Engagement Feature Articles

Asahi Group Holdings - Transitioning from a Mature Company to a Global Growing Company through a Bold Business Portfolio Restructuring

Right: Hiroyasu Koike, President and CEO of Nomura Asset Management Co., Ltd.

After transitioning to a holding company in 2011, Asahi Group Holdings has been actively working to restructure its business portfolio and transform itself from a mature company into a growing company. Mr. Atsushi Katsuki of Asahi Group Holdings, Ltd. sat down with Mr. Hiroyasu Koike of Nomura Asset Management to discuss the background of this strategic decision, the success factors of large-scale acquisition, and the group's future medium-term strategy.

Deciding to Shift Global Business Strategy

Koike With the continuing contraction of the beer market amid a deflationary economy, I felt it was difficult to find a long-term story of improving share value, despite Asahi Group's well-executed domestic beer business.

However, after transitioning to a holding company in 2011, I have been impressed with the strategic sense of your business portfolio restructuring and the rationality behind your subsidiary reorganization. In fact, through the divestment and acquisition of overseas businesses, your company has transitioned from being a mature company that is highly dependent on the domestic Japanese market to being a global growing company. Could you share the background regarding how management reached this decision?

Katsuki Since the early 1990s, we had been investing in foreign companies, mainly Chinese beer companies. Our investment in Tsingtao Beer and establishment of a joint beverage venture with major Chinese food company Tingyi in the 2000s contributed to growth of our company's market capitalization, we had only minority investments. It was difficult for us to take a leading position in the intense competitive environment and had only limited synergies with our domestic business. It was this situation that led us to determine a shift in our overseas business strategy was necessary.

Additionally, beer consumption in Japan has been declining alongside the decreasing working-age population since 1995, and we recognized that mass consumer goods would not be resilient against the shrinking population. It was natural to look for growth overseas, but we reviewed our strategy from the perspective of increasing corporate value.

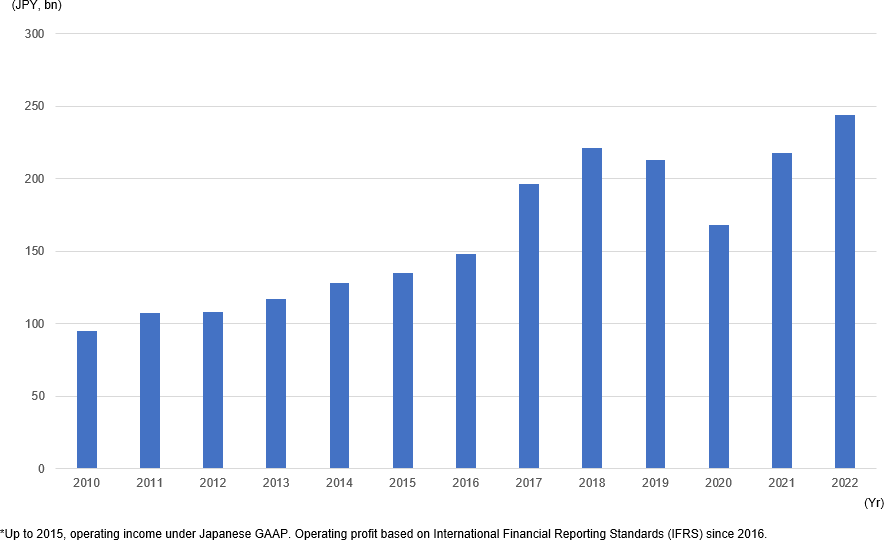

Our strength lies in beer, and expanding our beer business is at the forefront of our strategy. There was much M&A activity in the global beer industry, so we strengthened our research into such opportunities. We acquired Western European and Central/Eastern European beer businesses in 2016 and 2017 which were subject to divesture due to antitrust issues when Anheuser-Busch InBev acquired SAB Miller, and they became our growth drivers.

This successful experience led to our acquisition of Australia's Carlton and United Brewers (CUB) in 2020. Currently, sales are evenly split between Japan and overseas, but the overseas businesses account for 66% of our core operating profit. We believe that this level of growth would have been unachievable without shifting our overseas strategy.

Valuing Mutual Trust in M&A

Koike From decision to Post Merger Integration (PMI), your acquisitions of Calpis and in Europe and Australia are impressive. The acquired companies have improved their performance and are generating synergies. Could you introduce some of the points and considerations for managing a large corporate group?

