rather than life insurance itself.

Koike Shifting from the traditional style to a future-oriented consulting approach will lead to a major change in corporate culture. There are 37,000 Total Life Plan Designers across Japan. Are there any points that you are concerned about in communication with management and its penetration?

Inagaki The values in the sales field will change considerably. Town-hall meetings are held at each site across Japan to increase opportunities for executives to speak directly to employees. Now we have a web environment and can connect with sales representatives all over the country through online meetings. I myself use the "Seiji's Words" intranet to convey my daily thoughts to employees. I feel that it is important to communicate from various angles to promote understanding of new policies in each business area and to maintain solid communication.

Continuing to connect with customers through a Human/Digital Fusion

Koike Dai-ichi Life has been advocating "InsTech" since 2015, which combines the insurance business with digital technology. You have a pioneering impression of DX ("digital transformation"). What is your future outlook?

Inagaki As a result of the global pandemic, I feel that customer resistance to EC ("electronic commerce") and other contactless purchasing has considerably decreased. It is true that many people are still hesitant about purchasing life insurance through digital means, but from now on, the fusion between humans and digital technology is the way to continue to connect with customers, and I feel that the pandemic has become an accelerating factor.

Our communication website "Mirashiru" has been in operation since December 2021 as the digital foundation for the CX design strategy. This website is designed to communicate with customers in a digital space, and is characterized by a design that personalizes the user page for each customer. For example, your "Mirashiru" incorporates the blog of the Total Life Plan Designer in charge of your account, enabling everyday communication. Sales representatives across Japan have begun to take on the challenge of implementing this system, and our relationship with customers is in a transitional period.

Koike I am also a user of the smartphone app "Kenko Daiichi (Health First)" provided by QOLead of Dai-ichi Life Group. Recently, I've finally started to pay attention to my health, checking my daily steps, etc., but when I look at my insurance through the app, I realize that it's closer to me than I thought. In addition to health and medical care, there is an area of expandability that can be targeted to link to insurance.

Inagaki As you say, life insurance is regarded as extraordinary by customers, and there are not so many life events that change insurance needs. It is quite difficult to connect with customers on a regular basis. In order to maintain our connection, it is important to communicate the importance of the value that we want to deliver to our customers, such as retirement/savings, health promotion, and social connections. For example, we would like to connect customers to their local communities, and continue our relationship through both human and digital avenues.

Koike It's clear to me that you have reached a new stage where the existence of life insurance companies is evolving.

Inagaki Recently, we have been discussing how to overcome the situation of being simply a life insurance provider. Our group vision is to "Protect and improve the well-being of all" so that we become a company to protect and support the well-being of our customers.

Koike I'm looking forward to seeing how your business develops.

Inagaki Thank you. There is much left to be done.

Importing Best Practices as Strategic Synergy

Koike I would like to ask about the overseas insurance business. Since listing on the Tokyo Stock Exchange in 2010, the company has actively expanded its business overseas, and currently operates in 8 countries. There are many cases where M&As do not go as planned or generate synergies even after closing, but the Dai-ichi Life Group seems to be doing quite well. Could you share some insight into the secret of your success?

Inagaki The life insurance business is closely related to the social security system of each country, and the way in which it operates varies from country to country. From the time we started overseas development, I thought that we would never impose our way of doing things in Japan. Mr. Watanabe, my predecessor, used to talk to the CEOs of overseas group companies about "Respecting each other," "Learning from each other," and "Growing together." When Dai-ichi Life became a holding company, we placed the domestic Dai-ichi Life on equal standing with the insurance companies operating overseas.

Koike I understand the need for mutual respect, but following the investment of capital and unification as a single group, it is important to seek synergies beyond business profits and dividends.

Inagaki There was a time when we considered integrating the middle/back office, but we found it difficult because the products each company sells are different. So as a strategic synergy, we started to import best practices with a good understanding of each country's business. To this end, close communication is essential. The CEOs of all group companies gather online once every three months to exchange information, focusing on good practices. For example, Dai-ichi Life could replicate the agency strategy of Protective Life in the United States.

Koike In August 2022, you announced the acquisition of Partners Life in New Zealand. I don't think it's a big market for insurance, but what is the significance of this move?

Inagaki Many of the overseas insurance companies that have joined the group are traditional, but Partners Life is a new company that has only been in the business for about 10 years. Nevertheless, in a short period of time, it has risen to second place in market share in New Zealand, and it possesses advantages that we do not have in terms of product characteristics and management speed. We expect synergies that will allow the entire group to learn these management techniques.

