Engagement Feature Articles

ANA Holdings - Turning International Passenger Business and Cargo Business into a Growth Driver via Network Enhancement

Left: Hiroyasu Koike, President and CEO of Nomura Asset Management Co., Ltd.

ANA Holdings achieved profitability for the first time in three fiscal years. As the company continues to build its financial base, it is steadily working on growth strategies, such as optimizing its international passenger business brands and growing its cargo business. Mr. Koji Shibata of ANA Holdings Corporation and Mr. Hiroyasu Koike of Nomura Asset Management discussed their future business prospects, including risk management, on May 29th.

Returning the Balance Sheet to Pre-Pandemic Levels

Koike The airline industry has been hit hard by the pandemic, but now it seems to be returning to normal. Following a series of structural reforms, your company achieved full-year profitability for the first time in 3 fiscal years in the fiscal year ended March 2023. On the other hand, your company's stock price still appears discounted. Some investors may be concerned about the sustainability of the earnings recovery and your balance sheet. Could you share some of your thoughts about balance sheet management?

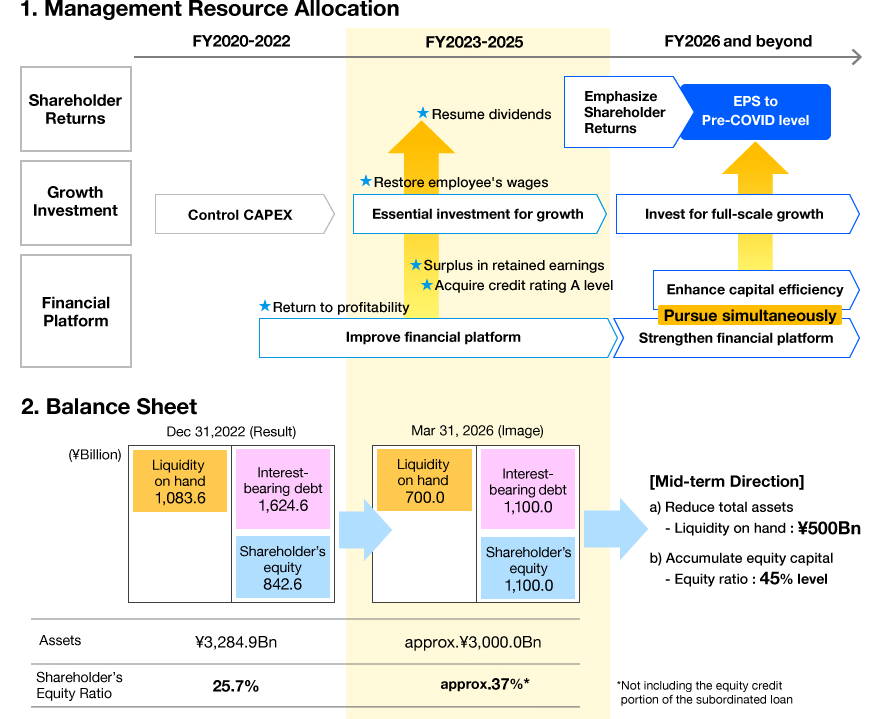

Shibata We would like to return our balance sheet to its pre-pandemic level as soon as possible. At present, we have 860 billion yen in capital and our capital adequacy ratio is 25.6%. In the fiscal year ended March 2019, before the global pandemic, we had over 1 trillion yen in capital and our capital adequacy ratio was over 40%. Under the new medium-term corporate strategy, we will return to this level by fiscal year 2025. We hope to raise our capital adequacy ratio to a level of 45% by 2030, as laid out in our new management vision. Investors have questioned whether we are maintaining excessive liquidity (highly liquid assets such as cash and deposits), and there is no doubt that we secured more than 1 trillion yen to weather the unstable environment caused by the pandemic. We plan to reduce our liquidity to around 500 billion yen by reducing our assets.

Koike Your company increased its capital during the COVID-19 pandemic. As institutional investors, we tend to have a negative impression of capital increases in general, but I think there is no denying the fact that the business was able to continue because of capital increases. On the other hand, as your financial position improves, it will be important to focus on growth potential in the future. What is your outlook on the balance between financial soundness and growth?