Katsuki Our acquisition of the Australian beverage division of the UK's Cadbury Schweppes in 2009 was our first experience with overseas M&A. During the initial PMI stage, they were not interested in dealing with us. I believe they doubted that Japanese could understand their business. Even so, we advanced our business while engaging in patient dialogue and discovered that their document management and internal controls were almost incomparably stronger than those of Japanese companies at the time.

Their marketing methods were also advanced and we were able to learn a significant amount. We embraced the opportunity to learn, and they eventually recognized our earnest approach and gained an appreciation for our expertise and careful decision-making, thereby building a positive mutual relationship.

We also focused on promoting mutual understanding during our European beer business acquisitions starting in 2016. Whereas we lacked management experience in the European market and relied on the experience of the local management team, I believe they lacked plans for long-term strategy and investment. Communicating our intentions, sharing our long-term strategy, being willing to make the necessary investments, and strengthening our marketing deepened the trust we had established, thereby boosting their motivation and leading to positive results.

I believe that the transfer delegation of authority is vital in the management of overseas subsidiaries, but more than that, motivational communication is indispensable. We arrived at this approach after a lot of hard work. With the acquisition of CUB, we were able to achieve our cost synergy target two years ahead of schedule without losing market share during the sensitive transition period.

Based on these experiences, we established the Asahi Group Philosophy (AGP) as the starting point for all our business activities. Organizational control is based on the development of reporting lines, but we believe that in order to integrate diverse human resources and businesses, it is important to govern them via corporate culture, in addition to rules and hierarchy.

When establishing the AGP, we discussed with our overseas management team and established a new global philosophy. Because it was a collaborative creation, they are able to feel a sense of ownership.

Strengthening the Business Portfolio in accordance with Long-term Megatrends

Koike You have set financial targets for your next major acquisitions in your Medium- to Long-Term Management Policy. In 2024, we expect financial leverage to fall to the levels seen prior to the Western Europe acquisitions. In addition, the stability of operating cash flow and the rise in international risk diversification gives the impression that the policy is somewhat biased toward financial security. What are your thoughts on strengthening your business portfolio in the future? In particular, you mention using acquisitions to establish a presence in North America. What is your stance in this case?

Katsuki Moving forward, we believe that we can still continue promoting further "premiumization" of our products, especially in Japan, Europe, and Oceania. We also want to expand into emerging markets to capture future growth. However, our capabilities, including dealing with the regulatory and cultural aspects of emerging countries, are still insufficient. We believe this is a challenge that should be addressed over a somewhat longer time frame while sharpening our capabilities.

In addition, our lack of a presence in North America is often cited as a reason why our company's current growth is less appreciated. However, in addition to the limited opportunities for large M&A activity in North America, our company's balance sheet is not ready for large investments. We have established a start-up investment fund, and we are preparing to develop our market presence there. In North America, startup companies are developing unique premium products and creating new markets. Our aim is to seek growth in North America through investments in brands and expertise, while fusing their ideas with the seeds we develop through our R&D.

Koike In your Medium- to Long-Term Management Policy, you seem to have extracted management topics from backcasting of megatrends leading up to 2050. What strengths do you think your company has that enable it to address issues, seize opportunities and generate profits? In your DX strategy, you also mention the challenge of personalization, leaving the strong impression that your company is skilled at mass target business.