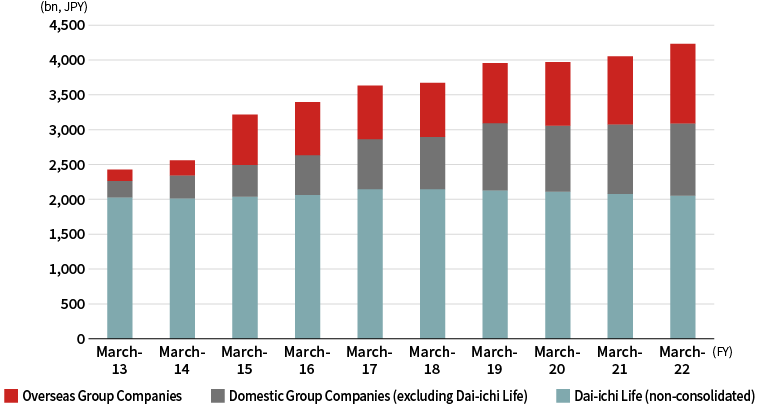

Koike Profits from overseas operations have increased to about 30% of the group total. I think you will have a portfolio encompassing geopolitical and various insurance risks. Is there anything that you feel is a challenge in promoting global development?

Inagaki The insurance business is influenced by long-term macroeconomic trends. In an internal presentation at the beginning of the fiscal year, we introduced future trends in a population pyramid. As you know, while Japan's population is declining, India and Southeast Asia are expected to continue healthy growth. In that sense, it is important to continue to capture overseas markets, and we would like to increase our share of overseas business to about half of profits.

As life insurance is a product that builds long-term relationships with customers, it is essential to pay attention to country risks in countries where we operate. In fact, a coup has occurred in Myanmar that we did not expect, and we are very concerned. However, our business is not connected with the government, but with the people, and we will continue to take on challenges while managing risks.

Pursuing Concurrent Growth in the Retirement, Savings and Asset Management Business

Koike I understand that Dai-ichi is trying to transform the mature Japanese market with CX and DX, while gaining steady growth overseas. Nevertheless, Dai-ichi Life's insurance premium revenues (non-consolidated) are on the decline, and the stock price level shows that investors have doubts about the profitability and growth potential of your businesses.

Inagaki I think investors are probably feeling concern about that area. Indeed, Japan is a mature country, so it is difficult to assume double-digit growth like emerging countries. Nevertheless, we want to differentiate ourselves in the insurance market and pursue greater market share.

Another major source of revenue is the asset management business. Dai-ichi Frontier Life Insurance Co., Ltd., an insurance company that focuses on bancassurance, is doing very well this fiscal year due to the recent recovery in interest rates. In Japan, the risk of asset depletion is increasing because interest rates are low while longevity is increasing. Although protection insurance has taken root, we have not seen sufficient improvement in the overall household portfolios of customers. In August 2022, we established an asset management company called Vertex Investment Solutions to strengthen product development through retirement, savings and asset succession. While there remains much room to grow, we are pursuing concurrent growth in this business.

Koike At the end of 2020, Dai-ichi revised its shareholder return policy. Based on your transition to a more global player, what are your relative values and views?

Inagaki In terms of shareholder returns, we have repeatedly held dialogues with investors and analysts over the past few years, and I believe that we have made considerable progress in communicating our views. When new capital is invested, it is carefully selected so that the investment exceeds the cost of capital. Without those investment opportunities, the excess capital is returned to shareholders. Our policy is to do this in a disciplined manner. If we are able to build shareholder trust regarding these rules, we believe we will be able to communicate effectively and be evaluated appropriately.

Koike When Dai-ichi was listed in 2010, I was in charge of Nomura Securities Co., Ltd., the lead underwriter, and I discussed with you how to increase the multiplier for estimated corporate value. I think it is growing quite according to plan. However, personally, I wonder if the lack of improvement in stock price arises from the negative view of foreign investors on the Japanese insurance business, or if a strong growth story is needed to overcome it.

Inagaki Our goal is to be assessed as a global insurance company rather than as a Japanese financial institution. To this end, we are strengthening our governance system. Also, we are seeking to make the domestic business more attractive through differentiation. By pursuing these two goals, I am sure investors will recognize our value.

Koike Dai-ichi Life Group is engaged in a variety of activities as an institutional investor. Indeed, you made industry news as the first person in Asia to become a member of the Principal Group of GFANZ (Glasgow Financial Alliance for Net Zero), which was launched at COP 26.

Inagaki I believe that climate change and the transition to decarbonization is a period of major industrial change. We would like to support and engage with investors as an entity that can capture the upside over the long-term horizon. Another important point is the global perspective. In order to achieve carbon neutrality, it is important to support countries that are short of funds. Providing funds where they are needed will also contribute to our raison d'etre as an institutional investor with over \60 trillion in assets. Through discussions at GFANZ, we will contribute to the creation of a framework that supports the proper flow of funds.

Koike As a Japanese institutional investor, we at Nomura Asset Management have a firm belief that we will do our best to provide information to boost the Japanese stock market. However, foreign investors tend to think engagement is still weak. As a listed company, do you have any expectations for NAM?

Inagaki These dialogues are very stimulating and engagement with analysts and investors is one of the great benefits of our listing as a public company. I think that offering your insights and encouragement will produce positive outcomes and aid the development of Japanese corporations. Of course, we are very serious about our business and would appreciate your engagement, while also holding our ground where we should. Nomura Asset Management is a leading company, and I think it is wonderful that you are taking the lead in engagement as CEO.

Koike Dai-ichi's evolution since listing has been significant, and I am looking forward to your future growth. Thank you very much for today's valuable discussion.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: December 2, 2022)