Shibata For 2030, we also want to return EPS (earnings per share) diluted by the capital increase to pre-COVID-19 levels. Under our medium-term corporate strategy, we have set a target of operating income of 200 billion yen by 2025. However, assuming the current number of shares, we will need to improve operating income to a level that exceeds this target before reaching EPS before the coronavirus pandemic. That's the challenge. It is also a major goal to resume dividends as soon as possible, as we have already been without dividends for four fiscal years. But there are a couple of assumptions. We need to restore our financial base, implement measures for profit growth, improve the treatment of our employees, including their wages, and secure an A credit rating. We also need to clear the conditions for early repayment of subordinated loans. I think the environment has been set up for these assumptions, but there is still uncertainty. For one thing, we are still in the process of due diligence to examine the impact of the NCA acquisition on our company's balance sheet and other issues. The other is that we need to observe the future of the United States and the world economy. I really want to take a little more time before deciding to resume dividends.

Securing SAF for Decarbonization

Koike The pandemic was an event like no one had ever experienced, which no company could be expected to handle. In the future, we expect that there will be other events that will be difficult for individual companies to respond to, such as those related to geopolitical risks. Are there any issues that your company is preparing to address in cooperation with the government and industry associations?

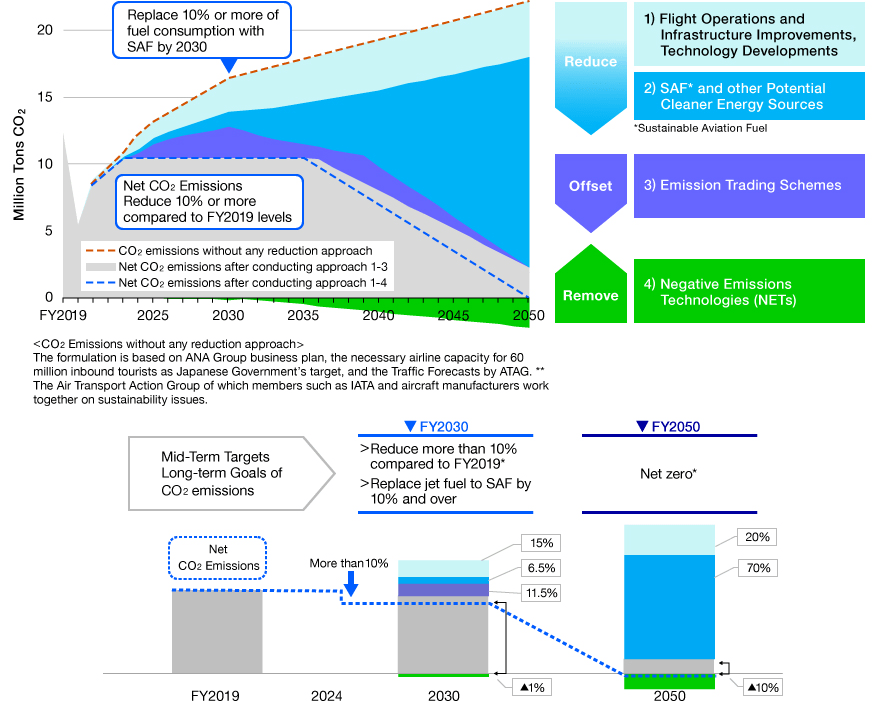

Shibata Making accommodations for decarbonization is a pressing issue for the airline industry. We call it "SAF" (sustainable aviation fuel), and the question is how to secure low-carbon fuel. We are asking the government to produce domestic SAF at the same price as current jet fuel, and we have already started a study group involving both the public and private sectors. In addition, there is the problem of the aviation labor shortage. We have been working on resource-related measures during the COVID-19 pandemic, but even if airlines maintain their own resources, aircraft cannot fly unless they have the necessary infrastructure in place in areas such as ground handling, security checkpoints, and customs/immigration. This is another problem that cannot be solved by airlines alone, so the public and private sectors are working together to share their wisdom on how to allocate people and how to make airport infrastructure operations more efficient through digitalization.