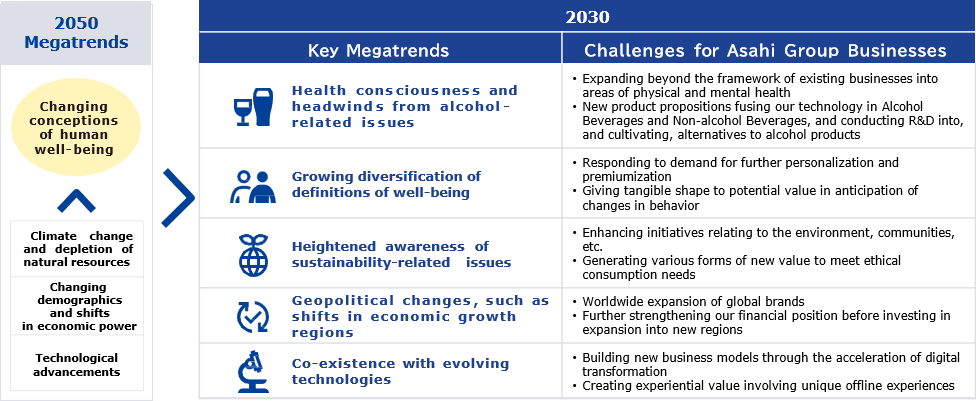

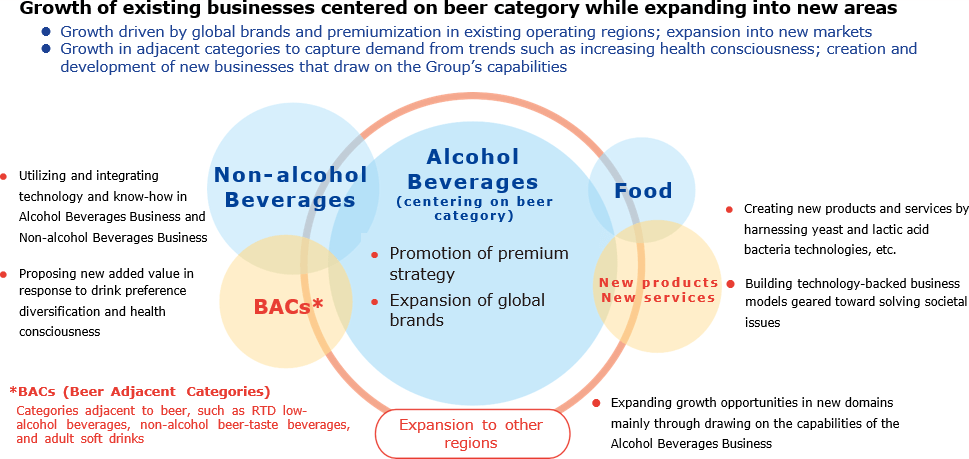

Katsuki We created our Medium- to Long-Term Management Policy last year using backcasting of megatrends leading up to 2050. We believe that megatrends stem from the changing nature of humanity's "well-being", and we positioned expansion into adjacent areas a key theme while placing our alcohol beverage business at the core. We have unique capabilities in two areas: alcohol and non-alcohol beverages. The intermediate area between these two beverage types, represented by, for example, low-alcohol/non-alcohol beers and non-alcohol drinks for adults, is an area we intend to develop over the medium- to long-term.

DX is driven in three areas: process, business model and organizational climate. Process is DX in the narrowest sense, and we're advancing it in the production and procurement space. We are producing results by setting a theme and proceeding with investment.

For business model transformation, we are aiming to use personalization through data to add premium aspects to our core business, as well as create new models. It is also the key to the health and wellness business in adjacent areas.

Finally, we are working to integrate digital technologies throughout our overall organization. We cannot expect results if DX is isolated to a single specialized department. Toward that end, we are investing in employee education and the acquisition of external talent.

Considering Disclosure of Capital Efficiency Indicators

Koike I'd like to ask about your financial KPIs. As medium-term growth guidelines, you have set specific targets for growing core operating profit and adjusted EPS in the high single-digit range on a compound annual growth rate basis, generating free cash flow (FCF) of more than 200 billion yen on an annual average basis, reducing debt to about 3 times net debt/EBITDA, and steadily increasing dividends. On the other hand, from the perspective of improving equity value, I think it is desirable to add capital efficiency KPIs such as ROIC and ROE. What are your views on capital efficiency? In particular, your ROE has not reached 10%, which is low compared to other global companies.

Katsuki Our three KPIs are currently core operating profit, EPS growth and FCF. A series of acquisitions increased our interest-bearing debt, and although we are making steady progress in repaying the debt, about 1.5 trillion yen remains, so we have added FCF to our KPIs to restore our financial health. We are continuing to improve our financial condition.

On the other hand, capital efficiency is naturally required from the perspective of shareholders, and we monitor ROE and ROIC internally. For ROE, we are in the process of recovering profit margins that were damaged by the pandemic and the recent increase in the cost of variable expenses, and the depreciation of the yen has also pushed up net assets. Since we have about 2 trillion yen worth of goodwill, some believe that we should increase our net assets from the perspective of financial risk management. Essentially, we want to improve our ROE through profit growth.

We will also improve ROIC over the medium-term. Large-scale mergers and acquisitions temporarily lower ROIC, even if the investment hurdle rate is cleared. Currently, our approach involves checking each element of the ROIC tree every quarter to make improvements. There are also factors that depress ROIC, such as DX investment, sustainability measures, and strengthening R&D. As such, we intend to prepare for disclosure of ROIC in the future.

Positioning the Integration of Sustainability into Management as Core Strategy

Koike In terms of environmental issues, your company is actively working to acquire SBT certification, become a member of RE100, and set a net-zero target for 2050. You've also been recognized for your high level of risk management in your responses to biodiversity, water resources, and plastic issues.

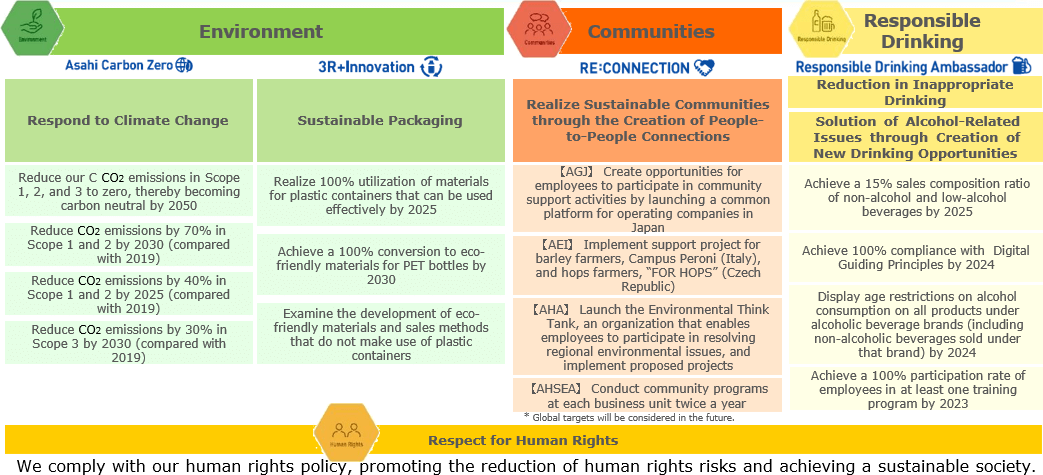

Katsuki We operate our business while enjoying the gifts of nature, and we are a company that cannot survive without preserving the environment and society. We have created a corporate statement called "Cheer the Future" to strategically accelerate the integration of sustainability into management. For environmental issues that have received particularly high attention, we have declared a "Planet Positive" tagline and will work on four pillars: climate change, containers and packaging, raw materials for agricultural products, and water resources.

As for climate change, Japan is likely to reduce its Scope 1 and Scope 2 greenhouse gas emissions by 70% from 2019 levels by 2030 through the adoption of renewable energy. For Scope 3, we will work with suppliers to take a leading role. In our containers and packaging, we plan to use bio-PET and recycling to transition to 100% eco-friendly materials by 2030. As for raw materials for agricultural products, we are working with farmers to ensure sustainable production and improve quality. We have advanced initiatives with hop farmers in the Czech Republic. In terms of water resources, Japan is nearing the progress seen in Europe, which leads in reducing water use. Our company ranks 12th in Japan in terms of forest holdings thanks to the Asahi Forest in Hiroshima, and we plan to further expand our efforts to include the cultivation of water sources.

We have reformed governance in accordance with the Corporate Governance Code and global best practices as benchmarks, but there are challenges that remain. Still, the executives at Global Headquarters are mostly Japanese. We will need to globalize our human resources to create competitive strategies and decisive management. In the future, we will actively promote the advancement of non-Japanese personnel, and we hope to establish a diverse management structure and execute governance that supports leadership.

Koike In conclusion, do you have any requests for institutional investors like us?

Katsuki We have faced harsh valuation in the stock market since the COVID-19 pandemic. We are appropriately responding to the recent changes in the external environment, and we would like investors to recognize that we are laying the foundation for growth as stated in our Medium- to Long-Term Management Policy. If we can have constructive dialogue on that basis, I think it will support our growth.

Koike We also hope to have more of these dialogues to contribute to the improvement of corporate value and reinvigoration of the Japanese capital market. Thank you for your time today.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: April 25, 2023)