Koike I imagine that you had to deal with various unknowns during the COVID-19 pandemic. Did you learn any lessons that you could apply in the event of a similar situation?

Shibata First, keep costs as low as possible and keep cash on hand. The biggest factor impacting airlines is reduced production. In other words, to reduce depreciation and maintenance costs, we had to part with some of our airplanes. This was a significant decision. As for the outlook for demand following the pandemic, there are various factors, but it is most important to determine the number of aircrafts that can be used as a base and to adjust production volume to demand trends, such as providing allowances ahead of schedule in the upside phase of demand. That was our challenge during the three years of the pandemic, and we have examined and discussed it in depth.

Spurring Growth of the International Passenger Business through Brand Optimization

Koike If you actively disseminate the risk management information that you described, I think it will help dispel the discount factor of the airline industry. I am also interested in where your company's competitive advantage lies when considering future growth. Could you elaborate on your domestic passenger business, international passenger business, and cargo business?

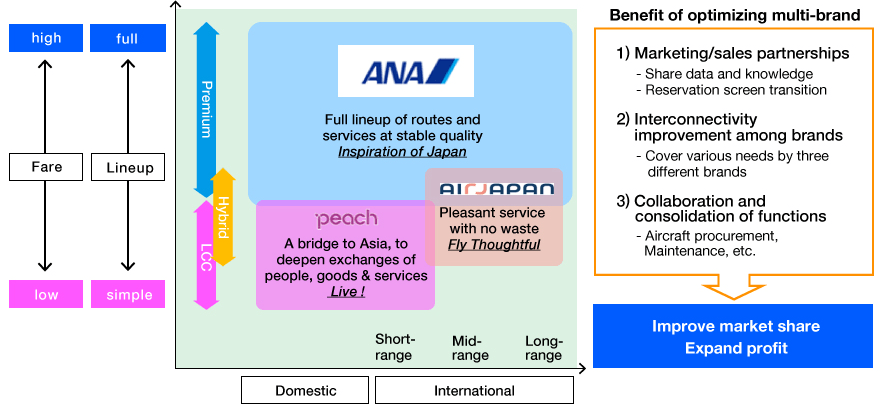

Shibata The domestic passenger business has been the revenue base that has supported the entire business, and that will not change. But the market has changed a lot. For example, customers on main lines such as "Tokyo-Osaka" and "Tokyo-Fukuoka" and customers on local routes each have their own needs. Some people focus on service, while some prefer cheap fares. In order to meet such diverse needs, it is important to align to the market through the combination of our full-service brand ANA and our LCC brand Peach (Peach Aviation).

In addition, I say " Optimized supply to demand," but since wide-body aircraft like a Boeing 787 is not suitable for a route with about 50 passengers per flight, it is necessary to have aircraft that match each route. Recently, Mitsubishi Aircraft Corporation announced that it will stop developing domestic jetliners, so we will need to introduce aircraft to replace them. As new aircraft comes in, the supply-demand adjustment will progress further. We believe that domestic flights will continue to be the revenue base of our business as in the past due to our alignment with both the market and supply-and-demand.

Future growth drivers will be the international passenger business and cargo business. If the current high-yield environment continues, international passenger revenue could exceed domestic passenger revenue this fiscal year. Our international passenger business also has the advantage of overseas alliances. We have joint ventures with United Airlines on Pacific routes and Lufthansa on European routes. We are also applying for a joint venture with Singapore Airlines on Asian routes. In comparison with pre-pandemic conditions, for example, in Europe, flights to Vienna and Munich are not yet available on a daily basis, and I would like to return them to their pre-pandemic state as soon as possible. The international network set forth in the previous medium-term management strategy is expected to be in place around 2025, so the future outlook is also important. Filling the gaps, or "white spots", in our coverage of Latin America and Africa will be a test of our abilities in the future.

In addition to our full service carrier ANA brand for international flights, we also launched the Air Japan brand. We had a lot of internal discussions before the pandemic, and after it subsided, we became convinced that inbound travel to Japan will create a huge groundswell of demand in the future. In particular, Air Japan has established its brand image for proper in-flight services and suitable fares among passengers from Thailand, Singapore, and other parts of Southeast Asia. ANA offers our full service, Air Japan covers the mid-range, and our LCC Peach covers the short-range, including Taiwan, South Korea, and China. We believe that by optimizing these three brands, our international passenger business will grow.

Koike For domestic flights, the ANA brand has a higher profit margin than your LCC. Is it correct to think that the efficiency of domestic passenger business will be improved by the brand division?

Shibata ANA, as a full-service brand, can cover the highly-profitable domestic routes well, but that doesn't mean that we should stop servicing the low-profit routes because they're not profitable. I think it is our duty to maintain the widest possible network. This is where Peach's positioning as an LCC comes in. If allotting domestic routes to Peach gives them extra resources, such as pilots, they can shift them to international routes. Looking at the group as a whole, including ANA, Peach, and international flights, I think this approach contributes to higher profit margins.

Alleviating the Cargo Business Bottleneck via NCA Acquisitions

Koike In the cargo business, I believe there was also the topic of NCA acquisitions.

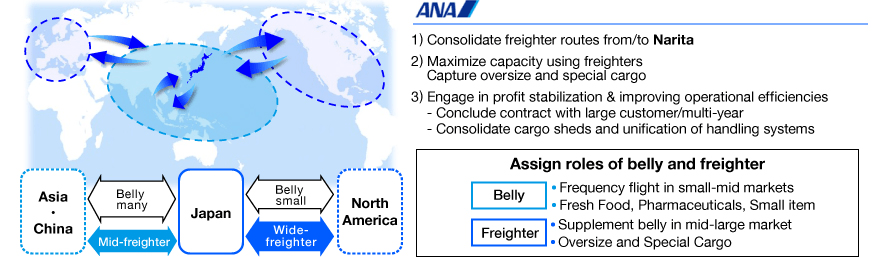

Shibata The cargo business had a wave of revenue in the past, and while there have been various discussions on the business within the company, it was an important revenue support during the global pandemic. An important factor was our well-established network of routes. More specifically, we assembled a total of 11 aircraft at Narita Airport, including 2 large freighters and 9 medium-sized freighters, and established a highly efficient operation. As a result, our annual sales exceeded 300 billion yen. I believe that it has become clear that the cargo business can continue to be monetized through structural reforms such as the optimization of such routes and the expansion of the transportation of large cargo such as semiconductor manufacturing equipment and specialty cargo such as pharmaceuticals requiring advanced temperature control.

On the other hand, in order to achieve business growth, we are still limited by our fleet of 11 freighters. That's where the NCA deal came up. Cargo from Narita to Southeast Asia can be adequately covered by "combination carriers," which utilize cargo space for passenger flights in addition to medium-size freighters, but there is insufficient space for cargo bound for North America and Europe. With the introduction of NCA's B747 large freighter, the bottleneck is expected to be solved.

Leveraging ANA Mileage Member Information

Koike Finally, I would like to ask about ANA's economic sphere model. Originally, Japanese people don't have many opportunities to fly. So looking at the economic sphere, sphere for mobile phones and online shopping is larger. From a user perspective, it seems quite difficult to establish a competitive advantage for ANA's model. How do you view this issue?

Shibata The original idea was to leverage the information of the 38 million ANA Mileage members. In addition to aviation, our business covers a wide range of areas, including travel, e-commerce, real estate, and education. As a mechanism to bring attention to these areas, we have renewed the ANA Mileage Club App as a gateway application to various services. In May of this year, ANA Pay, a mobile payment service, was also renewed to enable payments of 1 yen per mile. It has thankfully developed a very good reputation and I have high hopes that this will be a source of competitiveness. When I went to watch a baseball game the other day, I used ANA Pay instead of cash to buy a drink, and I appreciated how easy it is to use.

Koike Thank you for today's candid and valuable discussion.

This report is not intended as a solicitation or recommendation with respect to the purchase or sale of any particular investment.

(Date of publication: July 21, 2023)